PGIM Investments continues to expand its global UCITS footprint

with the addition of its first ESG equity fund joining a number of

fixed income funds incorporating an ESG process. Sub-advised by

QMA, the actively managed PGIM QMA Global Core Equity ESG Fund

evaluates the ESG status of every security in the global core

equity universe and integrates these insights into the fund, aiming

to avoid the worst ESG offenders while maintaining performance

expectations.

PGIM Investments is the global manufacturer and fund distributor

of PGIM, the $1 trillion global investment management business

of Prudential Financial, Inc. (NYSE: PRU)—a top-10 investment

manager globally.* QMA is PGIM’s quantitative equity and global

multi-asset solutions manager.

“We’re pleased to provide a new investment solution for

investors who want the potential benefit of ESG factors,” said

Stuart Parker, president and CEO of PGIM Investments. “The ESG

equity fund, like the rest of our platform, draws from PGIM’s

multi-manager model, bringing PGIM Investments’ and QMA’s

capabilities to serve a significant need for ESG products from

global clients.”

ESG investing is estimated at more than $20 trillion—or a

quarter of all professionally managed assets around the world**.

The fund joins a number of fixed income UCITS that factor ESG into

their strategies. The current UCITS platform, launched in 2013, has

grown to 28 funds. Domiciled in Ireland, the UCITS platform spans

multiple sectors in fixed income, equity and real estate with 16

country registrations across Europe and Asia. The platform has

grown to $3.1 billion in assets under management as of Sept.

30, 2018, growing 24 percent in the last year.

“Our proprietary way of looking at data allows QMA to integrate

ESG factors into portfolios aiming for performance comparable to

non-ESG holdings,” said Andrew Dyson, QMA chairman and CEO. “This

process—which also solves for the industry-wide challenge of data

sparsity when investing in ESG—is built around our time-tested core

investment strategy that identifies alpha opportunities using

value, growth and quality factors.”

Specifically, the PGIM QMA Global Core Equity ESG Fund:

- Provides the ability to substitute less

attractive ESG stocks for companies with better ESG metrics without

any change to performance expectation.

- Draws on QMA’s ESG approach and

proprietary methodology on data completion to solve the issue of

data sparsity while seeking to maximize returns.

- Employs a client-driven focus that can

be tailored to specific ESG needs with full transparency.

- Seeks to consistently capture alpha to

achieve financial objectives through fundamental insights which are

systematically applied through an actively managed, disciplined and

adaptive strategy.

- Employs a data-driven holistic approach

to ESG investing that focuses on financially relevant, material ESG

items that are both industry-specific and systemic in nature.

- Incorporates carefully crafted ESG risk

factors focused on Sustainability Accounting Standards Board

materiality and carbon emissions into its investment process.

The UCITS strategy draws upon QMA’s research recently detailed

in a study published by the company, Integrating ESG in Portfolio

Construction.

All investments involve risk, including the possible loss of

capital.

About PGIM Investments and PGIM

Funds

PGIM Investments LLC offers more than 100 funds globally across

a broad spectrum of asset classes and investment styles. All

products draw on PGIM’s globally diversified investment platform

that encompasses the expertise of managers across fixed income,

equities and real estate.

PGIM Funds plc is an Ireland-domiciled UCITS umbrella fund

serving institutional and wholesale investors across the globe. The

PGIM QMA Global Core Equity ESG Fund is currently registered in the

U.K., Germany, the Netherlands, Norway, Denmark, Finland, France,

Sweden, Switzerland (institutional only), Luxembourg, Singapore

(institutional only) and Spain. For a full list of funds available

in your region, visit pgimfunds.com.

About QMA

QMA applies a disciplined, research-driven approach that seeks

to identify and capture alpha opportunities, and combines factor

exposures to create diversified, risk-aware strategies designed for

long-term, consistent performance. Founded in 1975, QMA manages

portfolios for a worldwide institutional client base, including

corporate and public pension plans, endowments and foundations,

multi-employer pension plans, and sub-advisory accounts for other

financial services companies. As of Sept. 30, 2018, QMA had

approximately $128.1 billion in assets under management.

