0000320335false00003203352024-02-072024-02-070000320335us-gaap:CommonStockMember2024-02-072024-02-070000320335us-gaap:SubordinatedDebtMember2024-02-072024-02-07

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 7, 2024

GLOBE LIFE INC.

(Exact name of registrant as specified in its charter) | | | | | | | | | | | | | | |

| Delaware | | 001-08052 | | 63-0780404 |

(State or other jurisdiction of incorporation) | | (Commission File No.) | | (I.R.S. Employer ID No.) |

3700 South Stonebridge Drive, McKinney, Texas 75070

(Address of principal executive offices) (Zip Code)

Registrant’s telephone number, including area code: (972) 569-4000

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a.-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, $1.00 par value per share | GL | New York Stock Exchange |

| 4.250% Junior Subordinated Debentures | GL PRD | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter):

| | | | | | | | | | | | | | | | | | | | |

| | | | Emerging growth company | | ☐ |

| If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. | | ☐ |

Item 2.02 Results of Operations and Financial Condition.

On February 7, 2024, Globe Life Inc. issued a press release announcing its fourth quarter 2023 financial results. A copy of the press release is incorporated herein by reference and is provided as Exhibit 99.1.

In accordance with General Instruction B.2 of Form 8-K, the information included or incorporated in this report (including Exhibit 99.1) shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934 (the “Exchange Act”), nor shall such information be deemed incorporated by reference in any filing under the Securities Act of 1933 or the Exchange Act, except as shall be set forth by specific reference in such filing.

Item 9.01 Financial Statement and Exhibits.

(a)Financial Statements of businesses or funds acquired.

Not applicable.

(b)Pro forma financial information.

Not applicable.

(c)Shell company transactions.

Not applicable

(d)Exhibits.

(104) Cover Page Interactive Data File (embedded within the Inline XBRL document)

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | | | | |

| | | | |

| | |

Date: February 7, 2024 | | GLOBE LIFE INC. |

| | |

| | /s/ Christopher T. Moore |

| | Christopher T. Moore

Corporate Senior Vice President,

Associate Counsel and Corporate Secretary |

GLOBE LIFE INC. REPORTS

Fourth Quarter 2023 Results

McKinney, TX, February 7, 2024—Globe Life Inc. (NYSE: GL) reported today that for the quarter ended December 31, 2023, net income was $2.88 per diluted common share, compared with $2.46 per diluted common share for the year-ago quarter. Net operating income for the quarter was $2.80 per diluted common share, compared with $2.55 per diluted common share for the year-ago quarter.

Net income for the year ended December 31, 2023 was $10.07 per diluted common share, compared with $9.04 per diluted common share for the year-ago period. Net operating income for the year ended December 31, 2023 was $10.65 per diluted common share compared with $9.71 per diluted common share for the year-ago period.

The results included herein reflect the adoption of ASU 2018-12, Financial Services - Insurance (Topic 944): Targeted Improvements to the Accounting for Long-Duration Contracts (LDTI). Globe Life Inc. implemented the standard on January 1, 2023 using the modified retrospective transition method at adoption. As a result of this election, the prior year figures have been restated as of January 1, 2021 with impacts to Shareholders' Equity, underwriting margins and net income.

HIGHLIGHTS: | | | | | | | | | | | | | | |

| l | | Net income as an ROE was 23.2% for the twelve months ended December 31, 2023. Net operating income as an ROE excluding accumulated other comprehensive income (AOCI) was 14.7% for the same period. |

| | |

| l | | Net income increased 13% and net operating income increased 6% over the year-ago quarter. For the full year, net income was $971 million and net operating income surpassed $1.0 billion for the first time in company history. |

| | |

| l | | At the American Income Life Division, life net sales increased 9% and life premium increased 7% over the year-ago quarter. Additionally, the average producing agent count increased 20% over the year-ago quarter. |

|

| l | | At the Liberty National Division, life net sales and health net sales increased over the year-ago quarter by 12% and 9%, respectively. Additionally, life premiums increased 8% and the average producing agent count increased 15% over the year-ago quarter. |

|

| l | | At the Family Heritage Division, health net sales increased 12% and premiums increased 8% over the year-ago quarter. |

|

| l | | Net investment income grew 6% over the year-ago quarter. |

| | | | |

| | |

| | | | |

| | |

|

| l | | 660,170 shares of Globe Life Inc. common stock were repurchased during the quarter. |

Note: As used in the earnings release, "Globe Life," the "Company," "we," "our," and "us" refer to Globe Life Inc., a Delaware corporation incorporated in 1979, its subsidiaries and affiliates.

