As filed with the Securities and Exchange Commission on November 2, 2017

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

____________________________________________________________________

FORM S-3

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

____________________________________________________________________

OGE ENERGY CORP.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

Oklahoma

(State or other jurisdiction of

incorporation or organization)

|

|

73-1481638

(I.R.S. Employer

Identification No.)

|

321 N. Harvey, P.O. Box 321

Oklahoma City, Oklahoma 73101-0321

(405) 553-3000

(Address, including zip code, and telephone number,

including area code, of registrant's principal executive offices)

SEAN TRAUSCHKE

Chairman of the Board, President and Chief Executive Officer

OGE ENERGY CORP.

321 N. Harvey, P.O. Box 321

Oklahoma City, Oklahoma 73101-0321

(405) 553-3000

(Name, address, including zip code, and telephone number,

including area code, of agent for service)

Copy to:

ROBERT J. JOSEPH

Jones Day

77 West Wacker

Chicago, Illinois 60601

(312) 269-4176

____________________________________________________________________

Approximate date of commencement of proposed sale to the public:

From time to time after the effective date of this registration statement.

____________________________________________________________________

If the only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please check the following box.

o

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plans, check the following box.

R

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.

o

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.

o

If this Form is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become effective upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box.

R

If this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.D. filed to register additional securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box.

o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of "large accelerated filer," "accelerated filer," "smaller reporting company" and "emerging growth company" in Rule 12b-2 of the Exchange Act.

|

|

|

|

|

|

Large accelerated filer

R

|

Accelerated filer

£

|

|

Non-accelerated filer

£

(Do not check if a smaller reporting company)

|

Smaller reporting company

£

|

|

|

Emerging growth company

£

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of Securities Act.

£

Calculation of Registration Fee

|

|

|

|

|

|

|

|

|

Title of each class of

securities to be registered

|

Amount to be

registered

|

Proposed maximum

offering price

per unit(1)

|

Proposed maximum

aggregate offering

price(1)

|

Amount of

registration fee

|

|

Common stock, par value $0.01 per share

|

5,000,000

|

$36.81

|

$184,050,000

|

$22,914.23

|

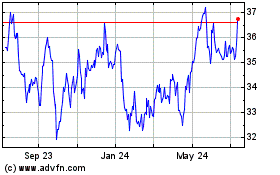

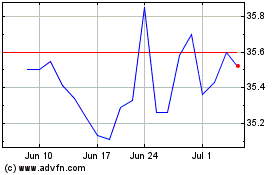

(1)

This amount is an estimate made solely for the purpose of calculating the registration fee pursuant to the Rule 457(c) of the Securities Act of 1933, as amended, and is based on the average of the high and low prices of the registrant's common stock on the New York Stock Exchange on November 1, 2017.

PROSPECTUS

5,000,000 Shares

OGE ENERGY CORP.

321 N. Harvey, P.O. Box 321

Oklahoma City, Oklahoma 73101-0321

(405) 553-3000

Common Stock

AUTOMATIC DIVIDEND REINVESTMENT

AND STOCK PURCHASE PLAN

This prospectus describes our automatic dividend reinvestment and stock purchase plan.

Our plan is designed to provide you with a convenient way to purchase shares of our common stock, par value $0.01 per share, and to reinvest all or a portion of the cash dividends paid on our common stock.

Several significant changes have been made to the plan and, accordingly, you are encouraged to read this prospectus in its entirety. Among these changes are:

|

|

|

|

•

|

we will no longer pay trading fees for the purchase of shares and you will be assessed service and trading fees for most transactions under the plan, including, among others, the purchase of shares, whether through reinvestment of dividends or optional cash purchases; and

|

|

|

|

|

•

|

you will now have four options for selling your shares, including via a market order sale, batch order sale, day limit order sale, or good-til-canceled limit order sale.

|

The other basic features of the plan remain the same, however.

As a plan participant you may:

|

|

|

|

•

|

reinvest all or a portion of the cash dividends paid on our common stock registered in your name or common stock credited to your plan account in additional shares of common stock;

|

|

|

|

|

•

|

make an initial investment in our common stock with a cash payment of at least $250 or, if you already are a holder of our common stock, you may increase your investment by making optional cash payments at any time of at least $25 for any single investment, up to a maximum of $100,000 per year. Investments greater than $100,000 per year may be made only with our permission;

|

|

|

|

|

•

|

receive, upon request, certificates for whole shares of common stock credited to your plan account;

|

|

|

|

|

•

|

deposit your common stock share certificates into the plan for safekeeping; and

|

|

|

|

|

•

|

sell shares of common stock credited to your plan account through the plan.

|

Shares of common stock will be purchased under the plan, at our option, from newly issued shares, shares held in our treasury or shares purchased in the open market. Any open market purchases will be made through a registered broker-dealer selected by the administrator. To the extent required by state securities laws in certain jurisdictions, offers under the plan to persons who are not currently shareowners must be only through a registered broker/dealer. Our common stock is listed on the New York Stock Exchange and trades under the symbol "OGE." The closing price on November 1, 2017 on the New York Stock Exchange was

$36.60.

Except as described below, the purchase price of newly issued or treasury shares of common stock purchased under the plan will be the average of the high and low sales prices of the common stock reported on the New York Stock Exchange Composite Tape as published in

The Wall Street Journal

for that date. The price of shares of common stock purchased in the open market will be the weighted average price per share of the relevant batch (as discussed below) of shares purchased in the open market for the relevant period. Common stock purchased directly from us pursuant to an optional investment of more than $100,000 (with our permission) may be priced at a discount from recent market prices (as described in this prospectus) ranging from 0% to 3%. We may change or adjust any discount at any time in our sole discretion.

We are providing this prospectus both to current and prospective participants in the plan. If you currently participate in the plan, this prospectus (including the materials incorporated by reference) provides more current information concerning our company and the plan and is intended to replace our prospectus dated November 13, 2014.

Investing in our common stock involves risks. See "Risk Factors" on page 1.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus is November 2, 2017.

You should rely only on the information contained in or incorporated by reference into this prospectus. We have not authorized any other person to provide you with different information. If anyone provides you with different or inconsistent information, you should not rely on it. We are not making an offer to sell these securities in any jurisdiction where the offer or sale is not permitted. You should assume that the information contained in or incorporated by reference into this prospectus is accurate only as of the date on the front cover of this prospectus or the date of the document incorporated by reference herein.

