PennyMac Mortgage Investment Trust (NYSE: PMT) today reported

net income of $35.4 million, or $0.49 per diluted share,

for the third quarter of 2016, on net investment income of

$103.3 million. PMT previously announced a cash dividend for

the third quarter of $0.47 per common share of beneficial

interest, which was declared on September 26, 2016, and paid

on October 27, 2016.

Third Quarter Highlights

Financial results:

- Diluted earnings per common share of

$0.49, up from a loss per common share of $0.08 in the prior

quarter

- Net income of $35.4 million,

compared with a net loss of $5.3 million in the prior

quarter

- Net investment income of $103.3

million, up 117 percent from the prior quarter

- Book value per share of $20.21, up from

$20.09 at June 30, 2016

- Return on average equity of

10 percent, up from (1) percent for the prior

quarter1

Investment activities and correspondent production results:

- Continued investment in GSE credit risk

transfer (CRT) and mortgage servicing rights (MSRs) resulting from

PMT’s correspondent production business

- Correspondent production related to

conventional conforming loans totaled $7.3 billion in unpaid

principal balance (UPB), up 40 percent from the prior

quarter

- CRT deliveries totaled

$3.4 billion in UPB, resulting in an additional

$90 million of new CRT investments

- Completed third CRT commitment with

Fannie Mae and entered into a fourth CRT commitment for

$7.5 billion in UPB2

- Added $78 million in new MSR

investments

- Repurchased approximately

1 million of PMT’s common shares from August 5th through

October 7th at a cost of $14.4 million; 8.4 million

shares repurchased since the program’s inception last year

- Cash proceeds from the liquidation and

paydown of distressed mortgage loans and real estate owned (REO)

properties were $75 million, reflecting a decrease in REO

sales

Notable activity after quarter end:

- Entered into an agreement to sell

$172 million in UPB of performing loans from the distressed

portfolio2

“PMT’s earnings have improved significantly as we continue to

transition our capital to our newer investment strategies and away

from distressed mortgage loans,” said Chairman and Chief Executive

Officer Stanford L. Kurland. “During the third quarter, our results

were driven by the strength of our correspondent business and the

investments that it creates, including our unique GSE credit risk

transfer investments. We continued to make progress in liquidating

and resolving our distressed mortgage investments, including a

pending sale of performing loans from the distressed portfolio. We

are particularly pleased with the performance of our newer

strategies and correspondent production business, and look for

continuing improvement from the performance of our distressed

investments going forward.”

PMT reported pretax income of $45.0 million for the quarter

ended September 30, 2016, compared with a pretax loss of

$8.2 million in the second quarter.

The following table presents the contribution of PMT’s

Investment Activities and Correspondent Production segments:

Quarter ended September 30, 2016 Correspondent

Investment

Production

Activities

Consolidated

(in thousands) Net investment income: Net interest income

Interest income $ 14,850 $ 43,284 $ 58,134 Interest expense

9,373 30,957 40,330 5,477 12,327 17,804 Net mortgage

loan servicing fees - 15,761 15,761 Net gain on mortgage loans

acquired for sale 43,858 - 43,858 Net (loss) gain on investments

Mortgage loans at fair value - (3,400 ) (3,400 ) Mortgage loans

held by variable interest entity net of

asset-backed secured financing

- 2,454 2,454 Mortgage-backed securities - 517 517 CRT Agreements -

18,477 18,477 Hedging derivatives - (945 ) (945 ) Excess servicing

spread investments - (2,824 ) (2,824 ) -

14,279 14,279 Other income (loss) 12,724 (1,100 )

11,624 62,059 41,267 103,326 Expenses: Mortgage loan

fulfillment, servicing and management

fees payable to PennyMac Financial

Services, Inc.

