Filed by: Everi Holdings Inc.

(Commission File No.: 001-32622)

pursuant to Rule 425 under the Securities Act of 1933, as amended,

and deemed filed pursuant to Rule 14a-12 under the

Securities Exchange Act of 1934, as amended

Subject Company: Everi Holdings Inc.

(Commission File No.: 001-32622)

Everi Holdings Inc.

Frequently Asked Questions (FAQs) for Employees

1. Why is our company expecting to merge with IGT?

Everi leadership continually seeks opportunities to enhance our business and increase profitability. This pursuit often involves evaluating various strategic options, including acquisitions and mergers. We engage in thorough analysis and due diligence to ensure that any potential deal aligns with our long-term objectives and values.

In the case of our expected merger with IGT’s Global Gaming and PlayDigital businesses, we believe we have identified a compelling opportunity. IGT is globally recognized in our industry, known for its expansive reach and impressive track record. Their strength, particularly in the Digital and Gaming sectors, complements our existing strengths and capabilities. The IGT Lottery business is not included in this expected merger.

After careful consideration, our Board of Directors concluded that they believe the potential of merging with IGT’s Global Gaming and PlayDigital businesses presents a strategic avenue to enhance our industry position, broaden our product and service offerings, and create additional value for our stakeholders. This decision was made with a vision of the future and a dedication to the continued success and growth of our combined entity.

We believe the combined company will be well positioned in the industry and will open new avenues for innovation and growth. We are excited about the possibilities that lie ahead and are targeting a seamless integration process, with a focus on maintaining the high standards of service and excellence that our customers, employees, and partners expect from us.

Upon closing, Mike Rumbolz, Executive Chairman of Everi is expected to become the Chairman of the Board of the combined company and Randy Taylor is expected to be a member of the Board. Upon closing, Vince Sadusky, CEO of IGT is expected to be named CEO, Fabio Celadon, EVP of Strategy for IGT is expected to be named CFO and Mark Labay is expected to move to the role of Chief Integration Officer. Our leadership team has targeted a seamless integration process, with a focus on maintaining the high standards of service and excellence that define us.

2. How will this expected merger affect the company's vision and values?

Our company places a high priority on cultivating a strong culture and upholding our core values. These efforts have been central to our identity and success. As we move forward with the expected merger with IGT’s Global Gaming and PlayDigital businesses, we recognize the importance of these foundational elements.

Both our company and IGT have demonstrated a commitment to fostering positive work environments and pursue business practices that benefit our employees, customers, and

communities. This shared corporate focus is a key factor in our decision to merge, as it provides a fundamental alignment in our business approach and people management.

As the expected merger process unfolds, our leadership team will continue to be focused on preserving and enhancing the best aspects of both organizations' cultures. We understand that our employees are the cornerstone of our success, and we are committed to maintaining an environment that continues to be attractive and rewarding for all current and future team members.

We will actively engage in dialogue with employees at all levels to understand and address any employee questions about the planned integration of our cultures and values. Our goal is to emerge from this expected merger stronger, with a unified vision and a set of values that reflect the best of both companies. We see this as an opportunity to reinforce our commitment to excellence, innovation, and a positive workplace culture.

Rest assured; the leadership plans to keep a close pulse on the evolving culture prior to closing. We are excited about the opportunities this expected merger presents and are committed to ensuring that post-closing our combined company will be a place where everyone is proud to work.

3. What changes can we expect in our day-to-day operations?

Mergers are complex and require careful planning and regulatory approvals, which means changes do not happen overnight. We anticipate that the process of completing the transaction may take up to a year.

In the immediate future, our day-to-day operations will continue as usual. Our primary focus remains on delivering the high-quality service and performance that our customers and partners expect from us. It is business as usual, and we all have a vital role to play in maintaining the smooth operation of our company.

Like any dynamic business, we will continue to review and refine our operations to remain competitive and effective. This ongoing evolution is a standard part of how we operate and is not tied to the expected merger process.

