Statement of Changes in Beneficial Ownership (4)

May 04 2020 - 5:32PM

Edgar (US Regulatory)

FORM 4

[ ]

Check this box if no longer subject to Section 16. Form 4 or Form 5 obligations may continue. See Instruction 1(b).

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

STATEMENT OF CHANGES IN BENEFICIAL OWNERSHIP OF SECURITIES

|

OMB APPROVAL

OMB Number:

3235-0287

Estimated average burden

hours per response...

0.5

|

|

Filed pursuant to Section 16(a) of the Securities Exchange Act of 1934 or Section 30(h) of the Investment Company Act of 1940

|

|

|

1. Name and Address of Reporting Person

*

ROBO JAMES L |

2. Issuer Name and Ticker or Trading Symbol

NEXTERA ENERGY INC

[

NEE

]

|

5. Relationship of Reporting Person(s) to Issuer

(Check all applicable)

__X__ Director _____ 10% Owner

__X__ Officer (give title below) __X__ Other (specify below)

Chairman, President & CEO

/

Director of Subsidiary |

|

(Last)

(First)

(Middle)

C/O NEXTERA ENERGY, INC., 700 UNIVERSE BLVD. |

3. Date of Earliest Transaction

(MM/DD/YYYY)

5/1/2020 |

|

(Street)

JUNO BEACH, FL 33408

(City)

(State)

(Zip)

|

4. If Amendment, Date Original Filed

(MM/DD/YYYY)

|

6. Individual or Joint/Group Filing

(Check Applicable Line)

_X

_ Form filed by One Reporting Person

___ Form filed by More than One Reporting Person

|

Table I - Non-Derivative Securities Acquired, Disposed of, or Beneficially Owned

|

1.Title of Security

(Instr. 3)

|

2. Trans. Date

|

2A. Deemed Execution Date, if any

|

3. Trans. Code

(Instr. 8)

|

4. Securities Acquired (A) or Disposed of (D)

(Instr. 3, 4 and 5)

|

5. Amount of Securities Beneficially Owned Following Reported Transaction(s)

(Instr. 3 and 4)

|

6. Ownership Form: Direct (D) or Indirect (I) (Instr. 4)

|

7. Nature of Indirect Beneficial Ownership (Instr. 4)

|

|

Code

|

V

|

Amount

|

(A) or (D)

|

Price

|

| Common Stock | 5/1/2020 | | M(1) | | 50968 | A | $60.22 | 394338 (2)(3) | D |

|

| Common Stock | 5/1/2020 | | S(4) | | 6727 | D | $225.798 (5) | 387611 (2)(3) | D |

|

| Common Stock | 5/1/2020 | | S(4) | | 38502 | D | $226.801 (6) | 349109 (2)(3) | D |

|

| Common Stock | 5/1/2020 | | S(4) | | 20545 | D | $227.575 (7) | 328564 (2)(3) | D |

|

| Common Stock | 5/1/2020 | | S(4) | | 5194 | D | $228.471 (8) | 323370 (2)(3) | D |

|

| Common Stock | | | | | | | | 107632 | I | James L. Robo Gifting Trust |

| Common Stock | | | | | | | | 73550 | I | Spouse's Gifting Trust |

| Common Stock | | | | | | | | 31292 | I | 2018 Spouse's Gifting Trust |

| Common Stock | | | | | | | | 74724 (9) | I | By Rabbi Trust |

| Common Stock | | | | | | | | 4714 | I | By Retirement Savings Plan Trust |

Table II - Derivative Securities Beneficially Owned (e.g., puts, calls, warrants, options, convertible securities)

|

1. Title of Derivate Security

(Instr. 3) | 2. Conversion or Exercise Price of Derivative Security | 3. Trans. Date | 3A. Deemed Execution Date, if any | 4. Trans. Code

(Instr. 8) | 5. Number of Derivative Securities Acquired (A) or Disposed of (D)

(Instr. 3, 4 and 5) | 6. Date Exercisable and Expiration Date | 7. Title and Amount of Securities Underlying Derivative Security