27,969 15,350 43,319 Other 2,707 12,286 14,993

30,676 27,636 58,312 Pretax income (loss) $

31,383 $ 13,631 $ 45,014

Investment Activities Segment

The Investment Activities segment generated pretax income of

$13.6 million on revenues of $41.3 million, compared with

a pretax loss of $24.6 million on revenues of

$9.4 million in the second quarter. Net gain on investments in

the third quarter totaled $14.3 million, compared with a net

loss of $15.5 million in the prior quarter. Net gain on

investments for the third quarter included $18.5 million of

gains on CRT investments, $0.5 million of gains on

mortgage-backed securities (MBS) and $2.5 million of gains on

mortgage loans held by a variable interest entity, net of valuation

changes on the related asset-backed secured financing. These gains

were partially offset by net losses on distressed mortgage loans of

$3.4 million; $2.8 million of losses related to excess

servicing spread (ESS), net of recapture income; and

$0.9 million of losses related to hedging derivatives.

Net loan servicing fees were $15.8 million, up slightly

from $15.7 million in the second quarter. Net loan servicing

fees included $34.7 million in servicing fees and MSR

recapture income, reduced by $17.9 million of amortization and

realization of MSR cash flows. Net loan servicing fees also

included $6.7 million of impairment provisioning and fair

value losses related to MSRs, offset by $5.6 million of

related hedging gains. PMT’s hedging activities are intended to

manage its net exposure across all interest rate-sensitive

strategies, which include MSRs, ESS and MBS.

MSR fair value losses, impairment provisioning and ESS valuation

losses in the third quarter resulted from higher actual and

expected prepayment activity due to the continued low mortgage rate

environment. ESS valuation losses were partially offset by

recapture income totaling $1.3 million payable to PMT for

prepayment activity during the quarter. When prepayment of a loan

underlying PMT’s ESS results from a refinancing by PennyMac

Financial Services, Inc. (NYSE: PFSI), PMT generally benefits from

recapture income.

Interest income earned on PMT’s interest rate-sensitive

strategies of ESS, MBS and mortgage loans held by a variable

interest entity totaled $12.3 million, a 9 percent

decrease from the second quarter. Interest income from PMT’s

distressed mortgage loans totaled $29.0 million, up from

$23.0 million in the second quarter. Interest income from

distressed mortgage loans included $23.1 million of

capitalized interest from loan modifications, which increases

interest income and reduces loan valuation gains.

Other investment losses were $1.1 million, compared with a

$0.5 million loss in the second quarter, driven by an increase

in valuation losses of PMT’s REO properties. At quarter end, PMT’s

inventory of REO properties totaled $288.3 million, down from

$299.5 million at June 30, 2016.

Segment expenses were $27.6 million, down from

$34.0 million in the second quarter, primarily driven by

$5.1 million in servicing activity fees included in second

quarter expenses related to a sale of performing loans from the

distressed portfolio.

Distressed Mortgage Investments

PMT’s distressed mortgage loan portfolio generated realized and

unrealized losses totaling $3.4 million, compared with

realized and unrealized losses of $13.5 million in the second

quarter. In the third quarter, fair value losses on the performing

loans in the distressed portfolio were $16.4 million while

fair value gains on nonperforming loans were

$11.5 million.

The schedule below details the realized and unrealized (losses)

gains on distressed mortgage loans:

Quarter ended

September 30,

2016

June 30,

2016

(in thousands) Valuation changes: Performing loans $ (16,350

) $ (8,356 ) Nonperforming loans 11,506 (5,919 )

(4,844 ) (14,275 ) Gain on payoffs 1,298 1,208 Gain (loss) on sale

146 (396 ) $ (3,400 ) $ (13,463 )

Income contribution from the distressed portfolio improved

significantly from the second quarter, but underperformed PMT’s

expectations. The underperformance was primarily related to lower

expected REO proceeds on loans transitioning from foreclosure to

REO, an increase in redefaults of performing loans, and fewer

nonperforming loans transitioning from foreclosure to REO. The

performance of the distressed loan portfolio in the third quarter

was aided by home prices which performed in line with prior

forecasts.

Mortgage Servicing Rights

PMT’s MSR portfolio, which is subserviced by PFSI, grew to

$50.9 billion in UPB compared with $47.1 billion at

June 30, 2016. Servicing fees and MSR recapture revenue of

$34.7 million was reduced by $17.9 million of

amortization. Provision for impairment and fair value losses

totaled $6.7 million, which was largely offset by

$5.6 million of gains on hedging derivatives.