1

GL Q4 2023 Earnings Release

GLOBE LIFE INC.

Earnings Release—Q4 2023

(Dollar amounts in thousands, except share and per share data)

(Unaudited)

RESULTS OF OPERATIONS

Net operating income, a non-GAAP(1) financial measure, has been used consistently by Globe Life’s management for many years to evaluate the operating performance of the Company, and is a measure commonly used in the life insurance industry. It differs from net income primarily because it excludes certain non-operating items such as realized investment gains and losses and certain significant and unusual items included in net income. Management believes an analysis of net operating income is important in understanding the profitability and operating trends of the Company’s business. Net income is the most directly comparable GAAP measure.

The following table represents Globe Life's operating summary for the three months ended December 31, 2023 and 2022:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Operating Summary |

| Per Share | | | | | | |

| Three Months Ended

December 31, | | | | Three Months Ended

December 31, | | |

| 2023 | | 2022 | | %

Chg. | | 2023 | | 2022 | | %

Chg. |

Insurance underwriting income(2) | $ | 3.43 | | | $ | 3.18 | | | 8 | | $ | 327,825 | | | $ | 314,131 | | | 4 |

Excess investment income(2) | 0.38 | | | 0.31 | | | 23 | | 35,824 | | | 30,716 | | | 17 |

| Interest on debt | (0.27) | | | (0.25) | | | 8 | | (25,676) | | | (24,658) | | | 4 |

Parent company expense | (0.03) | | | (0.03) | | | | | (2,612) | | | (3,067) | | | |

| Income tax expense | (0.68) | | | (0.63) | | | 8 | | (64,993) | | | (61,744) | | | 5 |

| Stock compensation benefit (expense), net of tax | (0.03) | | | (0.04) | | | | | (2,955) | | | (4,057) | | | |

| Net operating income | 2.80 | | | 2.55 | | | 10 | | 267,413 | | | 251,321 | | | 6 |

| | | | | | | | | | | |

| Reconciling items, net of tax: | | | | | | | | | | | |

| Realized gain (loss)—investments | 0.11 | | | (0.08) | | | | | 10,496 | | | (7,665) | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Non-operating expenses | (0.03) | | | — | | | | | (2,396) | | | (460) | | | |

| Legal proceedings | (0.01) | | | (0.01) | | | | | (711) | | | (853) | | | |

| | | | | | | | | | | |

Net income(3) | $ | 2.88 | | | $ | 2.46 | | | | | $ | 274,802 | | | $ | 242,343 | | | |

| | | | | | | | | | | |

| Weighted average diluted shares outstanding | 95,464 | | | 98,640 | | | | | | | | | |

(1)GAAP is defined as accounting principles generally accepted in the United States of America.

(2)Definitions included within this document.

(3)A GAAP-basis condensed consolidated statement of operations is included in the appendix of this report.

Note: Tables in this earnings release may not sum due to rounding.

2

GL Q4 2023 Earnings Release

GLOBE LIFE INC.

Earnings Release—Q4 2023

(Dollar amounts in thousands, except share and per share data)

(Unaudited)

The following table represents Globe Life's operating summary for the year ended December 31, 2023 and 2022:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Operating Summary |

| Per Share | | | | | | |

| Year Ended December 31, | | | | Year Ended December 31, | | |

| 2023 | | 2022 | | %

Chg. | | 2023 | | 2022 | | %

Chg. |

| Insurance underwriting income | $ | 13.27 | | | $ | 12.32 | | | 8 | | $ | 1,278,548 | | | $ | 1,219,078 | | | 5 |

| Excess investment income | 1.35 | | | 1.06 | | | 27 | | 130,382 | | | 104,589 | | | 25 |

| Interest on debt | (1.06) | | | (0.91) | | | 16 | | (102,316) | | | (90,395) | | | 13 |

| Parent company expense | (0.11) | | | (0.11) | | | | | (10,866) | | | (11,156) | | | |

| Income tax expense | (2.59) | | | (2.41) | | | 7 | | (249,546) | | | (238,177) | | | 5 |

| Stock compensation benefit (expense), net of tax | (0.20) | | | (0.23) | | | | | (19,558) | | | (22,912) | | | |

