THE INDIA FUND, INC.

1900 Market Street, Suite 200

Philadelphia, PA 19103

April 15, 2023

DEAR STOCKHOLDER:

We are pleased to enclose the notice and proxy statement for the Annual Meeting of Stockholders (the "Meeting") of The India Fund, Inc. (NYSE: IFN; the "Fund") to be held at the offices of abrdn Inc., located at 1900 Market Street, Suite 200, Philadelphia, PA 19103 on Thursday, May 25, 2023 at 1:30 p.m., Eastern Time, for the purpose of considering and voting upon proposals to:

1. Elect two Class II Directors to the Board of Directors.

2. Consider the continuation of the term of one Director under the Fund's Corporate Governance Policies.

3. Transact such other business as may be properly presented at the Meeting or any adjournments or postponements thereof.

After careful consideration, the Board of Directors of the Fund, including all of the Independent Directors, recommends that you vote "FOR" the election of each of the nominees.

We will admit to the Meeting (1) all stockholders of record on the Record Date, (2) persons holding proof of beneficial ownership on the Record Date, such as a letter or account statement from the person's broker, (3) persons who have been granted proxies, and (4) such other persons that we, in our sole discretion, may elect to admit. All persons wishing to be admitted to the Meeting must present photo identification. If you plan to attend the Meeting, we ask that you call us in advance at 1-800-522-5465.

If your completed proxy card is not received, you may be contacted by representatives of the Fund, the Fund's transfer agent, or the Fund's proxy solicitor, Georgeson LLC ("Georgeson"). Georgeson has been engaged to assist the Fund in soliciting proxies. Representatives of Georgeson will remind you to vote your shares. You may also call the number provided on your proxy card for additional information.

As always, we thank you for your confidence and support.

Sincerely,

Megan Kennedy

Vice President and Secretary

You also may view or obtain these documents from the SEC:

In Person: At the SEC's Public Reference Room at 100 F Street, N.E., Washington, D.C. 20549

By Phone: 1-800-SEC-0330

By Mail: Public Reference Branch

Office of Consumer Affairs and Information Services

Securities and Exchange Commission

100 F Street, N.E.

Washington, D.C. 20549

(duplicating fee required)

By Email: publicinfo@sec.gov

(duplicating fee required)

By Internet: www.sec.gov

Stockholders who execute proxies retain the right to revoke them at the Meeting, by written notice received by the Secretary of the Fund at any time before they are voted or by delivering a duly executed proxy bearing a later date. Proxies that are not revoked will be voted in accordance with the specifications thereon and, unless specified to the contrary, will be voted "FOR" each of the nominees for Director.

The close of business on April 10, 2023 has been fixed as the record date for the determination of stockholders entitled to notice of and to vote at the Meeting and at any adjournments or postponements thereof (the "Record Date"). Each stockholder is entitled to one vote for each full share and an appropriate fraction of a vote for each fractional share held.

On the record date, there were 29,704,016.0753 shares of the Fund's common stock outstanding.

Whether or not a quorum is present at the Meeting, the Chair of the Meeting, without notice other than by announcement at the Meeting, may adjourn the Meeting to a date not more than 120 days after the original record date. Under the By-Laws of the Fund, a quorum is constituted by the presence in person or by proxy of the stockholders of the Fund entitled to cast at least a majority of the votes entitled to be cast.

Votes cast by proxy or in person at the Meeting will be tabulated by the inspector of election appointed for the Meeting. The inspector of election will determine whether or not a quorum is present at the Meeting. The inspector of election will treat abstentions and "broker non-votes" (i.e., shares held by brokers or nominees, typically in "street name," as to which proxies have been returned but (i) instructions have not been received from the beneficial owners or persons entitled to vote and (ii) the broker or nominee does not have discretionary voting power on a particular matter) as present for purposes of determining a quorum. For purposes of the election of Directors, abstentions and "broker non-votes" will not be considered votes cast and will not affect the vote required for Directors.

We will admit to the Meeting (1) all stockholders of record on the Record Date, (2) persons holding proof of beneficial ownership on the Record Date, such as a letter or account statement from the person's broker, (3) persons who have been granted proxies, and (4) such other persons that we, in our sole discretion, may elect to admit. To gain admittance, if you are a stockholder of record or a proxy holder of a stockholder of record, you must bring a form of personal identification to the Meeting, where your name will be verified against our stockholder list. If a broker or other nominee holds your shares and you plan to attend the Meeting, you should bring a recent brokerage statement showing your ownership of the shares, as well as a form of personal identification. If you are a beneficial owner and plan to vote at the Meeting, you should also bring a proxy card from your broker.

The Board of Directors of the Fund knows of no business other than that discussed above that will be presented for consideration at the Meeting. If any other matter is properly presented, it is the intention of the persons named in the enclosed proxy to vote in accordance with their best judgment.

The Fund is a non-diversified, closed-end management investment company registered under the 1940 Act. The principal business address of the Fund is 1900 Market Street, Suite 200, Philadelphia, PA 19103.

The date of this Proxy Statement is April 15, 2023.

Important Notice Regarding the Availability of Proxy Materials for the

Stockholder Meeting to be Held on May 25, 2023:

The proxy statement is available at

www.abrdnifn.com

PROPOSAL 1. ELECTION OF DIRECTORS

Background

In accordance with the Fund's Articles of Amendment and Restatement, the Board is divided into three classes: Class I, Class II and Class III. These staggered terms have the effect of limiting the ability of other entities or persons to acquire control of the Fund by delaying the replacement of a majority of the Board and could have the effect of depriving stockholders of an opportunity to sell their shares at a premium over prevailing market prices by discouraging a third party from seeking to obtain control of the Fund.

At the Meeting, stockholders will be asked to elect two Class II Directors, each to hold office until the 2026 Annual Meeting of Stockholders, or thereafter until their respective successors are elected and qualified. Mr. Luis F. Rubio and Ms. Nisha Kumar are the nominees for election as Class II Directors. Their qualifications are described in more detail below.

