UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 13D

(Rule 13d-101)

Information to be Included in Statements Filed

Pursuant to § 240.13d-1(a) and Amendments Thereto Filed Pursuant to § 240.13d-2(a)

Under the Securities Exchange Act of 1934

(Amendment No. 5)*

MANCHESTER UNITED PLC

(Name of Issuer)

Class A ordinary shares, par value $0.0005

per share

(Title of Class of Securities)

G5784H106

(CUSIP Number)

c/o Manchester United plc

Old Trafford

Manchester M16 0RA

United Kingdom

+44 (0) 161 868 8000

(Name, Address and Telephone

Number of Person

Authorized to Receive Notices and Communications)

March 9, 2022

(Date of Event which Requires Filing of this Statement)

If the filing person has

previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule

because of §§240.13d-1(e), 240.13d-1(f) or 240.13d-1(g), check the following box. ¨

Note:

Schedules filed in paper format shall include a signed original and five copies of the schedule, including all exhibits. See §

240.13d-7 for other parties to whom copies are to be sent.

* The remainder of this cover

page shall be filled out for a reporting person’s initial filing on this form with respect to the subject class of securities,

and for any subsequent amendment containing information which would alter disclosures provided in a prior cover page.

The information required on the remainder of this

cover page shall not be deemed to be “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934

(“Act”) or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of

the Act (however, see the Notes).

| 1 |

NAMES OF REPORTING PERSONS

RECO Holdings LLC |

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

(a) ¨

(b) ¨ |

| 3 |

SEC USE ONLY

|

| 4 |

SOURCE OF FUNDS

OO |

| 5 |

Check

if disclosure of legal proceedings is required pursuant to Items 2(d) or 2(e) ¨ |

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION

Nevada |

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON WITH |

7 |

SOLE VOTING POWER

0 |

| 8 |

SHARED VOTING POWER

150,000 |

| 9 |

SOLE DISPOSITIVE POWER

0 |

| 10 |

SHARED DISPOSITIVE POWER

150,000 |

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

150,000 |

| 12 |

CHECK

IF THE AGGREGATE AMOUNT IN ROW (11)

EXCLUDES ¨

CERTAIN SHARES |

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

0.3% |

| 14 |

TYPE OF REPORTING PERSON

OO |

| 1 |

NAMES OF REPORTING PERSONS

Joel M. Glazer Irrevocable Exempt Trust |

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

(a) ¨

(b) ¨ |

| 3 |

SEC USE ONLY

|

| 4 |

SOURCE OF FUNDS

OO |

| 5 |

Check

if disclosure of legal proceedings is required pursuant to Items 2(d) or 2(e) ¨ |

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION

Nevada |

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON WITH |

7 |

SOLE VOTING POWER

0 |

| 8 |

SHARED VOTING POWER

23,606,980 |

| 9 |

SOLE DISPOSITIVE POWER

0 |

| 10 |

SHARED DISPOSITIVE POWER

23,606,980 |

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

23,606,980 |

| 12 |

CHECK

IF THE AGGREGATE AMOUNT IN ROW (11)

EXCLUDES ¨

CERTAIN SHARES |

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

35.3% |

| 14 |

TYPE OF REPORTING PERSON

OO |

| 1 |

NAMES OF REPORTING PERSONS

Joel M. Glazer |

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

(a) ¨

(b) ¨ |

| 3 |

SEC USE ONLY

|

| 4 |

SOURCE OF FUNDS

OO |

| 5 |

Check

if disclosure of legal proceedings is required pursuant to Items 2(d) or 2(e) ¨ |

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION

United States of America |

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON WITH |

7 |

SOLE VOTING POWER

0 |

| 8 |

SHARED VOTING POWER

23,606,980 |

| 9 |

SOLE DISPOSITIVE POWER

0 |

| 10 |

SHARED DISPOSITIVE POWER

23,606,980 |

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

23,606,980 |

| 12 |

CHECK

IF THE AGGREGATE AMOUNT IN ROW (11)

EXCLUDES ¨

CERTAIN SHARES |

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

35.3% |

| 14 |

TYPE OF REPORTING PERSON

IN |

Explanatory Note

This Amendment No. 4 to Schedule 13D (“Amendment

No. 5”) amends and supplements the Statement on Schedule 13D filed with the United States Securities and Exchange Commission

on August 23, 2013, as previously amended (the “Statement”), relating to Class A ordinary shares, par value $0.0005

per share (the “Shares”) of Manchester United plc, a Cayman Islands company (the “Issuer”). Capitalized terms

used herein without definition shall have the meaning set forth in the Statement.

Item 2. Identity and Background.

Item 2 of the Statement is amended and restated

in its entirety as follows: This statement is being filed by the following persons (each a “Reporting Person” and collectively,

the “Reporting Persons”): RECO Holdings LLC ("RECO LLC"); Joel M. Glazer Irrevocable Exempt Trust (the “Trust”);

and Joel M. Glazer (the “Trustee”). RECO LLC is organized in the State of Delaware. The Trust is organized in the State of

Nevada. The Trustee is a citizen of the United States of America and is the trustee of the Trust. The business address for each of the

Reporting Persons is c/o Manchester United plc, Sir Matt Busby Way, Old Trafford, Manchester, England, M16 0RA. The present principal

occupation of the Trustee is Executive Co-Chairman and Director of the Issuer. During the last five years, none of the Reporting Persons

(i) has been convicted in any criminal proceeding (excluding traffic violations or similar misdemeanors) or (ii) was a party

to a civil proceeding of a judicial or administrative body of competent jurisdiction and as a result of such proceeding was or is subject

to a judgment, decree or final order enjoining future violations of, or prohibiting or mandating activities subject to, federal or state

securities laws or finding any violation with respect to such laws.

