PAR Technology Corporation Announces Proposed Offering of $60 Million of Convertible Senior Notes

April 09 2019 - 4:02PM

Business Wire

PAR Technology Corporation (NYSE:PAR) ("Company" or "PAR")

announced today its intention to offer $60 million aggregate

principal amount of Convertible Senior Notes due 2024 (the “Notes”)

in a private offering to qualified institutional buyers pursuant to

Rule 144A under the Securities Act of 1933, as amended (the

“Securities Act”), subject to market conditions and other factors.

The Company also expects to grant to the initial purchaser of the

Notes a 30-day option to purchase up to an additional $10 million

aggregate principal amount of Notes.

The Notes will be unsecured senior obligations of the Company

with interest payable semiannually. The Notes will be convertible

at the option of the holders, prior to the close of business on the

business day immediately preceding October 15, 2023, only under

certain circumstances and during certain periods, and thereafter,

at any time until the close of business on the second business day

immediately preceding the maturity date. Upon conversion, the Notes

may be settled, at the Company’s election, in cash, shares of the

Company’s common stock, or a combination of cash and shares of the

Company’s common stock. The Notes will not be redeemable at the

Company’s option prior to April 15, 2022. On or after April 15,

2022, the Notes will be redeemable at the Company’s option if the

last reported sale price of the Company’s common stock for at least

20 trading days (whether or not consecutive) in any 30-day trading

period (including the last trading day of such period) exceeds 130%

of the conversion price for the Notes. The terms of the notes,

including interest rate, conversion rate and principal amount, will

depend on market conditions at the time of pricing and will be

determined by negotiations between the Company and the initial

purchaser.

The Company intends to use the net proceeds from the offering to

repay in full amounts outstanding under its credit facility, which

were approximately $16.1 million as of March 31, 2019, and

terminate the credit facility. The Company intends to use the

remaining proceeds from the offering (including any net proceeds

from the sale of any additional Notes that may be sold should the

initial purchaser exercise its option to purchase additional Notes)

for general corporate purposes, including funding investment in its

Brink business and for other working capital needs. The Company may

also use a portion of the proceeds to acquire or invest in other

assets complementary to its business.

The Notes will only be offered to qualified institutional buyers

pursuant to Rule 144A under the Securities Act. Neither the Notes

nor the shares of the Company’s common stock into which the Notes

are convertible have been, or will be, registered under the

Securities Act or the securities laws of any other jurisdiction,

and unless so registered, may not be offered or sold in the United

States except pursuant to an applicable exemption from such

registration requirements.

This announcement is neither an offer to sell nor a solicitation

of an offer to buy the Notes (or the shares of the Company’s common

stock into which the Notes are convertible), nor will there be any

offer, solicitation or sale in any jurisdiction in which such

offer, solicitation or sale is unlawful.

Forward-Looking Statements.

This press release includes “forward-looking statements” within

the meaning of the Private Securities Litigation Reform Act of

1995, Section 27A of the Securities Act of 1933 and Section 21E of

the Securities Exchange Act of 1934, including statements regarding

the intention to offer the Notes, the intended use of proceeds from

the offering and the expected terms of the offering. These

forward-looking statements are subject to risks and uncertainties

that may cause actual results or events to differ materially from

those expressed in the forward-looking statements, including risks

related to whether the Company will consummate the offering of the

Notes on the expected terms, or at all, the potential impact of

market and other general economic conditions, whether the Company

will be able to satisfy the conditions required to close any sale

of the Notes, the intended use of the proceeds of the offering and

the fact that the Company’s management will have broad discretion

in the use of the proceeds from any sale of the Notes. Other risks

and uncertainties that could cause the actual results or events to

differ materially from those contemplated in forward looking

statements are discussed in “Risk Factors” discussed in the

Company’s Annual Report on Form 10-K for the year ended December

31, 2018 and the Company’s other filings with the SEC. The Company

undertakes no obligation to update or revise any forward-looking

statements, whether as a result of new information, future events,

or otherwise, except as may be required under applicable securities

law.

ABOUT PAR TECHNOLOGY CORPORATION

PAR Technology Corporation (PAR) is a leading global provider of

software, systems, and service solutions to the restaurant and

retail industries. Today, with 40 years of experience and point of

sale systems in nearly 100,000 restaurants and more than 110

countries, PAR is redefining the point of sale through cloud

software and bringing technological innovation to all corners of

the enterprise. PAR’s Government business is a leader in providing

computer-based system design, engineering and technical services to

the Department of Defense and various federal agencies. PAR

Technology Corporation's stock is traded on the New York Stock

Exchange under the symbol PAR. For more information, visit

www.partech.com or connect with PAR on Facebook at

www.facebook.com/parpointofsale or Twitter at

www.twitter.com/Par_tech.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20190409005976/en/

Christopher R. Byrnes (315) 738-0600 ext.

6226chris_byrnes@partech.comwww.partech.com

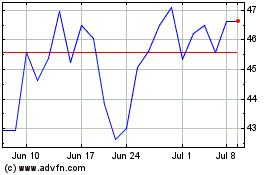

PAR Technology (NYSE:PAR)

Historical Stock Chart

From Mar 2024 to Apr 2024

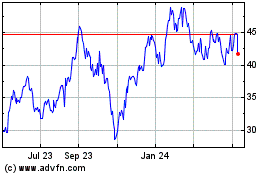

PAR Technology (NYSE:PAR)

Historical Stock Chart

From Apr 2023 to Apr 2024