UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15 (d) of The Securities Exchange Act of 1934

Date of Report: March 20, 2015

(Date of earliest event reported)

KB HOME

(Exact name of registrant as specified in charter)

|

| | | | |

| | | | |

Delaware | | 1-9195 | | 95-3666267 |

(State or other jurisdiction of incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) |

| | |

10990 Wilshire Boulevard, Los Angeles, California | | 90024 |

(Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code: (310) 231-4000

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

| |

o | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

|

| |

o | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

|

| |

o | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

|

| |

o | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 2.02 Results of Operations and Financial Condition.

On March 20, 2015, KB Home issued a press release announcing its results of operations for the three months ended February 28, 2015. A copy of the press release is furnished as Exhibit 99.1 to this report and is incorporated herein.

The information in this report, including Exhibit 99.1 attached hereto, shall not be deemed to be “filed” for purposes of Section 18 of the Securities and Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that Section, and shall not be incorporated by reference into any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

| |

99.1 | Press release dated March 20, 2015 announcing KB Home’s results of operations for the three months ended February 28, 2015. |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Date: March 20, 2015

|

| | | |

| KB Home |

| |

By: | /s/ Jeff J. Kaminski |

| Jeff J. Kaminski |

| Executive Vice President and Chief Financial Officer |

EXHIBIT INDEX

|

| | |

Exhibit No. | | Description |

| | |

99.1 | | Press release dated March 20, 2015, announcing KB Home’s results of operations for the three months ended February 28, 2015. |

|

| | |

FOR RELEASE, Friday, March 20, 2015 | | For Further Information Contact: |

5:30 a.m. Pacific Daylight Time | | Katoiya Marshall, Investor Relations Contact |

| | (310) 893-7446 or kmarshall@kbhome.com |

| | Susan Martin, Media Contact |

| | (310) 231-4142 or smartin@kbhome.com |

KB HOME REPORTS 2015 FIRST QUARTER RESULTS

Revenues Increase 29% to $580 Million

Net Income of $8 Million or $.08 Per Diluted Share

Net Order Value Up 25% to $753 Million; Backlog Value Up 30% to $1.1 Billion

LOS ANGELES (March 20, 2015) — KB Home (NYSE: KBH), one of the nation’s largest and most recognized homebuilders, today reported results for its first quarter ended February 28, 2015. Highlights and developments include the following:

Three Months Ended February 28, 2015

| |

• | Total revenues of $580.1 million rose 29% from $450.7 million in the year-earlier quarter, driven by growth in the Company’s housing and land sale revenues. The Company’s total revenues have increased on a year-over-year basis for 14 consecutive quarters. |

| |

◦ | Housing revenues grew 19% to $524.8 million in the current quarter from $440.1 million for the corresponding quarter of 2014. The Company delivered 1,593 homes in the first quarter, representing an increase of 10% from 1,442 homes delivered in the year-earlier quarter. |

| |

▪ | The overall average selling price of homes delivered grew 8% to $329,500, up from $305,200 a year ago, reflecting a shift in the geographic mix of deliveries and generally favorable conditions in the Company’s served markets. |

| |

* | Average selling prices in the Company’s West Coast, Central and Southeast homebuilding regions increased 5%, 13% and 3%, respectively, compared to the same quarter of 2014, while the average selling price in its Southwest homebuilding region decreased 4%. |

| |

◦ | Land sale revenues increased to $53.0 million from $8.1 million a year ago, primarily due to the Company’s current quarter sale of a large parcel in northern California as part of its strategic emphasis on enhancing asset efficiency by executing on targeted opportunities to monetize certain land positions. |

| |

• | Homebuilding operating income totaled $14.4 million, compared to $17.7 million in the year-earlier quarter. The current quarter included a $6.0 million gain on the sale of land, compared to a $1.0 million gain in the prior-year quarter. |

| |

◦ | The Company’s housing gross profit margin decreased 260 basis points to 15.1% from 17.7% in the year-earlier quarter. Excluding the amortization of previously capitalized interest and land option contract abandonment charges in each period, the Company’s first quarter adjusted housing gross profit margin was 19.5% in 2015 and 21.8% in 2014. |

