Owlet, Inc. ("Owlet" or the "Company") (NYSE: OWLT) today

reported preliminary unaudited financial results for the first

quarter ended March 31, 2022. Owlet’s Chief Executive Officer, Kurt

Workman, and Chief Financial Officer, Kate Scolnick, will host a

conference call to review the Company’s results today, May 11,

2022, at 4:30 p.m. ET.

Recent Highlights

- Generated revenues of $21.5 million in the first quarter of

2022

- International revenues accounted for 13% in the first quarter

of 2022, more than double the revenues from the same period in

2021

- Launched the new Dream product line domestically in January

2022 in 100% of Owlet’s previous retail doors by March 2022

- Dream Sock™ and Dream Duo™ named a best baby monitor and baby

gift by Babylist, Glamour, Spy and Gear Brain

- Strong word-of-mouth referral continues, with 56% of customers

reporting they heard about Owlet from a friend1

- 93% of Dream users report peace of mind with the Dream

Sock2

“The first quarter of 2022 was an inflection point for Owlet as

we officially launched our most intelligent monitoring system yet,

the Dream Duo, to truly empower parents with a better understanding

of their baby’s sleep,” said Kurt Workman, Owlet Co-Founder and

Chief Executive Officer. “The best way to characterize the first

quarter of 2022 is we focused on regaining our footing and

positioning back in the market and worked to re-establish ourselves

as the best monitoring solution for parents. I am proud of the

Owlet team, as we remain focused on our core growth areas,

including increasing penetration in the U.S. with our core

products, continuing to build out our connected nursery ecosystem,

developing medical devices, and advancing our international

presence. We cannot imagine a world in the future where every

family doesn’t have access to basic health-sensing technology to

monitor their baby at home, and we are more dedicated than ever to

achieving that vision.”

“Our first quarter results were encouraging, as we achieved our

main operational objectives in the midst of a dynamic operating

environment,” said Kate Scolnick, Owlet Chief Financial Officer.

“In the first quarter, we successfully launched the Dream product

domestically to all our retail channels and saw increasing support

from parents as we added features and improved the offering

throughout the quarter. We continue to manage our working capital,

operating expenses, and existing cash position effectively.”

Financial Results for the First Quarter Ended March 31,

2022

Revenues were $21.5 million for the quarter ended March 31,

2022, as compared to revenues of $21.9 million for the same period

in 2021. First quarter revenues included growth in international

markets, along with the initial launch and retail sell-in of the

Dream product line domestically. First quarter revenues were

impacted by higher reserves for returns. Higher consumer return

rates at initial product launch improved dramatically through the

quarter and are anticipated to stabilize as parents continue to

better understand the new value proposition of the Dream

products.

Cost of revenues for the quarter ended March 31, 2022 was $12.8

million, compared to $9.2 million for the same period in 2021.

Gross margin for the quarter ended March 31, 2022 was 40.7%,

compared to 57.9% for the same period in 2021. The gross margin

decline was primarily due to cost inflation, which represented

approximately half of the decline in gross margin year over year.

Certain near-term gross margin headwinds in the first quarter of

2022 included higher consumer return rates at initial Dream product

launch and costs incurred for products returned from retailers to

be reworked into Dream products.

Operating expenses for the quarter ended March 31, 2022 were

$30.5 million, compared to $15.5 million for the same period in

2021. The increase in operating expenses was primarily for

investments associated with scaling of the business, including

expanded employee headcount for research and development and

incremental public company obligations and higher sales and

marketing spend.

Operating loss and net loss for the quarter ended March 31, 2022

were $21.7 million and $28.8 million, respectively, as compared to

a $2.8 million operating loss and $7.9 million net loss for the

same period in 2021.

Adjusted EBITDA loss for the first quarter of 2022 was $18.0

million, compared to adjusted EBITDA of $0.1 million for the same

period in 2021.

Net loss per share for the quarter ended March 31, 2022 was

$0.26, compared to a net loss per share of $0.35 for the same

period in 2021. Adjusted net loss per share was $0.17 for the

quarter ended March 31, 2022, compared to an adjusted net loss per

share of $0.02 for the same period in 2021.

Financial Outlook

Updated guidance for the second quarter of 2022 will be provided

on the Company’s conference call and webcast.