| Net operating income | 10.65 | | | 9.71 | | | 10 | | 1,026,644 | | | 961,027 | | | 7 |

| | | | | | | | | | | |

| Reconciling items, net of tax: | | | | | | | | | | | |

| Realized gain (loss)—investments | (0.54) | | | (0.61) | | | | | (51,884) | | | (60,473) | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Non-operating expenses | (0.03) | | | (0.04) | | | | | (3,294) | | | (4,196) | | | |

| Legal proceedings | (0.01) | | | (0.02) | | | | | (711) | | | (1,972) | | | |

| | | | | | | | | | | |

| Net income | $ | 10.07 | | | $ | 9.04 | | | | | $ | 970,755 | | | $ | 894,386 | | | |

| | | | | | | | | | | |

| Weighted average diluted shares outstanding | 96,364 | | | 98,985 | | | | | | | | | |

3

GL Q4 2023 Earnings Release

GLOBE LIFE INC.

Earnings Release—Q4 2023

(Dollar amounts in thousands, except share and per share data)

(Unaudited)

MANAGEMENT VS. GAAP MEASURES

Shareholders' equity, excluding AOCI, and book value per share, excluding AOCI, are non-GAAP measures that are utilized by management to view the business without the effect of changes in AOCI, which are primarily attributable to fluctuation in interest rates. Management views the business in this manner because it creates more meaningful and easily identifiable trends, as we exclude fluctuations resulting from changes in interest rates. Shareholders' equity and book value per share are the most directly comparable GAAP measures.

| | | | | | | | | | | |

| Year Ended

December 31, |

| 2023 | | 2022 |

Net income | $ | 970,755 | | | $ | 894,386 | |

Net operating income | 1,026,644 | | | 961,027 | |

Net income as an ROE(1) | 23.2 | % | | 29.2 | % |

Net operating income as an ROE (excluding AOCI)(1) | 14.7 | % | | 14.8 | % |

| | | |

| December 31, |

| 2023 | | 2022 |

| Shareholders' equity | $ | 4,486,803 | | | $ | 3,949,577 | |

| Impact of adjustment to exclude AOCI | 2,772,419 | | | 2,790,313 | |

| Shareholders' equity, excluding AOCI | $ | 7,259,222 | | | $ | 6,739,890 | |

| | | |

| Book value per share | $ | 47.10 | | | $ | 40.05 | |

| Impact of adjustment to exclude AOCI | 29.11 | | | 28.30 | |

| Book value per share, excluding AOCI | $ | 76.21 | | | $ | 68.35 | |

(1) Calculated using average shareholders' equity for the measurement period.

INSURANCE OPERATIONS:

Life insurance accounted for 75% of the Company’s insurance underwriting margin for the quarter and 70% of total premium revenue.

Health insurance accounted for 24% of the Company's insurance underwriting margin for the quarter and 30% of total premium revenue.

Net sales of life insurance increased 3% for the quarter, and net health sales increased 21%.

The following table summarizes Globe Life's premium revenue by product type for the three months ended December 31, 2023 and 2022:

| | | | | | | | | | | | | | | | | |

| Insurance Premium Revenue |

| Quarter Ended |

| December 31, 2023 | | December 31, 2022 | | %

Chg. |

| Life insurance | $ | 794,815 | | | $ | 762,929 | | | 4 |

| Health insurance | 335,857 | | | 326,020 | | | 3 |

| Annuity | — | | | — | | | |

| Total | $ | 1,130,672 | | | $ | 1,088,949 | | | 4 |

4

GL Q4 2023 Earnings Release

GLOBE LIFE INC.

Earnings Release—Q4 2023

(Dollar amounts in thousands, except share and per share data)

(Unaudited)

INSURANCE UNDERWRITING INCOME

Insurance underwriting margin is management’s measure of profitability of the Company's life, health, and annuity segments’ underwriting performance, and consists of premiums less policy obligations (excluding interest on policy liabilities), commissions and other acquisition expenses. Insurance underwriting income is the sum of the insurance underwriting margins of the life, health, and annuity segments, plus other income, less administrative expenses. It excludes the investment segment, interest on debt, Parent Company expense, stock compensation expense and income taxes. Management believes this information helps provide a better understanding of the business and a more meaningful analysis of underwriting results by distribution channel. Insurance underwriting income, a non-GAAP measure, is a component of net operating income, which is reconciled to net income in the Results of Operations section above.

