HNI Corporation (NYSE: HNI) today announced sales for the

second quarter ended June 27, 2020 of $417.5 million and net income

of $12.6 million. GAAP net income per diluted share was $0.29,

compared to $0.36 in the prior year. Non-GAAP net income per

diluted share was $0.20, compared to $0.38 in the prior year. GAAP

to non-GAAP reconciliations follow the financial statements in this

release.

Second Quarter Highlights

- The Corporation delivered solid profits and increased second

quarter operating cash flows by $20 million or 49 percent versus

the prior year despite pandemic related top-line pressures.

- Residential Building Products segment operating profit

increased, and segment operating margin expanded on a

year-over-year basis in the second quarter 2020.

- Workplace Furnishings segment generated second quarter 2020

operating profit of nearly $8 million, despite a 25 percent

year-over-year contraction on the top line.

- Quarter-ending debt levels were $183 million, equal to a gross

leverage ratio of approximately 0.8x. Liquidity, as measured by

cash and borrowing availability, at the end of the second quarter

was $392 million.

“Our members did a great job of managing through challenging

second quarter conditions. We aggressively managed costs and drove

productivity—offsetting much of the impact from lower volumes. Our

teams stayed focused on our customers—generating and seizing market

opportunities. The strength of our strategy, including our diverse

revenue streams, price point breadth, channel reach, and lean

operating model, along with the dedication of our members, helped

demonstrate again what makes HNI unique,” stated Jeff Lorenger,

Chairman, President, and Chief Executive Officer.

Salary adjustments

Compensation for HNI members and Board of Directors are being

restored to levels existing prior to the reductions announced on

April 22, 2020.

“Our members responded in an outstanding manner to this

environment, and I am pleased we are able to take this action 60-90

days earlier than we originally anticipated,” continued Mr.

Lorenger.

Debt Level Update

As of June 27, 2020, the Corporation’s net debt totaled $157

million (as defined as gross debt of $183 million less cash and

cash equivalents of $26 million). At the end of the quarter, the

Corporation had $366 million of borrowing capacity under its

existing $450 million credit facility. On a gross leverage basis,

the quarter-ending level of 0.8x remains well below the

Corporation’s debt covenant of 3.5x.

“We generated strong free cash flow in the quarter and further

enhanced our already strong balance sheet. We have the financial

strength and cost structure to successfully weather this crisis for

a prolonged period,” said Mr. Lorenger.

HNI Corporation – Financial

Performance

(Dollars in millions, except per

share data)

Three Months Ended

June 27, 2020

June 29, 2019

Change

GAAP

Net Sales

$

417.5

$

526.0

(20.6

%)

Gross Profit %

36.1

%

36.6

%

-50 bps

SG&A %

32.6

%

32.0

%

60 bps

Restructuring Charges %

—

%

0.2

%

Operating Income

$

14.8

$

23.2

(36.2

%)

Operating Income %

3.6

%

4.4

%

-80 bps

Effective Tax Rate

2.7

%

23.9

%

Net Income %

3.0

%

3.0

%

— bps

EPS – diluted

$

0.29

$

0.36

(19.4

%)

Non-GAAP

Gross Profit %

36.1

%

36.6

%

-50 bps

Operating Income

$

14.8

$

24.2

(38.6

%)

Operating Income %

3.6

%

4.6

%

-100 bps

EPS – diluted

$

0.20

$

0.38

(47.4

%)

Second Quarter Summary Comments

- Consolidated net sales decreased 20.6 percent from the

prior-year quarter to $417.5 million. On an organic basis, sales

decreased 21.2 percent. The impact of acquiring residential

building products distributors increased sales $2.9 million

compared to the prior-year quarter. A reconciliation of organic

sales, a non-GAAP measure, follows the financial statements in this

release.

- Gross profit margin decreased 50 basis points compared to the

prior-year quarter. This decrease was primarily driven by lower

volume, partially offset by price realization and net

productivity.

- Selling and administrative expenses as a percent of sales

increased 60 basis points compared to prior-year quarter due to

lower volume, partially offset by lower core SG&A spend and net

productivity.

- Non-GAAP net income per diluted share was $0.20 compared to

$0.38 in the prior-year quarter. The $0.18 decrease was primarily

due to lower volume, partially offset by lower core SG&A spend,

net productivity, and price realization.

- Non-GAAP EPS in the current quarter includes an effective tax

rate of 32.5 percent, compared to a GAAP tax rate of 2.7 percent.

The higher non-GAAP tax rate is related to timing of the tax impact

from one-time charges recorded in first quarter 2020.