Forward-Looking Statements

This release and oral statements made from time to time by

representatives of the Company may contain or incorporate by

reference certain statements that are “forward-looking statements”

within the meaning of the Private Securities Litigation Reform Act

of 1995 (the “Reform Act”). Generally, forward-looking statements

include the words “may,” “believes,” “plans,” “expects,”

“anticipates,” “intends,” “estimate,” “goal,” “potential,”

“upcoming,” “outlook,” “guidance,” or the negation thereof, or

similar expressions. In addition, all statements (including any

underlying assumptions) that address projected or future operating,

financial or business performance, strategies or initiatives,

future efficiencies or savings, anticipated costs or charges,

future capitalization, anticipated impacts of recent or pending

investments or transactions, and statements expressing general

views about our future results, performance, operations or business

are forward-looking statements within the meaning of the Reform

Act. Forward-looking statements are based on the Company’s

expectations at the time such statements are made, speak only as of

the dates they are made and are susceptible to a number of risks,

uncertainties and other factors. For all such forward-looking

statements, the Company claims the protection of the safe harbor

for forward-looking statements contained in the Reform Act. The

Company’s actual results, performance or achievements may differ

materially from any future results, performance or achievements

expressed or implied by our forward-looking statements.

Many important factors could affect the Company’s future results

and cause those results to differ materially from those expressed

in or implied by the Company’s forward-looking statements. Such

factors include, but are not limited to, the following: (1) Owlet’s

competition and ability to profitably grow and manage growth; (2)

the regulatory pathway for Owlet products and responses from

regulators, including the U.S. Food and Drug Administration and

similar regulators outside of the United States, as well as legal

proceedings and regulatory requirements; (3) the ability of Owlet

to maintain relationships with customers, manufacturers and

suppliers and retain Owlet’s management and key employees; (4)

changes in applicable laws or regulations; (5) the possibility that

Owlet may be adversely affected by other economic, business,

regulatory and/or competitive factors; (6) the ability of Owlet to

implement its strategic initiatives and continue to innovate its

existing products; (7) the ability of Owlet to acquire, defend and

protect its intellectual property and satisfy regulatory

requirements, including but not limited to those concerning privacy

and data protection; (8) the impact of the COVID-19 pandemic on

Owlet’s business, financial condition, operations and supply chain;

and (9) other risks and uncertainties set forth in the Company’s

releases, public statements and/or filings with the Securities and

Exchange Commission, including those identified in the “Risk

Factors” section in the Company’s Annual Reports on Form 10-K and

Quarterly Reports on Form 10-Q.

All future written and oral forward-looking statements

attributable to the Company or any person acting on the Company’s

behalf are expressly qualified in their entirety by the cautionary

statements contained or referred to above. Moreover, Owlet operates

in an evolving environment. In addition to the factors described

above, new risk factors and uncertainties may emerge from time to

time, and it is impossible for the Company to predict such events

or how they may affect us.

Except as required by federal securities laws, the Company

assumes no obligation to update any forward-looking statements

after the date of this release as a result of new information,

future events or otherwise, although we may do so from time to

time. The Company does not endorse any projections regarding future

performance that may be made by third parties.

This press release does not constitute an offer to sell or the

solicitation of any offer to buy any securities. Any debt

securities, if offered, will not be registered under the Securities

Act of 1933, as amended (the “Securities Act”), or any state

securities laws, and may not be offered or sold in the U.S. absent

registration or an applicable exemption from the registration

requirements of the Securities Act and applicable state securities

laws.

Disclosure Regarding Non-GAAP Financial Measures

In addition to the financial measures presented in this release

in accordance with U.S. Generally Accepted Accounting Principles

(“GAAP”), the Company has included certain non-GAAP financial

measures in this release, including EBITDA, adjusted EBITDA,

adjusted net loss and adjusted net loss per share.