The following table summarizes Globe Life's insurance underwriting income by segment for the three months ended December 31, 2023 and 2022:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Insurance Underwriting Income |

| Quarter Ended |

| December 31, 2023 | | % of

Premium | | December 31, 2022 | | % of

Premium | | %

Chg. |

| Insurance underwriting margins: | | | | | | | | | |

| Life | $ | 305,480 | | | 38 | | $ | 292,922 | | | 38 | | 4 |

| Health | 97,486 | | | 29 | | 96,224 | | | 30 | | 1 |

| Annuity | 1,946 | | | | | 2,629 | | | | | |

| 404,912 | | | | | 391,775 | | | | | 3 |

| Other income | 123 | | | | | 384 | | | | | |

| Administrative expenses | (77,210) | | | | | (78,028) | | | | | (1) |

| Insurance underwriting income | $ | 327,825 | | | | | $ | 314,131 | | | | | 4 |

| Per share | $ | 3.43 | | | | | $ | 3.18 | | | | | 8 |

| | | | | | | | | |

The ratio of administrative expenses to premium was 6.8%, compared with 7.2% for the year-ago quarter.

5

GL Q4 2023 Earnings Release

GLOBE LIFE INC.

Earnings Release—Q4 2023

(Dollar amounts in thousands, except share and per share data)

(Unaudited)

LIFE INSURANCE RESULTS BY DISTRIBUTION CHANNEL

Our distribution channels consist of the following exclusive agencies: American Income Life Division (American Income), Liberty National Division (Liberty National) and Family Heritage Division (Family Heritage); an independent agency, United American Division (United American); and our Direct to Consumer Division (Direct to Consumer).

Total premium, underwriting margins, first-year collected premium and net sales by all distribution channels are shown at https://investors.globelifeinsurance.com at "Financial Reports and Other Financial Information."

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Life Underwriting Margin |

| Quarter Ended | | |

| December 31, | | |

| 2023 | | 2022 | | |

| Amount | | % of Premium | | Amount | | % of Premium | | % Chg. |

| American Income | $ | 183,176 | | | 45 | | | $ | 174,755 | | | 46 | | | 5 |

| Direct to Consumer | 59,241 | | | 24 | | | 60,344 | | | 24 | | | (2) |

| Liberty National | 31,144 | | | 35 | | | 26,768 | | | 32 | | | 16 |

| Other | 31,919 | | | 62 | | | 31,055 | | | 59 | | | 3 |

| Total | $ | 305,480 | | | 38 | | | $ | 292,922 | | | 38 | | | 4 |

| | | | | | | | | | | | | | | | | |

| Life Premium |

| Quarter Ended | | |

| December 31, | | |

| 2023 | | 2022 | | %

Chg. |

| American Income | $ | 406,356 | | | $ | 380,922 | | | 7 |

| Direct to Consumer | 247,274 | | | 246,471 | | | — |

| Liberty National | 89,700 | | | 83,320 | | | 8 |

| Other | 51,485 | | | 52,216 | | | (1) |

| Total | $ | 794,815 | | | $ | 762,929 | | | 4 |

| | | | | | | | | | | | | | | | | |

Life Net Sales(1) |

| Quarter Ended | | |

| December 31, | | |

| 2023 | | 2022 | | %

Chg. |

| American Income | $ | 76,323 | | | $ | 69,796 | | | 9 |

| Direct to Consumer | 25,861 | | | 30,676 | | | (16) |

| Liberty National | 26,046 | | | 23,252 | | | 12 |

| Other | 2,188 | | | 2,568 | | | (15) |

| Total | $ | 130,418 | | | $ | 126,292 | | | 3 |

(1)Net sales is calculated as annualized premium issued, net of cancellations in the first thirty days after issue, except in the case of Direct to Consumer, where net sales is annualized premium issued at the time the first full premium is paid after any introductory offer period has expired. Management considers net sales to be a better indicator of the rate of premium growth than annualized premium issued.

6

GL Q4 2023 Earnings Release

GLOBE LIFE INC.