TABLE OF CONTENTS

FORWARD-LOOKING STATEMENTS

This prospectus and the documents incorporated by reference contain statements that are not historical fact and constitute "forward-looking statements." Such forward-looking statements are intended to be identified by the words "anticipate," "believe," "estimate," "expect," "intend," "objective," "plan," "possible," "potential," "project," and similar expressions. Forward-looking statements are not guarantees of performance. They involve risks, uncertainties and assumptions. Our future results may differ materially from those expressed in these forward-looking statements. These statements are necessarily based upon various assumptions involving judgments with respect to the future and other risks, including, among others:

|

|

|

|

•

|

general economic conditions, including the availability of credit, access to existing lines of credit, access to the commercial paper markets, actions of rating agencies and their impact on capital expenditures;

|

|

|

|

|

•

|

our ability and the ability of our subsidiaries to access the capital markets and obtain financing on favorable terms as well as inflation rates and monetary fluctuations;

|

|

|

|

|

•

|

the ability to obtain timely and sufficient rate relief to allow for recovery of items such as capital expenditures, fuel costs, operating costs, transmission costs and deferred expenditures;

|

|

|

|

|

•

|

prices and availability of electricity, coal, natural gas and natural gas liquids;

|

|

|

|

|

•

|

the timing and extent of changes in commodity prices, particularly natural gas and natural gas liquids, the competitive effects of the available pipeline capacity in the regions served by Enable Midstream Partners, and the effects of geographic and seasonal commodity price differentials, including the effects of these circumstances on re-contracting available capacity on Enable's interstate pipelines;

|

|

|

|

|

•

|

the timing and extent of changes in the supply of natural gas, particularly supplies available for gathering by Enable Midstream Partners' gathering and processing business and transporting by Enable Midstream Partners' interstate pipelines, including the impact of natural gas and natural gas liquids prices on the level of drilling and production activities in the regions Enable Midstream Partners serves;

|

|

|

|

|

•

|

business conditions in the energy and natural gas midstream industries, including the demand for natural gas, natural gas liquids, crude oil and midstream services;

|

|

|

|

|

•

|

competitive factors, including the extent and timing of the entry of additional competition in the markets we serve;

|

|

|

|

|

•

|

the impact on demand for our services resulting from cost-competitive advances in technology, such as distributed electricity generation and customer energy efficiency programs;

|

|

|

|

|

•

|

technological developments, changing markets and other factors that result in competitive disadvantages and create the potential for impairment of existing assets;

|

|

|

|

|

•

|

factors affecting utility operations such as unusual weather conditions; catastrophic weather-related damage; unscheduled generation outages, unusual maintenance or repairs; unanticipated changes to fossil fuel, natural gas or coal supply costs or availability due to higher demand, shortages, transportation problems or other developments; environmental incidents; or electric transmission or gas pipeline system constraints;

|

|

|

|

|

•

|

availability and prices of raw materials for current and future construction projects;

|

|

|

|

|

•

|

the effect of retroactive pricing of transactions in the Southwest Power Pool markets or adjustments in market pricing mechanisms by the Southwest Power Pool;

|

|

|

|

|

•

|

Federal or state legislation and regulatory decisions and initiatives that affect cost and investment recovery, have an impact on rate structures or affect the speed and degree to which competition enters our markets;

|

|

|

|

|

•

|

environmental laws, safety laws or regulations that may impact the cost of our operations or restrict or change the way we operate our facilities;

|

|

|

|

|

•

|

changes in accounting standards, rules or guidelines;

|

|

|

|

|

•

|

the discontinuance of accounting principles for certain types of rate-regulated activities;

|

|

|

|

|

•

|

the cost of protecting assets against, or damage due to, terrorism or cyber-attacks and other catastrophic events;

|

|

|

|

|

•

|

creditworthiness of suppliers, customers and other contractual parties;

|

|

|

|

|

•

|

social attitudes regarding the utility, natural gas and power industries;

|

|

|

|

|

•

|

identification of suitable investment opportunities to enhance shareholder returns and achieve long-term financial objectives through business acquisitions and divestitures;

|

|

|

|

|

•

|

increased pension and healthcare costs;

|

|

|

|

|

•

|

costs and other effects of legal and administrative proceedings, settlements, investigations, claims and matters, including, but not limited to, those described in the reports we file with the Securities and Exchange Commission, or SEC;

|

|

|

|

|

•

|

the difficulty in making accurate assumptions and projections regarding future revenues and costs associated with our equity investment in Enable Midstream Partners that we do not control; and

|

|

|

|

|

•

|

other factors listed from time to time in reports we file with the SEC.

|

In light of these risks and uncertainties, there can be no assurance that the results and events contemplated by the forward-looking information contained or incorporated by reference in this prospectus will in fact transpire. You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of their dates. We undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. These risks and uncertainties are discussed in more detail under "Business," "Risk Factors," "Management's Discussion and Analysis of Financial Condition and Results of Operations" and "Notes to Consolidated Financial Statements" in our most recent Annual Report on Form 10-K and in our Quarterly Reports on Form 10-Q and other documents on file with the SEC. You may obtain copies of these documents as described under "Where You Can Find More Information."

RISK FACTORS

An investment in our shares of common stock involves risk. Prior to making a decision about investing in our shares of common stock, you should carefully consider the risk factors and cautionary statements under the heading "Risk Factors" in our most recently filed Annual Report on Form 10-K and Quarterly Reports on Form 10-Q filed subsequent thereto and other filings we make from time to time with the SEC. Such factors could affect actual results and cause results to differ materially from those expressed or implied in our forward-looking statements made by us or on our behalf. Additional risks and uncertainties not currently known to us or that we currently view as immaterial may also affect our business operations.

THE COMPANY

We are an energy and energy services provider offering physical delivery and related services for both electricity and natural gas primarily in the south central United States. We conduct these activities through two business segments: (i) electric utility and (ii) natural gas midstream operations.

Our electric utility segment generates, transmits, distributes and sells electric energy in Oklahoma and western Arkansas. These operations are conducted through our wholly owned subsidiary, Oklahoma Gas and Electric Company ("OG&E") and are subject to regulation by the Oklahoma Corporation Commission, the Arkansas Public Service Commission and the Federal Energy Regulatory Commission. OG&E is the largest electric utility in Oklahoma and its franchised service territory includes Fort Smith, Arkansas and the surrounding communities. OG&E sold its retail natural gas business in 1928 and is no longer engaged in the natural gas distribution business.

Our natural gas midstream operations segment consists of our investment in Enable Midstream Partners, LP (“Enable”). Enable is engaged in the business of gathering, processing, transporting and storing natural gas. Enable's natural gas gathering and processing assets are strategically located in four states and serve natural gas production from shale developments in the Anadarko, Arkoma and Ark-La-Tex basins. Enable also owns an emerging crude oil gathering business in the Bakken shale formation, principally located in the Williston basin of North Dakota. Enable's natural gas transportation and storage assets extend from western Oklahoma and the Texas Panhandle to Alabama and from Louisiana to Illinois.

The general partner of Enable is equally controlled by CenterPoint Energy, Inc. and us, who each have 50 percent of the management rights. At September 30, 2017, through our wholly owned subsidiary OGE Holdings, we hold 25.7 percent of the limited partner interests in Enable. We also own a 60 percent interest in any incentive distribution rights in Enable.

We were incorporated in August 1995 in the state of Oklahoma and our principal executive offices are located at 321 North Harvey, P.O. Box 321, Oklahoma City, Oklahoma 73101-0321; telephone 405-553-3000.