As we move forward, we expect any changes to our operations to be communicated clearly and in advance. Our goal is to make this transition as seamless as possible, and that any adjustments are made thoughtfully and with ample support for our teams.

We understand that change can bring uncertainty, but we also see it as an opportunity for growth and improvement. We encourage everyone to stay engaged, provide feedback, and be open to the evolving opportunities this expected merger will bring. Together, we will navigate this period of change while continuing to excel in our daily responsibilities.

4. Will there be any restructuring or layoffs?

As we proceed with the expected merger with IGT’s Global Gaming and PlayDigital businesses, it is natural to have questions about the impact on our organizational structure and our team. In the short term, we do not anticipate any significant changes. Our immediate focus is on maintaining our current operations and ensuring that our day-to-day activities continue smoothly.

Mergers, by their nature, involve a process of planning and evaluation for post-closing integration. As we work through planning for and, after closing, implementing the integration with IGT’s Global Gaming and PlayDigital businesses, we will be assessing how best to combine our resources and capabilities to create a stronger, more efficient organization post-closing.

At this stage, it is too early to speculate what changes might occur, including any potential restructuring or changes in staffing. Our goal is for a thoughtful and strategic approach to integration planning, one that values the contributions of all our employees and seeks to capitalize on the strengths of both companies.

Should there be any plans for post-closing changes in the future, our priority will be to communicate these as early and as transparently as possible. We understand the importance of clarity and certainty for all our employees, and we are committed to providing support and information throughout this process.

We also want to emphasize that we are focused on the well-being of our employees and the long-term health of our company. We value the hard work and dedication of our team, and we seek to navigate this period with respect and care for every member of our organization.

5. How will this expected merger impact our current projects and customers?

As we move forward with the expected merger process with IGT’s businesses, our primary commitment is to the ongoing success and stability of our current projects and the relationships we have with our customers and their patrons. Given the typically extended timeline required to finalize such a merger in the gaming industry, and the importance of operating independently prior to official closing, our day-to-day operations, including all ongoing projects, will continue as planned.

For now, it is 'business as usual.' Our teams will remain focused on their current objectives, providing the high-quality service and support that our customers and their patrons expect from us.

As the expected merger progresses and integration occurs post-closing, we will keep all stakeholders, including our customers and suppliers, fully informed of any developments that may affect them. We intend to work closely with our customers to clearly communicate any changes and continue to meet their needs with the same level of professionalism and excellence they have come to expect from us.

We believe that this expected merger will strengthen our ability to serve our customers and their patrons and enhance the quality and range of services we offer. We are excited about the opportunities that lie ahead and are targeting a future transition that is smooth and beneficial for our customers and our teams.

6. Will there be changes to our benefits, compensation, or job titles?

We understand that questions regarding benefits, compensation, and job titles may be of significant concern to our employees. In the immediate future, we do not anticipate any changes to these areas. Our priority is to provide a stable and seamless transition for all our team members.

Historically, when integrating with new acquisitions, we have taken a thoughtful and measured approach. We believe it is crucial to first understand the needs and expectations of our employees

and the operational requirements of our business before planning for any changes to our benefits plans.

Regarding compensation and job titles, these are aspects that will require careful alignment between the two merging entities. This process involves a thorough evaluation of the roles, responsibilities, and compensation structures within both organizations. Our goal is for any adjustments made to be fair, competitive, and reflective of the value each employee brings to our combined company.

We want to emphasize that any recommendations for planned changes in these areas will be made with careful consideration and in consultation with the affected business leaders. We are committed to maintaining open lines of communication throughout this process and will provide updates as more information becomes available.

We understand the importance of these matters to our employees, and we are dedicated to making decisions that are in the best interest of our team members and our company. We appreciate your patience and understanding as we work through this planning process and plan to keep you informed as we move forward.

7. How will communication be handled throughout the expected merger process?

Effective communication is a cornerstone of a successful merger process, and we are dedicated to keeping all our employees informed and engaged. Recognizing the global spread of our teams and the challenges of synchronizing communications across different time zones, we have developed a comprehensive communication strategy to provide everyone with timely and relevant updates.