Workplace Furnishings –

Financial Performance

(Dollars in millions)

Three Months Ended

June 27, 2020

June 29, 2019

Change

GAAP

Net Sales

$

308.1

$

409.5

(24.8

%)

Operating Income

$

7.8

$

18.7

(58.5

%)

Operating Income %

2.5

%

4.6

%

-210 bps

Non-GAAP

Operating Profit

$

7.8

$

19.7

(60.4

%)

Operating Profit %

2.5

%

4.8

%

-230 bps

- Workplace Furnishings net sales decreased 24.8 percent from the

prior-year quarter to $308.1 million.

- Workplace Furnishings GAAP operating profit margin decreased

210 basis points versus the prior-year quarter. On a non-GAAP

basis, segment operating margin decreased 230 basis points

year-over-year driven by lower volume, partially offset by net

productivity, lower core SG&A spend, and price

realization.

Residential Building Products

– Financial Performance

(Dollars in millions)

Three Months Ended

June 27, 2020

June 29, 2019

Change

GAAP

Net Sales

$

109.4

$

116.5

(6.1

%)

Operating Profit

$

14.4

$

13.4

7.5

%

Operating Profit %

13.1

%

11.5

%

160 bps

Non-GAAP

Operating Profit

$

14.4

$

13.4

7.5

%

Operating Profit %

13.1

%

11.5

%

160 bps

- Residential Building Products net sales decreased 6.1 percent

from the prior-year quarter to $109.4 million. On an organic basis,

sales decreased 8.6 percent. The impact of acquiring building

products distributors increased sales $2.9 million compared to the

prior-year quarter.

- Residential Building Products operating profit margin expanded

160 basis points, driven by price realization, lower variable

compensation, lower core SG&A spend, and net productivity,

partially offset by lower volume and unfavorable mix.

Concluding Remarks

“The HNI culture remains the foundation for our success.

Together, our members, dealers, suppliers, and communities will

continue to overcome the challenges presented by this crisis.

Pandemic-related uncertainty continues to limit visibility and

our ability to provide guidance. However, we are seeing a seasonal

uptick in sales and do expect third quarter sales and profit to

track ahead of second quarter 2020 levels. We have demonstrated we

can adapt our cost structure quickly, and our balance sheet is

strong. More importantly, we have developed new and better ways to

operate our businesses that will serve us well in the future,” Mr.

Lorenger concluded.

Conference Call

HNI Corporation will host a conference call on Thursday, July

23, 2020 at 10:00 a.m. (Central) to discuss second quarter fiscal

year 2020 results. To participate, call 1-877-512-9166 – conference

ID number 6232199. A live webcast of the call will be available on

HNI Corporation’s website at http://www.hnicorp.com (under Investors – News

Releases & Events). A replay of the webcast will also be made

available at that website address. An audio replay of the call will

be available until Thursday, July 30, 2020, 10:59 p.m. (Central) by

dialing 1-855-859-2056 or 1-404-537-3406 – Conference ID number

6232199.

About HNI Corporation

HNI Corporation (NYSE: HNI) is a manufacturer of workplace

furnishings and building products, operating under two segments.

The Workplace Furnishings segment is a leading global designer and

provider of commercial furnishings, going to market under multiple

unique brands. The Residential Building Products segment is the

nation's leading manufacturer and marketer of hearth products,

which include a full array of gas, electric, wood, and

pellet-burning fireplaces, inserts, stoves, facings, and

accessories. More information can be found on the Corporation's

website at www.hnicorp.com.

Forward-Looking

Statements

This release contains "forward-looking" statements based on

current expectations regarding future plans, events, outlook,

objectives, financial performance, expectations for sales growth,

and earnings per diluted share (GAAP and non-GAAP), including

statements regarding the expected effects on our business,

financial condition and results of operations from the COVID-19

pandemic. Forward-looking statements can be identified by words

including “expect,” “believe,” “anticipate,” “estimate,” “may,”

“will,” “would,” “could,” “confident,” or other similar words,

phrases, or expressions. Forward-looking statements involve known

and unknown risks and uncertainties, which may cause the

Corporation's actual future results and performance to differ

materially from expected results. These risks include but are not

limited to: the duration and scope of the COVID-19 pandemic, and

its effect on people and the economy; the levels of office

furniture needs and housing starts; overall demand for the

Corporation's products; general economic and market conditions in

the United States and internationally; industry and competitive

conditions; the consolidation and concentration of the

Corporation's customers; the Corporation's reliance on its network

of independent dealers; change in trade policy; changes in raw

material, component, or commodity pricing; market acceptance and

demand for the Corporation's new products; changing legal,

regulatory, environmental, and healthcare conditions; the risks

associated with international operations; the potential impact of

product defects; the various restrictions on the Corporation's

financing activities; an inability to protect the Corporation's

intellectual property; impacts of tax legislation; and force

majeure events outside the Corporation’s control. A description of

these risks and additional risks can be found in the Corporation's

annual and quarterly reports filed with the Securities and Exchange

Commission on Forms 10-K and 10-Q. The Corporation assumes no

obligation to update, amend, or clarify forward-looking statements,

except as required by applicable law.

