UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF

1934

For the month of June 2020

Commission file number: 001-36535

GLOBANT

S.A.

(Exact name of registrant as specified in

its charter)

Not applicable

(Translation of registrant’s name

into English)

37A Avenue J.F. Kennedy

L-1855, Luxembourg

Tel: + 352 20 30 15 96

(Address of principal executive office)

Indicate by check mark whether the registrant files or will

file annual reports under cover of Form 20-F or Form 40-F:

x Form

20-F ¨ Form

40-F

Indicate by check mark if the registrant is submitting the Form

6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ____

Indicate by check mark if the registrant is submitting the Form

6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ____

GLOBANT S.A.

FORM 6-K

Globant Announces Pricing of its Public Offering of 2,000,000

of its Common Shares

Globant S.A. (the “Company”

or “we”) a digitally-native technology services company, today announced the pricing of an underwritten public offering

of 2,000,000 of its common shares at a public offering price of $135.00 per share. The gross proceeds to the Company from the offering,

before deducting the underwriting discounts and commissions and other estimated offering expenses payable by the Company, are expected

to be approximately $270 million. In addition, the Company has granted the underwriters a 30-day option to purchase up to 300,000

additional common shares at the public offering price, less the underwriting discounts and commissions. The offering is expected

to close on or about June 9, 2020, subject to customary closing conditions.

The Company intends to use the proceeds

from this offering for general corporate purposes, including working capital, operating expenses and capital expenditures. In connection

with the advancement of its acquisition strategy, the Company may use a portion of the proceeds from this offering to fund acquisitions.

J.P. Morgan Securities LLC, Goldman Sachs

& Co. LLC and Citigroup Global Markets Inc. are acting as joint lead book-running managers for the offering. The co-managers

for the offering are BBVA Securities Inc., BNP Paribas Securities Corp., BofA Securities, Inc., Morgan Stanley & Co. LLC and

Santander Investment Securities, Inc.

The common shares described above are being

offered by the Company pursuant to its shelf registration statement on Form F-3 (File No. 333-225731) that became automatically

effective upon filing with the Securities and Exchange Commission (the “SEC”) on June 20, 2018. The offering is being

made only by means of a prospectus supplement and accompanying prospectus. Before making any investment decision, you should read

the prospectus supplement, accompanying prospectus and other documents the Company has filed with the SEC for more complete information

about the Company and this offering. You may obtain these documents for free by visiting EDGAR on the SEC Web site at: www.sec.gov.

Copies of the prospectus supplement and accompanying prospectus may also be obtained by contacting J.P. Morgan Securities LLC,

Attention: Broadridge Financial Solutions, 1155 Long Island Avenue, Edgewood, NY 11717, by telephone at 1-866-803-9204 or by email

at prospectus-eq_fi@jpmchase.com; Goldman Sachs & Co. LLC by mail at 200 West Street, New York, NY 10282, Attention: Prospectus

Department, by telephone at (866) 471-2526, or by email at prospectus-ny@ny.email.gs.com; or Citigroup, c/o Broadridge Financial

Solutions, 1155 Long Island Avenue, Edgewood, NY 11717, by telephone at 800-831-9146 or by email at Prospectus@citi.com.

This report on Form 6-K shall not constitute

an offer to sell or the solicitation of an offer to buy nor shall there be any sale of these securities in any state or jurisdiction

in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of

any such state or jurisdiction.

About the Company

We are a digitally-native company where

innovation, design and engineering meet scale. We use the latest technologies in the digital and cognitive fields to transform

organizations in every aspect.

|

|

·

|

We are more than 12,500 professionals

and we are present in 16 countries working for companies like Google, Rockwell Automation and Electronic Arts, among others.

|

|

|

·

|

We are featured as a business case study

at Harvard, MIT and Stanford.

|

|

|

·

|

We are a member of the Cybersecurity Tech

Accord.

|

Forward Looking Statements

Certain matters discussed in this press

release are “forward-looking statements”. The Company may, in some cases, use terms such as “predicts,”

“believes,” “potential,” “continue,” “estimates,” “anticipates,” “expects,”

“plans,” “intends,” “may,” “could,” “might,” “will,” “should”

or other words that convey uncertainty of future events or outcomes to identify these forward-looking statements. The forward-looking

statements include, but are not limited to, statements about the Company’s public offering and the anticipated use of proceeds

therefrom. Actual results may differ from those set forth in this press release due to the risks and uncertainties inherent in

the Company’s business, including, without limitation: the uncertainties related to market conditions and the completion

of the public offering on the anticipated terms or at all, and the uncertainties inherent in the identification, negotiation, consummation

and integration of acquisitions of other businesses; the impact and duration of the COVID-19 pandemic; the Company’s ability

to maintain current resource utilization rates and productivity levels; the Company’s ability to manage attrition and attract

and retain highly-skilled IT professionals; the Company’s ability to accurately price its client contracts; the Company’s

ability to achieve its anticipated growth; the Company’s ability to effectively manage its rapid growth; the Company’s

ability to retain its senior management team and other key employees; the Company’s ability to continue to innovate and remain

at the forefront of emerging technologies and related market trends; the Company’s ability to retain its business relationships

and client contracts; the Company’s ability to manage the impact of global adverse economic conditions; and the Company’s

ability to manage uncertainty concerning the instability in the current economic, political and social environment in Latin America.

The factors discussed herein could cause actual results and developments to be materially different from those expressed in or

implied by such statements. A further list and description of the Company’s risks, uncertainties and other factors can be

found in the Company’s most recent Annual Report on Form 20-F and the Company’s subsequent filings with the SEC. Copies

of these filings are available online at www.sec.gov. The forward-looking statements are made only as of the date of this press

release and the Company undertakes no obligation to publicly update such forward-looking statements to reflect subsequent events

or circumstances. All forward-looking statements are qualified in their entirety by this cautionary statement, which is made under

the safe harbor provisions of the Private Securities Litigation Reform Act of 1995.

Contacts:

Investor Relations Contact:

Paula Conde & Amit Singh, Globant

investors@globant.com

+1 (877) 215-5230

Media Contact:

Lucía Ledesma,

Globant

pr@globant.com

+1 (877) 215-5230

The information contained in this report

on Form 6-K is hereby incorporated by reference into the Company’s registration statements on Form F-3 (File No. 333-225731)

and on Form S-8 (File Nos. 333-201602, 333-211835 and 333-232022), to be a part thereof from the date on which this report is submitted,

to the extent not superseded by documents or reports subsequently filed or furnished.

Signatures

Pursuant to the requirements

of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the

undersigned, thereunto duly authorized.

|

|

GLOBANT S.A.

|

|

|

|

|

|

|

|

|

|

|

By:

|

/s/ JUAN IGNACIO URTHIAGUE

|

|

|

|

Name: Juan Ignacio Urthiague

|

|

|

|

Title: Chief Financial Officer

|

Date: June 5, 2020

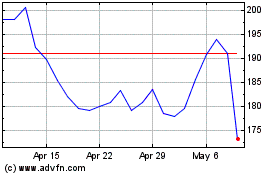

Globant (NYSE:GLOB)

Historical Stock Chart

From Mar 2024 to Apr 2024

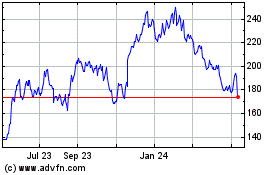

Globant (NYSE:GLOB)

Historical Stock Chart

From Apr 2023 to Apr 2024