We recognize that clear and consistent communication is vital. Our aim is to ensure that every employee, regardless of their location or role, feels informed, involved, and supported throughout this process. We encourage everyone to utilize these resources and to actively participate in this dialogue as we move forward.

8. What opportunities will this expected merger create for professional growth and development?

As we look forward to this expected merger with IGT’s Global Gaming and PlayDigital businesses, we are excited about the prospects for enhanced professional growth and development opportunities for our employees. Upon closing of the expected merger, we anticipate becoming a combined entity of nearly 7,000 employees. This scale not only brings increased diversity in skills and experiences, but also opens a broader range of opportunities for personal and professional advancement.

We have always taken pride in our dedication to the development of our people. We expect this dedication to not only continue but to expand with the expected merger. A larger organization inherently presents a wider array of roles, projects, and challenges, offering our employees more potential avenues for career progression, skill enhancement, and personal growth.

In this potentially expanded company, the scope for cross-functional collaboration, international exposure, and leadership development is likely to increase. We envision that the combined strengths and resources of our two companies will allow us to offer more comprehensive training programs, mentorship opportunities, and career development pathways.

We encourage our employees to view this expected merger as an opportunity to broaden their horizons and explore new areas of professional interest within the larger organization. While we cannot predict every opportunity that may arise, we believe that the expected merger will create a dynamic and enriching environment for professional growth.

As always, we remain dedicated to supporting our employees in their career aspirations and personal development goals. We believe that the success of our company is intrinsically linked to the growth and satisfaction of our team, and we look forward to exploring and realizing these new opportunities.

9. Who can we talk to if we need more information?

We understand that during this expected merger process with IGT’s businesses, you may have various questions. To facilitate access to accurate information and support, we have established multiple channels for communication and feedback.

We also recognize the importance of direct communication. Therefore, your immediate supervisors and our People Ops department are available to discuss any questions you may have. They will be equipped with the latest information and can guide you on specific queries related to your role or department.

Please understand that while we are committed to providing timely and transparent updates, there are legal and confidential aspects of the expected merger process that may limit the details we can share at certain stages. We ask for your patience and understanding in this regard.

Our goal is to keep you, our valued team members, as informed as possible throughout this journey. Your feedback and questions are important to us, and we encourage you to use these channels to stay connected and informed.

10. How can we contribute to a successful expected merger?

As we navigate through the expected merger process with IGT’s businesses, your role in contributing to its success is invaluable. One of the most effective ways you can help is by continuing to focus on what you do best. We believe your daily responsibilities and ongoing projects are the foundation of our company's success, and maintaining your commitment to excellence is crucial.

We encourage you to keep a positive and proactive attitude. If you are involved in discussions or integration planning activities related to the expected merger, we appreciate your insights and ideas. Your perspective on potentially improving processes and achieving results can make a significant difference. We value the creativity, expertise, and experience that each of you brings to the table.

Moreover, staying adaptable and open to change is key. As we expect to merge with IGT’s Gaming and PlayDigital businesses, there will be new opportunities to learn, grow, and collaborate. Embracing these opportunities with an open mind and a willingness to contribute positively will be key to our collective success.

We also recommend staying engaged with any communications about the expected merger. Your feedback and questions during this time are not only welcome but encouraged, as they provide us with valuable insights into the team's thoughts.

Lastly, please continue to support each other. A merger can be a time of uncertainty, but by working together and maintaining a supportive environment, we can prepare for a smooth transition and a stronger future for our combined organization.

Your ongoing dedication and hard work have been key to our success so far. As we move forward with this expected merger, we believe your continued contributions, ideas, and enthusiasm will drive us towards a successful future.

11. What is the timeline for the expected merger process?

Mergers are complex and require careful planning and regulatory approvals. We are currently targeting the completion of the expected merger by late 2024 or early 2025.

12. What can we do if we experience stress or uncertainty due to the expected merger?

We recognize that the announcement of an expected merger can create feelings of stress and uncertainty for some of our team members. It is important to us that you have the support you need.