HNI Corporation and

Subsidiaries

Condensed Consolidated

Statements of Comprehensive Income

(In thousands, except per share

data)

(Unaudited)

Three Months Ended

Six Months Ended

June 27, 2020

June 29, 2019

June 27, 2020

June 29, 2019

Net sales

$

417,456

$

526,026

$

886,161

$

1,005,482

Cost of sales

266,551

333,437

559,238

643,279

Gross profit

150,905

192,589

326,923

362,203

Selling and administrative expenses

136,063

168,411

303,148

334,348

Impairment and restructuring charges

—

930

32,661

930

Operating income (loss)

14,842

23,248

(8,886

)

26,925

Interest expense, net

1,943

2,480

3,754

4,591

Income (loss) before income taxes

12,899

20,768

(12,640

)

22,334

Income taxes

345

4,957

(1,299

)

5,503

Net income (loss)

12,554

15,811

(11,341

)

16,831

Less: Net income (loss) attributable to

non-controlling interest

(2

)

1

(2

)

(1

)

Net income (loss) attributable to HNI

Corporation

$

12,556

$

15,810

$

(11,339

)

$

16,832

Average number of common shares

outstanding – basic

42,640

43,218

42,634

43,376

Net income (loss) attributable to HNI

Corporation per common share – basic

$

0.29

$

0.37

$

(0.27

)

$

0.39

Average number of common shares

outstanding – diluted

42,929

43,634

42,634

43,860

Net income (loss) attributable to HNI

Corporation per common share – diluted

$

0.29

$

0.36

$

(0.27

)

$

0.38

Foreign currency translation

adjustments

$

45

$

(333

)

$

(555

)

$

630

Change in unrealized gains (losses) on

marketable securities, net of tax

244

126

302

216

Change in pension and post-retirement

liability, net of tax

—

—

—

(1,185

)

Change in derivative financial

instruments, net of tax

(283

)

(1,327

)

(2,499

)

(1,636

)

Other comprehensive income (loss), net of

tax

6

(1,534

)

(2,752

)

(1,975

)

Comprehensive income (loss)

12,560

14,277

(14,093

)

14,856

Less: Comprehensive income (loss)

attributable to non-controlling interest

(2

)

1

(2

)

(1

)

Comprehensive income (loss) attributable

to HNI Corporation

$

12,562

$

14,276

$

(14,091

)

$

14,857

HNI Corporation and

Subsidiaries

Condensed Consolidated Balance

Sheets

(In thousands)

(Unaudited)

June 27, 2020

December 28, 2019

Assets

Current Assets:

Cash and cash equivalents

$

26,204

$

52,073

Short-term investments

2,310

1,096

Receivables

208,795

278,124

Allowance for doubtful accounts

(5,778

)

(3,559

)

Inventories

156,647

163,465

Prepaid expenses and other current

assets

42,816

37,635

Total Current Assets

430,994

528,834

Property, Plant, and Equipment:

Land and land improvements

29,750

29,394

Buildings

294,238

295,517

Machinery and equipment

568,265

581,225

Construction in progress

22,630

20,881

914,883

927,017

Less accumulated depreciation

546,036

545,510

Net Property, Plant, and Equipment

368,847

381,507

Right-of-use Finance Leases

2,282

2,129

Right-of-use Operating Leases

76,614

72,883

Goodwill and Other Intangible Assets

416,317

445,709

Other Assets

20,309

21,450

Total Assets

$

1,315,363

$

1,452,512

Liabilities and Equity

Current Liabilities:

Accounts payable and accrued expenses

$

334,719

$

453,202

Current maturities of long-term debt

—

790

Current maturities of other long-term

obligations

2,953

1,931

Current lease obligations - Finance

654

564

Current lease obligations - Operating

23,266

22,218

Total Current Liabilities

361,592

478,705

Long-Term Debt

183,481

174,439

Long-Term Lease Obligations - Finance

1,639

1,581

Long-Term Lease Obligations -

Operating

60,761

58,233

Other Long-Term Liabilities

67,337

67,990

Deferred Income Taxes

87,484

87,196

Equity:

