LEGGETT & PLATT INC false 0000058492 0000058492 2019-08-05 2019-08-05

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d)

of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported) August 5, 2019

LEGGETT & PLATT, INCORPORATED

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

Missouri

|

|

001-07845

|

|

44-0324630

|

|

(State or other jurisdiction

of incorporation)

|

|

(Commission

File Number)

|

|

(IRS Employer

Identification No.)

|

|

|

|

|

|

|

|

|

|

No. 1 Leggett Road,

|

|

|

|

Carthage, MO

|

|

64836

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

Registrant’s telephone number, including area code

417-358-8131

N/A

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form

8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (

see

General Instruction A.2. below):

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule

14a-12

under the Exchange Act (17 CFR

240.14a-12)

|

|

☐

|

Pre-commencement

communications pursuant to Rule

14d-2(b)

under the Exchange Act (17 CFR

240.14d-2(b))

|

|

☐

|

Pre-commencement

communications pursuant to Rule

13e-4(c)

under the Exchange Act (17 CFR

240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s)

|

|

Name of each exchange

on which registered

|

|

Common Stock, $.01 par value

|

|

LEG

|

|

New York Stock Exchange

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule

12b-2

of the Securities Exchange Act of 1934 (§

240.12b-2

of this chapter).

Emerging growth company

☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

☐

|

Item 1.01

|

Entry into a Material Definitive Agreement.

|

Entry into Indemnification Agreement

On August 6, 2019, the Company entered into an indemnification agreement, to be effective September 3, 2019 (

Agreement

), with its newly appointed Executive Vice President and Chief Financial Officer, Jeffrey L. Tate, as discussed below. Substantially similar agreements are already in place with the Company’s directors and other executive officers. The form of the indemnification agreement was approved by the Company’s shareholders on May 7, 1986.

Pursuant to the agreement, the Company has agreed to indemnify and hold harmless Mr. Tate against all expenses (including attorneys’ fees), judgments, fines, and amounts paid in settlement to the fullest extent permitted or authorized by applicable law. For this purpose, “

applicable law

” generally means Section 351.355 of the General and Business Corporation Law of the State of Missouri, including any amendment since May 7, 1986, but only to the extent such amendment permits the Company to provide broader indemnification rights. In addition, the Company has agreed to further indemnify and hold harmless Mr. Tate if he is a party or is threatened to be made a party to any proceeding, including any proceeding by or in the right of the Company, by reason of the fact that he is or was a director, officer, employee or agent of the Company, or is or was serving at the request or on the behalf of the Company as a director, officer, employee or agent of another enterprise, or by reason of anything done or not done by him in any such capacities.

However, under the agreement, the Company will not provide indemnification: (i) for amounts indemnified by the Company outside of the Agreement or paid pursuant to insurance; (ii) in respect of remuneration paid to Mr. Tate if determined finally that such remuneration was in violation of law; (iii) on account of any suit for any accounting of profits pursuant to Section 16(b) of the Securities Exchange Act of 1934 or similar provisions of any federal, state or local law; (iv) on account of his conduct which is finally adjudged to have been knowingly fraudulent, deliberately dishonest or willful misconduct; or (v) if a final adjudication shall determine that such indemnification is not lawful.

The Agreement requires the Company, with certain exceptions, to purchase and maintain director and officer insurance. Also, at the request of Mr. Tate, the Company is obligated to advance expenses (including attorneys’ fees) in defending any proceeding. However, if it is determined that Mr. Tate is not entitled to be indemnified, he must repay the Company all amounts advanced, or the appropriate portion thereof.

The above disclosure is only a brief description of the Agreement and is qualified in its entirety by the

Form of Indemnification Agreement

which is attached as Exhibit 10.11 to the Company’s Form

10-K

filed on March 28, 2002, and is incorporated herein by reference.

|

Item 5.02

|

Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

|

Appointment of New Chief Financial Officer and Approval of Compensation

On August 5, 2019, the Compensation Committee of the Board (

Committee

) approved the compensation, as described below, to be awarded to Mr. Jeffrey L. Tate subject to and effective upon his appointment by the Board as the Company’s Chief Financial Officer. On August 6, 2019, pursuant to Section 3.2 of the Bylaws, the Board appointed Mr. Tate as Executive Vice President and Chief Financial Officer (

CFO

) of the Company to be effective September 3, 2019.