USE OF PROCEEDS

If newly issued or treasury shares of common stock are purchased under the plan, the proceeds from these sales will be used for general corporate purposes, including, without limitation, to provide funds for the redemption, repayment or retirement of our outstanding indebtedness or the advance or contribution of funds to one or more of our subsidiaries to be used for general corporate purposes, including, without limitation, to fund the acquisition of additional generating facilities or for their construction programs

or for the redemption, repayment or retirement of their indebtedness. We will not receive any proceeds when shares of common stock are purchased under the plan in the open market.

OGE ENERGY CORP.

AUTOMATIC DIVIDEND REINVESTMENT AND STOCK PURCHASE PLAN

The following questions and answers summarize the provisions of our automatic dividend reinvestment and stock purchase plan as in effect on the date of this prospectus.

The plan provides existing and potential investors in our company with a simple and convenient method of purchasing shares of our common stock. The plan also provides you with a convenient way to reinvest all or a portion of your cash dividends in shares of our common stock.

|

|

|

|

2.

|

What Is the Purpose of the Plan and What Are Some of Its Advantages and Disadvantages?

|

Purpose

-The purpose of the plan is to provide existing and potential investors in our company with a convenient way to purchase shares of our common stock and to reinvest all or a portion of their cash dividends in shares of our common stock. Because new shares may be purchased directly from us, we may receive additional funds for general corporate purposes.

Advantages

|

|

|

|

•

|

If you are not currently a record holder of our common stock, you may become a participant in the plan by making an initial minimum cash investment of at least $250 to purchase common stock through the plan.

|

|

|

|

|

•

|

If you are currently a record holder of our common stock, but are not participating in the plan, you can become a participant by: (1) electing to have dividend payments on all or a portion of your common stock reinvested in common stock; (2) depositing your common stock certificates into the plan for safekeeping; or (3) making a minimum cash investment of at least $25 to purchase common stock through the plan.

|

|

|

|

|

•

|

In addition to having your dividend payments reinvested in common stock, you may invest additional funds in common stock through optional cash investments of at least $25 for any single investment up to $100,000 per year. Optional cash investments may be made by check or by individual or periodic electronic funds transfer from a pre-designated U.S. bank account. Optional cash investments may be made occasionally or at regular intervals, as you desire. At our discretion, we may permit investments of greater than $100,000 per year. See Question 9 below for a discussion of Requests for Waiver.

|

|

|

|

|

•

|

Funds invested in the plan are fully invested in common stock through the purchase of whole shares and fractions of shares, and proportionate cash dividends on fractions of shares of common stock are used to purchase additional shares of common stock.

|

|

|

|

|

•

|

The plan offers a "safekeeping" service whereby you may deposit, free of any service charges, your common stock certificates into the plan. Shares of common stock deposited will be credited to your account. You can select this service without participating in any other feature of the plan.

|

|

|

|

|

•

|

You may direct us, at any time and at no cost to you, to transfer all or a portion of the shares of common stock credited to your account (including any shares of common stock deposited into the plan for safekeeping) to the account of another participant (or to set up an account for a new participant in connection with this transfer) or to send certificate(s) representing these shares to you or another designated person or entity.

|

|

|

|

|

•

|

Periodic statements will be mailed to you showing all transactions completed during the year to date, total shares of common stock credited to your account and other information related to your account.

|

|

|

|

|

•

|

You may direct that all, a portion or none of your dividend payments on shares of our common stock that you own, including shares of common stock purchased for you under the plan and shares of common stock deposited into the plan for safekeeping, be reinvested in shares of common stock. Dividend payments not reinvested will be paid to you in cash or directly deposited to a designated U.S. bank account.

|

|

|

|

|

•

|

You may sell, through the plan, shares of common stock credited to your account (including those shares of common stock deposited into the plan for safekeeping) via a market order sale, batch order sale, day limit order sale, or good-til-canceled limit order sale. (See the answer to Question 18.)

|

Disadvantages

|

|

|

|

•

|

You have no control over the price, and in the case of shares of common stock purchased or sold (except for prices specified for day limit order sales or good-til-canceled limit order sales) in the open market by an independent agent, the time, at which common stock is purchased or sold, respectively, for your account.

Purchases in the open market generally will occur at least once each week. Funds not invested in common stock within 30 days after receipt for reinvested dividends and 35 days after receipt for optional cash investments will be promptly returned to you. Your sales under the plan will be made by a registered broker-dealer selected by the administrator as soon as practicable after processing the sales request. Therefore, you bear the market risk associated with fluctuations in the price of the common stock. (See the answers to Questions 7, 8, 10, 14 and 18.)

|

|

|

|

|

•

|

No interest will be paid on funds held by the administrator of the plan pending investment under the plan.

|

|

|

|

|

•

|

You will be assessed service and trading fees for certain transactions under the plan, including, among others, the purchase and sale of shares. (See the answer to Question 23.)

|

|

|

|

|

3.

|

Who Administers the Plan and What Are Some of the Functions Performed by the Administrator?

|

Administration of the plan is conducted by the individual (who may be an employee of our company), bank, trust company or other entity (including our company) appointed from time to time by us to act as administrator of the plan. Computershare Trust Company, N.A. ("Computershare") is the current administrator. The administrator is responsible for administering the plan, receiving all your cash investments, maintaining records of account activities, issuing statements of account and performing other duties required by the plan. The number of shares credited to your account under the plan will be shown on your statement of account. Normally, certificates for shares purchased under the plan will not be issued to you, but will be held by the administrator in book-entry form and registered in your name. However, subject to the conditions described in the answers to Questions 11 and 12 regarding withdrawal of shares, certificates for any number of whole shares credited to your account under the plan will be issued to you upon your request to the administrator. Any remaining whole and fractional shares will continue to be credited to your account. Certificates for fractional shares will not be issued.

If we have decided that shares purchased under the plan are to be purchased in the open market, the administrator or another agent we select that is an "agent independent of the issuer," as that term is defined in the rules and regulations under the Exchange Act, will purchase shares of common stock in the open market. In this prospectus, we refer to the "agent independent of the issuer" as the "independent agent." The administrator will use a registered broker-dealer that is independent of us as the independent agent to make these purchases. The independent agent may be affiliated with the administrator. The independent agent is responsible for purchasing and selling shares of common stock in the open market for participants' accounts in accordance with the provisions of the plan.

Except as provided in the answers to Questions 9 and 15, all communications regarding the plan should be made directly to the administrator through the following:

Internet

You can enroll in the Plan, obtain information and perform certain transactions on your account online via Investor Center at

www.computershare.com/investor

.

Telephone

You can telephone Shareholder Customer Service toll-free within the United States and Canada by calling 1-888-216-8114. An automated voice response system is available 24 hours a day, 7 days a week. Customer service representatives are available from 9:00 a.m. to 7:00 p.m., Eastern Time, Monday through Friday (except holidays).