The Board, including the Independent Directors, recommends that stockholders vote "FOR" the nominees as Directors.

PROPOSAL 2. CONTINUATION OF TERM FOR ONE DIRECTOR UNDER THE CORPORATE GOVERNANCE POLICIES

Background

The Board has adopted Corporate Governance Policies which include a policy requiring that after an Independent Director has served on the Board for three consecutive terms of three years following the later of (a) engagement of the existing investment manager of the Fund or (b) the Independent Director's election to the Board, the Independent Director will be put forth for consideration by stockholders annually. Under the Corporate Governance Policies, Independent Directors currently serving on the Board will be submitted to stockholders for consideration of continuation as a director on an annual basis beginning at the first annual meeting following three complete consecutive terms following the later of the appointment of the Fund's then current investment manager or the initial election of the director by the Fund's stockholders, whichever is later. Jeswald W. Salacuse is to be put forth for consideration by stockholders annually pursuant to the Corporate Governance Policies. It is anticipated that Luis F. Rubio, up for election at the Meeting as a Class II Director under Proposal 1, will be up for election again at the Fund's next Annual Meeting of Stockholders pursuant to the Corporate Governance Policies.

The Board, including the Independent Directors, upon the recommendation of the Board's Nominating and Corporate Governance Committee ("Nominating Committee"), which is composed entirely of Independent Directors, recommends the continuation of Jeswald W. Salacuse as a Director until the 2024 Annual Meeting.

The following table provides information concerning a Class I Director currently serving until the 2024 Annual Meeting of Stockholders:

Name, Address and

Year of Birth |

|

Position(s)

Held with

Fund |

|

Length of

Time Served |

|

Principal Occupation(s)

During Past Five Years |

|

Number of

Funds

in Fund

Complex*

Overseen by

Director

(including

the Fund) |

|

Other

Board

Memberships

Held by Director |

|

|

Interested Director |

|

Alan Goodson(2)

c/o abrdn Inc.,

1900 Market Street,

Suite 200

Philadelphia, PA 19103

Year of Birth: 1974 |

|

Director; President of the Fund |

|

Since 2021 (Class I) |

|

Currently, Executive Director, Product & Client Solutions—Americas for abrdn Inc., overseeing Product Management & Governance and Product Development and Client Solutions for abrdn Inc.'s registered and unregistered investment companies in the U.S., Brazil and Canada. Mr. Goodson is Director and Vice President of abrdn Inc. and joined abrdn Inc. in 2000. |

|

|

1 |

|

|

None. |

|

* As of December 31, 2022, the Fund Complex consists of: abrdn Income Credit Strategies Fund, abrdn Asia-Pacific Income Fund, Inc., abrdn Global Income Fund, Inc., abrdn Australia Equity Fund, Inc., abrdn Emerging Markets Equity Income Fund, Inc., abrdn Japan Equity Fund, Inc., The India Fund, Inc., abrdn Global Dynamic Dividend Fund, abrdn Total Dynamic Dividend Fund, abrdn Global Premier Properties Fund, abrdn Global Infrastructure Income Fund, abrdn Funds (which consists of 19 portfolios) and abrdn ETFs (which consists of 3 portfolios).

(1) Mr. Young is an "interested person," as defined in the 1940 Act because he serves as Managing Director of abrdn Asia Limited, the Fund's investment manager.

(2) Mr. Goodson is an "interested person," as defined in the 1940 Act because he serves as an officer of abrdn Inc., the Fund's administrator and affiliate of the Fund's investment manager.

Each Director was selected to join the Board based on a variety of factors including, but not limited to, the Director's ability to carry out his or her duties as a Director, the Director's background, business and professional experience, qualifications and skills. Each Director possesses the following specific characteristics: Ms. Kumar has financial and accounting experience as the chief financial officer of other companies and experience as a board member of private equity funds; Ms. Maasbach has financial and research analysis experience in and covering the Asia region and experience in world affairs; Mr. Rubio has business and academic experience as president of a not-for-profit think tank focused on Mexico's economic and democratic development and has served as a board member of other investment companies; Mr. Goodson has financial and research analysis experience; Mr. Salacuse has academic and foreign affairs experience and has served as a board member of other investment companies; and Mr. Young is the managing director of the Fund's investment manager in the Asia region and has served as a board member of other investment companies. The Board has determined that Ms. Kumar is an "audit committee financial expert" as explained further below.

Director Compensation

Under the federal securities laws, the Fund is required to provide to stockholders in connection with the Meeting information regarding compensation paid to Directors by the Fund as well as by the various other U.S. registered investment companies advised by the investment manager of the Fund or an affiliate thereof during the Fund's prior fiscal year. The following table provides information concerning the approximate compensation paid as a retainer and for meetings held during the fiscal year ended December 31, 2022 to each Director of the Fund and the aggregate compensation paid to them from all registered funds in the abrdn Fund Complex as a retainer and for meetings held during the fiscal year ended December 31, 2022. The Fund does not provide any pension or retirement benefits to Directors.

A Fund Complex means two or more registered investment companies that hold themselves out to investors as related companies for purposes of investment and investor services, or that have a common investment manager or that have an investment manager that is an affiliated person of the investment manager of any of the other registered investment companies. Investment companies are considered to be in the same family if they share the same investment manager or principal underwriter and hold themselves out to investors as related companies for purposes of investment and investor services.