| |

▪ | The year-over-year decline in the housing gross profit margin was primarily due to higher land and construction costs, start-up field costs associated with new home community openings, competitive pricing pressures, and the close-out of certain higher margin communities within the Company’s West Coast homebuilding region in the latter part of 2014. |

| |

◦ | Selling, general and administrative expenses as a percentage of housing revenues improved 40 basis points to 13.5% from 13.9% in the year-earlier quarter even as the Company increased staffing levels during the current quarter to support community count growth and a higher number of deliveries anticipated in the second half of 2015. |

| |

• | Interest expense decreased to $5.3 million from $11.3 million in the year-earlier quarter due to an increase in the amount of the Company’s inventory qualifying for interest capitalization in the current quarter, partly offset by an increase in interest incurred. |

| |

• | Financial services operations generated pretax income of $1.7 million in the current quarter and $1.6 million in the year-earlier quarter. The current quarter results included $.4 million of pretax income from Home Community Mortgage, LLC, the Company’s mortgage banking joint venture with Nationstar Mortgage LLC that commenced operations in July 2014. |

| |

• | The Company’s total pretax income of $10.5 million for the first quarter of 2015 was nearly even with $10.8 million for the year-earlier period. |

| |

◦ | The 2014 first quarter included a gain of $3.2 million on the sale of the Company’s interest in an unconsolidated joint venture. |

| |

• | Net income for the current quarter totaled $7.8 million, or $.08 per diluted share, compared to $10.6 million, or $.12 per diluted share, for the first quarter of 2014. |

| |

◦ | Income tax expense of $2.7 million for the current quarter reflected the favorable impact of $1.4 million of federal energy tax credits the Company earned from building high-efficiency homes, resulting in an effective tax rate of approximately 26%. The year-earlier quarter included income tax expense of $.2 million. |

Backlog and Net Orders

| |

• | Potential future housing revenues in backlog rose 30% to $1.11 billion at February 28, 2015 from $851.6 million at February 28, 2014. |

| |

◦ | The Company’s backlog at February 28, 2015 was comprised of 3,505 homes, up 22% from 2,880 homes in backlog at February 28, 2014. |

| |

◦ | The number of homes in backlog and corresponding backlog value at February 28, 2015 reached their highest first-quarter levels since 2008. |

| |

• | Net order value rose 25% to $753.2 million, up from $600.2 million in the year-earlier quarter, marking the Company’s 12th straight quarter of year-over-year increases. |

| |

◦ | All four of the Company’s homebuilding regions posted year-over-year growth in net order value, ranging from 6% in the West Coast homebuilding region to 125% in the Southwest homebuilding region. |

| |

▪ | In the Company’s Central homebuilding region, which primarily consists of its operations in Texas, net order value was up 34% from a year ago. |

| |

• | Net orders increased 24% from the year-earlier quarter to 2,189, mainly due to the Company’s higher average community count. |

| |

◦ | The current quarter cancellation rate, both as a percentage of gross orders and as a percentage of beginning backlog, improved to 25% from 30% a year ago. |

| |

• | The Company’s overall average community count for the first quarter increased 22% to 231, up from 190 for the year-earlier quarter. |

| |

◦ | The Company ended the current quarter with 235 communities open for sales, up 25% from 188 communities a year ago. |