HNI Corporation shareholders' equity

552,747

584,044

Non-controlling interest

322

324

Total Equity

553,069

584,368

Total Liabilities and Equity

$

1,315,363

$

1,452,512

HNI Corporation and

Subsidiaries

Condensed Consolidated

Statements of Cash Flows

(In thousands)

(Unaudited)

Six Months Ended

June 27, 2020

June 29, 2019

Net Cash Flows From (To) Operating

Activities:

Net income (loss)

$

(11,341

)

$

16,831

Non-cash items included in net income:

Depreciation and amortization

38,605

38,450

Other post-retirement and post-employment

benefits

736

738

Stock-based compensation

5,659

4,072

Reduction in carrying amount of

right-of-use assets

11,342

11,617

Deferred income taxes

1,092

1,360

Impairment of goodwill and intangible

assets

32,661

—

Other – net

(284

)

3,856

Net increase (decrease) in operating

assets and liabilities, net of divestitures

(49,631

)

(56,281

)

Increase (decrease) in other

liabilities

(1,019

)

(7,876

)

Net cash flows from (to) operating

activities

27,820

12,767

Net Cash Flows From (To) Investing

Activities:

Capital expenditures

(15,739

)

(34,659

)

Proceeds from sale of property, plant, and

equipment

69

159

Acquisition spending, net of cash

acquired

(10,857

)

—

Capitalized software

(5,037

)

(2,948

)

Purchase of investments

(1,631

)

(2,459

)

Sales or maturities of investments

1,043

1,802

Other – net

—

2,025

Net cash flows from (to) investing

activities

(32,152

)

(36,080

)

Net Cash Flows From (To) Financing

Activities:

Payments of long-term debt

(73,828

)

(40,272

)

Proceeds from long-term debt

82,129

76,677

Dividends paid

(26,040

)

(26,075

)

Purchase of HNI Corporation common

stock

(6,764

)

(57,357

)

Proceeds from sales of HNI Corporation

common stock

1,294

18,906

Other – net

1,672

3,397

Net cash flows from (to) financing

activities

(21,537

)

(24,724

)

Net increase (decrease) in cash and cash

equivalents

(25,869

)

(48,037

)

Cash and cash equivalents at beginning of

period

52,073

76,819

Cash and cash equivalents at end of

period

$

26,204

$

28,782

HNI Corporation and

Subsidiaries

Reportable Segment

Data

(In thousands)

(Unaudited)

Three Months Ended

Six Months Ended

June 27, 2020

June 29, 2019

June 27, 2020

June 29, 2019

Net Sales:

Workplace furnishings

$

308,081

$

409,512

$

646,467

$

763,023

Residential building products

109,375

116,514

239,694

242,459

Total

$

417,456

$

526,026

$

886,161

$

1,005,482

Income (Loss) Before Income Taxes:

Workplace furnishings

$

7,785

$

18,749

$

(25,446

)

$

17,018

Residential building products

14,365

13,362

35,036

30,970

General corporate

(7,308

)

(8,863

)

(18,476

)

(21,063

)

Operating Income (Loss)

14,842

23,248

(8,886

)

26,925

Interest expense, net

1,943

2,480

3,754

4,591

Total

$

12,899

$

20,768

$

(12,640

)

$

22,334

Depreciation and Amortization Expense:

Workplace furnishings

$

10,782

$

11,247

$

22,113

$

22,307

Residential building products

2,318

2,174

4,624

4,230

General corporate

6,019

5,989

11,868

11,913

Total

$

19,119

$

19,410

$

38,605

$

38,450

Capital Expenditures (including

capitalized software):

Workplace furnishings

$

4,293

$

12,347

$

11,394

$

22,666

Residential building products

206

2,577

3,179

7,575

General corporate

3,118

3,587

6,203

7,366

Total

$

7,617

$

18,511

$

20,776

$

37,607

As of June 27, 2020

As of December 28, 2019

Identifiable Assets:

Workplace furnishings

$

741,876

$

874,913

Residential building products

383,642

364,653

General corporate

189,845

212,946

Total

$

1,315,363

$

1,452,512

Non-GAAP Financial

Measures

This earnings release includes certain non-GAAP financial

information as defined by Securities and Exchange Commission

Regulation G. Pursuant to the requirements of this regulation,

reconciliations of this non-GAAP financial information to HNI’s

financial statements as prepared in accordance with GAAP are

included below and throughout this earnings release. This

information gives investors additional insights into HNI’s

financial performance and operations. While HNI’s management

believes the non-GAAP financial measures are useful in evaluating

HNI’s operations, this information should be considered

supplemental and not in isolation or as a substitute for, or

superior to, financial information prepared and presented in

accordance with GAAP. In addition, these measures may be different

from non-GAAP financial measures used by other companies, limiting

their usefulness for comparison purposes.

