Lands' End to Start Selling Items on Amazon.com

September 02 2016 - 3:50PM

Dow Jones News

Lands' End Inc. said it would begin selling some of its

merchandise on Amazon.com Inc., becoming the latest apparel brand

trying to tap into the Internet giant's rapid growth.

The struggling apparel maker, known for its outdoorsy clothes,

will list items from its Lands' End sports, footwear and Canvas

collections on Amazon by the end of the month.

"This provides an additional channel for us to introduce

consumers to our new brand and expanded category," Lands' End CEO

Federica Marchionni told analysts Thursday.

Once shunned by the fashion community for its downscale feel and

reputation for cut-rate prices, Amazon is becoming an important

partner for an expanding list of apparel, footwear and accessories

companies. To win over the brands, Amazon has promised to hold the

line on discounting, people familiar with the discussions have

said, a departure from how it has gained market share in books,

electronics and other categories.

With Lands' End, Amazon agreed to respect the company's pricing,

according to a person familiar with the situation. To further

protect the brand, Ms. Marchionni has decided to only sell a

limited number of categories and not the full Lands' End collection

to the online retailer, this person said.

"As Amazon's credibility of being a desired fashion destination

for shoppers continues to grow, Lands' End sees the potential to

accelerate our newest initiatives by leveraging that trend," Ms.

Marchionni wrote in an email.

Amazon, with its huge customer base and Prime two-day shipping,

has provided a refuge for brands suffering from declining foot

traffic at department stores and their own retail locations. Gap

Inc. Chief Executive Art Peck said in May that he was open to the

possibility of selling on the Internet retailer.

But such moves aren't without risks. Shoemaker Birkenstock

informed its retail partners in July that it would stop selling to

Amazon in the U.S. as of Jan. 1, and no longer authorize

third-party merchants to sell to the site because of high levels of

counterfeits and knock-offs, according to Matt Hundley, a company

spokesman.

Amazon didn't immediately respond to a request for comment.

Liz Dunn, a former equity analyst who founded Talmage Advisors,

a retail consulting firm, said companies are wrestling with the

trade-off between getting in front of all of those Amazon eyeballs

without damaging their brands.

Ms. Marchionni has been trying to remake Lands' End into more of

a fashion brand by adding slimmer fitting clothes, stiletto heels

and a new line of athletic wear. So far her efforts haven't

resonated with Lands' End's core catalog shoppers. On Thursday, the

company reported a $1.98 million loss on sales of $292 million for

the three months to July 29. That compares with a profit of $7.46

million on sales of $312 million a year earlier.

Lands' End doesn't have much of a retail footprint of its own,

instead relying on roughly 277 shops within Sears stores. Selling

on Amazon would allow Lands' End "to start to enter the

conversation for purchase consideration," said Ms. Dunn, who noted

the move is less expensive than building a store base or trying to

attract shoppers to Lands' End's website.

"Amazon," Ms. Dunn said, "has become an A+ mall."

Write to Suzanne Kapner at Suzanne.Kapner@wsj.com

(END) Dow Jones Newswires

September 02, 2016 15:35 ET (19:35 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

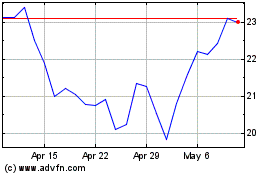

Gap (NYSE:GPS)

Historical Stock Chart

From Mar 2024 to Apr 2024

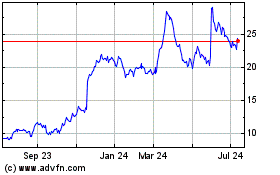

Gap (NYSE:GPS)

Historical Stock Chart

From Apr 2023 to Apr 2024