Your immediate supervisors are a valuable resource and are available to discuss any questions you may have. They can provide guidance, information, and support to help you navigate through this period. We encourage open and honest communication with your leaders, as they are here to assist you.

Additionally, our People Operations team is readily accessible to all employees. They can offer detailed information about the wellness resources available to you, including services provided through our employee assistance program with Lyra. Whether you are seeking professional counseling, stress management resources, or need someone to talk to, these services are confidential and designed to support your well-being.

We also understand the importance of maintaining a supportive work environment. We encourage you to lean on your colleagues for support, as they may be experiencing similar feelings. Sharing experiences and coping strategies can be beneficial for everyone.

Please remember that it is normal to feel a range of emotions during times of change. We seek to provide the resources and support you need to manage these feelings. We view your well-being as a priority, and we are here to facilitate access to the necessary support systems during this expected merger process.

Additional Information and Where to Find It

In connection with the proposed transaction (the “Proposed Transaction”) between Everi Holdings Inc. (“Everi”), International Game Technology PLC (“IGT”), Ignite Rotate LLC (“Spinco”) and Ember Sub LLC (“Merger Sub”), Everi, IGT and Spinco will file relevant materials with the Securities and Exchange Commission (“SEC”). Everi will file a registration statement on Form S-4 that will include a joint proxy statement/prospectus relating to the Proposed Transaction, which will constitute a proxy statement and prospectus of Everi and a proxy statement of IGT. A definitive proxy statement/prospectus will be mailed to stockholders of Everi and a definitive proxy statement will be mailed to shareholders of IGT. INVESTORS AND SECURITY HOLDERS OF EVERI ARE URGED TO READ THE REGISTRATION STATEMENT, THE JOINT PROXY STATEMENT/PROSPECTUS AND ALL OTHER RELEVANT DOCUMENTS FILED OR THAT WILL BE FILED WITH THE SEC, AND INVESTORS AND SECURITY HOLDERS OF IGT ARE URGED TO READ THE JOINT PROXY STATEMENT/PROSPECTUS AND ALL OTHER RELEVANT DOCUMENTS FILED OR THAT WILL BE FILED WITH THE SEC, CAREFULLY AND IN THEIR ENTIRETY BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT EVERI, IGT AND SPINCO, AND THE PROPOSED TRANSACTION. Investors and security holders will be able to obtain free copies of the registration statement and the joint proxy statement/prospectus (when available) and other documents filed with the SEC by Everi or IGT through the website

maintained by the SEC at http://www.sec.gov. Copies of the documents filed with the SEC by Everi will be available free of charge on Everi’s website at www.everi.com or by contacting Everi’s Investor Relations Department at Everi Holdings Inc., Investor Relations, 7250 S. Tenaya Way, Suite 100, Las Vegas, NV 89113. Copies of the documents filed with the SEC by IGT will be available free of charge on IGT’s website at www.igt.com or by contacting IGT’s Investor Relations Department at International Game Technology PLC, Investor Relations, 10 Memorial Boulevard, Providence, RI 02903.

No Offer or Solicitation

This communication is for informational purposes only and not intended to and does not constitute an offer to subscribe for, buy or sell, or the solicitation of an offer to subscribe for, buy or sell, or an invitation to subscribe for, buy or sell, any securities of Everi, IGT, Spinco or Merger Sub, or the solicitation of any vote or approval in any jurisdiction pursuant to or in connection with the Proposed Transaction or otherwise, nor shall there be any sale, issuance or transfer of securities in any jurisdiction in contravention of applicable law. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended (the “Securities Act”), and otherwise in accordance with applicable law.

Participants in the Solicitation

This communication is not a solicitation of a proxy from any security holder of Everi or IGT. However, Everi and IGT and each of their respective directors and executive officers may be considered participants in the solicitation of proxies in connection with the Proposed Transaction. Information about the directors and executive officers of Everi may be found in its most recent Annual Report on Form 10-K and in its most recent proxy statement for its annual meeting of stockholders, in each case as filed with the SEC. Information about the directors, executive officers and members of senior management of IGT is set forth in its most recent Annual Report on Form 20-F as filed with the SEC. Other information regarding the participants in the proxy solicitations and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the joint proxy statement/prospectus and other relevant materials to be filed with the SEC when they become available.