Officers of the Fund and Directors who are interested persons of the Fund do not receive any compensation directly from the Fund or any other fund in the Fund Complex for performing their duties as officers or Directors, respectively, although they are reimbursed by the Fund for reasonable out-of-pocket travel expenses for attending Board meetings.

|

Name of Director |

|

Aggregate

Compensation

from Fund |

|

Total Compensation

from Fund and

Fund Complex |

|

|

Alan Goodson* |

|

$ |

0 |

|

|

$ |

0 |

|

|

|

Nisha Kumar |

|

$ |

62,000 |

|

|

$ |

62,000 |

|

|

|

Nancy Yao Maasbach |

|

$ |

62,000 |

|

|

$ |

308,500 |

|

|

|

Luis F. Rubio |

|

$ |

62,000 |

|

|

$ |

62,000 |

|

|

|

Jeswald W. Salacuse |

|

$ |

79,500 |

|

|

$ |

79,500 |

|

|

|

Hugh Young* |

|

$ |

0 |

|

|

$ |

0 |

|

|

* Messrs. Goodson and Young are considered Interested Directors.

Beneficial Share Ownership

Based upon a review of the most recent filings made pursuant to Section 13 of the 1934 Act, as of March 31, 2022, the following table shows certain information concerning persons who may be deemed beneficial owners of 5% of more of the outstanding shares of the Fund:

|

Share |

|

Percentage |

|

Name |

|

Address |

|

|

|

2,058,954 |

|

|

|

7.03 |

% |

|

Lazard Asset Management |

|

30 Rockefeller Plaza

New York, New York 10112 |

|

As of December 31, 2022, Cede & Co., a nominee for participants in The Depository Trust Company, held of record had 28,021,756 shares, equal to approximately 95.2% of the outstanding shares of the Fund.

12

Ownership of Securities

The following table provides information concerning the number and dollar range of equity securities beneficially owned by each Director or nominee as of October 31, 2022:

|

Name of Director or Nominee |

|

Dollar Range of

Equity Securities

in the Fund |

|

Aggregate Dollar Range

of Equity Securities

in All Funds Overseen

or to be Overseen by

Director or Nominee in

abrdn Family of

Investment Companies(1) |

|

|

Alan Goodson |

|

$10,001 — $50,000 |

|

Over $100,000 |

|

|

Nisha Kumar |

|

$10,001 — $50,000 |

|

$10,001 — $50,000 |

|

|

Nancy Yao Maasbach |

|

$10,001 — $50,000 |

|

$50,001 — $100,000 |

|

|

Hugh Young |

|

$10,001 — $50,000 |

|

$10,001 — $50,000 |

|

|

Luis F. Rubio |

|

$10,001 — $50,000 |

|

$10,001 — $50,000 |

|

|

Jeswald W. Salacuse |

|

$10,001 — $50,000 |

|

$10,001 — $50,000 |

|

(1) "abrdn Family of Investment Companies" means those registered investment companies that share abrdn Asia Limited, the Fund's investment manager, or an affiliate as the investment adviser and that hold themselves out to investors as related companies for purposes of investment and investor services.

As of October 31, 2022, the holdings of no Director or executive officer, nor the Directors and executive officers of the Fund as a group, represented more than 1% of the outstanding shares of the Fund's common stock. At October 31, 2022, no Director or nominee for election as Director who is not an "interested person" of the Fund as defined in the 1940 Act, nor any immediate family member of such persons, owned beneficially or of record any shares of abrdn Asia Limited (formerly, Aberdeen Standard Investments (Asia) Limited and Aberdeen Asset Management Asia Limited) ("abrdn Asia"), the Fund's investment manager, or any person or entity (other than the Fund) directly or indirectly controlling, controlled by, or under common control with abrdn Asia.

Responsibilities of the Board of Directors

The Board of Directors is responsible under applicable state law for overseeing generally the operation of the Fund. The Directors oversee the Fund's operations by, among other things, meeting at regularly scheduled meetings and as otherwise needed with the Fund's management and evaluating the performance of the Fund's service providers including abrdn Asia, the Fund's custodian, and the transfer agent. As part of this process, the Directors consult with the Fund's independent registered public accounting firm, and the directors who are not considered to be "interested persons" of the Fund, as defined in the 1940 Act ("Independent Directors"), consult with their own separate independent counsel.

The Directors regularly review the Fund's financial statements, performance and market price as well as the quality of the services being provided to the Fund. As part of this process, the Directors review the Fund's fees and expenses to determine if they are reasonable and competitive in light of the services being received, while also ensuring that the Fund continues to have access to high quality services in the future.

Based on these reviews, the Directors periodically make suggestions to the Fund's management and monitor to ensure that responsive action is taken. The Directors also monitor potential conflicts of interest among the Fund, abrdn Asia and its affiliates and other funds and clients managed by abrdn Asia with the objective that the Fund will be managed in a manner that is in the best interest of the Fund's stockholders.

13

The Board has four regularly scheduled meetings each year and additional meetings are scheduled as needed. Furthermore, the Board has a standing Audit Committee and a Nominating Committee, which meet periodically during the year and the responsibilities of which are described below, each composed entirely of Directors who are not "interested persons" of the Fund, abrdn Asia or its affiliates (together, "abrdn") within the meaning of the 1940 Act, and who are "independent" as defined in the NYSE listing standards.

Officers of the Fund

The executive officers of the Fund are chosen annually to hold office until the next year and until their successors are chosen and qualified. The current executive officers of the Fund are:

Officers of the Fund Name,

Address and Year of Birth |

|

Positions Held

with the Fund |

|

Officer of the

Fund Since |

|

Principal Occupation(s) During Past Five Years |

|

|

Officers |

|

Alan Goodson*

c/o abrdn Inc.

1900 Market Street,

Suite 200,

Philadelphia, PA 19103

Year of Birth: 1974 |

|

President |

|

Since 2011 |

|

Currently, Executive Director, Product &Client Solutions—Americas for abrdn Inc. , overseeing Product Management, Product Development and Client Services for abrdn's registered and unregistered investment companies in the U.S., Brazil and Canada. Mr. Goodson is Director and Vice President of abrdn Inc. and joined abrdn in 2000. |

|

Joseph Andolina*

c/o abrdn Inc.