Mr. Tate, age 50, has served as Vice President and Business CFO of the Packaging & Specialty Plastics Operating Segment of The Dow Chemical Company since 2017. He previously served The Dow Chemical Company as Chief Audit Executive from 2012 to 2017, as Division CFO of Performance Products from 2009 to 2012, and Director, Investor Relations from 2006 to 2009. Mr. Tate served Dow Automotive as Global Finance Director from 2003 to 2006, and he served The Dow Chemical Company as Global Finance Manager, Polyurethane Systems from 2000 to 2003 and in various controller and financial analyst positions from 1992 to 2000. He currently serves as a member of the Board of Directors of TCF Financial Corporation, a bank holding company headquartered in Detroit, Michigan. Mr. Tate, a Certified Public Accountant, holds a Bachelor of Science in Accounting from the University of Alabama.

Annual Base Salary and Cash Incentive Plan

. Mr. Tate will receive an annual base salary of $550,000 and participate in the Company’s 2019 Key Officers Incentive Plan (

KOIP

), which is a cash bonus plan. Mr. Tate will be eligible to receive a cash award calculated by multiplying his annual base salary at the end of the year by a percentage set by the Committee (

Target Percentage

), then applying the 2019 award formula for the KOIP (

2019 Award Formula

). The Committee set Mr. Tate’s Target Percentage at 80% of his base salary. His cash incentive will be prorated for the number of days employed in 2019. Mr. Tate will participate in the KOIP as a corporate participant under the 2019 Award Formula. The performance objectives under the 2019 Award Formula are return on capital employed (

ROCE

) (60% weight), cash flow (20% weight) and individual performance goals (20% weight). However, Mr. Tate was not assigned individual performance goals for the remainder of 2019. As such, his cash incentive for 2019 will be weighted between two performance objectives: (i) the Company’s 2019 ROCE (70% weight); and (ii) the Company’s 2019 cash flow (30% weight). Below is the 2019 Corporate Targets and Payout Schedule.

2019

Corporate Targets and Payout Schedule

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ROCE

|

|

|

|

|

|

Cash Flow

|

|

|

Achievement

|

|

|

Payout

|

|

|

|

|

|

Achievement

|

|

|

Payout

|

|

|

|

< 30.5%

|

|

|

|

0

|

%

|

|

|

|

|

|

|

<$ 300M

|

|

|

|

0

|

%

|

|

|

30.5%

|

|

|

|

50

|

%

|

|

|

Threshold

|

|

|

|

$ 300M

|

|

|

|

50

|

%

|

|

|

37.5%

|

|

|

|

100

|

%

|

|

|

Target

|

|

|

|

$ 375M

|

|

|

|

100

|

%

|

|

|

44.5%

|

|

|

|

150

|

%

|

|

|

Maximum

|

|

|

|

$ 450M

|

|

|

|

150

|

%

|

No awards are paid for ROCE achievement below 30.5% and Cash Flow below $300 million. The maximum payout percentage for ROCE and Cash Flow achievement is capped at 150%. Reference is made to our

KOIP

and

2019 Award Formula

which were filed as Exhibits 10.1 and 10.2 respectively, to the Company’s Form

8-K

on February 28, 2019, each of which is incorporated herein by reference. Reference is also made to the Company’s

Summary Sheet of Executive Cash Compensation

, which has been updated to include Mr. Tate’s cash compensation and is attached hereto and incorporated herein as Exhibit 10.4.

Interim Performance Stock Unit Grants

. The Committee authorized the grant of two interim Performance Stock Unit (

PSU

) awards to Mr. Tate to be made subject to his employment on his start date of September 3, 2019 (

Start Date

). The Committee set Mr. Tate’s PSU Award Multiple at 250% of his annual base salary. The base award for the two interim PSU grants was adjusted for the length of time remaining in their respective Performance Periods—for the 2018 PSU award, the base award is

one-third

of his base salary multiplied by his Award Multiple, and for the 2019 PSU award, the base award is

two-thirds

of his base salary multiplied by his Award Multiple. To determine the number of PSUs for each of the interim awards, the target amount is divided by the average closing price of the Company’s common stock for the 10 business days immediately after the second quarter 2019 earnings press release date.