The following schedule details net loan servicing fees:

Quarter ended

September 30,

2016

June 30,

2016

(in thousands) Net mortgage loan servicing fees Servicing fees (1)

$ 34,304 $ 31,578 MSR recapture fee receivable from PFSI 409 311

Effect of MSRs: Carried at lower of amortized cost or fair value

Amortization (17,902 ) (15,531 ) Provision for impairment (3,460 )

(23,170 ) Gain on sale - 11 Carried at fair value - change in fair

value (3,202 ) (4,941 ) Gains on hedging derivatives 5,612

27,433 (18,952 ) (16,198 ) Net mortgage loan

servicing fees $ 15,761 $ 15,691 (1) Includes contractually

specified servicing and ancillary fees

Correspondent Production Segment

PMT acquires newly originated mortgage loans from third-party

correspondent sellers and typically sells or securitizes the loans,

resulting in current-period income and ongoing investments in MSRs

and GSE credit risk transfers related to a portion of its

production. For the third quarter, PMT’s Correspondent Production

segment generated pretax income of $31.4 million, versus

$16.4 million in the second quarter.

Through its correspondent production activities, PMT acquired

$18.9 billion in UPB of loans and issued IRLCs totaling

$21.6 billion, compared with $14.6 billion and

$16.0 billion, respectively, in the second quarter. Of the

correspondent acquisitions, conventional conforming and jumbo

acquisitions totaled $7.3 billion, and government-insured or

guaranteed acquisitions totaled $11.7 billion, compared with

$5.2 billion and $9.4 billion, respectively, in the

second quarter.

Segment revenues were $62.1 million, a 62 percent

increase from the second quarter, driven by a 46 percent

quarter-over-quarter increase in conventional conforming and jumbo

lock volume and strong margins, including specified loan sales made

possible by PMT’s large production volumes. The increase in volumes

reflects a larger mortgage origination market, driven by low

mortgage rates, and market share gains for PMT facilitated by

maintaining high service levels in a market with significantly

elevated volume. Net gain on mortgage loans acquired for sale in

the third quarter also included a $5.1 million benefit from a

revision of previously recorded provision for representations and

warranties due to a change in estimate.

The following schedule details the net gain on mortgage loans

acquired for sale:

Quarter ended

September 30,

2016

June 30,

2016

(in thousands) Net gain on mortgage loans acquired for sale Receipt

of MSRs in loan sale transactions $ 77,635 $ 60,109 Provision for

representation and warranties (781 ) (650 ) Revision of previously

recorded provision for representations

and warranties due to change in

estimate

5,098 - Cash investment (1) (42,480 ) (47,579 ) Fair value changes

of pipeline, inventory and hedges 4,386 12,346 $

43,858 $ 24,226 (1) Includes cash hedge expense

Segment expenses were $30.7 million, up from

$21.8 million in the second quarter, primarily due to the

increase in acquisition volumes. The weighted average fulfillment

fee rate in the third quarter was 38 basis points, up slightly

from 37 basis points in the prior quarter.3

Management Fees and Taxes

Management fees were $5.0 million, down from

$5.2 million in the second quarter, driven by a decrease in

PMT’s shareholders’ equity as a result of common share repurchases.

There were no incentive fees for the third quarter as a result of

PMT’s financial performance over the four-quarter period for which

incentive fees are calculated.

PMT recorded a $9.6 million provision for income taxes,

versus an income tax benefit of $2.9 million in the second

quarter.

Mr. Kurland concluded, “PMT remains uniquely positioned, through

PFSI’s specialized capabilities as our manager and service

provider, to access investment opportunities that result from our

correspondent production activities, including GSE credit risk

transfers and excess servicing spread. We continue to transition

capital over time into these opportunities and away from distressed

loan investments, which represent a decreasing allocation of PMT’s

equity. We also continue to evaluate repurchasing our common

shares, where we believe the return is superior to other investment

opportunities. We believe that these strategies have the potential

to continue producing earnings in line with our dividend

level.”

Management’s slide presentation will be available in the

Investor Relations section of the Company’s website at

www.pennymac-REIT.com beginning at 1:30 p.m. (Pacific Daylight

Time) on Thursday November 3, 2016.