The Company uses such non-GAAP financial measures as internal

measures of business operating performance and as performance

measures for benchmarking against the Company’s peers and

competitors. The Company believes its presentation of EBITDA,

adjusted EBITDA, adjusted net loss and adjusted net loss per share

provide a meaningful perspective of the underlying operating

performance of our current business and enables investors to better

understand and evaluate our historical and prospective operating

performance. The Company believes that these non-GAAP financial

measures are important supplemental measures of operating

performance because they exclude items that vary from period to

period without correlation to our core operating performance and

highlight trends in our business that may not otherwise be apparent

when relying solely on GAAP financial measures. Due to the nature

of the items being excluded, such items do not reflect future

gains, losses, expenses or benefits and are not indicative of the

Company’s future operating performance. The Company believes

investors, analysts and other interested parties use EBITDA,

adjusted EBITDA, adjusted net loss and adjusted net loss per share

in evaluating issuers, and the presentation of these measures

facilitates a comparative assessment of the Company’s operating

performance in addition to the Company’s performance based on GAAP

results.

The Company’s non-GAAP financial measures should not be

considered as an alternative to net loss or net loss per share as a

measure of financial performance or any other performance measure

derived in accordance with GAAP, and should not be construed as an

inference that the Company’s future results will be unaffected by

unusual or non-recurring items. EBITDA is defined as net loss

adjusted for income tax provision, interest expense, interest

income, and depreciation and amortization. Adjusted EBITDA is

defined as net loss adjusted for income tax provision, interest

expense, interest income, depreciation and amortization, warrant

liability adjustments, stock-based compensation, and transaction

costs. Adjusted net loss is defined as net loss adjusted for

warrant liability adjustments, stock-based compensation, and

transaction costs. Adjusted loss per share is defined as Adjusted

net loss divided by weighted-average shares of common stock.

EBITDA, adjusted EBITDA, adjusted net loss and adjusted net loss

per share are not recognized terms under GAAP, and the Company’s

presentation of these non-GAAP financial measures does not replace

the presentation of the Company’s financial results in accordance

with GAAP. Because all companies do not use EBITDA, adjusted

EBITDA, adjusted net loss and adjusted net loss per share (and

similarly titled financial measures) in the same way, those

measures as used by other companies may not be consistent with the

way the Company calculates such measures. The non-GAAP financial

measures included in this release should not be construed as

substitutes for or better indicators of the Company’s performance

than the most directly comparable GAAP financial measures. See the

reconciliation tables that accompany this release for additional

information regarding certain of the non-GAAP financial measures

included herein.

Conference Call and Webcast information

Owlet will host a conference call and audio webcast today at

4:30 p.m. ET to discuss these results.

To access the conference call by telephone, please dial (844)

200-6205 (domestic) or +1 (929) 526-1599 (international) and

reference Access Code 164978. To listen to the conference call via

live audio webcast, please visit the Events section of Owlet’s

Investor Relations website at investors.owletcare.com.

A replay of the conference call will be available by telephone

by dialing (929) 458-6194 (domestic) or +44 (204) 525-0658

(international) and using Access Code 729488. The archived webcast

will also be available on Owlet’s Investor Relations website

mentioned above.

About Owlet, Inc.

Owlet was founded by a team of parents in 2012. Owlet’s mission

is to empower parents with the right information at the right time,

to give them more peace of mind and help them find more joy in the

journey of parenting. Owlet’s digital parenting platform aims to

give parents real-time data and insights to help parents feel more

calm and confident. Owlet believes that every parent deserves peace

of mind and the opportunity to feel their well-rested best. To

learn more, visit www.owletcare.com.

__________________________________ 1Company survey, April 2022

2Company survey, April 2022. N=364

Owlet, Inc.

Condensed Consolidated Balance

Sheets - Preliminary, Unaudited1

(in millions)

December 31,

Assets

March 31, 2022

2021

Current assets:

Cash and cash equivalents

$

68.7

$

95.1

Accounts receivable

16.6

10.5

Inventory

24.7

18.0

Prepaid expenses and other current

assets

6.7

12.3

Total current assets

116.7

135.8

Property and equipment, net

1.7

1.9

Right of use assets, net

2.7

—

Intangible assets, net

2.1

1.7

Other assets

0.8

0.7

Total assets

$

124.1

$

140.0

Liabilities and Stockholders’

Equity

Current liabilities:

Accounts payable

$

23.5

$

27.8

Accrued and other expenses

35.2

31.7

Current portion of deferred revenues

1.1

1.1

Line of credit

4.6

—

Current portion of long-term debt

7.1

8.5

Total current liabilities

71.6

69.1

Long-term debt, net

6.5

8.0

Noncurrent lease liabilities

2.1

—

Common stock warrant liability

13.9

7.1

Other long-term liabilities

0.2

0.7

Total liabilities

94.3

84.9

Total stockholders’ equity

29.8

55.2

Total liabilities and stockholders’

equity

$

124.1

$

140.0

Owlet, Inc.

