PG&E's Bankruptcy Judge Opens the Door to Rival Chapter 11 Exit Plan

October 09 2019 - 6:38PM

Dow Jones News

By Peg Brickley

The judge presiding over PG&E Corp.'s bankruptcy handed

shareholders a loss, opening the door to a competition over the

best path out of bankruptcy that pits the troubled utility against

bondholders led by Elliott Management Corp.

Judge Dennis Montali of the U.S. Bankruptcy Court in San

Francisco cleared the way for a rival chapter 11 plan from Elliott

and other bondholders that are allied with victims of wildfires

that drove PG&E to bankruptcy. His ruling stripped PG&E of

the sole right to propose a chapter 11 plan covering billions of

dollars of damages from blazes linked to PG&E equipment. Shares

of the company were down 27% after hours.

The decision means at least two chapter 11 plans will move

forward as PG&E shifts into a crucial phase of its chapter 11

proceeding. The coming months will see either a deal with fire

victims or a series of judicial rulings that will produce an

estimate of how much PG&E will have to set aside to cover those

damages. PG&E didn't immediately comment on the decision.

The rival plans are about $5 billion to $6 billion apart on

where they think that number will fall. Wall Street banks and hedge

funds from California to Connecticut are placing their bets,

cutting deals to finance PG&E's chapter 11 plan, the

bondholders' rival plan or both.

The bondholders proposed a plan to raise new money and use all

but a sliver of PG&E equity to pay off debts, while the company

favors raising both debt and equity financing to dig itself out of

chapter 11 and prevent shareholders from taking a bigger hit.

The San Francisco utility has faced criticism from regulators

and consumer advocates for years for skimping on safety while

paying out shareholder dividends. The dividends stopped before

bankruptcy, and PG&E's chapter 11 plan would dilute existing

shareholders if it makes it through bankruptcy court and past the

California Public Utilities Commission.

PG&E's plan is more protective of shareholders than the

bondholder plan, which was put together in an alliance with fire

victims who said the utility wasn't treating them fairly. At a

court hearing Monday, backers of PG&E's strategy said the

bondholder plan was the equivalent of a hostile takeover of the

company.

Bondholders, backed by most of PG&E's creditors, said it

makes sense to have multiple options on the table as the company

races to hit a June 2020 deadline to exit bankruptcy. Missing the

deadline would cost PG&E the chance to participate in a

statewide fund established to cushion California utilities against

rising wildfire risks.

What actually happens to the value of PG&E's shares will be

determined by the outcome of a judicial process designed to assign

a dollar figure to liabilities from blazes that claimed more than

100 lives and wiped out thousands of homes and businesses.

Judges in state, federal and bankruptcy courts are handling

different elements of the process, but the end game is to name the

number that PG&E has to put into a trust to cover damages owed

to people who lost homes, livelihoods and loved ones to the

fires.

PG&E pegs its debts to people, state firefighters and

federal emergency management agencies at about $8.4 billion. If the

court-supervised damages estimate comes in at about that number,

PG&E's chapter 11 plan will work out.

At that level, big shareholders and Wall Street investors are

standing by to invest fresh cash in the company, some of it in

equity, some of it in debt, the company's lawyers said at Monday's

hearing in the U.S. Bankruptcy Court in San Francisco. If the

figure goes somewhat higher, PG&E may have to reconfigure its

financing, but the chapter 11 plan will still work, according to

backers of the company's plan.

The higher the fire damages estimate moves, the less value is

left for shareholders, who are at the bottom of the payment

priority scheme established in bankruptcy.

If the estimate of fire damages hits a certain point, PG&E

could be deemed insolvent, meaning shareholders could be wiped out.

Dennis Dunne, lawyer for an official committee representing nonfire

creditors, said he feared that a high damages estimate will cause

big shareholders to "tap out" and refuse to fund PG&E's

bankruptcy plan.

Cecily Dumas, lawyer for the fire-damage committee, said at

Monday's hearing that if the estimation process produces a figure

that is above the $13.5 billion mark, PG&E could be tipped into

insolvency, and that is something the fire victims want to avoid.

So even if the damages estimate comes in higher than $13.5 billion,

the committee will still honor its agreement to jointly sponsor the

bondholder plan, she said.

PG&E has accused fire victims of trying to get more than

they are owed. Ms. Dumas said the victims won't ask for

overpayment.

Both proposed chapter 11 plans provide $11 billion for insurers

that paid fire claims and investors that bought those claims,

chiefly the Baupost Group LLC, a Boston hedge fund. Both also stand

to honor a $1 billion settlement with the city of Paradise, Calif.,

and other government bodies that sustained fire damage.

Write to Peg Brickley at peg.brickley@wsj.com

(END) Dow Jones Newswires

October 09, 2019 18:23 ET (22:23 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

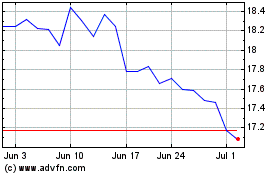

PG&E (NYSE:PCG)

Historical Stock Chart

From Mar 2024 to Apr 2024

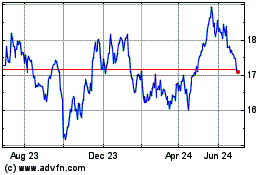

PG&E (NYSE:PCG)

Historical Stock Chart

From Apr 2023 to Apr 2024