1 Return on average equity is calculated based on

annualized quarterly net income as a percentage of monthly average

shareholders’ equity during the period. 2 Although definitive

documentation has been executed, these transactions are subject to

continuing due diligence and customary closing conditions. There

can be no assurance regarding the size of the transactions or that

the transactions will be completed at all. 3 Fulfillment fees are

based on the unpaid principal balance of acquired mortgage loans

and monthly funding volumes. Effective September 1, 2016, the

contractual fulfillment fee is 0.35% for conventional loans sold to

the Agencies, and 0.85% for all other loans. Previously, the

fulfillment fee was 0.50% of the unpaid principal balance of

conventional and jumbo loans, subject to reductions at specified

volumes and discretionary reductions by PFSI.

About PennyMac Mortgage Investment Trust

PennyMac Mortgage Investment Trust is a mortgage real estate

investment trust (REIT) that invests primarily in residential

mortgage loans and mortgage-related assets. PennyMac Mortgage

Investment Trust trades on the New York Stock Exchange under the

symbol “PMT” and is externally managed by PNMAC Capital Management,

LLC, an indirect subsidiary of PennyMac Financial Services, Inc.

Additional information about PennyMac Mortgage Investment Trust is

available at www.PennyMac-REIT.com.

This press release contains forward-looking statements within

the meaning of Section 21E of the Securities Exchange Act of

1934, as amended, regarding management’s beliefs, estimates,

projections and assumptions with respect to, among other things,

the Company’s financial results, future operations, business plans

and investment strategies, as well as industry and market

conditions, all of which are subject to change. Words like

“believe,” “expect,” “anticipate,” “promise,” “plan,” and other

expressions or words of similar meanings, as well as future or

conditional verbs such as “will,” “would,” “should,” “could,” or

“may” are generally intended to identify forward-looking

statements. Actual results and operations for any future period may

vary materially from those projected herein and from past results

discussed herein. Factors which could cause actual results to

differ materially from historical results or those anticipated

include, but are not limited to: changes in our investment

objectives or investment or operational strategies, including any

new lines of business or new products and services that may subject

us to additional risks; volatility in our industry, the debt or

equity markets, the general economy or the real estate finance and

real estate markets specifically, whether the result of market

events or otherwise; events or circumstances which undermine

confidence in the financial markets or otherwise have a broad

impact on financial markets, such as the sudden instability or

collapse of large depository institutions or other significant

corporations, terrorist attacks, natural or man-made disasters, or

threatened or actual armed conflicts; changes in general business,

economic, market, employment and political conditions, or in

consumer confidence and spending habits from those expected;

declines in real estate or significant changes in U.S. housing

prices or activity in the U.S. housing market; the availability of,

and level of competition for, attractive risk-adjusted investment

opportunities in mortgage loans and mortgage-related assets that

satisfy our investment objectives; the inherent difficulty in

winning bids to acquire mortgage loans, and our success in doing

so; the concentration of credit risks to which we are exposed; the

degree and nature of our competition; our dependence on our manager

and servicer, potential conflicts of interest with such entities

and their affiliates, and the performance of such entities; changes

in personnel and lack of availability of qualified personnel at our

manager, servicer or their affiliates; the availability, terms and

deployment of short-term and long-term capital; the adequacy of our

cash reserves and working capital; our ability to maintain the

desired relationship between our financing and the interest rates

and maturities of our assets; the timing and amount of cash flows,

if any, from our investments; unanticipated increases or volatility

in financing and other costs, including a rise in interest rates;

the performance, financial condition and liquidity of borrowers;