1900 Market Street,

Suite 200,

Philadelphia, PA 19103

Year of Birth: 1978 |

|

Chief Compliance Officer and Vice President |

|

Since 2017 |

|

Currently, Chief Risk Officer—Americas and serves as the Chief Compliance Officer for abrdn Inc. Prior to joining the Risk and Compliance Department, he was a member of abrdn Inc.'s Legal Department, where he served as U.S. Counsel since 2012. |

|

Katherine Corey*

c/o abrdn Inc.,

1900 Market St,

Suite 200

Philadelphia, PA 19103

Year of Birth: 1985 |

|

Vice President |

|

Since 2023 |

|

Currently, Senior Legal Counsel, Product Governance US for abrdn Inc. Ms. Corey joined abrdn Inc. as U.S. Counsel in 2013. |

|

Chris Demetriou*

c/o abrdn Investments

Limited

280 Bishopsgate

London, EC2M 4AG

United Kingdom

Year of Birth: 1983 |

|

Vice President |

|

Since 2020 |

|

Currently, Chief Executive Officer—UK, EMEA and Americas for abrdn. Mr. Demetriou joined abrdn Inc. in 2013, as a result of the acquisition of SVG, a FTSE 250 private equity investor based in London. |

|

Sharon Ferrari*

c/o abrdn Inc.

1900 Market Street,

Suite 200,

Philadelphia, PA 19103

Year of Birth: 1977 |

|

Treasurer and Chief Financial Officer |

|

Treasurer & Chief Financial Officer Since 2023, Fund Officer Since 2013 |

|

Currently, Director, Product Management for abrdn Inc. Ms. Ferrari joined abrdn Inc. as a Senior Fund Administrator in 2008. |

|

Katie Gebauer*

c/o abrdn Inc.,

1900 Market Street,

Suite 200

Philadelphia, PA 19103

Year of Birth: 1986 |

|

Vice President |

|

Since 2023 |

|

Currently, Chief Compliance Officer—ETFs and serves as the Chief Compliance Officer for abrdn ETFs Advisors LLC. Ms. Gebauer joined abrdn Inc. in 2014. |

|

14

Officers of the Fund Name,

Address and Year of Birth |

|

Positions Held

with the Fund |

|

Officer of the

Fund Since |

|

Principal Occupation(s) During Past Five Years |

|

Heather Hasson*

c/o abrdn Inc.

1900 Market Street,

Suite 200,

Philadelphia, PA 19103

Year of Birth: 1982 |

|

Vice President |

|

Since 2018 |

|

Currently, Senior Product Solutions and Implementation Manager, Product Governance US for abrdn Inc. Ms. Hasson joined abrdn Inc. as a Fund Administrator in 2006. |

|

Robert Hepp*

c/o abrdn Inc.

1900 Market Street,

Suite 200

Philadelphia, PA 19103

Year of Birth: 1986 |

|

Vice President |

|

Since 2022 |

|

Currently, Senior Product Governance Manager, Product Governance US at abrdn. Mr. Hepp joined abrdn in 2016. |

|

Megan Kennedy*

c/o abrdn Inc.

1900 Market Street,

Suite 200,

Philadelphia, PA 19103

Year of Birth: 1974 |

|

Vice President and Secretary |

|

Since 2011 |

|

Currently, Senior Director, Product Governance for abrdn Inc. Ms. Kennedy joined abrdn Inc. as a Senior Fund Administrator in 2005. |

|

Andrew Kim*

c/o abrdn Inc.

1900 Market Street,

Suite 200

Philadelphia, PA 19103

Year of Birth: 1983 |

|

Vice President |

|

Since 2022 |

|

Currently, Senior Product Governance Manager, Product Governance US for abrdn Inc. Mr. Kim joined abrdn Inc. in 2013. |

|

Brian Kordeck*

c/o abrdn Inc.

1900 Market Street,

Suite 200

Philadelphia, PA 19103 |

|

Vice President |

|

Since 2022 |

|

Currently, Senior Product Manager, Product Governance US for abrdn. Mr. Kordeck joined abrdn Inc. in 2013. |

|

Adrian Lim

c/o abrdn Inc.

1900 Market Street,

Suite 200,

Philadelphia, PA 19103

Year of Birth: 1971 |

|

Vice President |

|

Since 2011 |

|

Currently, Investment Director on the Asian Equities Team at abrdn. Adrian joined the company in 2000. |

|

Michael Marsico*

c/o abrdn Inc.

1900 Market Street,

Suite 200

Philadelphia, PA 19103

Year of Birth: 1980 |

|

Vice President |

|

Since 2022 |

|

Currently, Senior Product Manager, Product Governance US for abrdn Inc. Mr. Marsico joined abrdn Inc. in 2014. |

|

Yoojeong Oh

c/o abrdn Inc.

1900 Market Street,

Suite 200,

Philadelphia, PA 19103

Year of Birth: 1981 |

|

Vice President |

|

Since 2019 |

|

Currently, Investment Director on the Asian Equities Team at abrdn. Yoojeong joined the company in 2005. |

|

15

Officers of the Fund Name,

Address and Year of Birth |

|

Positions Held

with the Fund |

|

Officer of the

Fund Since |

|

Principal Occupation(s) During Past Five Years |

|

Christian Pittard*

c/o abrdn Investments Limited

280 Bishopsgate

London EC2M 4AG

United Kingdom

Year of Birth: 1973 |

|

Vice President |

|

Since 2012 |

|

Currently, Group Head of Product Opportunities at abrdn and a Director of abrdn (Holdings) PLC since 2010. Mr. Pittard joined abrdn from KPMG in 1999. |

|

Lucia Sitar*

c/o abrdn Inc.

1900 Market Street,

Suite 200,

Philadelphia, PA 19103

Year of Birth: 1971 |

|

Vice President and Chief Legal Officer |

|

Since 2012 |

|

Currently, Vice President and Head of Product Management and Governance—Americas since 2021. Previously, Ms. Sitar served as Managing U.S. Counsel for abrdn Inc. She joined abrdn Inc. as U.S. Counsel in 2007. |

|

James Thom

c/o abrdn Inc.