Balance Sheet

| |

• | Cash, cash equivalents and restricted cash increased to $573.6 million at February 28, 2015, compared to $383.6 million at November 30, 2014, largely due to proceeds received from a senior notes offering completed in the current quarter, partly offset by cash used in operating activities. |

| |

◦ | The Company had no borrowings outstanding under its $200 million unsecured revolving credit facility at February 28, 2015. |

| |

• | Inventories of $3.25 billion at February 28, 2015 were essentially even with the $3.22 billion at November 30, 2014. |

| |

◦ | The Company’s investments in land acquisition and development totaled $201.6 million for the first quarter of 2015 and $354.3 million for the corresponding quarter of 2014. |

| |

• | Notes payable of $2.82 billion at February 28, 2015 rose from $2.58 billion at November 30, 2014, mainly reflecting the Company’s current-quarter underwritten public issuance of $250 million in aggregate principal amount of 7.625% senior notes due 2023. |

| |

◦ | The Company currently plans to use a portion of the net proceeds from the issuance to repay $199.9 million in aggregate principal amount of its 6 1/4% senior notes at their maturity on June 15, 2015. |

| |

◦ | The Company’s ratio of debt to capital was 63.8% as of February 28, 2015 compared to 61.8% as of November 30, 2014. The ratio of net debt to capital was 58.4% at February 28, 2015 and 57.9% at November 30, 2014. |

Management Comments

“We are pleased with the robust growth in our first quarter net orders, net order value and backlog levels, which was fueled primarily by our expanded community count and healthy buyer demand,” said Jeffrey Mezger, president and chief executive officer. “Having successfully opened 32 new home communities across our geographic footprint, we ended the quarter with 25% more active communities than we had a year ago, positioning us well as we enter the spring selling season and setting the foundation for a strong finish to 2015. With our expanding community count, we are poised to generate further momentum in our business and prepared to capture pent-up demand for housing as it is unlocked by improvement in fundamental demographic, economic and housing market dynamics.”

“We extended our positive revenue growth trajectory during the quarter, driven by increases in both the number of homes delivered and the average selling price compared to a year ago,” continued Mezger. “As we anticipated, our housing gross profit margin was tempered in the quarter; however, with our rising community count providing a strong start entering the spring selling season and the leverage benefits we are anticipating from projected higher revenues, we expect to produce sequential margin improvement in each of the remaining quarters of 2015, and to significantly narrow the year-over-year gap in our gross margin percentage by the end of the year. Moreover, as the year unfolds, we also anticipate accelerated growth in our revenues as well as greater operating leverage to bolster our bottom-line performance. We believe that further progress on the execution of our strategies to enhance our top-line growth, profitability, asset efficiency and return on invested capital will be a catalyst that, along with the benefits of our larger community count, will enable us to deliver strong financial and operational results in the second half of this year.”

Earnings Conference Call

The conference call on the first quarter 2015 earnings will be broadcast live TODAY at 8:30 a.m. Pacific Daylight Time, 11:30 a.m. Eastern Daylight Time. To listen, please go to the Investor Relations section of the Company’s website at www.kbhome.com.

About KB Home

KB Home is one of the largest and most recognized homebuilding companies in the United States. Since its founding in 1957, the company has built more than half a million quality homes. KB Home's unique homebuilding approach lets each buyer customize their new home from lot location to floor plan and design features. As a leader in utilizing state-of-the-art sustainable building practices, all KB homes are highly energy efficient and meet strict ENERGY STAR® guidelines. This helps to lower monthly utility costs for homeowners, which the company demonstrates with its proprietary KB Home Energy Performance Guide® (EPG®). KB Home has been named an ENERGY STAR Partner of the Year Sustained Excellence Award winner for four straight years and a WaterSense® Partner of the Year for four consecutive years. A FORTUNE 1,000 company, Los Angeles-based KB Home was the first homebuilder listed on the New York Stock Exchange, and trades under the ticker symbol "KBH." For more information about KB Home, call 888-KB-HOMES, visit www.kbhome.com, or connect with KB Home on Facebook.com/KBHome and Twitter.com/KBHome.