the ability of our servicer, which also provides us with

fulfillment services, to approve and monitor correspondent sellers

and underwrite loans to investor standards; incomplete or

inaccurate information or documentation provided by customers or

counterparties, or adverse changes in the financial condition of

our customers and counterparties; our indemnification and

repurchase obligations in connection with mortgage loans we

purchase and later sell or securitize; the quality and

enforceability of the collateral documentation evidencing our

ownership and rights in the assets in which we invest; increased

rates of delinquency, default and/or decreased recovery rates on

our investments; our ability to foreclose on our investments in a

timely manner or at all; increased prepayments of the mortgages and

other loans underlying our mortgage-backed securities or relating

to our mortgage servicing rights , excess servicing spread and

other investments; the degree to which our hedging strategies may

or may not protect us from interest rate volatility; the effect of

the accuracy of or changes in the estimates we make about

uncertainties, contingencies and asset and liability valuations

when measuring and reporting upon our financial condition and

results of operations; our failure to maintain appropriate internal

controls over financial reporting; technologies for loans and our

ability to mitigate security risks and cyber intrusions; our

ability to obtain and/or maintain licenses and other approvals in

those jurisdictions where required to conduct our business; our

ability to detect misconduct and fraud; our ability to comply with

various federal, state and local laws and regulations that govern

our business; developments in the secondary markets for our

mortgage loan products; legislative and regulatory changes that

impact the mortgage loan industry or housing market; changes in

regulations or the occurrence of other events that impact the

business, operations or prospects of government agencies or

government-sponsored entities, or such changes that increase the

cost of doing business with such entities; the Dodd-Frank Wall

Street Reform and Consumer Protection Act and its implementing

regulations and regulatory agencies, and any other legislative and

regulatory changes that impact the business, operations or

governance of mortgage lenders and/or publicly-traded companies;

the Consumer Financial Protection Bureau and its issued and future

rules and the enforcement thereof; changes in government support of

homeownership; changes in government or government-sponsored home

affordability programs; limitations imposed on our business and our

ability to satisfy complex rules for us to qualify as a real estate

investment trust (REIT) for U.S. federal income tax purposes and

qualify for an exclusion from the Investment Company Act of 1940

and the ability of certain of our subsidiaries to qualify as REITs

or as taxable REIT subsidiaries for U.S. federal income tax

purposes, as applicable, and our ability and the ability of our

subsidiaries to operate effectively within the limitations imposed

by these rules; changes in governmental regulations, accounting

treatment, tax rates and similar matters (including changes to laws

governing the taxation of REITs, or the exclusions from

registration as an investment company); the effect of public

opinion on our reputation; the occurrence of natural disasters or

other events or circumstances that could impact our operations; and

our organizational structure and certain requirements in our

charter documents. You should not place undue reliance on any

forward-looking statement and should consider all of the

uncertainties and risks described above, as well as those more

fully discussed in reports and other documents filed by the Company

with the Securities and Exchange Commission from time to time. The

Company undertakes no obligation to publicly update or revise any

forward-looking statements or any other information contained

herein, and the statements made in this press release are current

as of the date of this release only.

PENNYMAC MORTGAGE INVESTMENT TRUST AND

SUBSIDIARIES CONSOLIDATED BALANCE SHEETS (UNAUDITED)

September 30,

2016

June 30,

2016

September 30,

2015

(in thousands except share amounts)