International Telephone Inquiries: 1-201-680-6578

For the hearing impaired (TDD): 1-800-368-0328

In Writing

You may write to the administrator at the following address:

Computershare

P.O. Box 505000

Louisville, KY 40233-5000

You should be sure to include your name, address, daytime phone number, account number and a reference to OGE Energy on all correspondence.

|

|

|

|

4.

|

Am I Eligible to Participate in the Plan?

|

Whether or not you are a record holder of our common stock, you are eligible to participate in the plan, if: (1) you fulfill the conditions for participation described below in the third and fourth paragraphs of the answer to Question 5; and (2) if you are a citizen or resident of a country other than the United States, its territories and possessions, your participation would not violate local laws applicable to our company, the plan and you.

If you are already a participant in the plan, you are not required to re-enroll. However, if you wish to change your participation in any way (for example, from partial to full reinvestment), you must submit instructions or a new enrollment form to that effect to the administrator.

After being furnished with a copy of this prospectus, you may join the plan at any time by enrolling online through Investor Center at

www.computershare.com/investor

or by completing and signing an enrollment form in the manner set forth below.

All plan materials, including enrollment forms, as well as other plan forms and this prospectus, are available through Investor Center at

www.computershare.com/investor

or by contacting the administrator as indicated in the answer to Question 3 above.

In order to become a participant in the plan, you can enroll online or submit an enrollment form to the administrator and either: (1) elect to have cash dividends paid on our common stock of which you are the record holder invested in common stock (see the answer to Question 10); (2) deposit share certificates into the plan for safekeeping (see the answer to Question 17); or (3) make an initial cash investment (see the answer to Question 7).

If you are the beneficial owner of common stock registered in "street name" (for example, in the name of a bank, broker or trustee), you may participate in the plan by either: (1) transferring those securities into your own name and depositing those shares of common stock into the plan for safekeeping and/or electing to reinvest cash dividend payments on those shares in common stock (see the answer to Question 19); or (2) making arrangements with your record or registered holder (for example, your bank, broker or trustee, who will become the participant) to participate in the plan on your behalf.

You will become a participant after a properly completed enrollment form has been received and accepted by the administrator or after you enroll online. If you are a holder of common stock and your election is received by the administrator before the record date for payment of a cash dividend on common stock (dividend record dates for common stock normally are expected to be the tenth day of January, April, July and October), that cash dividend and all future cash dividends payable on your common stock will be used by the administrator to buy shares of common stock for your account under the plan to the extent you requested. See the answer to Question 10. If your election is not received on or before the record date for a cash dividend on common stock, the dividend will be paid to you in cash and the reinvestment of your dividends under the plan will begin with the next cash dividend payment on the common stock. Thus, for example, an October 30 cash dividend will be used to purchase shares of common stock under the plan only if your enrollment is received on or before October 10.

|

|

|

|

6.

|

What Securities are Eligible for Automatic Dividend Reinvestment Under the Plan?

|

In addition to our common stock, we may from time to time designate, in our sole discretion, other equity or debt securities of our company or OG&E as eligible securities by notifying the administrator in writing of the designation.

|

|

|

|

7.

|

How Do I Make Initial Cash Investments and Optional Cash Investments?

|

Initial Investments.

Whether or not you are currently a record holder of our common stock, you may become a participant by making an investment through the plan as described below.

If you are not a record holder, you must authorize or include a minimum initial cash investment of at least $250 and not more than $100,000 with your completed enrollment. If you are a record holder and do not elect to have dividends reinvested and do not deposit common stock certificates in the plan for safekeeping, you must authorize or include a minimum initial cash investment of at least $25 with your completed enrollment.

Such investments may be made electronically or by personal check (in U.S. dollars and drawn against a U.S. bank) payable to Computershare/OGE.

Do not send cash, traveler's checks, money orders or third party checks.

Optional Cash Investments

General.

You may make one-time optional cash investments online through Investor Center at

www.computershare.com/investor

or by personal check or monthly recurring investments through electronic funds transfer from a pre-designated U.S. bank account, as described below. Optional cash investments must be at least $25 for any single investment. There is no obligation to make any optional cash investment and the amount and timing of your investments may vary from time to time.

Optional cash investments may not exceed $100,000 in the aggregate per year. We refer to this limit on the dollar amount of optional cash investments as the "maximum amount." In determining whether the maximum amount has been reached, initial investments will be counted as optional cash investments.

Optional cash investments by a current participant of more than $100,000 per year and any initial cash investment by a new investor in excess of $100,000, may only be made pursuant to a Request for Waiver that has been granted by us as described in more detail in the answer to Question 9.

Online Investments.

You may authorize individual or ongoing automatic deductions of a specified amount (not less than $25) from a designated U.S. bank account through Investor Center at

www.computershare.com/investor

. Please see the answer to Question 3 for information on how to access Investor Center.

Check.

You may make optional cash investments by delivering to the administrator: (1) a completed optional cash investment stub which will be attached to your statement of account or enrollment form; and (2) a personal check (in U.S. dollars and drawn against a U.S. bank) payable to Computershare/OGE. Do not send cash, traveler's checks, money orders or third party checks.

Electronic Transfer from Bank Account.

You may make monthly recurring automatic investments of a specified amount (not less than $25 or more than $100,000 per year) by electronic funds transfer from a pre-designated U.S. bank account.

You can initiate monthly automatic deductions online through Investor Center at

www.computershare.com/investor

or you may complete and sign a direct debit authorization form and return it to the administrator together with a voided blank check for the account from which funds are to be drawn. Automatic deductions will be processed and will become effective as promptly as practicable.

Once a monthly automatic deduction is initiated, funds will be drawn from your designated bank account on the fifteenth day of each month (unless such date falls on a bank holiday or weekend, in which case funds will be deducted on the next business day) and will be invested in common stock as soon as practicable, generally within a week.

You may change or terminate automatic deduction by notifying the administrator. To be effective for a particular deduction date, however, notification must be received by the administrator at least seven business days preceding such deduction date.

If your check submitted for an optional cash investment is returned unpaid for any reason, or your authorized electronic transfer is refused for any reason, the administrator will immediately remove shares that were purchased in anticipation of the collection of those funds from your account. Those shares will be sold to recover any uncollected funds. If the net proceeds of the sale of those shares are not sufficient to recover the full amount of the uncollected funds, the administrator reserves the right to sell additional shares from any accounts you maintain with the administrator as may be necessary to recover the full uncollected balance. There is a $35 fee for any check or other deposit that is returned unpaid by your bank and if your authorized electronic payment is refused for any reason. This fee will be collected by the administrator through the sale of the number of shares from your account necessary to satisfy the fee.

No interest will be paid on amounts held pending investment.

|

|

|

|

8.

|

When Will My Initial and Optional Cash Investments Be Applied to the Purchase of Common Stock?

|

Optional and initial cash investments of $100,000 or less per year will be invested in common stock at least once each week, except where and to the extent any applicable federal securities laws or other government or stock exchange regulations otherwise require.