Item 4. Purpose of Transaction.

Item 4 of the Statement is amended and supplemented

by inserting the following information: On March 9, 2022, the Trust terminated its previously disclosed line of credit and replaced it

with a new line of credit. All shares of the Issuer provided as security pursuant to the previously disclosed line of credit were provided

as security for the new line of credit. The disclosure regarding the New Line of Credit in Item 6 below is incorporated herein by reference.

Item 5.

Interest in Securities of the Issuer.

Item 5 of the Statement is amended and restated

in its entirety as follows:

(a) — (b)

The following sets forth, as of the date of this Statement, the aggregate number and percentage of Shares beneficially owned by each of

the Reporting Persons, as well as the number of Shares as to which each Reporting Person has the sole power to vote or to direct the vote,

sole power to dispose or to direct the disposition, or shared power to dispose or to direct the disposition of, based 52,795,150 Shares

outstanding as of October 7, 2021.

| Reporting Person |

|

Amount

beneficially

owned |

|

Percent

of class |

|

Sole

power to

vote or

direct the

vote |

|

Shared

power to

vote or to

direct the

vote |

|

Sole

power to

dispose or

to direct

the

disposition

of |

|

Shared

power to

dispose or

to direct

the

disposition

of |

| Joel M. Glazer Irrevocable Exempt Trust |

|

23,606,980 |

|

31.6 |

% |

0 |

|

23,606,980 |

|

0 |

|

23,606,980 |

| Joel M. Glazer |

|

23,606,980 |

|

31.6 |

% |

0 |

|

23,606,980 |

|

0 |

|

23,606,980 |

| RECO Holdings LLC |

|

150,000 |

|

0.3 |

% |

|

|

150,000 |

|

|

|

150,000 |

The Trust and RECO LLC

are the record holders of 21,899,366 Class B ordinary shares, which are convertible on a one-for-one basis into Shares at any time

at the option of the holder. The Trust is the record holder of 1,707,614 Shares. The Trust is the sole member of RECO LLC, and in

such capacity may be deemed to beneficially own the shares held of record by RECO LLC. The Trustee is a trustee of the Trust, and in such

capacity may be deemed to beneficially own the shares held of record by the Trust. (c) Except as reported in Item 4 above, during

the past 60 days none of the Reporting Persons has effected any transactions in the Shares of the Issuer. (d) None.(e) Not applicable.

Item

6. Contract, Arrangements, Understandings or Relationships with Respect to

Securities of the Issuer. Item 6 of the Statement is amended and supplemented as follows: Item 4 above summarizes certain updates to

the previously disclosed line of credit and is incorporated herein by reference. The Trust entered into a new line of credit

agreement on March 9, 2022 to replace the previously disclosed line of credit (the "New Line of Credit"). Pursuant to the

New Line of Credit, the Trust provided an additional 1,900,000 Class B ordinary shares of the Issuer as security. Except as set

forth herein, none of the Reporting Persons has any contracts, arrangements, understandings or relationships (legal or otherwise)

with any person with respect to any securities of the Issuer, including but not limited to any contracts, arrangements,

understandings or relationships concerning the transfer or voting of such securities, finder’s fees joint ventures, loan or

option arrangements, puts or calls, guarantees of profits, division of profits or losses, or the giving or withholding of

proxies.

Item

7. Materials to be Filed as Exhibits.

SIGNATURES

After reasonable inquiry and to the best of my

knowledge and belief, I certify that the information set forth in this statement is true, complete and correct.

Date: March 9,

2022

| |

RECO Holdings LLC |

| |

|

|

|

| |

By: |

Joel M. Glazer Irrevocable Exempt Trust, its sole member |

|

| |

|

|

|

| |

By: |

/s/ Joel M. Glazer |

| |

Name: Joel M. Glazer |

| |

Title: Trustee |

| |

|

|

|

| |

Joel M. Glazer Irrevocable Exempt Trust |

| |

|

|

|

| |

By: |

/s/ Joel M. Glazer |

| |

Name: Joel M. Glazer |

| |

Title: Trustee |

| |

|

|

|

| |

Joel M. Glazer |

| |

|

|

|

| |

/s/ Joel M. Glazer |

| |

Name: Joel M. Glazer |

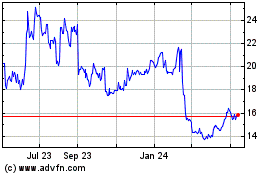

Manchester United (NYSE:MANU)

Historical Stock Chart

From Mar 2024 to Apr 2024

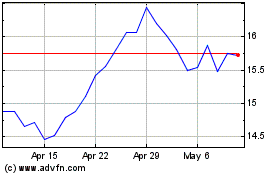

Manchester United (NYSE:MANU)

Historical Stock Chart

From Apr 2023 to Apr 2024