To supplement condensed consolidated financial statements, which

are prepared and presented in accordance with GAAP, this earnings

release uses the following non-GAAP financial measures: organic

sales, gross profit, operating income (loss), operating profit

(loss), income taxes, net income (loss), and net income (loss) per

diluted share (i.e., EPS). These measures are adjusted from the

comparable GAAP measures to exclude the impacts of the selected

items as summarized in the table below. In the current period, the

effective tax rate used to calculate non-GAAP EPS differs from the

GAAP effective tax rate due to the timing of the tax impact of

one-time charges recorded in first quarter 2020. Generally,

non-GAAP EPS is calculated using HNI’s overall effective tax rate

for the period, as this rate is reflective of the tax applicable to

most non-GAAP adjustments.

The sales adjustments to arrive at the non-GAAP organic sales

information included in this earnings release excludes the impact

of acquiring residential building products distributors.

Restructuring charges incurred in the prior year period are

primarily comprised of severance costs related to a structural

realignment in the Workplace Furnishings segment.

HNI Corporation

Reconciliation

(Dollars in millions)

Three Months Ended

June 27, 2020

June 29, 2019

Workplace Furnishings

Residential Building Products

Total

Workplace Furnishings

Residential Building Products

Total

Sales as reported (GAAP)

$

308.1

$

109.4

$

417.5

$

409.5

$

116.5

$

526.0

% change from PY

(24.8

%)

(6.1

%)

(20.6

%)

Less: Acquisitions

—

2.9

2.9

—

—

—

Organic Sales (non-GAAP)

$

308.1

$

106.5

$

414.6

$

409.5

$

116.5

$

526.0

% change from PY

(24.8

%)

(8.6

%)

(21.2

%)

HNI Corporation

Reconciliation

(Dollars in millions, except per

share data)

Three Months Ended June 27,

2020

Gross Profit

Operating Income

Tax

Net Income

EPS

As reported (GAAP)

$

150.9

$

14.8

$

0.3

$

12.6

$

0.29

% of net sales

36.1

%

3.6

%

3.0

%

Tax %

2.7

%

Income tax adjustment

—

—

3.8

(3.8

)

(0.09

)

Results (non-GAAP)

$

150.9

$

14.8

$

4.2

$

8.7

$

0.20

% of net sales

36.1

%

3.6

%

2.1

%

Tax %

32.5

%

HNI Corporation

Reconciliation

(Dollars in millions, except per

share data)

Three Months Ended June 29,

2019

Gross Profit

Operating Income

Tax

Net Income

EPS

As reported (GAAP)

$

192.6

$

23.2

$

5.0

$

15.8

$

0.36

% of net sales

36.6

%

4.4

%

3.0

%

Tax %

23.9

%

Restructuring charges

—

0.9

0.2

0.7

0.02

Results (non-GAAP)

$

192.6

$

24.2

$

5.2

$

16.5

$

0.38

% of net sales

36.6

%

4.6

%

3.1

%

Tax %

23.9

%

Workplace Furnishings

Reconciliation

(Dollars in millions)

Three Months Ended

June 27, 2020

June 29, 2019

Percent Change

Operating profit as reported (GAAP)

$

7.8

$

18.7

(58.5

%)

% of net sales

2.5

%

4.6

%

Restructuring charges

—

0.9

Operating profit (non-GAAP)

$

7.8

$

19.7

(60.4

%)

% of net sales

2.5

%

4.8

%

View source

version on businesswire.com: https://www.businesswire.com/news/home/20200722005852/en/

Marshall H. Bridges, Senior Vice President and Chief Financial

Officer (563) 272-7400 Matthew S. McCall, Vice President, Investor

Relations and Corporate Development (563) 275-8898

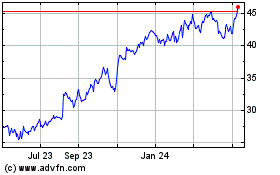

HNI (NYSE:HNI)

Historical Stock Chart

From Aug 2024 to Sep 2024

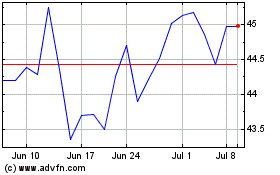

HNI (NYSE:HNI)

Historical Stock Chart

From Sep 2023 to Sep 2024