No interest will be paid on funds held by the administrator pending investment.

Upon your request, a cash investment not already invested in common stock will be returned to you. However, no refund of a check will be made until the funds from these instruments have been actually collected by the administrator. Accordingly, these refunds may be significantly delayed.

Optional and initial cash investments, pending investment pursuant to the plan, will be credited to your account and held in a trust account which will be separated from our other funds or monies. Cash investments not invested in common stock within 35 days of receipt will be promptly returned to you. All cash investments are subject to collection by the administrator of full face value in U.S. funds. The method of delivery of any cash investment is at your election and risk or that of an interested investor and will be deemed received when actually received by the administrator. If the delivery is by mail, it is recommended that you or the interested investor use properly insured registered mail with return receipt requested.

Cash dividends paid on shares of common stock credited to your account that were purchased through the plan with optional and initial cash investments will be reinvested in accordance with your current plan election unless you notify the administrator otherwise.

|

|

|

|

9.

|

How Do I Make Optional Cash Investments Over the Maximum Amount?

|

If you wish to make an optional cash investment in excess of $100,000 per year and be eligible for a potential discount from the market price, you must obtain our prior written approval. If you are interested in obtaining such approval, you must submit a Request for Waiver. To make a Request for Waiver, you should obtain a "Request for Waiver" form by contacting the administrator at 1-888-216-8114 or

www.computershare.com/investor

. Completed Request for Waiver forms should be sent to the administrator. The administrator will notify you as to whether your Request for Waiver has been granted or denied, either in whole or in part, within one business day of the receipt of your request. If your Request for Waiver is granted in part, the administrator will advise you of the maximum amount that will be accepted from you in connection with your purchase. If your request is approved, the administrator must receive the funds for your purchase prior to or on the applicable date specified by the administrator for the relevant pricing period (which typically will be one business day prior to the applicable pricing period). If you do not receive a response from the administrator in connection with your Request for Waiver, you should assume that we have denied your request.

We may alter, amend, supplement or waive, in our sole discretion, the time periods and/or other parameters relating to optional cash purchases in excess of $100,000 made by one or more participants in the plan or new investors, at any time and from time to time, prior to the granting of any Request for Waiver. For more information regarding a particular pricing period (including applicable pricing period start dates), please contact the administrator at 1-888-216-8114. Please see the answer to Question 15 for a discussion of the pricing applicable to any approved Request for Waivers.

We also may make the foregoing information available on the Investor Relations segment of our website at www.oge.com or on another website we may establish for this purpose from time to time.

We have the sole discretion whether to approve any request to make an optional cash investment in excess of the $100,000 annual maximum. We may grant those requests for waiver in order of receipt or by any other method that we determine to be appropriate. We also may determine the amount that you may invest pursuant to a waiver. In deciding whether to approve your Request for Waiver, we may consider, among other things, the following factors:

|

|

|

|

•

|

whether, at the time of such request, the administrator is acquiring shares of common stock for the plan directly from us or in the open market or in privately negotiated transactions with third parties;

|

|

|

|

|

•

|

our need for additional funds;

|

|

|

|

|

•

|

our desire to obtain additional funds through the sale of common stock as compared to other sources of funds;

|

|

|

|

|

•

|

the purchase price likely to apply to any sale of common stock;

|

|

|

|

|

•

|

the extent and nature of your prior participation in the plan;

|

|

|

|

|

•

|

the number of shares of common stock you hold of record; and

|

|

|

|

|

•

|

the total amount of optional cash investments in excess of $100,000 per year for which Requests for Waiver have been submitted.

|

We reserve the right to modify, suspend or terminate participation in the plan by otherwise eligible registered holders or beneficial owners of our common stock for any reason whatsoever including elimination of practices that are inconsistent with the purposes of the plan.

|

|

|

|

10.

|

How and When Are My Cash Dividends Reinvested?

|

You may elect to invest in common stock by reinvesting all or a portion of the cash dividends paid on all or a portion of the common stock registered in your name, common stock purchased through the plan and credited to your account and common stock deposited into the plan for safekeeping, by designating your election with the administrator.

If you do not make an election, cash dividends paid on shares of common stock credited to your account that were purchased through the plan or deposited into the plan for safekeeping will automatically be reinvested in shares of common stock.

If you elect partial reinvestment of cash dividends, you must designate the whole number of shares for which reinvestment is desired. Once you elect reinvestment, cash dividends on the designated shares of common stock will be reinvested in shares of common stock.

The amount reinvested will be reduced by any amount which is required to be withheld under any applicable tax or other statutes.

If you have specified partial reinvestment, that portion of cash dividends not designated for reinvestment will be sent to you by check in the usual manner or with regard to the partial reinvestment of cash dividends on common stock credited to your account, by electronic direct deposit, if you have elected the direct deposit option (see the answer to Question 13).

Dividends will be invested in common stock as soon as practicable following payment; however, purchases may be made over a number of days to meet the requirements of the plan. (See the answers to Questions 8 and 14.) Dividends not invested in common stock within 30 days of receipt will be promptly returned to you. Cash dividend reinvestment amounts, pending investment pursuant to the plan, will be credited to your account and held in a trust account which will be separated from our other funds or monies.

No interest will be paid on funds held by the administrator pending investment.

|

|

|

|

11.

|

How Do I Change Participation in, or Withdraw Shares From, the Plan?

|

You may change your reinvestment options, including changing the reinvestment level (i.e., full, partial or none) of cash dividends online through Investor Center at

www.computershare.com/investor

, by telephone or by delivering written instructions or a new enrollment form to that effect to the administrator.

You can withdraw from the plan at any time by contacting the administrator via Investor Center at

www.computershare.com/investor

, by telephone or in writing. In your request, you can instruct the administrator to withdraw some or all of your shares by continuing to hold your whole shares in safekeeping and selling any fraction of a share less any applicable fees, issuing a certificate for the whole shares held in your account and selling any fraction of a share less any applicable fees or selling your shares, including any fraction of a share held in your account less any applicable fees. The administrator will process a proper and complete request for withdrawal as soon as practicable (typically within five (5) business days after receipt). For the available sales options and related fees please see the answer to Question 18. Issuance of certificates may be subject to an additional fee. Please contact the administrator to determine if there is a certificate issuance fee.

|

|

|

|

12.

|

When May I Change Participation in, or Withdraw Shares From, the Plan?

|

You may change participation in, or withdraw from, the plan at any time.

To be effective with respect to a particular cash dividend date, any instructions to change reinvestment options must be received by the administrator prior to the cash dividend record date. If instructions are not received by the administrator prior to the record date, the instructions will not become effective until after such dividend is paid. The shares of common stock purchased with these funds will be credited to your account.