The first of Mr. Tate’s interim PSU awards will be pursuant to the 2018 Form of Performance Stock Unit Award Agreement (

2018 PSU Form of Award

) for the three-year Performance Period ending December 31, 2020, with a grant date target value of $458,333 (and a grant date value ranging from $0 to $916,667 based upon a vesting schedule ranging from 0% to 200%).

The second of Mr. Tate’s interim PSU awards will be pursuant to the 2019 Form of Performance Stock Unit Award Agreement (

2019 PSU Form of Award

) for the three-year Performance Period ending December 31, 2021, with a grant date target value of $916,667 (and a grant date value ranging from $0 to $1,833,334 based upon a vesting schedule ranging from 0% to 200%).

The PSU awards are based upon two performance objectives: (i)

Relative TSR

: Fifty percent (50%) of each PSU award will vest based upon the Company’s Total Shareholder Return compared to a peer group consisting of all the companies in the Industrial, Consumer Discretionary and Materials sectors of the S&P 500 and S&P 400; and (ii)

EBIT CAGR

: Fifty percent (50%) of each PSU award will vest based upon the Company’s compound annual growth rate of Earnings Before Interest and Taxes (

EBIT

) during the third fiscal year of the Performance Period compared to the Company’s EBIT in the fiscal year immediately preceding the Performance Period. Depending upon the achievement of the performance objectives, the PSUs will vest and be paid out, subject to applicable tax withholding, from 0% to 200% of the grant date target value. Fifty percent of the vested PSU award will be paid out in cash, and the Company intends to pay out the remaining fifty percent in shares of the Company’s common stock, although the Company reserves the right, subject to Committee approval, to pay up to one hundred percent in cash. Each of the PSU awards contain a

non-competition

covenant for a period of two years after the payout date.

The PSU awards will be granted under the Company’s

Flexible Stock Plan

, amended and restated, effective May 5, 2015, filed March 25, 2015 as Appendix A to the Company’s Proxy Statement for the Annual Meeting of Shareholders (

Flexible Stock Plan

), the 2018 PSU Form of Award and 2019 PSU Form of Award, respectively. The above disclosure is only a brief description of the

2018 PSU Form of Award

and

2019 PSU Form of Award

and is qualified in its entirety by such form of awards, which were filed November 9, 2017 as Exhibit 10.7 to the Company’s Form

8-K,

and March 13, 2019 as Exhibit 10.1 to the Company’s Form

8-K,

respectively, each of which are incorporated herein by reference. The specific Relative TSR and EBIT CAGR performance metrics and vesting schedules can be found in the 2018 PSU Form of Award and 2019 PSU Form of Award, respectively.

Restricted Stock Unit Award

. The Committee authorized the grant of time-based restricted stock units (

RSUs

) valued at $500,000 to Mr. Tate to be made, subject to his employment, on his Start Date. The number of RSUs will be determined by dividing $500,000 by the average closing price of the Company’s common stock for the 10 business days immediately after the second quarter 2019 earnings press release date. The RSUs vest, provided that Mr. Tate remains employed with the Company, in

one-third

(1/3) increments on the first, second and third anniversaries of the grant date. Upon vesting, each RSU is converted into one share of Company common stock and distributed, subject to reduction for tax withholding. If Mr. Tate’s employment with the Company is terminated because of death or disability, or, in certain circumstances when related to a Change in Control of the Company, the vesting of the awards will accelerate and become 100% vested. The RSUs are not transferrable and Mr. Tate has no shareholder rights until the underlying common stock is issued. The RSU Form of Award contains a

non-competition

covenant during Mr. Tate’s employment and for a period of two years after each vesting date. The above disclosure is only a brief description of the RSUs and is qualified in its entirety by the

RSU Form of Award

, which was approved by the Committee on August 5, 2019, and which is attached hereto and incorporated herein by reference as Exhibit 10.8.

Executive Stock Unit Program

.