Forward-Looking and Cautionary Statements

Certain matters discussed in this press release, including any statements that are predictive in nature or concern future market and economic conditions, business and prospects, our future financial and operational performance, or our future actions and their expected results are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements are based on current expectations and projections about future events and are not guarantees of future performance. We do not have a specific policy or intent of updating or revising forward-looking statements. Actual events and results may differ materially from those expressed or forecasted in forward-looking statements due to a number of factors. The most important risk factors that could cause our actual performance and future events and actions to differ materially from such forward-looking statements include, but are not limited to the following: general economic, employment and business conditions; population growth, household formations and demographic trends; adverse market conditions, including an increased supply of unsold homes, declining home prices and greater foreclosure and short sale activity, among other things, that could negatively affect our consolidated financial statements, including due to additional impairment or land option contract abandonment charges, lower revenues and operating and other losses; conditions in the capital, credit and financial markets (including residential mortgage lending standards, the availability of residential mortgage financing and mortgage foreclosure rates); material prices and availability; subcontracted trade labor costs and availability; changes in interest rates; inflation; our debt level, including our ratio of debt to capital, and our ability to adjust our debt level, maturity schedule and structure and to access the equity, credit, capital or other financial markets or other external financing sources, including raising capital through the public or private issuance of common stock, debt or other securities, and/or project financing, on favorable terms; our compliance with the terms and covenants of our revolving credit facility; weak or declining consumer confidence, either generally or specifically with respect to purchasing homes; competition for home sales from other sellers of new and resale homes, including lenders and other sellers of homes obtained through foreclosures or short sales; weather conditions, significant natural disasters and other environmental factors; government actions, policies, programs and regulations directed at or affecting the housing market (including the Dodd-Frank Act, tax credits, tax incentives and/or subsidies for home purchases, tax deductions for residential mortgage interest payments and property taxes, tax exemptions for profits on home sales, programs intended to modify existing mortgage loans and to prevent mortgage foreclosures and the standards, fees and size limits applicable to the purchase or insuring of mortgage loans by government-sponsored enterprises and government agencies), the homebuilding industry, or construction activities; decisions regarding federal fiscal and monetary policies, including those relating to taxation, government spending, interest rates and economic stimulus measures; the availability and cost of land in desirable areas; our warranty claims experience with respect to homes previously delivered and actual warranty costs incurred, including our warranty claims and costs experience at certain of our communities in Florida; legal or regulatory proceedings or claims; our ability to use/realize the net deferred tax assets we have generated; our ability to successfully implement our current and planned strategies and initiatives with respect to product, geographic and market positioning (including our efforts to expand our inventory base/pipeline with desirable land positions or interests at reasonable cost and to expand our community count, open additional new home communities for sales, sell higher-priced homes and more design options, increase the size and value of our backlog, and our operational and investment concentration in markets in California), revenue growth, asset optimization (including by effectively balancing home sales prices and sales pace in our new home communities), asset activation and/or monetization, local field management and talent investment, containing and leveraging overhead costs, gaining share in our served markets and increasing our housing gross profit margins and profitability; consumer traffic to our new home communities and consumer interest in our product designs and offerings, particularly from higher-income consumers; cancellations and our ability to realize our backlog by converting net orders to home deliveries; our home sales and delivery performance, particularly in key markets in California; our ability to generate cash from our operations, enhance our asset efficiency, increase our operating income margin and/or improve our return on invested capital; the manner in which our homebuyers are offered and whether they are able to obtain residential mortgage loans and mortgage banking services, including from Home Community Mortgage; the performance of Home Community Mortgage; information technology failures and data security breaches; and other events outside of our control. Please see our periodic reports and other filings with the Securities and Exchange Commission for a further discussion of these and other risks and uncertainties applicable to our business.

# # #

(Tables Follow)

# # #

KB HOME

CONSOLIDATED STATEMENTS OF OPERATIONS

For the Three Months Ended February 28, 2015 and 2014

(In Thousands, Except Per Share Amounts — Unaudited)