To be effective with respect to a particular cash dividend date, the administrator should receive your withdrawal request prior to the cash dividend record date. If the request is not received prior to the cash dividend record date, your request will be processed but may not include any additional shares purchased with reinvested dividends.

|

|

|

|

13.

|

Can I Have a Portion of My Cash Dividends Deposited Directly Into My Bank Account?

|

If you elect not to reinvest all or any portion of cash dividends on shares of common stock credited to your account, you may receive these cash dividends by electronic deposit to your pre-designated U.S. bank, savings, or credit union accounts. To receive a direct deposit of funds, you must complete and sign an authorization for electronic direct deposit and return it to the administrator. Alternatively, you may authorize direct deposit of funds through Investor Center at

www.computershare.com/investor

. Direct deposit will become effective as promptly as practicable after receipt of a completed authorization for electronic direct deposit. Changes in designated direct deposit accounts may be made by delivering a completed authorization for electronic direct deposit to the administrator or online through Investor Center at

www.computershare.com/investor

.

Cash dividends on shares of common stock not designated for reinvestment and not directly deposited will be paid by check on the applicable dividend payment date.

|

|

|

|

14.

|

What Is the Source of Shares Purchased Under the Plan?

|

Shares of common stock purchased for participants under the plan will be either newly issued shares or shares held in our treasury or, at our option, shares of common stock purchased in the open market by an independent agent. The primary consideration in determining the source of shares is expected to be our need to increase equity capital. If we do not need to raise funds externally or if financing needs are satisfied using non-equity sources of funds to maintain our targeted capital structure, shares of common stock purchased for participants under the plan will be purchased in the open market, subject to the limitation discussed below for changing the source of shares of common stock. As of the date of this prospectus, shares of common stock purchased for participants under the plan are shares of common stock purchased in the open market by the administrator's broker-dealer who is considered an independent agent.

Except as described below in the answer to Question 15 relating to Requests for Waiver, purchases of shares of common stock directly from us, whether newly issued or treasury shares, will be made at least once each week at the average of the high and low sales prices of the common stock reported on the New York Stock Exchange Composite Tape as published in

The Wall Street Journal

for the date these shares are purchased. In the event no trading is reported for the trading day, the purchase price may be determined by us on the basis of market quotations we deem appropriate.

Purchases in the open market generally will occur at least once each week, except where and to the extent necessary under any applicable federal securities laws or any other governmental or stock exchange regulations. Funds not invested in common stock within 35 days of receipt will be promptly returned to you. If the administrator purchases shares of our common stock in the open market, the administrator may combine a participant’s funds with funds of other participants and generally will batch purchase types (reinvestment of dividends, initial cash investments and optional cash investments) for separate execution by its broker-dealer. At the administrator’s discretion, these batches may be combined and executed by its broker-dealer. The administrator may also direct its broker-dealer to execute each purchase type in several batches throughout a trading day. Depending on the number of shares being purchased and current trading volume in shares of our common stock, the administrator’s broker-dealer may execute purchases for any batch or batches in multiple transactions and over more than one day. If different purchase types are batched, the price per share of our common stock purchased for each participant’s account, whether purchased with reinvested dividends, initial cash investments or optional cash investments, shall be the weighted average price of the specific batch for shares of our common stock purchased by the administrator’s broker-dealer on that investment date. The administrator will purchase such shares as soon as is practical on or after an investment date.

With regard to open market purchases of shares of common stock, we and you will not have any authority or power to direct the time or price at which shares may be purchased, the markets on which the shares are to be purchased (including on any securities exchange, in the over-the-counter market or in negotiated transactions), or the selection of the broker or dealer through or from whom purchases may be made. The administrator's broker-dealer may commingle your funds with those of other participants for the purpose of executing purchase transactions. Dividend and voting rights will commence upon settlement, whether shares are purchased from us or any other source.

|

|

|

|

15.

|

Once a "Request for Waiver" of Optional Cash Investments Over $100,000 Has Been Granted (See Question 9), How Are Shares Priced and Purchased?

|

Shares purchased pursuant to a granted Request for Waiver will be purchased directly from us. Optional cash investments made pursuant to a Request for Waiver will be priced as follows:

|

|

|

|

•

|

Investments for which a Request for Waiver has been granted will be made subject to a "pricing period," which will generally consist of one (1) to twelve (12) separate days during which trading of our common stock is reported on the

|

New York Stock Exchange. Each of these separate days will be an "investment date," and an equal proportion of the investment amount will be invested on each trading day during such pricing period, subject to the qualifications listed below. The purchase price for shares acquired on a particular investment date will be equal to 100% (subject to change as provided below) of the volume-weighted average price (less any applicable discount), rounded to four decimal places, of our common stock as reported by the New York Stock Exchange only, obtained from Bloomberg, LP for the trading hours from 9:30 a.m. to 4:00 p.m., Eastern Time (through and including the last trade on the New York Stock Exchange even if reported after 4:00 p.m.), for that investment date. For example, if a cash investment of $10 million is made pursuant to an approved Request for Waiver and the pricing period is ten days, the number of shares will be calculated for each day of the pricing period by taking a pro rata portion of the total cash investment for each day of the pricing period, which would be $1 million, and dividing it by the volume weighted average price obtained from Bloomberg, LP for the trading hours from 9:30 a.m. to 4:00 p.m., Eastern time (through and including the last trade on the New York Stock Exchange even if reported after 4:00 p.m.), less the discount. Funds for such investments must be received by the administrator not later than the business day before the first day of the pricing period.

|

|

|

|

•

|

We may establish a minimum, or "threshold," price for any pricing period that the volume-weighted average price, rounded to four decimal places, of our common stock must equal or exceed during each trading day of the pricing period for investments made pursuant to a Request for Waiver. If the threshold price is not satisfied for a trading day in the pricing period, then we will exclude from the pricing period such trading day and refund that day's proportional investment amount. For example, if the threshold price is not met for two (2) of the trading days in a ten-day pricing period, then we will return 20% of the funds you submitted in connection with your Request for Waiver, without interest, unless we have activated the pricing period extension feature for the pricing period, as described below. Neither we nor the administrator are required to notify you that a threshold price has been established for any pricing period. The establishment of the threshold price and the possible return of a portion of the payment applies only to optional cash investments exceeding $100,000 per year made pursuant to a granted Request for Waiver. Setting a threshold price for a pricing period will not affect the setting of a threshold price for any other pricing period. We may waive our right to set a threshold price for any particular pricing period.

|

|

|

|

|

•

|

For each pricing period, we may establish a discount from the market price applicable to optional cash purchases and initial investments made pursuant to a Request for Waiver. This waiver discount, if any, will range from 0% to 3% of the purchase price and may vary for each pricing period. The waiver discount, if any, will be established at our sole discretion after a review of current market conditions, the level of participation in the plan, the attractiveness of obtaining additional funds through the sale of our common shares as compared to other sources of funds, and our need for additional funds. You may obtain information regarding the waiver discount, if any, by contacting the administrator at 1-888-216-8114 or

www.computershare.com/investor

. Setting a waiver discount for a particular pricing period will not affect the setting of a waiver discount for any subsequent pricing period. The waiver discount, if any, will apply only to optional cash purchases and initial investments in excess of $100,000 made pursuant to a Request for Waiver. The waiver discount, if any, however, will apply to the entire optional cash purchase or initial investment made pursuant to the Request for Waiver and not just the portion in excess of $100,000.