Upon his Start Date,

Mr. Tate will be eligible to participate in the Company’s Executive Stock Unit Program (

ESU Program

). The ESU Program is a

non-qualified

retirement program that allows executives to make

pre-tax

deferrals of up to 10% of their compensation, above certain thresholds, into diversified investments. The Company makes an additional 17.65% contribution to the diversified investments acquired with executive contributions. The Company also matches 50% of the executive’s contribution in Company stock units, purchased at a 15% discount, which may increase up to a 100% match if the Company meets annual ROCE targets linked to the KOIP. Matching contributions vest once employees have participated in the ESU Program for five years. Company stock units held in the ESU Program accrue dividends, which are used to acquire additional stock units at a 15% discount. At distribution, the balance of the diversified investments is paid in cash. Although the Company intends to settle the stock units in shares of the Company’s common stock, it reserves the right to distribute the balance in cash, but only if there are not enough shares reserved for future issuance under the Flexible Stock Plan. The disclosure above is only a brief description of the ESU Program and is qualified in its entirety by the

ESU Program

, which was filed February 25, 2016 as Exhibit 10.15 to the Company’s Form

10-K,

and is incorporated herein by reference.

Deferred Compensation Program

. Mr. Tate will be eligible to participate in the Company’s Deferred Compensation Program (

DCP

) beginning in 2020. The DCP allows key managers to defer up to 100% of salary, incentive awards and other cash compensation in exchange for any combination of the following:

|

|

•

|

Stock units with dividend equivalents, acquired at a 20% discount to the fair market value of our common stock on the dates the compensation or dividends otherwise would have been paid.

|

|

|

•

|

At-market

stock options with the underlying shares of common stock having an initial market value five times the amount of compensation forgone, with an exercise price equal to the closing market price of our common stock on the grant date.

|

|

|

•

|

Cash deferrals with an interest rate intended to be slightly higher than otherwise available for comparable investments.

|

Participants who elect a cash or stock unit deferral can receive distributions in a lump sum or in annual installments. Distribution payouts must begin no more than 10 years from the effective date of the deferral and all amounts subject to the deferral must be distributed within 10 years of the first distribution payout. Although the Company intends to settle the stock units in shares of the Company’s common stock, it reserves the right, subject to the Committee’s approval, to distribute the balance in cash, but only if there are not enough shares reserved for future issuance under the Flexible Stock Plan. Participants who elect

at-market

stock options, which have a

10-year

term, may exercise them approximately 15 months after the start of the year for which the deferral is made. The disclosure above is only a brief description of the DCP and is qualified in its entirety by the

DCP

, which was filed November 9, 2017 as Exhibit 10.6 to the Company’s Form

8-K,

and is incorporated herein by reference.

Severance Benefit Agreement

. On August 6, 2019, the Company entered into a Severance Benefit Agreement with Mr. Tate (

Severance

Agreement

) to be effective on the Start Date. Upon a Change in Control of the Company, the Severance Agreement provides for severance payments and benefits during a “

Protected

Period”

following the Change in Control. The Protected Period is 24 months.

In general, a Change in Control is deemed to occur when: (i) a shareholder becomes the beneficial owner of 40% or more of our common stock; (ii) the current directors, as of the date of the Severance Agreement, or their successors no longer constitute a majority of the Board of Directors; (iii) after a merger or consolidation with another corporation, less than 65% of the voting securities of the surviving corporation are owned by our former shareholders; (iv) the Company liquidates, sells or otherwise transfers substantially all of its assets to an unrelated third party; or (v) the Company enters into an agreement, including a letter of intent, which contemplates a Change in Control (as described above), or the Company or a person makes a public announcement of an intention to take actions which, if consummated, would result in a Change in Control (as described above).

The payments and benefits under the Severance Agreement are subject to a “double trigger”; that is, they become due only after both (i) a Change in Control of the Company and (ii) Mr. Tate’s employment is terminated by the Company (except for “cause” or upon total disability or death) or Mr. Tate terminates his employment for “good reason.” In general, Mr. Tate would have “good reason” to terminate his employment if he were required to relocate or experienced a reduction in job responsibilities, title, compensation or benefits, or if any successor company did not assume the obligations of the Severance Agreement. The Company may cure the “good reason” for termination within 30 days of receiving notice from Mr. Tate.