Earnings Release—Q4 2023

(Dollar amounts in thousands, except share and per share data)

(Unaudited)

HEALTH INSURANCE RESULTS BY DISTRIBUTION CHANNEL

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Health Underwriting Margin |

| Quarter Ended | | |

| December 31, | | |

| 2023 | | 2022 | | |

| Amount | | % of Premium | | Amount | | % of Premium | | % Chg. |

| United American | $ | 14,180 | | | 10 | | | $ | 16,908 | | | 12 | | | (16) |

| Family Heritage | 35,633 | | | 35 | | | 31,921 | | | 34 | | | 12 |

| Liberty National | 27,157 | | | 57 | | | 27,024 | | | 58 | | | — |

| American Income | 19,080 | | | 62 | | | 18,360 | | | 62 | | | 4 |

| Direct to Consumer | 1,436 | | | 8 | | | 2,011 | | | 11 | | | (29) |

| Total | $ | 97,486 | | | 29 | | | $ | 96,224 | | | 30 | | | 1 |

| | | | | | | | | | | | | | | | | |

| Health Premium |

| Quarter Ended | | |

| December 31, | | |

| 2023 | | 2022 | | %

Chg. |

| United American | $ | 138,586 | | | $ | 137,908 | | | — |

| Family Heritage | 102,180 | | | 94,391 | | | 8 |

| Liberty National | 47,416 | | | 46,678 | | | 2 |

| American Income | 30,676 | | | 29,423 | | | 4 |

| Direct to Consumer | 16,999 | | | 17,620 | | | (4) |

| Total | $ | 335,857 | | | $ | 326,020 | | | 3 |

| | | | | | | | | | | | | | | | | |

Health Net Sales(1) |

| Quarter Ended | | |

| December 31, | | |

| 2023 | | 2022 | | %

Chg. |

| United American | $ | 28,155 | | | $ | 20,110 | | | 40 |

| Family Heritage | 25,228 | | | 22,432 | | | 12 |

| Liberty National | 9,349 | | | 8,612 | | | 9 |

| American Income | 4,235 | | | 3,921 | | | 8 |

| Direct to Consumer | 2,220 | | | 2,188 | | | 1 |

| Total | $ | 69,187 | | | $ | 57,263 | | | 21 |

(1)Net sales is calculated as annualized premium issued, net of cancellations in the first thirty days after issue, except in the case of Direct to Consumer, where net sales is annualized premium issued at the time the first full premium is paid after any introductory offer period has expired. Management considers net sales to be a better indicator of the rate of premium growth than annualized premium issued.

7

GL Q4 2023 Earnings Release

GLOBE LIFE INC.

Earnings Release—Q4 2023

(Dollar amounts in thousands, except share and per share data)

(Unaudited)

PRODUCING EXCLUSIVE AGENT COUNT RESULTS BY DISTRIBUTION CHANNEL

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Quarterly Average Producing Agent Count(1) | | | | |

| Quarter Ended | | | | Quarter Ended | | | | | | | | | | |

| December 31, | | | | September 30, | | | | | | | | | | |

| 2023 | | 2022 | | % Chg. | | 2023 | | | | | | | | | | | | |

| American Income | 11,131 | | | 9,243 | | | 20 | | | 10,983 | | | | | | | | | | | | | |

| Liberty National | 3,387 | | | 2,946 | | | 15 | | | 3,339 | | | | | | | | | | | | | |

| Family Heritage | 1,368 | | | 1,334 | | | 3 | | | 1,323 | | | | | | | | | | | | | |

(1) The quarterly average producing agent count is based on the actual count at the beginning and end of each week during the period.

INVESTMENTS

Management uses excess investment income as the measure to evaluate the performance of the investment segment. It is defined as net investment income less the required interest attributable to policy liabilities. We also view excess investment income per diluted common share as an important and useful measure to evaluate performance of the investment segment, since it takes into consideration our stock repurchase program.

The following table summarizes Globe Life's investment income, excess investment income, and excess investment income per diluted common share.

| | | | | | | | | | | | | | | | | |

| Excess Investment Income |

| Quarter Ended |

| December 31, |

| 2023 | | 2022 | | %

Chg. |

| Net investment income | $ | 271,609 | | | $ | 255,483 | | | 6 |

| | | | | |

Interest on policy liabilities(1) | (235,785) | | | (224,767) | | | 5 |

| | | | | |

| Excess investment income | $ | 35,824 | | | $ | 30,716 | | | 17 |

| Per share | $ | 0.38 | | | $ | 0.31 | | | 23 |

| | | | | |

(1)Interest on policy liabilities is a component of total policyholder benefits, a GAAP measure. The amounts presented for 2022 have been retrospectively adjusted to exclude the interest on deferred acquisition costs due to the LDTI standard and the interest on debt.