ASSETS Cash $ 139,068 $

95,705 $ 89,303 Short-term investments 33,353 16,877 31,518

Mortgage-backed securities at fair value 708,862 531,612 315,599

Mortgage loans acquired for sale at fair value 2,043,453 1,461,029

1,050,296 Mortgage loans at fair value 1,957,117 2,035,997

2,637,730 Excess servicing spread purchased from PennyMac Financial

Services, Inc. 280,367 294,551 418,573 Derivative assets 44,774

35,007 16,806 Real estate acquired in settlement of loans 288,348

299,458 353,563 Real estate held for investment 25,708 20,662 4,448

Mortgage servicing rights 524,529 471,458 423,095 Servicing

advances 78,624 74,090 79,528 Deposits securing credit risk

transfer agreements 427,677 338,812 87,892 Due from PennyMac

Financial Services, Inc. 5,776 12,375 9,050 Other assets

61,245 344,651 74,830 Total assets $

6,618,901 $ 6,032,284 $ 5,592,231

LIABILITIES

Assets sold under agreements to repurchase $ 4,041,085 $ 3,275,691

$ 2,864,032 Mortgage loan participation and sale agreements 88,458

96,335 61,078 Federal Home Loan Bank advances - - 183,000 Notes

payable 196,132 163,976 192,332 Asset-backed financing of a

variable interest entity at fair value 384,407 325,939 234,287

Exchangeable senior notes 245,824 245,564 244,805 Note payable to

PennyMac Financial Services, Inc. 150,000 150,000 150,000

Interest-only security payable at fair value 1,699 1,663 -

Derivative liabilities 1,620 3,894 2,786 Accounts payable and

accrued liabilities 88,704 75,587 67,086 Due to PennyMac Financial

Services, Inc. 14,747 22,054 17,220 Income taxes payable 36,380

26,774 42,702 Liability for losses under representations and

warranties 14,927 19,258 18,473

Total liabilities 5,263,983 4,406,735

4,077,801

SHAREHOLDERS' EQUITY Common shares of

beneficial interest—authorized, 500,000,000 common

shares of $0.01 par value; issued and

outstanding 67,723,293, 68,687,094

and 74,811,922 common shares,

respectively

671 677 738 Additional paid-in capital 1,380,502

1,389,962 1,468,739 (Accumulated deficit)

retained earnings (26,255 ) (29,812 )

44,953 Total shareholders' equity 1,354,918

1,360,827 1,514,430 Total liabilities and

shareholders' equity $ 6,618,901 $ 5,767,562 $

5,592,231

PENNYMAC MORTGAGE INVESTMENT TRUST AND

SUBSIDIARIES CONSOLIDATED STATEMENTS OF INCOME

(UNAUDITED) Quarter ended

September 30,

2016

June 30,

2016

September 30,

2015

(in thousands, except per share amounts)

Investment Income

Net interest income: Interest income From nonaffiliates $ 53,307 $

46,053 $ 53,412 From PennyMac Financial Services, Inc. 4,827

5,713 8,026 58,134 51,766 61,438 Interest expense To

nonaffiliates 38,356 34,371 36,471 To PennyMac Financial Services,

Inc. 1,974 2,222 1,289 40,330 36,593 37,760

Net interest income 17,804 15,173 23,678 Net gain on mortgage loans

acquired for sale 43,858 24,226 13,884 Mortgage loan origination

fees 12,684 8,519 9,135 Net gain (loss) on investments From

nonaffiliates 17,103 337 32,802 From PennyMac Financial Services,

Inc. (2,824 ) (15,824 ) (7,844 ) 14,279

(15,487 ) 24,958 Net mortgage loan servicing fees 15,761 15,691

20,791 Results of real estate acquired in settlement of loans

(3,285 ) (2,565 ) (4,221 ) Other 2,225 2,061

2,549 Net investment income 103,326 47,618

90,774

Expenses Earned by PennyMac Financial Services, Inc.:

Mortgage loan fulfillment fees 27,255 19,111 17,553 Mortgage loan

servicing fees (1) 11,039 16,427 11,736 Management fees 5,025 5,199

5,742 Mortgage loan collection and liquidation 6,205 4,290 1,853

Compensation 1,134 2,011 1,759 Professional services 1,508 2,224

1,550 Other 6,146 6,515 5,474 Total expenses

58,312 55,777 45,667 Income (loss) before

provision for (benefit from)

income taxes

45,014 (8,159 ) 45,107 Provision for (benefit from) income taxes

9,606 (2,892 ) 6,295 Net income (loss) $

35,408 $ (5,267 ) $ 38,812

Earnings (loss) per share Basic $

0.52 $ (0.08 ) $ 0.51 Diluted $ 0.49 $ (0.08 ) $ 0.49

Weighted-average shares outstanding Basic 67,554 68,446 74,681

Diluted 76,329 68,446 83,411

(1) Mortgage loan servicing fees expense includes both special

servicing for PMT’s distressed portfolio and subservicing for its

mortgage servicing rights of $5.6 million and $5.0 million,

respectively for the third quarter 2016.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20161103006778/en/

PennyMac Mortgage Investment TrustMediaStephen

Hagey(805) 530-5817orInvestorsChristopher Oltmann(818)

264-4907

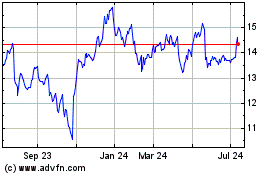

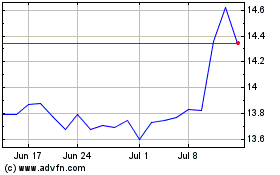

PennyMac Mortgage Invest... (NYSE:PMT)

Historical Stock Chart

From Mar 2024 to Apr 2024

PennyMac Mortgage Invest... (NYSE:PMT)

Historical Stock Chart

From Apr 2023 to Apr 2024