Novo Nordisk 1Q Was Boosted by Stockpiling Amid Virus Outbreak -- Earnings Review

May 06 2020 - 6:08AM

Dow Jones News

By Dominic Chopping

Novo Nordisk A/S reported results for the first quarter on

Wednesday. Here's what we watched:

SALES FORECAST: Sales rose 16% to 33.88 billion Danish kroner

($4.96 billion) against analysts' expectations of DKK31.79 billion

as patients in the U.S. and Europe in particular stockpiled

medicines during the coronavirus outbreak.

NET PROFIT FORECAST: Net profit for the first three months of

the year rose to DKK11.9 billion from DKK10.45 billion a year

earlier, beating the DKK11.1 billion forecast by analysts in a

FactSet poll.

WHAT WE WATCHED:

GLUCAGON-LIKE PEPTIDE-1: Sales of Novo Nordisk's glucagon-like

peptide-1 products for type 2 diabetes--Victoza, Ozempic and

Rybelsus--increased by 40% measured in Danish kroner and by 37% in

local currencies to DKK33.2 billion in 1Q. Sales growth was driven

by both its North America and international operations, it said.

The sales increase was also boosted by Covid-19-related

stockpiling. Sales totaled DKK4.76 billion and Ozempic has now been

launched in 34 countries. The GLP-1 segment's value share of the

total diabetes market has increased to 19.0% compared with 15.2% a

year ago, and Novo Nordisk said it has a 48.3% market share in the

global GLP-1 segment. Sales of obesity drug Saxenda rose 30% in the

quarter to DKK1.58 billion.

MARGINS: The gross margin was 84.1% in the first quarter of 2020

compared with 83.8% in the same period last year. The increase in

the gross margin reflects a positive product mix driven by

increased GLP-1 sales, productivity improvement--mainly within

insulin and GLP-1 production--and a positive currency impact of 0.2

percentage point, partly countered by a negative impact from lower

realized prices in the U.S. The earnings before interest and taxes

margin slipped to 48.1% from 48.6%.

GUIDANCE: Novo Nordisk backed guidance for 2020 sales growth of

3% to 6% measured in local currencies, and growth reported in

Danish kroner one percentage point higher than in local currencies.

Operating profit growth is also still expected to be 1% to 5%

measured in local currencies and one percentage point higher when

reported in Danish kroner. Capital expenditure is still expected to

be around DKK6.5 billion in 2020. Financial items are now seen at a

loss of around DKK2.5 billion from a loss of DKK1.5 billion

previously, mainly reflecting foreign exchange hedging

contracts.

Write to Dominic Chopping at dominic.chopping@wsj.com

(END) Dow Jones Newswires

May 06, 2020 05:53 ET (09:53 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

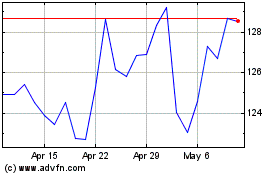

Novo Nordisk (NYSE:NVO)

Historical Stock Chart

From Aug 2024 to Sep 2024

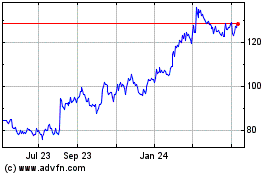

Novo Nordisk (NYSE:NVO)

Historical Stock Chart

From Sep 2023 to Sep 2024