Net investment income increased 6.3%, and average invested assets increased 3.7%. Required interest on policy liabilities increased 4.9%, and average policy liabilities increased 4.5%.

8

GL Q4 2023 Earnings Release

GLOBE LIFE INC.

Earnings Release—Q4 2023

(Dollar amounts in thousands, except share and per share data)

(Unaudited)

The composition of the investment portfolio at book value at December 31, 2023 is as follows:

| | | | | | | | | | | |

| Investment Portfolio |

| As of |

| December 31, 2023 |

| Amount | | % of Total |

Fixed maturities at fair value(1) | $ | 17,870,206 | | | 91 | |

| Mortgage Loans | 279,199 | | | 1 | |

| Policy loans | 657,020 | | | 3 | |

Other long-term investments(2) | 835,878 | | | 4 | |

| Short-term investments | 81,740 | | | — | |

| Total | $ | 19,724,043 | | | |

(1) As of December 31, 2023, fixed maturities at amortized cost were $18.9 billion, net of $7.1 million of allowance for credit losses.

(2) Includes $796 million of investments accounted for under the fair value option which have a cost of $763 million as of December 31, 2023.

Fixed maturities at amortized cost, net of allowance for credit losses, by asset class as of December 31, 2023 are as follows:

| | | | | | | | | | | | | | | | | | | | |

| Fixed Maturity Portfolio by Sector | |

| As of | |

| December 31, 2023 | |

| Investment Grade | | Below Investment Grade | | Total Amortized Cost, net | |

| Corporate bonds | $ | 14,574,424 | | | $ | 480,705 | | | $ | 15,055,129 | | |

| Municipals | 3,296,305 | | | — | | | 3,296,305 | | |

| Government, agencies and GSEs | 442,903 | | | — | | | 442,903 | | |

| Collateralized debt obligations | — | | | 37,110 | | | 37,110 | | |

| Other asset-backed securities | 74,656 | | | 11,696 | | | 86,352 | | |

| Total | $ | 18,388,288 | | | $ | 529,511 | | | $ | 18,917,799 | | |

Below are fixed maturities available for sale by amortized cost, allowance for credit losses, and fair value at December 31, 2023 and the corresponding amounts of net unrealized gains and losses recognized in accumulated other comprehensive income (loss).

| | | | | | | | | | | | | | | | | | | | | | | |

| As of |

Amortized

Cost | | Allowance for Credit Losses | | Net Unrealized Gains (Losses) | | Fair

Value |

December 31, 2023 | $ | 18,924,914 | | | $ | (7,115) | | | $ | (1,047,593) | | | $ | 17,870,206 | |

At amortized cost, net of allowance for credit losses, 97% of fixed maturities (97% at fair value) were rated “investment grade.” The fixed maturity portfolio earned an annual taxable equivalent effective yield of 5.23% during the fourth quarter of 2023, compared with 5.18% in the year-ago quarter.

Globe Life is not a party to any credit default swaps and does not participate in securities lending.

9

GL Q4 2023 Earnings Release

GLOBE LIFE INC.

Earnings Release—Q4 2023

(Dollar amounts in thousands, except share and per share data)

(Unaudited)

Comparable information for acquisitions of fixed maturity investments is as follows:

| | | | | | | | | | | |

| Fixed Maturity Acquisitions |

| Quarter Ended |

| December 31, |

| 2023 | | 2022 |

| Amount | $ | 443,385 | | | $ | 238,845 | |

| Average annual effective yield | 6.6 | % | | 6.1 | % |

| Average rating | BBB+ | | A |

| Average life (in years) to: | | | |

| Next call | 20.3 | | | 16.5 | |

| Maturity | 23.2 | | | 20.9 | |

SHARE REPURCHASE:

During the quarter, the Company repurchased 660,170 shares of Globe Life Inc. common stock at a total cost of $77 million and an average share price of $117.02.

For the year ended December 31, 2023, the Company repurchased 3.4 million shares of Globe Life Inc. common stock at a total cost of $380 million and an average share price of $112.84.

LIQUIDITY/CAPITAL:

Globe Life's operations consist primarily of writing basic protection life and supplemental health insurance policies which generate strong and stable cash flows. These cash flows are not impacted by volatile equity markets. Liquidity at the Parent Company is sufficient to meet additional capital needs of the insurance companies.

