Public Storage Defends Growth Plan After Elliott Nominates Directors

December 14 2020 - 5:13PM

Dow Jones News

By Micah Maidenberg

Public Storage defended its track record on driving growth after

activist investor Elliott Management nominated directors for the

company's board and criticized the self-storage firm's

performance.

"The Public Storage board of trustees and management team are

committed to serving the best interests of the company and its

shareholders, and will continue to take decisive action to drive

sustainable value creation," the company said.

The owner of interests in about 2,500 self-storage facilities

covering 171 million rentable square feet in the U.S. said it has

expanded its property portfolio, bolstered investment in customer

retention and raised more than $3 billion in fresh debt and

preferred capital to fund growth and lower capital costs, among

other efforts.

The company's total shareholder return over 20 years is 16%,

more than double that of the S&P 500 index, it said.

Public Storage also said it has added five new directors to its

board over the past 18 months.

Elliott said earlier Monday it believes Public Storage has

underperformed, faulting the real estate-investment trust for what

it said was a failure to invest aggressively in its business. The

investor said the company should refresh its board and nominated

six candidates.

Elliott said in a letter that Public Storage has underperformed

other self-storage companies "over the last decade, despite having

numerous structural advantages."

Write to Micah Maidenberg at micah.maidenberg@wsj.com

(END) Dow Jones Newswires

December 14, 2020 16:58 ET (21:58 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

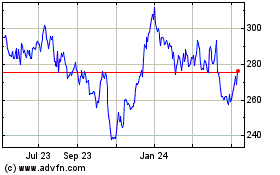

Public Storage (NYSE:PSA)

Historical Stock Chart

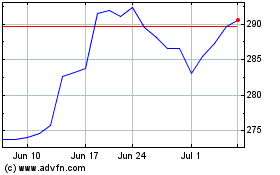

From Mar 2024 to Apr 2024

Public Storage (NYSE:PSA)

Historical Stock Chart

From Apr 2023 to Apr 2024