|

|

|

|

|

•

|

We may elect to activate for any particular pricing period a pricing period extension feature that will provide that the initial pricing period be extended by the number of days that the threshold price is not satisfied, subject to a maximum of five (5) trading days. If we elect to activate the pricing period extension feature and the threshold price is satisfied for any additional day that has been added to the initial pricing period, that day will be included as one of the trading days for the pricing period instead of the day on which the threshold price was not met. For example, if the determined pricing period is ten (10) days, and the threshold price is not satisfied for three (3) out of those ten (10) days in the initial pricing period, and we had previously announced in the Request for Waiver form that the pricing period extension feature was activated, then the pricing period will be automatically extended, and if the threshold price is satisfied on the next three (3) trading days (or a subset thereof), then those three (3) days (or subset thereof) will become investment dates in lieu of the three (3) days on which the threshold price was not met. As a result, because there were ten (10) trading days during the initial and extended pricing period on which the threshold price was satisfied, all of the funds that you include with your Request for Waiver will be invested.

|

|

|

|

|

•

|

Newly issued shares purchased pursuant to a Request for Waiver will be posted to participants' accounts within two (2) business days following the end of the applicable pricing period, or, if we elect to activate the continuous settlement feature, within two (2) business days of each separate investment date beginning on the first investment date in the relevant pricing period and ending on the final investment date in the relevant pricing period, with an equal amount being invested on each day, subject to the qualifications set forth above. During any month when we are proposing to grant a Request for Waiver for one or more investments, we may elect to activate the continuous settlement feature for such investments by announcing in the Request for Waiver form that we will be doing so. For each pricing period (assuming the threshold

|

price is met on each trading day of that pricing period), we would have a separate settlement of each investment dates' purchases, each based on the volume-weighted average price for the trading day relating to each of the investment dates during the pricing period.

|

|

|

|

•

|

Request for Waiver forms and information regarding the establishment of a threshold price, if any, and discount, if any, may be obtained by contacting the administrator at 1-888-216-8114 or

www.computershare.com/investor

.

|

|

|

|

|

16.

|

How Many Shares Will Be Purchased for My Account?

|

The number of shares (including any fraction of a share rounded to six decimal places) of common stock credited to your account for a particular purchase will be determined by dividing the total amount of cash dividends, optional cash investments and/or initial cash investments to be invested for you (less any applicable transaction and trading fees) by the relevant purchase price per share as determined in the answer to Question 14 or 15 above, as applicable.

|

|

|

|

17.

|

Can I Deposit Shares With the Administrator for Safekeeping?

|

At the time of enrollment, or at any later time, you may take advantage of the plan's cost-free safekeeping services. Common stock held in certificate form by you may be deposited into the plan, to be held in book-entry form by the administrator, by delivering with a letter of instruction and such certificates to the administrator. These certificates should not be endorsed. We strongly recommend that certificates be sent by registered or certified mail, with adequate insurance. However, the method used to submit certificates to the administrator is at your option and risk.

The shares of common stock deposited will be credited to your account. Thereafter, the shares of common stock will be treated in the same manner as shares of common stock purchased under the plan and credited to your account. References in this prospectus to shares of common stock credited to your account will include shares of common stock deposited into the plan for safekeeping unless otherwise indicated.

Cash dividends paid on shares of common stock credited to your account that were deposited into the plan for safekeeping will be reinvested in accordance with your current plan election unless you notify the administrator otherwise.

|

|

|

|

18.

|

Can I Sell Shares of Common Stock Credited to My Account?

|

Yes. You have four choices when making a sale, depending on how you submit your sale request, as follows:

Market Order:

A market order is a request to sell shares promptly at the current market price. Market order sales are only available at

www.computershare.com/investor

or by calling the administrator directly at 1-888-216-8114. Market order sale requests received at

www.computershare.com/investor

or by telephone will be placed promptly upon receipt during market hours (normally 9:30 a.m. to 4:00 p.m. Eastern time). Any orders received after 4:00 p.m. Eastern time will be placed promptly on the next day the market is open. Depending on the number of shares being sold and current trading volume in the shares, a market order may only be partially filled or not filled at all on the trading day in which it is placed, in which case the order, or remainder of the order, as applicable, will be canceled at the end of such day. To determine if the shares were sold, you should check your account online at

www.computershare.com/investor

or call the administrator directly at 1-888-216-8114. If the market order sale was not filled and you still would like the shares sold, you will need to re-enter the sale request. The price with respect to each market order will be the market price for such order obtained by the administrator’s broker-dealer, less a transaction fee of $25 per sale and a trading fee of $0.12 for each share sold.

Batch Order:

A batch order is an accumulation of all sale requests for a security submitted together as a collective request. Batch orders are submitted on each market day, assuming there are sale requests to be processed. Sale instructions for batch orders received by the administrator will be processed no later than five business days after the date on which the order is received (except where deferral is required under applicable federal or state laws or regulations), assuming the applicable market is open for trading and sufficient market liquidity exists. All sale requests received in writing will be submitted as batch order sales. The administrator will seek to sell shares in round lot (100 shares) transactions. For this purpose the administrator may combine each selling participant’s shares with those of other selling participants. In every case of a batch order sale, the price to each selling participant will be the weighted average sale price obtained by the administrator’s broker-dealer for each aggregate order placed by the Administrator and executed by the broker, less a transaction fee of $25 per sale and a trading fee of $0.12 for each share sold.

Day Limit Order:

A day limit order is an order to sell securities when and if they reach a specific trading price on a specific day. The order is automatically canceled if the price is not met by the end of that day (or, for orders placed after-market hours, the next day the market is open). Depending on the number of shares being sold and the current trading volume in the securities, such an order may only be partially filled, in which case the remainder of the order will be canceled. The order may be canceled by the

applicable stock exchange, by the administrator at its sole discretion or, if the administrator’s broker-dealer has not filled the order, at your request made online at

www.computershare.com/investor

or by calling the administrator directly at 1-888-216-8114. Each day limit order sale will incur a transaction fee of $25 per sale and a trading fee of $0.12 for each share sold.

Good-Til-Canceled (‘‘GTC’’) Limit Order:

A GTC limit order is an order to sell shares when and if the shares reach a specific trading price at any time while the order remains open (generally up to 30 days). Depending on the number of shares being sold and current trading volume in the shares, sales may be executed in multiple transactions and over more than one day. If shares are traded on more than one day during which the market is open, a separate fee will be charged for each such day. The order (or any unexecuted portion thereof) is automatically canceled if the trading price is not met by the end of the order period. The order may be canceled by the applicable stock exchange, by the administrator at its sole discretion or, if the administrator’s broker-dealer has not filled the order, at your request made online at

www.computershare.com/investor

or by calling the administrator directly at 1-888-216-8114. Each GTC limit order sale will incur a transaction fee of $25 per sale and a trading fee of $0.12 for each share sold.