EARNINGS GUIDANCE FOR THE YEAR ENDING DECEMBER 31, 2024:

Globe Life projects net operating income between $11.30 to $11.80 per diluted common share for the year ending December 31, 2024.

NON-GAAP MEASURES:

In this news release, Globe Life includes non-GAAP measures to enhance investors' understanding of management's view of the business. The non-GAAP measures are not a substitute for GAAP, but rather a supplement to increase transparency by providing broader perspective. Globe Life's definitions of non-GAAP measures may differ from other companies' definitions. More detailed financial information, including various GAAP and non-GAAP measurements, is located at https://investors.globelifeinsurance.com on the Investors page under “Financial Reports and Other Financial Information."

10

GL Q4 2023 Earnings Release

CAUTION REGARDING FORWARD-LOOKING STATEMENTS:

This press release may contain forward-looking statements within the meaning of the federal securities laws. These prospective statements reflect management’s current expectations, but are not guarantees of future performance. Whether or not actual results differ materially from forward-looking statements may depend on numerous foreseeable and unforeseeable events or developments, which may be national in scope, related to the insurance industry generally, or applicable to the Company specifically. Such events or developments could include, but are not necessarily limited to:

1) Economic and other conditions, including the continued impact of inflation, geopolitical events, and the recent pandemic on the U.S. economy, leading to unexpected changes in lapse rates and/or sales of our policies, as well as levels of mortality, morbidity, and utilization of health care services that differ from Globe Life's assumptions;

2) Regulatory developments, including changes in accounting standards or governmental regulations (particularly those impacting taxes and changes to the Federal Medicare program that would affect Medicare Supplement);

3) Market trends in the senior-aged health care industry that provide alternatives to traditional Medicare (such as Health Maintenance Organizations and other managed care or private plans) and that could affect the sales of traditional Medicare Supplement insurance;

4) Interest rate changes that affect product sales, financing costs, and/or investment portfolio yield;

5) General economic, industry sector or individual debt issuers’ financial conditions (including developments and volatility arising from geopolitical events, particularly in certain industries that may compromise part of our investment portfolio) that may affect the current market value of securities we own, or that may impair an issuer’s ability to make principal and/or interest payments due on those securities;

6) Changes in the competitiveness of the Company's products and pricing;

7) Litigation results;

8) Levels of administrative and operational efficiencies that differ from our assumptions (including any reduction in efficiencies resulting from increased costs arising from the impact of higher than anticipated inflation);

9) The ability to obtain timely and appropriate premium rate increases for health insurance policies from our regulators;

10) The customer response to new products and marketing initiatives;

11) Reported amounts in the consolidated financial statements which are based on management estimates and judgments which may differ from the actual amounts ultimately realized;

12) Compromise by a malicious actor or other event that causes a loss of secure data from, or inaccessibility to, our computer and other information technology systems;

13) The severity, magnitude, and impact of natural or man-made catastrophic events, including but not limited to pandemics, tornadoes, hurricanes, earthquakes, war and terrorism, on our operations and personnel, commercial activity and demand for our products; and

14) Globe Life’s ability to access the commercial paper and debt markets, particularly if such markets become unpredictable or unstable for a certain period.

Readers are also directed to consider other risks and uncertainties described in other documents on file with the Securities and Exchange Commission. Globe Life specifically disclaims any obligation to update or revise any forward-looking statement because of new information, future developments or otherwise.

11

GL Q4 2023 Earnings Release

EARNINGS RELEASE CONFERENCE CALL WEBCAST:

Globe Life will provide a live audio webcast of its fourth quarter 2023 earnings release conference call with financial analysts at 11:00 am (Eastern) tomorrow, February 8, 2024. Access to the live webcast and replay will be available at https://investors.globelifeinsurance.com on the Calls and Meetings page, at the Conference Calls on the Web icon. Immediately following this press release, supplemental financial reports will be available before the conference call on the Investors page menu of the Globe Life website at “Financial Reports.”

| | | | | | | | |

| | |

| For additional information contact: | | Mike Majors, Executive Vice President - Policy Acquisition and Chief Strategy Officer Globe Life Inc. 3700 South Stonebridge Drive P. O. Box 8080 McKinney, Texas 75070-8080 Phone: 972-569-3627 or email: investors@globe.life Website: https://investors.globelifeinsurance.com |

12

GL Q4 2023 Earnings Release

GLOBE LIFE INC.