Events considered grounds for termination by the Company for “cause” under the Severance Agreement generally include the executive’s (i) conviction of a felony or any crime involving property of the Company; (ii) willful breach of the Company’s Code of Business Conduct or Financial Code of Ethics which causes significant injury to the Company; (iii) willful act or omission involving fraud, misappropriation or dishonesty that causes significant injury to the Company or results in significant enrichment to the executive at the Company’s expense; (iv) willful violations of specific written directions of the Board following notice of such violation; or (v) continued, repeated, or willful failure to substantially perform duties after written notice from the Board.

The Severance Agreement has no fixed termination date but continues as long as Mr. Tate is employed by the Company or any successor. However, after September 3, 2020, the Company or Mr. Tate has the right to unilaterally terminate the Severance Agreement upon

one-year

written notice to the other party, so long as the Protected Period is not in effect. Upon termination of employment by the Company (except for “cause” or upon total disability or death) or by Mr. Tate for “good reason” during the Protected Period, the Company will provide the following payments and benefits:

|

|

|

|

|

Severance Benefit

|

|

Timing and/or Amount of Payment

|

|

Base Salary

|

|

Through the date of termination

|

|

|

|

|

|

Cash Bonus under 2019 Key Officers Incentive Plan (KOIP)

|

|

Pro-rata

incentive award for the year of termination based upon the results achieved under the KOIP for the year

|

|

|

|

|

|

Severance Payments

|

|

200% of base salary plus 200% of target bonus amount (currently 80% of base salary under the KOIP), paid in

bi-weekly

installments over 24 months

|

|

|

|

|

|

Continued Benefits

|

|

Continued health insurance and fringe benefits for 24 months, as permitted by the Internal Revenue Code, or

bi-weekly

payments in an equivalent amount

|

|

|

|

|

|

Additional Retirement Benefits

|

|

Lump sum additional retirement benefit based on the actuarial equivalent of an additional 24 months of continuous service

|

All amounts received by Mr. Tate as health insurance or fringe benefits from a new full-time job will reduce the benefits under the Severance Agreement. However, Mr. Tate is not required to mitigate the amount of any severance payment or benefit provided under the Severance Agreement. The Severance Agreement contains a

non-competition

covenant for two years after the termination date. If violated the Company’s sole remedy is to cease payment of any further benefits. The disclosure above is only a brief description of the

Severance Agreement

and is qualified in its entirety by such agreement with Mr. Tate, which is attached hereto as Exhibit 10.11 and incorporated herein by reference.

Separation Agreement

. On August 6, 2019, the Company entered into a Separation Agreement with Mr. Tate (

Separation

Agreement

). The Company agreed to pay Mr. Tate, on the Start Date, a

one-time

cash incentive in the amount of $250,000 (

Cash Incentive

) in connection with his appointment to the position of CFO of the Company. Reference is made to the

Summary Sheet of Executive Cash Compensation

attached hereto and incorporated herein as Exhibit 10.4. The Separation Agreement provides that if Mr. Tate is terminated for

Cause

(as defined in the Separation Agreement) or voluntarily terminates employment (other than for

Good Reason

, as defined in the Separation Agreement) within 24 months of the Start Date, he must

re-pay

the Company according to the following schedule:

|

|

(a)

|

100% of the Cash Incentive for a termination within 12 months of the Start Date; and

|

|

|

(b)

|

50% of the Cash Incentive for a termination between 12 months and 24 months of the Start Date.

|

If Mr. Tate is terminated by the Company for any reason other than for Cause, death or disability, or he terminates his employment for Good Reason, either of which is within 24 months from the Start Date, the Company must pay Mr. Tate the following:

|

|

(a)

|

12 months of his base salary (in effect at the time the notice of termination is given) for a termination that occurs within 12 months from the Start Date;

|

|

|

(b)

|

6 months of his base salary (in effect at the time the notice of termination is given) for a termination that occurs between 12 and 24 months from the Start Date;

|

|

|

(c)

|

Pro-rata

cash incentive award under the KOIP for the year of termination based upon the results achieved under the KOIP for the year;

|

|

|

(d)

|

Lump sum payment equal to 18 months of COBRA medical coverage; and

|

|

|

(e)

|

Reasonable and customary outplacement services for the shorter of (i) 12 months following the date of termination and (ii) the date Mr. Tate accepts an offer of employment.