1900 Market Street,

Suite 200,

Philadelphia, PA 19103

Year of Birth: 1977 |

|

Vice President |

|

Since 2019 |

|

Currently, a Senior Investment Director on the Asian Equities Team at abrdn. Mr. Thom joined the company in 2010. |

|

* Each officer may hold officer position(s) in one or more other funds which are part of the Fund Complex.

Audit Committee

The Audit Committee is composed entirely of Directors who are not "interested persons" of the Fund, abrdn Asia or its affiliates within the meaning of the 1940 Act, and who are "independent" as defined in the NYSE listing standards. Currently, Mr. Salacuse is the Chair and Mr. Rubio and Mses. Kumar and Maasbach are members of the Audit Committee. The Audit Committee convened three times during the fiscal year ended December 31, 2022. The principal functions of the Audit Committee are to appoint and retain the Fund's independent registered public accounting firm, to review with the independent registered public accounting firm the scope, performance and anticipated cost of their audit and to receive and consider a report from the independent registered public accounting firm concerning their conduct of the audit, including the form of the opinion proposed to be rendered, and any comments or recommendations the independent registered public accounting firm might want to make in that connection. The Board has determined that Ms. Kumar is an "audit committee financial expert," as defined in Section 401(h) of Regulation S-K. The Audit Committee Charter states that no member of the Audit Committee may serve on the audit committees of more than three public companies, including the Fund, unless the Board of Directors determines that such simultaneous service would not impair the ability of such member to serve on the Audit Committee effectively. For purposes of this determination, service on multiple audit committees within the same fund complex is counted as service on a single audit committee. The Fund's amended and restated Audit Committee Charter is available on the Fund's website at www.abrdnifn.com.

The members of the Audit Committee are not professionally engaged in the practice of auditing or accounting and are not employed by the Fund for accounting, financial management or internal control. Moreover, the Audit Committee relies on and makes no independent verification of the facts presented to it or representations made by management or the independent registered public accounting firm. Accordingly, the Audit Committee's oversight does not provide an independent basis to determine that management has maintained appropriate accounting and financial reporting principles and policies, or internal controls and procedures, designed to assure compliance with accounting standards and applicable laws and regulations. Furthermore, the Audit Committee's considerations and

16

discussions referred to above do not provide assurance that the audit of the Fund's financial statements has been carried out in accordance with generally accepted auditing standards or that the financial statements are presented in accordance with generally accepted accounting principles.

Pursuant to the Fund's Audit Committee Pre-Approval Policy, the Audit Committee pre-approved all audit and non-audit services provided by KPMG LLP ("KPMG"), the Fund's independent registered public accounting firm, to the Fund in 2022. As set forth in the Audit Committee Pre-Approval Policies, the Audit Committee has authorized the Chair of the Audit Committee to pre-approve certain services to be performed by KPMG, as necessary, between Audit Committee meetings which would then be presented to the full Audit Committee at its next regularly scheduled meeting. Representatives from KPMG are not expected to be present at the Meeting to make a statement or respond to questions from shareholders. If requested by any shareholder by two (2) business days before the Meeting, a representative from KPMG will be present by telephone at the Meeting to respond to appropriate questions and will have an opportunity to make a statement if he or she chooses to do so.

Nominating Committee

The Nominating Committee is composed entirely of Directors who are not "interested persons" of the Fund, abrdn Asia or its affiliates within the meaning of the 1940 Act and who are "independent" as defined in the NYSE listing standards. Currently, Mr. Salacuse is the Chair and Mr. Rubio and Mses. Kumar and Maasbach are members of the Nominating Committee. This Committee met one time during the fiscal year ended December 31, 2022. The principal function of the Nominating Committee is to select and nominate persons for election as Directors of the Fund. The Nominating Committee Charter is available on the Fund's website at www.abrdnifn.com.

The Nominating Committee identifies potential nominees through its network of contacts. While the Nominating Committee meets to discuss and consider such candidates' qualifications and then chooses a candidate by majority vote, the Nominating Committee does not have specific, minimum qualifications for nominees and has not established specific qualities or skills that it regards as necessary for one or more of the Fund's Directors to possess (other than any qualities or skills that may be required by applicable law, regulation or listing standard).

In identifying and evaluating nominees, the Nominating Committee considers factors it deems relevant, which include: whether or not the person is an "interested person" as defined in the 1940 Act and whether the person is otherwise qualified under applicable laws and regulations to serve on the Board of Directors of the Fund; whether or not the person has any relationship that might impair his or her independence, such as any business, financial or family relationships with Fund management, the investment manager of the Fund, Fund service providers or their affiliates; whether or not the person serves on boards of, or is otherwise affiliated with, competing organizations or funds; and the character and integrity of the person and the contribution which the person can make to the Board. The Nominating Committee does not have a formal diversity policy but may also consider diversity of professional experience, education and skills when evaluating potential nominees. The Nominating Committee will accept nominations for the office of Director made by Fund stockholders. Stockholders who wish to recommend a nominee should send nominations to the Secretary of the Fund which include biographical information and set forth the qualifications of the proposed nominee. There are no differences in the manner in which the Nominating Committee evaluates nominees based on whether such nominees are recommended by a stockholder.

The Fund does not pay a fee to any third party or parties to identify or evaluate or assist in identifying or evaluating potential nominees. The Nominating Committee did not receive a recommended nominee from a stockholder who beneficially owned, or a group of stockholders who beneficially owned, more than 5% of the Fund's shares for at least one year as of the date the recommendation to elect the Director nominees was made.

17

Board Meetings

During the fiscal year ended December 31, 2022, the Board of Directors held four regular meetings and one special meeting. Each Director attended at least 75% of the meetings of the Board or the committee(s) of the Board on which the Director served.