Earnings Release—Q4 2023

(Dollar amounts in thousands, except share and per share data)

(Unaudited)

APPENDIX

GLOBE LIFE INC.

GAAP CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

December 31, | | Year Ended

December 31, |

| | 2023 | | 2022(3) | | 2023 | | 2022(3) |

| Revenue: | | | | | | | |

| Life premium | $ | 794,815 | | | $ | 762,929 | | | $ | 3,137,244 | | | $ | 3,027,824 | |

| Health premium | 335,857 | | | 326,020 | | | 1,318,773 | | | 1,282,417 | |

| Other premium | — | | | — | | | — | | | 1 | |

| Total premium | 1,130,672 | | | 1,088,949 | | | 4,456,017 | | | 4,310,242 | |

| Net investment income | 271,609 | | | 255,483 | | | 1,056,884 | | | 991,800 | |

| Realized gains (losses) | 13,287 | | | (9,703) | | | (65,676) | | | (76,548) | |

| | | | | | | |

| Other income | 123 | | | 384 | | | 308 | | | 1,246 | |

| Total revenue | 1,415,691 | | | 1,335,113 | | | 5,447,533 | | | 5,226,740 | |

| | | | | | | |

| Benefits and expenses: | | | | | | | |

Life policyholder benefits(1) | 514,472 | | | 501,967 | | | 2,050,789 | | | 2,035,693 | |

Health policyholder benefits(2) | 195,686 | | | 191,364 | | | 776,362 | | | 752,866 | |

| Other policyholder benefits | 9,612 | | | 8,947 | | | 37,100 | | | 36,875 | |

| Total policyholder benefits | 719,770 | | | 702,278 | | | 2,864,251 | | | 2,825,434 | |

| Amortization of deferred acquisition costs | 97,541 | | | 90,131 | | | 379,700 | | | 348,824 | |

| Commissions, premium taxes, and non-deferred acquisition costs | 144,234 | | | 129,532 | | | 559,167 | | | 506,022 | |

| Other operating expense | 91,759 | | | 91,804 | | | 347,833 | | | 353,954 | |

| Interest expense | 25,676 | | | 24,658 | | | 102,316 | | | 90,395 | |

| Total benefits and expenses | 1,078,980 | | | 1,038,403 | | | 4,253,267 | | | 4,124,629 | |

| | | | | | | |

| Income before income taxes | 336,711 | | | 296,710 | | | 1,194,266 | | | 1,102,111 | |

| Income tax benefit (expense) | (61,909) | | | (54,367) | | | (223,511) | | | (207,725) | |

| Net income | $ | 274,802 | | | $ | 242,343 | | | $ | 970,755 | | | $ | 894,386 | |

| | | | | | | |

| Basic net income per common share | $ | 2.92 | | | $ | 2.50 | | | $ | 10.21 | | | $ | 9.13 | |

| | | | | | | |

| Diluted net income per common share | $ | 2.88 | | | $ | 2.46 | | | $ | 10.07 | | | $ | 9.04 | |

(1)Net of remeasurement gain of $12.9 million for the three months ended December 31, 2023, and a remeasurement gain of $1.9 million for the same period in 2022. Net of remeasurement gain of $29.4 million for the year ended December 31, 2023, and a remeasurement loss of $47.4 million for the same period in 2022.

(2)Net of remeasurement gain of $3.5 million for the three months ended December 31, 2023, and a remeasurement gain of $1.8 million for the same period in 2022. Net of remeasurement gain of $11.8 million for the year ended December 31, 2023, and a remeasurement gain of $15.6 million for the same period in 2022.

(3)The amounts presented for 2022 have been retrospectively restated due to the adoption of ASU 2018-12.

13

GL Q4 2023 Earnings Release

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLine items represent financial concepts included in a table. These concepts are used to disclose reportable information associated with domain members defined in one or many axes to the table.

| Name: |

dei_EntityListingsLineItems |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:stringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_SubordinatedDebtMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

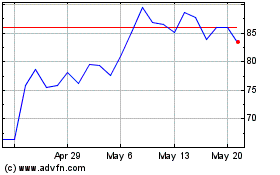

Globe Life (NYSE:GL)

Historical Stock Chart

From Mar 2024 to Apr 2024

Globe Life (NYSE:GL)

Historical Stock Chart

From Apr 2023 to Apr 2024