|

Mr. Tate will not be required to mitigate the amount of any of the benefits under the Separation Agreement by seeking other employment or otherwise; provided, however, any health, welfare and fringe benefits that Mr. Tate may receive from full time employment by a third person shall reduce any such benefits under (d) above, and the outplacement services under (e) above would cease. The Company’s obligation to make payment under the Separation Agreement is subject to Mr. Tate’s execution and delivery to the Company of a release and covenant not to sue agreement. The disclosure above is only a brief description of the

Separation Agreement

and is qualified in its entirety by such agreement with Mr. Tate, which is attached hereto as Exhibit 10.12 and incorporated herein by reference.

Long-Term Incentive Awards

. It is expected that Mr. Tate will receive annual long-term incentive awards beginning in 2020, based upon a 250% award multiple of his annual base salary pursuant to the form of awards approved by the Committee at that time. The terms and conditions of the long-term incentive awards will be the same as those of other executive officers of the Company.

Use of Company Car

.

Mr. Tate will be provided the use of a Company automobile in accordance with our standard executive officer compensation practices.

Other Plans and Programs Generally Available to All Salaried Employees

. Mr. Tate will also be eligible to participate in various other benefit plans and programs that do not discriminate in scope, terms or operation in favor of executive officers, and of which are generally available to all salaried employees.

Term of Office, Family Relationships and Related Person Transactions

Mr. Tate will serve as CFO until his death, resignation, retirement or removal, or until his successor is appointed. Mr. Tate has no family relationships with any director or other executive officer of the Company and has no related person transactions with the Company.

Retirement Date of Current Chief Financial Officer

We previously reported that Matthew C. Flanigan notified the Company of his intention to retire as Executive Vice President and CFO. Although a specific date for Mr. Flanigan’s retirement had not been set, he agreed to continue as CFO until his successor was hired and through a reasonable transition period. We also previously reported that Mr. Flanigan indicated that he would retire as a director from the Board concurrently with his retirement as CFO. However, because of Mr. Flanigan’s announced retirement plans, he was not nominated by the Board for

re-election

at the Company’s annual shareholder meeting which was held on May 7, 2019. As such, his term as a director of the Company expired on May 7, 2019. On August 6, 2019, Mr. Flanigan notified the Company that his retirement date from his executive position as Executive Vice President and CFO will be September 3, 2019. Mr. Flanigan will continue with the Company in a

non-executive

officer position for a period that has not yet been determined, in order to provide transition assistance to Mr. Tate, as the new CFO. Once the Company is notified of Mr. Flanigan’s ultimate retirement date from the Company, we will update this disclosure.

|

Item 7.01

|

Regulation FD Disclosure

.

|

The Company issued a

Press Release

, dated August 6, 2019, regarding the appointment of Mr. Tate as CFO and the retirement of Mr. Flanigan as CFO, which is attached hereto and incorporated herein as Exhibit 99.1.

|

Item 9.01

|

Financial Statements and Exhibits.

|

(d)

Exhibits

.

EXHIBIT INDEX

|

|

|

|

|

|

|

Exhibit

No.

|

|

|

Description

|

|

|

|

|

|

|

|

|

10.1

|

|

|

Form of Indemnification Agreement approved by the shareholders of the Company and entered into between the Company and directors and executive officers, filed March 28, 2002, as Exhibit 10.11 to the Company’s Form 10-K for the year ended December 31, 2001, is incorporated by reference. (SEC File No. 001-07845)

|

|

|

|

|

|

|

|

|

10.2

|

|

|

2019 Key Officers Incentive Plan, filed February 28, 2019, as Exhibit 10.1 to the Company’s Form 8-K, is incorporated by reference. (SEC File No. 001-07845)

|

|

|

|

|

|

|

|

|

10.3

|

|

|

2019 Award Formula for the 2019 Key Officers Incentive Plan, filed February 28, 2019, as Exhibit 10.2 to the Company’s Form 8-K, is incorporated by reference. (SEC File No. 001-07845)