Delinquent Section 16(a) Reports

Section 16(a) of the 1934 Act and Section 30(h) of the 1940 Act, as applied to the Fund, require the Fund's officers and Directors, certain officers and directors of the investment manager, affiliates of the investment manager, and persons who beneficially own more than 10% of the Fund's outstanding securities (collectively, the "Reporting Persons") to electronically file reports of ownership of the Fund's securities and changes in such ownership with the SEC and the NYSE.

Based solely on the Fund's review of such forms filed on EDGAR or written representations from Reporting Persons that all reportable transactions were reported, to the knowledge of the Fund, during the fiscal period ended December 31, 2022, the Fund's Reporting Persons timely filed all reports they were required to file under Section 16(a), except that: (i) a late Form 3 filing was submitted for Ai Hua Aik following her appointment as a director of the Fund's investment manager; and (ii) a late Form 4 filing was submitted for Alan Goodson, a Director of the Fund, with respect to an open-market purchase of Fund shares.

Report of the Audit Committee

The Audit Committee reports that it has: (i) reviewed and discussed the Fund's audited financial statements for the fiscal year ended December 31, 2022 with management; and (ii) discussed with KPMG, the Fund's independent registered public accounting firm, the matters required to be discussed by the applicable requirements of The Public Company Accounting Oversight Board ("PCAOB") and the SEC.

The Audit Committee also reports that it previously received (i) written confirmation from KPMG that it is independent and (ii) written disclosures regarding such independence as required by the Public Company Accounting Oversight Board Rule 3526 and discussed with KPMG the independent registered public accounting firm's independence. In addition, the Audit Committee has reviewed the aggregate fees billed by KPMG for professional services rendered to the Fund and for non-audit services provided to: abrdn Asia, the Fund's investment manager, and any entity controlling, controlled by or under common control with abrdn Asia that provided services to the Fund. As part of this review, the Audit Committee considered, in addition to other practices and requirements relating to selection of the Fund's independent registered public accounting firm, whether the provision of such non-audit services was compatible with maintaining the independence of KPMG.

Based on the foregoing review and discussions, the Audit Committee presents this report to the Board and recommends that the Fund's audited financial statements be included in the Fund's annual report to stockholders for the fiscal year ended December 31, 2022 and filed with the SEC.

Submitted by the Audit Committee of the Fund's Board of Directors

Nisha Kumar

Nancy Yao Maasbach

Luis F. Rubio

Jeswald W. Salacuse

February 22, 2023

18

Required Vote

Directors are elected by a majority of all the votes cast by the holders of shares of common stock of the Fund present in person or represented by proxy at a meeting with a quorum present. A "majority of the votes" cast means that the number of shares voted "FOR" a Director must exceed the number of votes cast "AGAINST" that Director.

Please note that unless otherwise instructed, the proxies will vote "FOR" each nominee for Director.

The Board, including the Independent Directors, recommends that stockholders vote "FOR" each nominee for Director.

ADDITIONAL INFORMATION

Service Providers

abrdn Asia currently serves as the Fund's investment manager. The address of abrdn Asia is 21 Church Street, #01-01, Capital Square Two, Singapore 049480. abrdn Asia is a wholly-owned indirect subsidiary of abrdn plc.

abrdn Inc. currently serves as the Fund's administrator. The address of abrdn Inc. is 1900 Market Street, Suite 200, Philadelphia, PA 19103. abrdn Inc. is a wholly-owned indirect subsidiary of abrdn plc.

abrdn Inc. subcontracts certain of its administrative responsibilities as administrator to State Street Bank and Trust Company. The address of State Street Bank and Trust Company is One Heritage Drive, North Quincy, MA 02171.

Independent Registered Public Accounting Firm

The Audit Committee has adopted written policies relating to the pre-approval of the audit and non-audit services performed by the Fund's independent registered public accounting firm. Unless a type of service to be provided by the independent registered public accounting firm has received general pre-approval, it requires specific pre-approval by the Audit Committee. Under the policies, on an annual basis, the Audit Committee reviews and pre-approves the services to be provided by the independent registered public accounting firm. In addition, the Audit Committee pre-approves any permitted non-audit services to be provided by the independent registered public accounting firm to abrdn Asia or any entity controlling, controlled by, or under common control with abrdn Asia if such services relate directly to the operations and financial reporting of the Fund. As set forth in the Audit Committee Pre-Approval Policies, the Audit Committee has authorized the Chair of the Audit Committee to pre-approve certain services to be performed by KPMG, as necessary, between audit committee meetings which would then be presented to the full Audit Committee at its next regularly scheduled meeting.

Audit Fees. The aggregate fees paid to KPMG for the fiscal year ended December 31, 2022 and the fiscal year ended December 31, 2021 in connection with the annual audit of the Fund's financial statements and for services normally provided in connection with the statutory and regulatory filings of the Fund were $56,250 and $51,368, respectively, including out-of-pocket expenses.

Audit-Related Fees. The aggregate fees paid to KPMG for the fiscal year ended December 31, 2022 and the fiscal year ended December 31, 2021 in connection with assurance and related services reasonably related to the annual audit of the Fund and for review of the Fund's financial statements, other than the Audit Fees described above, were $0 and $0, respectively.

Tax Fees. The aggregate fees paid for domestic and international tax-related services, including tax compliance, tax advice and tax planning, rendered to the Fund by KPMG for the fiscal years ended December 31, 2022 and December 31, 2021 were $0 and $8,880, respectively.

19

All Other Fees. The aggregate non-audit fees billed by KPMG for the fiscal year ended December 31, 2022 and for the fiscal year ended December 31, 2021 for services rendered to the Fund, abrdn Asia, the Fund's investment manager, and any entity controlling, controlled by or under common control with the Fund or abrdn Asia that provided ongoing services to the Fund were $1,108,929 and $1,556,436, respectively. The Audit Committee has determined that the provision of non-audit services is compatible with maintaining the independence of KPMG.

None of the services described above, provided in the fiscal year ended December 31, 2022, were approved pursuant to the de minimis exception provided in Rule 2-01(c)(7)(i)(C) of Regulation S-X promulgated by the SEC.