Condensed Consolidated

Statements of Cash Flows - Preliminary, Unaudited1

(in millions)

For the Three Months Ended March

31,

2022

2021

Net cash used in operating activities

(27.4

)

(7.0

)

Net cash used in investing activities

(0.7

)

—

Net cash provided by financing

activities

1.8

2.8

Net change in cash and cash

equivalents

(26.3

)

(4.2

)

1 Amounts may not sum due to rounding

Owlet, Inc.

Condensed Consolidated

Statements of Operations and Comprehensive Loss - Preliminary,

Unaudited1

(in millions, except share and

per share amounts)

For the three months ended

March 31,

2022

2021

Revenues

$

21.5

$

21.9

Cost of revenues

12.8

9.2

Gross profit

8.8

12.7

Operating expenses:

General and administrative

10.3

6.0

Sales and marketing

11.6

6.1

Research and development

8.5

3.4

Total operating expenses

30.5

15.5

Operating loss

(21.7

)

(2.8

)

Other income (expense):

Interest expense, net

(0.2

)

(0.4

)

Preferred stock warrant liability

adjustment

—

(4.6

)

Common stock warrant liability

adjustment

(6.9

)

—

Other income (expense), net

—

—

Total other income (expense), net

(7.1

)

(5.0

)

Loss before income tax provision

(28.8

)

(7.9

)

Income tax provision

—

—

Net loss and comprehensive loss

$

(28.8

)

$

(7.9

)

Net loss per share attributable to common

stockholders, basic and diluted

$

(0.26

)

$

(0.35

)

Weighted-average number of shares

outstanding used to compute net loss per share attributable to

common stockholders, basic and diluted

110,384,313

22,233,820

1 Amounts may not sum due to rounding

Owlet, Inc.

Reconciliation of GAAP to

Non-GAAP Measures - Preliminary, Unaudited1

(in millions)

For the three months ended March

31

2022

2021

Net Loss

$

(28.8

)

$

(7.9

)

Income tax provision

—

—

Interest expense, net

0.2

0.4

Depreciation and amortization

0.3

0.2

EBITDA

$

(28.2

)

$

(7.2

)

Preferred stock warrant liability

adjustment

—

4.6

Common stock warrant liability

adjustment

6.9

—

Stock based compensation

3.3

0.8

Merger transaction costs

$

—

$

1.9

Adjusted EBITDA

$

(18.0

)

$

0.1

Owlet, Inc.

Reconciliation of GAAP to

Non-GAAP Measures - Preliminary, Unaudited1

(in millions, except share and

per share amounts)

For the three months ended

March 31,

2022

2021

Net Loss

$

(28.8

)

$

(7.9

)

Non-GAAP Adjustments:

Preferred stock warrant liability

adjustment

—

4.6

Common stock warrant liability

adjustment

6.9

—

Stock based compensation

$

3.3

$

0.8

Merger transaction costs

—

1.9

Adjusted Net Loss

(18.6

)

(0.5

)

Net loss per share

(0.26

)

(0.35

)

Adjusted net loss per share

(0.17

)

(0.02

)

Weighted average number of shares

outstanding

110,384,313

22,233,820

1 Amounts may not sum due to rounding

View source

version on businesswire.com: https://www.businesswire.com/news/home/20220511005968/en/

Investors Mike Cavanaugh ICR

Westwicke Phone: (617) 877-9641 mike.cavanaugh@westwicke.com

Media Jane Putnam Owlet, Inc.

Phone: (801) 647-0025 jputnam@owletcare.com

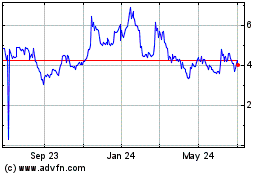

Sandbridge Aquisition (NYSE:OWLT)

Historical Stock Chart

From Mar 2024 to Apr 2024

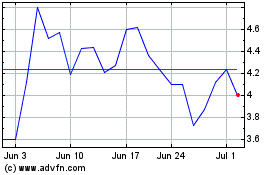

Sandbridge Aquisition (NYSE:OWLT)

Historical Stock Chart

From Apr 2023 to Apr 2024