(Instr. 3 and 4) | 8. Price of Derivative Security

(Instr. 5) | 9. Number of derivative Securities Beneficially Owned Following Reported Transaction(s) (Instr. 4) | 10. Ownership Form of Derivative Security: Direct (D) or Indirect (I) (Instr. 4) | 11. Nature of Indirect Beneficial Ownership (Instr. 4) |

| Code | V | (A) | (D) | Date Exercisable | Expiration Date | Title | Amount or Number of Shares |

| Employee Stock Option (Right to Buy) | $60.22 | 5/1/2020 | | M (1) | | | 50968 | (10) | 2/17/2022 | Common Stock | 50968 | $0 | 0 | D |

|

| Explanation of Responses: |

| (1) | Options exercised pursuant to Rule 10b5-1 trading plan adopted by the reporting person on July 26, 2019. |

| (2) | Includes a total of 48,269 shares deferred pursuant to the terms of a deferred stock grant under Issuer's Amended and Restated 2011 Long Term Incentive Plan (the "Deferred Shares Grant"), including an aggregate of 333 deferred shares deemed acquired pursuant to a dividend reinvestment feature under the Deferred Shares Grant since the last report filed by the reporting person. Under the terms of the Deferred Shares Grant, shares are distributable in stock at the end of the deferral period. |

| (3) | Includes a total of 221,920 shares deferred until reporting person's termination of employment with the Issuer and its subsidiaries, including an aggregate of 1,223 deferred shares deemed acquired pursuant to a dividend reinvestment feature. |

| (4) | Sales effected pursuant to Rule 10b5-1 trading plan adopted by the reporting person on July 26, 2019. |

| (5) | Weighted average sale price. Reporting person sold 6,727 shares through a trade order executed by a broker-dealer at prices ranging from $225.15 to $226.15 per share. The reporting person hereby undertakes to provide full information regarding the number of shares sold at each separate price upon request by the U.S. Securities and Exchange Commission staff, the Issuer, or a security holder of the Issuer. |

| (6) | Weighted average sale price. Reporting person sold 38,502 shares through a trade order executed by a broker-dealer at prices ranging from $226.16 to $227.16 per share. The reporting person hereby undertakes to provide full information regarding the number of shares sold at each separate price upon request by the U.S. Securities and Exchange Commission staff, the Issuer, or a security holder of the Issuer. |

| (7) | Weighted average sale price. Reporting person sold 20,545 shares through a trade order executed by a broker-dealer at prices ranging from $227.17 to $228.17 per share. The reporting person hereby undertakes to provide full information regarding the number of shares sold at each separate price upon request by the U.S. Securities and Exchange Commission staff, the Issuer, or a security holder of the Issuer. |

| (8) | Weighted average sale price. Reporting person sold 5,194 shares through a trade order executed by a broker-dealer at prices ranging from $228.21 to $229.20 per share. The reporting person hereby undertakes to provide full information regarding the number of shares sold at each separate price upon request by the U.S. Securities and Exchange Commission staff, the Issuer, or a security holder of the Issuer. |

| (9) | Deferred shares held by Trustee of grantor trust in which reporting person has a pecuniary interest only. Includes an aggregate of 509 shares acquired by the Trustee pursuant to a dividend reinvestment feature of the deferred shares grant since the last report filed by the reporting person. |

| (10) | The option, representing a right to buy shares, became exercisable in three substantially equal annual installments beginning on February 15, 2013. |

Reporting Owners

|

| Reporting Owner Name / Address | Relationships |

| Director | 10% Owner | Officer | Other |

ROBO JAMES L

C/O NEXTERA ENERGY, INC.

700 UNIVERSE BLVD.

JUNO BEACH, FL 33408 | X |

| Chairman, President & CEO | Director of Subsidiary |

Signatures

|

| Sharon Sartor (Attorney-in-Fact) | | 5/4/2020 |

| **Signature of Reporting Person | Date |

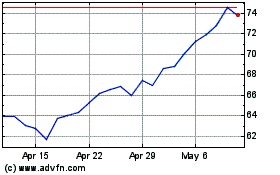

NextEra Energy (NYSE:NEE)

Historical Stock Chart

From Mar 2024 to Apr 2024

NextEra Energy (NYSE:NEE)

Historical Stock Chart

From Apr 2023 to Apr 2024