|

| | | | | | | |

| Three Months |

| 2015 | | 2014 |

Total revenues | $ | 580,121 |

| | $ | 450,687 |

|

Homebuilding: | | | |

Revenues | $ | 577,888 |

| | $ | 448,267 |

|

Costs and expenses | (563,490 | ) | | (430,548 | ) |

Operating income | 14,398 |

| | 17,719 |

|

Interest income | 103 |

| | 168 |

|

Interest expense | (5,338 | ) | | (11,276 | ) |

Equity in income (loss) of unconsolidated joint ventures | (347 | ) | | 2,590 |

|

Homebuilding pretax income | 8,816 |

| | 9,201 |

|

Financial services: | | | |

Revenues | 2,233 |

| | 2,420 |

|

Expenses | (964 | ) | | (852 | ) |

Equity in income (loss) of unconsolidated joint ventures | 414 |

| | (6 | ) |

Financial services pretax income | 1,683 |

| | 1,562 |

|

Total pretax income | 10,499 |

| | 10,763 |

|

Income tax expense | (2,700 | ) | | (200 | ) |

Net income | $ | 7,799 |

| | $ | 10,563 |

|

Earnings per share: | | | |

Basic | $ | .08 |

| | $ | .13 |

|

Diluted | $ | .08 |

| | $ | .12 |

|

Weighted average shares outstanding: | | | |

Basic | 91,954 |

| | 83,745 |

|

Diluted | 101,700 |

| | 93,946 |

|

KB HOME

CONSOLIDATED BALANCE SHEETS

(In Thousands — Unaudited)