About PGIM

With 15 consecutive years of positive third-party institutional

net flows, PGIM, the global asset management business of Prudential

Financial, Inc. (NYSE: PRU), ranks among the top 10 largest asset

managers in the world with more than $1 trillion in assets

under management as of Sept. 30, 2018. PGIM’s businesses offer a

range of investment solutions for retail and institutional

investors around the world across a broad range of asset classes,

including fundamental equity, quantitative equity, public fixed

income, private fixed income, real estate and commercial mortgages.

Its businesses have offices in 15 countries across five continents.

For more information about PGIM, visit pgim.com.

Prudential Financial, Inc.’s additional businesses offer a

variety of products and services, including life insurance,

annuities and retirement-related services. Prudential Financial,

Inc. of the United States is not affiliated in any manner with

Prudential plc, a company incorporated in the United Kingdom. For

more information visit news.prudential.com.

*As ranked in Pensions & Investments’ Top Money Managers

list, May 2018; based on Prudential Financial, Inc. total worldwide

assets under management as of Dec. 31, 2017.

**Source: Kell, G. (2018 July). The Remarkable Rise of ESG.

Forbes.

In the United Kingdom and various other jurisdictions in Europe

information is presented by PGIM Limited, an indirect subsidiary of

PGIM, Inc. PGIM Limited is authorized and regulated by the

Financial Conduct Authority (#193418) of the United Kingdom, and

duly passported in various jurisdictions in the European Economic

Area. Funds are available for professional investors only.

Investing places capital at risk; an investor could lose some or

all of their investment. An investor must review the fund’s

prospectus, supplement and Key Investor Information Document

(“KIID”) (together, the “Fund Documents”) before making a decision

to invest. The Fund Documents are available through PGIM Limited,

1-3 The Strand, Grand Buildings, Trafalgar Square, London, WC2N 5HR

or through pgimfunds.com.

Information for persons in France: The PGIM QMA Global

Core Equity ESG Fund has been registered with the Autorité des

marches financiers (AMF) for the offer in France to professional

investors only.

Information for persons in Spain: Investments in the PGIM

QMA Global Core Equity ESG Fund should be made on the basis of the

current Fund Documents, which are available along with the current

annual and semi-annual reports free of charge. For the purposes of

distribution in Spain, the PGIM QMA Global Core Equity ESG Fund is

registered with the official register of foreign collective

investment schemes of the Spanish Securities Market Commission

Comisión Nacional del Mercado de Valores (CNMV) under registration

number 1581, where complete information is available from the PGIM

QMA Global Core Equity ESG Fund’s authorized distributors. The

purchase of shares in the PGIM QMA Global Core Equity ESG Fund

shall be made on the basis of the Fund Documents. Prior to any

purchase, investors shall receive in advance a copy of the KIID in

Spanish, latest published economic report and a copy of the report

of the planned types of marketing in Spain (“Marketing

Memorandum”). The Fund Documents, together with the Marketing

Memorandum, is available free of charge at the registered office of

PGIM Funds plc and the locally authorized distributors as well as

at the CNMV.

Information for persons in Switzerland: The prospectus,

KIID, certificate of incorporation, memorandum and articles of

association as well as the annual and semi-annual reports may be

obtained free of charge from the Swiss Representative and Paying

Agent as well as at the registered office of PGIM Funds plc. The

Swiss Representative and Paying Agent is State Street Bank

International GmbH, Munich, Zurich Branch, Beethovenstrasse 19,

CH-8027, Zurich.

© 2018 Prudential Financial, Inc. (PFI) of the United States and

its related entities. PGIM and the PGIM logo are service marks of

PFI and its related entities, registered in many jurisdictions

worldwide.

2018-478

View source

version on businesswire.com: https://www.businesswire.com/news/home/20181211005014/en/

MEDIA:For QMA:Judith

Flynn973-802-9939judith.flynn@prudential.com

For PGIM Investments:Lizzie

Lowe973-802-8786lizzie.lowe@prudential.com

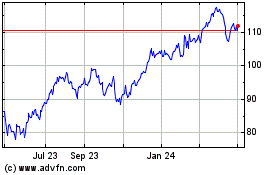

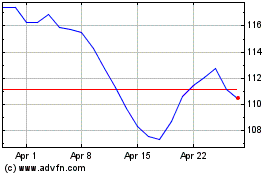

Prudential Financial (NYSE:PRU)

Historical Stock Chart

From Mar 2024 to Apr 2024

Prudential Financial (NYSE:PRU)

Historical Stock Chart

From Apr 2023 to Apr 2024