Current Report Filing (8-k)

February 18 2020 - 6:27AM

Edgar (US Regulatory)

0001509991

false

0001509991

2020-02-11

2020-02-11

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of Report (Date of earliest event

reported):

February 11, 2020

KOSMOS ENERGY LTD.

(Exact Name of Registrant as Specified in

its Charter)

|

Delaware

|

|

001-35167

|

|

98-0686001

|

|

(State or other jurisdiction of incorporation)

|

|

(Commission File Number)

|

|

(I.R.S. Employer Identification No.)

|

|

|

|

|

|

|

|

8176 Park Lane

Dallas, Texas

|

|

|

|

75231

|

|

(Address of Principal Executive Offices)

|

|

|

|

(Zip Code)

|

Registrant’s telephone number, including

area code: +214-445-9600

Not

Applicable

(Former name or former address, if changed

since last report)

Check the appropriate box below if the Form 8-K filing

is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General

Instruction A.2. below):

|

|

☐

|

Written communications pursuant to Rule 425 under

the Securities Act (17 CFR 230.425)

|

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under

the Exchange Act (17 CFR 240.14a-12)

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under

the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under

the Exchange Act (17 CFR 240.13e-4(c))

|

|

Securities registered pursuant to Section 12(b) of the Securities Exchange Act of 1934:

|

|

|

|

Title of each class

|

|

Trading symbol(s)

|

|

Name of each exchange on which registered

|

|

Common Stock, $0.01 Par Value

|

|

KOS

|

|

New York Stock Exchange

London Stock Exchange

|

Indicate by check mark whether the registrant is an emerging

growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange

Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the

registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards

provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01. Entry into a Material Definitive Agreement

On February 11, 2020, Kosmos Energy Mauritania

and Kosmos Energy Investments Senegal Limited (affiliates of Kosmos Energy Ltd.), BP Mauritania Investments Limited and BP Senegal

Investments Limited (affiliates of BP plc), La Société Mauritanienne Des Hydrocarbures et de Patrimoine Minier (the

National Oil Company of Mauritania) and La Société Des Pétroles du Sénégal (the National Oil

Company of Senegal), collectively (the “Seller Group”) and BP Gas Marketing Limited (the “Buyer”) signed an LNG Sale and Purchase Agreement (the “SPA”).

Pursuant to the terms of the SPA and subject

to the more detailed provisions and conditions set forth therein:

|

|

·

|

Annual Contract Quantity: The Seller Group will sell and make available for delivery from the Greater Tortue/Ahmeyim

Field located offshore Mauritania and Senegal, and the Buyer will take and pay for, or pay for if not taken, cargoes of liquefied

natural gas (“LNG”) with an annual contract quantity of 127,951,000 MMBTU (the “ACQ”) (equivalent

to approximately 2.45 million tonnes per annum). The ACQ is subject to limited downward adjustment by the Seller Group.

|

|

|

·

|

LNG Production and Transportation: The Buyer will lift LNG cargoes free on board (FOB) from a loading terminal adjacent

to the floating LNG production facilities.

|

|

|

·

|

Sales Price:

The Buyer will pay the Seller Group a price for LNG set as a percentage of a crude oil

price benchmark for the ACQ volumes (the “ACQ Sales Price”). Cargos

will be invoiced and paid for cargo-by-cargo. For LNG quantities delivered during the

commissioning period and for LNG quantities delivered annually in excess of the ACQ,

the Buyer will pay a price equal to the lower of the ACQ Sales Price or a percentage

of a gas index price with a fixed deduction for transportation and other costs.

|

|

|

·

|

Term: The SPA has a ten-year term that commences on the “Commercial Operations Date”, which occurs after

completion of certain LNG project facilities’ performance tests. The SPA allows for the Seller Group to extend the SPA term

for up to an additional ten years.

|

|

|

·

|

Take or Pay and Make-Up: The Buyer is subject to a cargo-by-cargo take or pay commitment with make-up rights.

|

|

|

·

|

Seller Group’s Failure to Deliver: If the Seller Group fails to make available all or part of a cargo (except

as a result of force majeure (as defined within the SPA) or due to the fault of the Buyer), the Seller Group shall pay an amount

equal to the difference between the scheduled cargo quantity and the quantity actually taken, multiplied by a defined percentage

of the applicable sales price.

|

|

|

·

|

Termination Rights: Customary default-based suspension and termination rights apply to each of the Seller Group and

the Buyer under the SPA.

|

The foregoing description of the SPA is not complete

and is qualified in its entirety by reference to the text of the SPA, a copy of which will be filed as an exhibit to Kosmos Energy

Ltd.’s Annual Report on Form 10-K later this year.

Item 8.01 Other Events

A copy of the press release relating to the SPA is filed as

Exhibit 99.1 hereto and is incorporated by reference.

Item 9.01. Financial Statements and Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act

of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Date: February

18, 2020

|

|

KOSMOS ENERGY LTD.

|

|

|

|

|

|

|

|

|

By:

|

/s/ Jason E. Doughty

|

|

|

|

Jason E. Doughty

|

|

|

|

Senior Vice President, General Counsel and Corporate Secretary

|

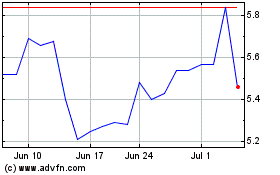

Kosmos Energy (NYSE:KOS)

Historical Stock Chart

From Mar 2024 to Apr 2024

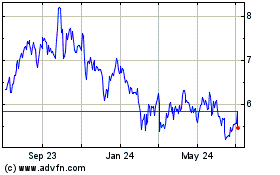

Kosmos Energy (NYSE:KOS)

Historical Stock Chart

From Apr 2023 to Apr 2024