|

| | | | | | | |

| February 28,

2015 | | November 30, 2014 |

Assets | | | |

Homebuilding: | | | |

Cash and cash equivalents | $ | 545,641 |

| | $ | 356,366 |

|

Restricted cash | 27,984 |

| | 27,235 |

|

Receivables | 143,697 |

| | 125,488 |

|

Inventories | 3,246,383 |

| | 3,218,387 |

|

Investments in unconsolidated joint ventures | 73,502 |

| | 79,441 |

|

Deferred tax assets, net | 822,632 |

| | 825,232 |

|

Other assets | 119,873 |

| | 114,915 |

|

| 4,979,712 |

| | 4,747,064 |

|

Financial services | 10,145 |

| | 10,486 |

|

Total assets | $ | 4,989,857 |

| | $ | 4,757,550 |

|

| | | |

Liabilities and stockholders’ equity | | | |

Homebuilding: | | | |

Accounts payable | $ | 161,902 |

| | $ | 172,716 |

|

Accrued expenses and other liabilities | 397,245 |

| | 409,882 |

|

Notes payable | 2,824,170 |

| | 2,576,525 |

|

| 3,383,317 |

| | 3,159,123 |

|

Financial services | 1,970 |

| | 2,517 |

|

Stockholders’ equity | 1,604,570 |

| | 1,595,910 |

|

Total liabilities and stockholders’ equity | $ | 4,989,857 |

| | $ | 4,757,550 |

|

KB HOME

SUPPLEMENTAL INFORMATION

For the Three Months Ended February 28, 2015 and 2014

(In Thousands, Except Average Selling Price — Unaudited) |

| | | | | | | |

| Three Months |

| 2015 | | 2014 |

Homebuilding revenues: | | | |

Housing | $ | 524,841 |

| | $ | 440,127 |

|

Land | 53,047 |

| | 8,140 |

|

Total | $ | 577,888 |

| | $ | 448,267 |

|

| | | |

| Three Months |

| 2015 | | 2014 |

Homebuilding costs and expenses: | | | |

Construction and land costs | | | |

Housing | $ | 445,383 |

| | $ | 362,106 |

|

Land | 47,035 |

| | 7,168 |

|

Subtotal | 492,418 |

| | 369,274 |

|

Selling, general and administrative expenses | 71,072 |

| | 61,274 |

|

Total | $ | 563,490 |

| | $ | 430,548 |

|

| | | |

| Three Months |

| 2015 | | 2014 |

Interest expense: | | | |

Interest incurred | $ | 45,003 |

| | $ | 39,280 |

|

Interest capitalized | (39,665 | ) | | (28,004 | ) |

Total | $ | 5,338 |

| | $ | 11,276 |

|

| | | |

| Three Months |

| 2015 | | 2014 |

Other information: | | | |

Depreciation and amortization | $ | 2,725 |

| | $ | 2,067 |

|

Amortization of previously capitalized interest | 22,293 |

| | 17,485 |

|

| | | |

| Three Months |

| 2015 | | 2014 |

Average selling price: | | | |

West Coast | $ | 550,600 |

| | $ | 525,200 |

|

Southwest | 274,800 |

| | 286,400 |

|

Central | 238,000 |

| | 210,400 |

|

Southeast | 264,200 |

| | 256,300 |

|

Total | $ | 329,500 |

| | $ | 305,200 |

|

|

| | | | | | | | | | | | | | |

KB HOME SUPPLEMENTAL INFORMATION For the Three Months Ended February 28, 2015 and 2014 (Dollars in Thousands — Unaudited) |

| | | |

| | | Three Months |

| | | | | 2015 | | 2014 |

Homes delivered: | | | | | | | |

West Coast | | | | | 414 |

| | 346 |

|

Southwest | | | | | 237 |

| | 161 |

|

Central | | | | | 653 |

| | 595 |

|

Southeast | | | | | 289 |

| | 340 |

|

Total | | | | | 1,593 |

| | 1,442 |

|

| | | | | | | |

| | | Three Months |

| | | | | 2015 | | 2014 |

Net orders: | | | | | | | |

West Coast | | | | | 552 |

| | 506 |

|

Southwest | | | | | 389 |

| | 181 |

|

Central | | | | | 870 |

| | 757 |

|

Southeast | | | | | 378 |

| | 321 |

|

Total | | | | | 2,189 |

| | 1,765 |

|

| | | | | | | |

| | | Three Months |

| | | | | 2015 | | 2014 |

Net order value: | | | | | | | |

West Coast | | | | | $ | 317,557 |

| | $ | 299,283 |

|

Southwest | | | | | 108,658 |

| | 48,388 |

|

Central | | | | | 227,043 |

| | 168,973 |

|

Southeast | | | | | 99,918 |

| | 83,528 |

|

Total | | | | | $ | 753,176 |

| | $ | 600,172 |

|

| | | | | | | |

| February 28, 2015 | | February 28, 2014 |

| Backlog Homes | | Backlog Value | | Backlog Homes | | Backlog Value |

Backlog data: | | | | | | | |

West Coast | 731 |

| | $ | 403,780 |

| | 580 |

| | $ | 328,676 |

|

Southwest | 476 |

| | 125,819 |

| | 208 |

| | 57,648 |

|

Central | 1,706 |

| | 419,490 |

| | 1,510 |

| | 320,926 |

|

Southeast | 592 |

| | 160,189 |

| | 582 |

| | 144,303 |

|

Total | 3,505 |

| | $ | 1,109,278 |

| | 2,880 |

| | $ | 851,553 |

|

KB HOME

RECONCILIATION OF NON-GAAP FINANCIAL MEASURES

For the Three Months Ended February 28, 2015 and 2014

(In Thousands, Except Percentages — Unaudited)

This press release contains, and Company management’s discussion of the results presented in this press release may include, information about the Company’s adjusted housing gross profit margin and ratio of net debt to capital, both of which are not calculated in accordance with generally accepted accounting principles (“GAAP”). The Company believes these non-GAAP financial measures are relevant and useful to investors in understanding its operations and the leverage employed in its operations, and may be helpful in comparing the Company with other companies in the homebuilding industry to the extent they provide similar information. However, because the adjusted housing gross profit margin and the ratio of net debt to capital are not calculated in accordance with GAAP, these financial measures may not be completely comparable to other companies in the homebuilding industry and thus, should not be considered in isolation or as an alternative to operating performance and/or financial measures prescribed by GAAP. Rather, these non-GAAP financial measures should be used to supplement their respective most directly comparable GAAP financial measures in order to provide a greater understanding of the factors and trends affecting the Company’s operations.