Trading fees include any applicable brokerage commissions the administrator is required to pay. Any fractional share will be rounded up to a whole share for purposes of calculating the trading fee.

The administrator may, for various reasons, require a sales request to be submitted in writing.

You should contact the administrator to determine if there are any limitations applicable to your particular sale request.

All sales requests processed over the telephone will entail an additional fee of $15 if the assistance of a Customer Service Representative is required when selling shares.

You should be aware that the price of our common stock may rise or fall during the period between a request for sale, its receipt by the administrator, and the ultimate sale on the open market. Instructions for a market order or a batch sale are binding and may not be rescinded.

If you elect to sell shares online at

www.computershare.com/investor

through Investor Center you may utilize the administrator’s international currency exchange service to convert your sale proceeds to local currency prior to being sent to you. Receiving sales proceeds in a local currency and having a check drawn on a local bank avoids the time consuming and costly ‘‘collection’’ process required for cashing U.S. dollar checks. This service is subject to additional terms and conditions and fees, to which you must agree online.

The administrator reserves the right to decline to process a sale if it determines, in its sole discretion, that supporting legal documentation is required. In addition, if you elect to sell shares through the administrator, you will not have any authority or power to direct the time or price at which shares are sold (except for prices specified for day limit orders or GTC limit orders), and only the administrator will select the broker-dealer through or from whom sales are to be made.

The administrator may deduct any applicable tax withholding from the sale proceeds. Sales processed on accounts without a valid Internal Revenue Service (“IRS”) Form W-9 for participants that are “United States persons” (within the meaning of the Internal Revenue Code), or IRS Form W-8BEN or IRS Form W-8BEN-E, as applicable, or other applicable IRS Form W-8 for participants that are not “United States persons” (within the meaning of the Internal Revenue Code), will be subject to U.S. federal backup withholding. See “Certain U.S. Federal Income Tax Consequences” for more information.

|

|

|

|

19.

|

How Do I Transfer Shares of Common Stock?

|

Please visit the Computershare Transfer Wizard at

www.computershare.com/transferwizard

. The Transfer Wizard will guide you through the transfer process, assist you in completing the transfer form, and identify other necessary documentation you may need to provide.

|

|

|

|

20.

|

Following the Withdrawal, Sale or Transfer of My Shares Under the Plan, How Will Dividends on Any Remaining Shares Credited to My Account Be Reinvested?

|

If you are reinvesting cash dividends paid on only a portion of the shares of common stock credited to your account through the plan and you elect to sell, withdraw or transfer a portion of the shares, cash dividends on the remainder of the shares credited to your account, up to the number of shares designated for reinvestment prior to the sale, withdrawal or transfer, will continue to be reinvested through the plan, except where you give specific instructions to the contrary in connection with the sale, withdrawal or transfer. For example, if you elected to have cash dividends reinvested through the plan on 50 shares of a total of 100 shares

of common stock credited to your account and you elected to sell, withdraw or transfer 25 shares, cash dividends on 50 shares of the remaining 75 shares credited to your account would be reinvested through the plan. If instead you elected to sell, withdraw or transfer 75 shares, cash dividends on the remaining 25 shares credited to the account would be reinvested through the plan.

|

|

|

|

21.

|

What Reports Will Be Sent to Me?

|

You will receive a statement of account following each transaction in your account under the plan. This statement of account will show all transactions for your account during the current calendar year, the number of shares of common stock credited to your account and other information for your account. For shares acquired in the plan after January 1, 2011, the statement will include specific cost basis information in accordance with applicable law.

You should retain these statements of account in order to establish the cost basis, for tax purposes, for shares of common stock acquired under the plan.

You will receive copies of all communications sent to holders of common stock. This may include annual reports to shareowners, proxy material, consent solicitation material and IRS information, if appropriate, for reporting dividend income. All notices, statements of account and other communications from the administrator to you will be addressed to the latest address of record; therefore, it is important that you promptly notify the administrator of any change of address.

|

|

|

|

22.

|

How Do I Terminate Participation in the Plan?

|

You may discontinue the reinvestment of dividends at any time by notifying the administrator. The administrator will continue to hold your plan shares unless you indicate otherwise. A request to terminate participation may be treated as a withdrawal as described in the answers to Questions 11 and 12.

Upon termination you can instruct the administrator to withdraw all of your shares by continuing to hold your whole shares in “safekeeping” and selling any fraction of a share less any applicable fees, issuing a certificate for the whole shares held in your account and selling any fraction of a share less any applicable fees or selling your shares, including any fraction of a share held in your account less any applicable fees. The administrator will process a proper and complete request for withdrawal as soon as practicable (typically within five (5) business days after receipt). For the available sales options and related fees please see the answer to Questions 18 and 23. Issuance of certificates may be subject to an additional fee. Please contact the administrator to determine if there is a certificate issuance fee.

If notice of termination is received near a record date for an account whose dividends are to be reinvested, the administrator in its sole discretion, may either distribute such dividends in cash or reinvest them in shares on your behalf. In the event reinvestment is made, the administrator will process the termination as soon as practicable, but in no event later than five business days after the investment is complete.

|

|

|

|

23.

|

Who Pays the Costs for Administering the Plan?

|

You pay the following service fees for participation in the plan:

|

|

|

|

|

|

Service Fee

|

Amount

|

|

Enrollment fee for participants not already shareowners

|

No charge

|

|

Reinvestment of dividends

|

5% of the dividend payment up to a maximum of $5 per reinvestment plus trading fee

|

|

Optional cash purchase by check

|

$5 per purchase plus trading fee

|

|

Optional cash purchase by one-time online bank debit

|

$5 per purchase plus trading fee

|

|

Optional cash purchase by recurring monthly automatic deduction

|

$2.50 per purchase plus trading fee

|

|

Batch order sale of shares (all or a portion)

|

$25 per sale plus trading fee

|

|

Market order sale of shares (all or a portion)

|

$25 per sale plus trading fee

|

|

Day limit order sale of shares (all or a portion)

|

$25 per sale plus trading fee

|

|

GTC limit order sale of shares (all or a portion)

|

$25 per sale plus trading fee

|

|

Agent Assistance Fee

|

$15 per sale

|

|

Reinvestment of dividends trading fee

|

$0.05 per share

|

|

Optional cash purchase trading fee

|

$0.05 per share

|

|

Sales trading fee

|

$0.12 per share

|

|

Insufficient funds fee

|

$35.00

|

|

Duplicate statement/1099 for prior year

|

No charge

|

The administrator will deduct the applicable fees from proceeds due from a sale, funds received for investment or the payment of dividends. Trading fees include any applicable brokerage commissions the administrator is required to pay. Any fractional share will be rounded up to a whole share for purposes of calculating the trading fee.

We will pay all other administrative costs and expenses associated with the plan.

|

|

|

|

24.

|