Current Report Filing (8-k)

October 22 2019 - 4:46PM

Edgar (US Regulatory)

false0001286043

0001286043

2019-10-22

2019-10-22

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): October 22, 2019

KITE REALTY GROUP TRUST

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

Maryland

|

1-32268

|

11-3715772

|

|

(State or other jurisdiction

|

(Commission

|

(IRS Employer

|

|

of incorporation)

|

File Number)

|

Identification Number)

|

30 S. Meridian Street

Suite 1100

Indianapolis, IN 46204

(Address of principal executive offices) (Zip Code)

(317) 577-5600

(Registrant's telephone number including area code)

Not applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

Title of each class

|

Trading Symbol

|

|

|

Common Shares, $0.01 par value per share

|

KRG

|

New York Stock Exchange

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 7.01 Regulation FD Disclosure

On October 22, 2019, Kite Realty Group Trust (the “Company”) announced it had achieved the high end of its 2019 disposition guidance by selling $502 million in assets since January 1, 2019. A copy of the Company's press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K. The information contained in Item 7.01 of this current report on Form 8-K, including Exhibit 99.1, shall not be deemed "filed" with the Securities and Exchange Commissions nor incorporated by reference in any registration statement by filed by the Company under the Securities Act of 1933, as amended.

This press release, together with other statements and information publicly disseminated by us, contains certain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Such statements are based on assumptions and expectations that may not be realized and are inherently subject to risks, uncertainties and other factors, many of which cannot be predicted with accuracy and some of which might not even be anticipated. Future events and actual results, performance, transactions or achievements, financial or otherwise, may differ materially from the results, performance, transactions or achievements, financial or otherwise, expressed or implied by the forward-looking statements. Risks, uncertainties and other factors that might cause such differences, some of which could be material, include, but are not limited to: national and local economic, business, real estate and other market conditions, particularly in light of low growth in the U.S. economy as well as economic uncertainty caused by fluctuations in the prices of oil and other energy sources and inflationary trends or outlook; the risk that the Company may not be able to successfully complete the planned dispositions on favorable terms - or at all; financing risks, including the availability of, and costs associated with, sources of liquidity; the Company's ability to refinance, or extend the maturity dates of, its indebtedness; the level and volatility of interest rates; the financial stability of tenants, including their ability to pay rent and the risk of tenant bankruptcies; the competitive environment in which the Company operates; acquisition, disposition, development and joint venture risks; property ownership and management risks; the Company’s ability to maintain its status as a real estate investment trust for federal income tax purposes; potential environmental and other liabilities; impairment in the value of real estate property the Company owns; the impact of online retail competition and the perception that such competition has on the value of shopping center assets; risks related to the geographical concentration of the Company's properties in Florida, Indiana and Texas; insurance costs and coverage; risks associated with cybersecurity attacks and the loss of confidential information and other business interruptions; other factors affecting the real estate industry generally; and other risks identified in our Annual Report on Form 10-K and, from time to time, in other reports we file with the Securities and Exchange Commission (the “SEC”) or in other documents that we publicly disseminate. The Company undertakes no obligation to publicly update or revise these forward-looking statements, whether as a result of new information, future events or otherwise.

Item 9.01. Financial Statements and Exhibits.

(a) Not applicable.

(b) Not applicable.

(c) Not applicable.

(d) Exhibits.

|

|

|

|

|

|

|

Exhibit No.

|

|

Description

|

|

99.1

|

|

Kite Realty Group Trust Press Release dated October 22, 2019

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

KITE REALTY GROUP TRUST

|

|

|

|

|

Date: October 22, 2019

|

By:

|

/s/ Heath R. Fear

|

|

|

|

Heath R. Fear

|

|

|

|

Executive Vice President and

|

|

|

|

Chief Financial Officer

|

EXHIBIT INDEX

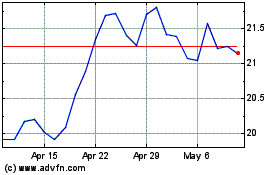

Kite Realty (NYSE:KRG)

Historical Stock Chart

From Mar 2024 to Apr 2024

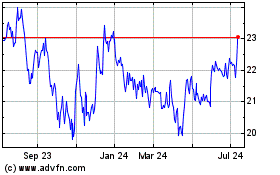

Kite Realty (NYSE:KRG)

Historical Stock Chart

From Apr 2023 to Apr 2024