Adjusted Housing Gross Profit Margin

The following table reconciles the Company’s housing gross profit margin calculated in accordance with GAAP to the non-GAAP financial measure of the Company’s adjusted housing gross profit margin:

|

| | | | | | | |

| Three Months |

| 2015 | | 2014 |

Housing revenues | $ | 524,841 |

| | $ | 440,127 |

|

Housing construction and land costs | (445,383 | ) | | (362,106 | ) |

Housing gross profits | 79,458 |

| | 78,021 |

|

Add: Amortization of previously capitalized interest | 22,293 |

| | 17,485 |

|

Land option contract abandonment charges | 448 |

| | 433 |

|

Adjusted housing gross profits | $ | 102,199 |

| | $ | 95,939 |

|

Housing gross profit margin as a percentage of housing revenues | 15.1 | % | | 17.7 | % |

Adjusted housing gross profit margin as a percentage of housing revenues | 19.5 | % | | 21.8 | % |

Adjusted housing gross profit margin is a non-GAAP financial measure, which the Company calculates by dividing housing revenues less housing construction and land costs excluding amortization of previously capitalized interest and land option contract abandonment charges recorded during a given period, by housing revenues. The most directly comparable GAAP financial measure is housing gross profit margin. The Company believes adjusted housing gross profit margin is a relevant and useful financial measure to investors in evaluating the Company’s performance as it measures the gross profits the Company generated specifically on the homes delivered during a given period and enhances the comparability between periods. This non-GAAP financial measure isolates the impact that the amortization of previously capitalized interest and land option contract abandonments have on housing gross profit margins and allows investors to make comparisons with the Company’s competitors that adjust housing gross profit margins in a similar manner. The Company also believes investors will find adjusted housing gross profit margin relevant and useful because it represents a profitability measure that may be compared to a prior period without regard to variability of the amortization of previously capitalized interest and land option contract abandonment charges. This financial measure assists management in making strategic decisions regarding product mix, product pricing and construction pace.

KB HOME

RECONCILIATION OF NON-GAAP FINANCIAL MEASURES

(In Thousands, Except Percentages — Unaudited)

Ratio of Net Debt to Capital

The following table reconciles the Company’s ratio of debt to capital calculated in accordance with GAAP to the non-GAAP financial measure of the Company’s ratio of net debt to capital:

|

| | | | | | | |

| February 28, | | November 30, |

| 2015 | | 2014 |

Notes payable | $ | 2,824,170 |

| | $ | 2,576,525 |

|

Stockholders’ equity | 1,604,570 |

| | 1,595,910 |

|

Total capital | $ | 4,428,740 |

| | $ | 4,172,435 |

|

Ratio of debt to capital | 63.8 | % | | 61.8 | % |

| | | |

Notes payable | $ | 2,824,170 |

| | $ | 2,576,525 |

|

Less: Cash and cash equivalents and restricted cash | (573,625 | ) | | (383,601 | ) |

Net debt | 2,250,545 |

| | 2,192,924 |

|

Stockholders’ equity | 1,604,570 |

| | 1,595,910 |

|

Total capital | $ | 3,855,115 |

| | $ | 3,788,834 |

|

Ratio of net debt to capital | 58.4 | % | | 57.9 | % |

The ratio of net debt to capital is a non-GAAP financial measure, which the Company calculates by dividing notes payable, net of homebuilding cash and cash equivalents and restricted cash, by capital (notes payable, net of homebuilding cash and cash equivalents and restricted cash, plus stockholders’ equity). The most directly comparable GAAP financial measure is the ratio of debt to capital. The Company believes the ratio of net debt to capital is a relevant and useful financial measure to investors in understanding the leverage employed in the Company’s operations.

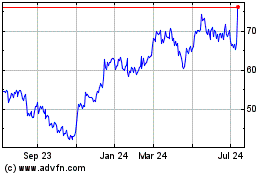

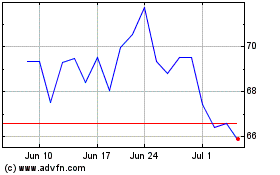

KB Home (NYSE:KBH)

Historical Stock Chart

From Mar 2024 to Apr 2024

KB Home (NYSE:KBH)

Historical Stock Chart

From Apr 2023 to Apr 2024