|

|

|

|

|

|

|

|

|

10.4*

|

|

|

Summary Sheet of Executive Cash Compensation

|

|

|

|

|

|

|

|

|

10.5

|

|

|

Company’s Flexible Stock Plan, amended and restated, effective May 5, 2015, filed March 25, 2015 as Appendix A to the Company’s Proxy Statement, is incorporated by reference. (SEC File No. 001-07845)

|

|

|

|

|

|

|

|

|

10.6

|

|

|

2018 Form of Performance Stock Unit Award Agreement, filed November

9, 2017 as Exhibit 10.7 to the Company’s Form 8-K, is incorporated by reference. (SEC File No.

001-07845)

|

|

|

|

|

|

|

|

|

10.7

|

|

|

2019 Form of Performance Stock Unit Award Agreement, filed March

13, 2019 as Exhibit

10.1 to the Company’s Form 8-K, is incorporated by reference. (SEC File No.

001-07845)

|

|

|

|

|

|

|

|

|

10.8*

|

|

|

Form of Restricted Stock Unit Award Agreement

|

|

|

|

|

|

|

|

|

10.9

|

|

|

The Company’s 2005 Executive Stock Unit Program, as amended and restated, effective February

23, 2016, filed February

25, 2016, as Exhibit 10.15 to the Company’s Form 10-K for the year ended December

31, 2015, is incorporated by reference. (SEC File No.

001-07845)

|

|

|

|

|

|

|

|

|

10.10

|

|

|

The Company’s Deferred Compensation Program, effective November

6, 2017, filed November

9, 2017 as Exhibit 10.6 to the Company’s Form 8-K, is incorporated by reference. (SEC File No.

001-07845)

|

|

|

|

|

|

|

|

|

10.11*

|

|

|

Severance Benefit Agreement between the Company and Jeffrey L. Tate, dated August 6, 2019

|

|

|

|

|

|

|

|

|

10.12*

|

|

|

Separation Agreement between the Company and Jeffrey L. Tate, dated August 6, 2019

|

|

|

|

|

|

|

|

|

99.1**

|

|

|

Press Release, dated August 6, 2019

|

|

|

|

The following documents are being filed pursuant to inline XBRL:

|

|

|

|

|

|

|

|

|

Exhibit 101.INS*

|

|

|

Instance Document (the instance document does not appear in the interactive data file because its XBRL tags are embedded in the inline XBRL document)

|

|

|

|

|

|

|

|

|

Exhibit 101.SCH*

|

|

|

Schema Document

|

|

|

|

|

|

|

|

|

Exhibit 101.LAB*

|

|

|

Labels linkbase Document

|

|

|

|

|

|

|

|

|

Exhibit 101.PRE*

|

|

|

Presentation linkbase Document

|

|

|

|

|

|

|

|

|

Exhibit 104*

|

|

|

Cover Page Interactive Data File (formatted as inline XBRL and contained in Exhibit 101)

|

|

*

|

Denotes filed herewith.

|

|

**

|

Denotes furnished herewith.

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

LEGGETT & PLATT, INCORPORATED

|

|

|

|

|

|

|

|

|

|

Date: August 6, 2019

|

|

|

|

By:

|

|

/S/ SCOTT S. DOUGLAS

|

|

|

|

|

|

|

|

Scott S. Douglas

|

|

|

|

|

|

|

|

Senior Vice President –

|

|

|

|

|

|

|

|

General Counsel & Secretary

|

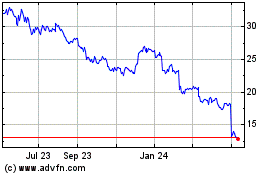

Leggett and Platt (NYSE:LEG)

Historical Stock Chart

From Mar 2024 to Apr 2024

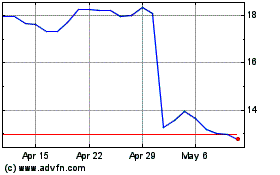

Leggett and Platt (NYSE:LEG)

Historical Stock Chart

From Apr 2023 to Apr 2024