The Audit Committee has considered whether the provision of non-audit services that were rendered to abrdn Asia and any entity controlling, controlled by, or under common control with abrdn Asia that provides ongoing services to the Fund that were not pre-approved pursuant to paragraph (c)(7)(ii) of Rule 2-01 of Regulation S-X is compatible with maintaining the principal accountant's independence and has concluded that it is independent.

Other Business

The Fund's Board of Directors does not know of any other matter that may come before the Meeting. If any other matter properly comes before the Meeting, it is the intention of the persons named in the proxy to vote the proxies in accordance with their judgment on that matter.

Stockholder Proposals

All proposals by stockholders of the Fund that are intended to be presented at the Fund's next Annual Meeting of Stockholders, to be held in 2024, must be received by the Fund (addressed to The India Fund, Inc., 1900 Market Street, Suite 200, Philadelphia, PA 19103) in order to be considered for inclusion in the Fund's proxy statement and proxy relating to that meeting no later than December 17, 2023. Any stockholder who desires to bring a proposal for consideration at the Fund's 2024 Annual Meeting of Stockholders without including such proposal in the Fund's proxy statement must deliver written notice thereof to the Secretary or Assistant Secretary of the Fund (addressed to The India Fund, Inc., 1900 Market Street, Suite 200, Philadelphia, PA 19103) during the period from January 25, 2024 to February 24, 2024. However, if the Fund's 2024 Annual Meeting of Stockholders is held earlier than April 25, 2024 or later than July 24, 2024, such written notice must be delivered to the Secretary or Assistant Secretary of the Fund no earlier than 120 days before the date of the 2024 Annual Meeting of Stockholders and no later than the later of 90 days before the date of the 2024 Annual Meeting of Stockholders or 10 days following the public announcement of the date of the 2024 Annual Meeting of Stockholders.

Any stockholder proposal intended to be included in the Fund's proxy statement, including any accompanying supporting statement, may not exceed 500 words. There are additional requirements regarding proposals of stockholders, and a stockholder contemplating submission of a proposal is referred to Rule 14a-8 promulgated under the 1934 Act and Section 4(b) of the By-Laws of the Fund. The timely submission of a proposal does not guarantee its inclusion in a Fund's proxy materials.

Stockholder Communications with the Board of Directors

The Fund has adopted procedures by which Fund stockholders may send communications to the Board. Stockholders may mail written communications to the Board to the attention of Directors of The India Fund, Inc., c/o the Fund's Chief Legal Officer, 1900 Market Street, Suite 200, Philadelphia, PA 19103. Stockholder communications must (i) be in writing and be signed by the stockholder and (ii) identify the number of shares held by the stockholder. The Chief Legal Officer of the Fund is responsible for reviewing properly submitted stockholder communications. The Chief Legal Officer shall either (i) provide a copy of each properly submitted stockholder communication to the Board at its next regularly scheduled board meeting or (ii) if the Chief Legal Officer determines that the communication requires more immediate attention, forward the communication to the Directors

20

promptly after receipt. The Chief Legal Officer may, in good faith, determine that a stockholder communication should not be provided to the Board because it does not reasonably relate to the Fund or its operations, management, activities, policies, service providers, Board, officers, stockholders or other matters relating to an investment in the Fund or is otherwise ministerial in nature. These procedures shall not apply to (i) any communication from an officer or Director of the Fund, (ii) any communication from an employee or agent of the Fund, unless such communication is made solely in such employee's or agent's capacity as a stockholder of the Fund, or (iii) any stockholder proposal submitted pursuant to Rule 14a-8 under the 1934 Act or any communication made in connection with such a proposal.

The Fund does not have a formal policy regarding attendance by Directors at Annual Meetings of Stockholders. No Directors attended the 2022 Annual Meeting of Stockholders.

Expenses of Proxy Solicitation

The costs of preparing, printing, assembling and mailing material in connection with this solicitation of proxies will be borne by the Fund, even if the proposals are not successful, as will all of the other costs in connection with the Meeting. Proxies may also be solicited personally by Directors and officers of the Fund, by employees of the Fund's transfer agent, and by regular employees of abrdn Asia, its respective affiliates or other representatives of the Fund, and may be accomplished by telephone in addition to the use of mails. Brokerage houses, banks and other fiduciaries may be requested to forward proxy solicitation material to their principals to obtain authorization for the execution of proxies, and they will be reimbursed by the Fund for out-of-pocket expenses so incurred.

In addition, Georgeson LLC ("Georgeson"), a proxy solicitation firm, has been retained to assist in the solicitation of the proxy vote. It is anticipated that Georgeson will be paid an amount estimated at $2,000 plus reasonable out-of-pocket expenses. Therefore, expenses of the Meeting will include costs of (i) preparing, assembling and mailing material in connection with the solicitation, (ii) soliciting proxies by officers or employees, personally or by telephone or telegraph, (iii) reimbursing brokerage houses, banks and other fiduciaries and (iv) compensating the proxy solicitor.

Georgeson may call stockholders to ask if they would be willing to have their votes recorded by telephone. The telephone voting procedure is designed to authenticate stockholders' identities, to allow stockholders to authorize the voting of their shares in accordance with their instructions and to confirm that their instructions have been recorded properly. A stockholder voting by telephone would be asked for his or her social security number or other identifying information and would be given an opportunity to authorize proxies to vote his or her shares in accordance with his or her instructions. To ensure that the stockholder's instructions have been recorded correctly, he or she will receive a confirmation of such instructions in the mail. The confirmation is a replica of the proxy card, but with marks indicating how the stockholder voted, along with a special toll-free number which will be available in the event the stockholder wishes to change or revoke the vote. Although a stockholder's vote may be taken by telephone, each stockholder will receive a copy of this proxy statement and may vote by mailing the enclosed proxy card. If you have any questions or need assistance in voting, please contact Georgeson at its toll-free number, 1-866-682-6148.

21

Please vote promptly by signing and dating the enclosed proxy card and returning it in the accompanying postage-paid return envelope or by following the instructions on the enclosed proxy card for voting by telephone or over the Internet.

April 15, 2022

By order of the Board of Directors,

Megan Kennedy

Vice President and Secretary

22

THE INDIA FUND, INC.

PO Box 43131

Providence, RI 02940-3131 |

EVERY VOTE IS IMPORTANT |

| |

EASY VOTING OPTIONS: |

| |

|

VOTE

ON THE INTERNET

Log on to:

www.proxy-direct.com

or scan the QR code

Follow the on-screen instructions

available 24 hours

|

| |

|

|

| |

|

VOTE

BY PHONE

Call 1-800-337-3503

Follow the recorded instructions

available 24 hours

|

| |

|

|

| |

|

VOTE

BY MAIL

Vote, sign and date this Proxy

Card and return in the

postage-paid envelope

|

| |

|

|

| |

|

VOTE

IN PERSON

Attend

Stockholder Meeting

1900 Market Street, Suite 200

Philadelphia, PA 19103

on May 25, 2023

|

Please detach at perforation before mailing.

| PROXY |

THE

INDIA FUND, INC.

|

| |

ANNUAL MEETING OF STOCKHOLDERS |

| |

TO BE HELD ON MAY 25, 2023 |

THIS

PROXY IS BEING SOLICITED BY THE BOARD OF DIRECTORS. The undersigned Stockholder(s) of The India Fund, Inc. (the “Fund”),

revoking previous proxies, hereby appoints Megan Kennedy, Katherine Corey, Andrew Kim and Robert Hepp, or any one of them true and lawful

attorneys with power of substitution of each, to vote all shares of The India Fund, Inc. which the undersigned is entitled to vote, at

the Annual Meeting of Stockholders to be held on Thursday, May 25, 2023, at 1:30 p.m. Eastern Time, at the offices of abrdn Inc., located

at 1900 Market Street, Suite 200, Philadelphia, Pennsylvania 19103, and at any adjournment thereof as indicated on the reverse side.

Please refer to the Proxy Statement for a discussion of these matters.

In

their discretion, the proxy holders named above are authorized to vote upon such other matters as may properly come before the meeting

or any adjournment thereof.

Receipt

of the Notice of the Annual Meeting of Stockholders and the accompanying Proxy Statement is hereby acknowledged. If this Proxy is executed

but no instructions are given, the votes entitled to be cast by the undersigned will be cast “FOR” the nominees for director

in Proposal 1 and Proposal 2.

| |

VOTE VIA THE INTERNET: www.proxy-direct.com |

| |

VOTE VIA THE TELEPHONE: 1-800-337-3503 |

| |

|

|

|

IFN_33289_032323

PLEASE SIGN, DATE AND RETURN THE PROXY PROMPTLY

USING THE ENCLOSED ENVELOPE.

EVERY STOCKHOLDER’S VOTE IS IMPORTANT

Important Notice Regarding the Availability

of Proxy Materials for the

The India Fund, Inc.

Stockholder Meeting to be held on May 25,

2023, at 1:30 p.m. (Eastern Time)

The Proxy Statement for this meeting is available

at: www.abrdnifn.com

IF YOU VOTE ON THE INTERNET OR BY TELEPHONE,

YOU NEED NOT RETURN THIS PROXY CARD

Please detach at perforation before mailing.

In

their discretion, the proxy holders are authorized to vote upon the matters set forth in the Notice of Meeting and Proxy Statement dated

April 15, 2023 and upon all other such matters as may properly come before the meeting or any adjournment thereof.

| TO VOTE MARK BLOCKS BELOW IN BLUE OR BLACK INK AS SHOWN IN THIS EXAMPLE: |

|

|

Proposals |

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE “FOR” THE NOMINEES FOR DIRECTORS IN THE PROPOSALS. |

| 1. | To

elect two Class II Directors of the Fund, for a three-year term until the 2026 Annual Meeting

of Stockholders. |

| |

FOR |

AGAINST |

ABSTAIN |

|

| 01. Luis F. Rubio |

☐ |

☐ |

☐ |

|

| 02. Nisha Kumar |

☐ |

☐ |

☐ |

|

| 2. | Consider the continuation of the term of one Class I Director under

the Fund’s Corporate Governance Policies until the 2024 Annual Meeting of Stockholders. |

| |

FOR |

AGAINST |

ABSTAIN |

|

| 01. Jeswald W. Salacuse |

☐ |

☐ |

☐ |

|

| 3. | Transact

such other business as may be properly presented at the Meeting or any adjournments or postponements

thereof. |

|

Authorized Signatures ─ This section must be completed for your vote to be counted.─ Sign and Date Below |

| Note: | Please sign exactly as your name(s) appear(s) on this Proxy

Card, and date it. When shares are held jointly, each holder should sign. When signing as attorney, executor, guardian, administrator,

trustee, officer of corporation or other entity or in another representative capacity, please give the full title under the signature. |

| Date (mm/dd/yyyy) ─ Please print date below |

|

Signature 1 ─ Please keep signature within the box |

|

Signature 2 ─ Please keep signature within the box |

| / / |

|

|

|

|

Scanner

bar code

| xxxxxxxxxxxxxx |

IFN 33289 |

xxxxxxxx |

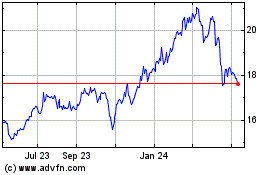

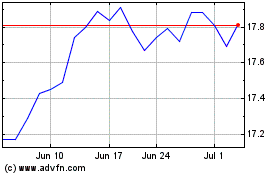

India (NYSE:IFN)

Historical Stock Chart

From Mar 2024 to Apr 2024

India (NYSE:IFN)

Historical Stock Chart

From Apr 2023 to Apr 2024