Forward-Looking Statements

This communication contains “forward-looking statements” within the meaning of Section 27A of the Securities Act and Section 21E of the Securities Exchange Act of 1934, as amended, related to Everi, IGT and the proposed spin-off of IGT’s Global Gaming and PlayDigital businesses (the “Spinco Business”), and the proposed acquisition of the Spinco Business by Everi. All statements other than statements of historical fact are forward-looking statements for purposes of federal and state securities laws. These forward-looking statements involve risks and uncertainties that could significantly affect the financial or operating results of Everi, IGT, the Spinco Business, or the combined company. These forward-looking statements may be identified by terms such as “anticipate,” “believe,” “foresee,” “estimate,” “expect,” “intend,” “plan,” “project,” “forecast,” “may,” “will,” “would,” “could” and “should” and the negative of these terms or other similar expressions. Forward-looking statements in this communication include, among other things, statements about the potential benefits and synergies of the Proposed Transaction, including enhancement of Everi’s industry position, increase of profitability, broadening of Everi’s products and service offerings, creation of additional value, growth opportunities for the combined company, and avenues of innovation; the integration process; leadership and governance of the combined company, future financial and operating results, goals, objectives and expectations; and the anticipated timing of closing of the Proposed Transaction. In addition, all statements that address operating performance, events or developments that Everi or IGT expects or anticipates will occur in the future — including statements relating to creating value for stakeholders, benefits of the Proposed Transaction to customers, employees, stakeholders and other constituents of the combined company and IGT, separating and integrating the companies, cost savings and the expected timetable for completing the Proposed Transaction — are forward-looking statements. These forward-looking statements involve substantial risks and uncertainties that could cause actual results, including the actual results of Everi, IGT, the Spinco Business, or the combined company, to differ materially from those expressed or implied by such statements. These risks and uncertainties include, among other things, risks related to the possibility that the conditions to the consummation of the Proposed Transaction will not be satisfied (including the failure to obtain necessary regulatory, stockholder and shareholder approvals or any necessary waivers, consents, or transfers, including for any required licenses or other agreements) in the anticipated timeframe or at all; risks related to the ability to realize the anticipated benefits of the Proposed Transaction, including the possibility that Everi and IGT may be unable to achieve the expected benefits, synergies and operating efficiencies in connection with the Proposed Transaction within the expected timeframes or at all and to successfully separate and/or integrate the Spinco Business; the ability to retain key personnel; negative effects of the announcement or the consummation of the proposed acquisition on the market price of the capital stock of Everi and IGT and on Everi’s and IGT’s operating results; risks relating to the value of Everi’s shares to be issued in the Proposed Transaction; the occurrence of any event, change or other circumstances that could give rise to the termination of the merger agreement relating to the Proposed Transaction (the “Merger Agreement”); changes in the extent and characteristics of the common stockholders of Everi and ordinary shareholders of IGT and its effect

pursuant to the Merger Agreement for the Proposed Transaction on the number of shares of Everi common stock issuable pursuant to the Proposed Transaction, magnitude of the dividend payable to Everi’s stockholders pursuant to the Proposed Transaction and the extent of indebtedness to be incurred by Everi in connection with the Proposed Transaction; significant transaction costs, fees, expenses and charges (including unknown liabilities and risks relating to any unforeseen changes to or the effects on liabilities, future capital expenditures, revenue, expenses, synergies, indebtedness, financial condition, losses and future prospects); operating costs, customer loss, and business disruption (including, without limitation, difficulties in maintaining employee, customer, or other business, contractual, or operational relationships following the Proposed Transaction announcement or closing of the Proposed Transaction); failure to consummate or delay in consummating the Proposed Transaction for any reason; risks related to competition in the gaming and lottery industry; issues and costs arising from the separation and integration of acquired companies and businesses and the timing and impact of accounting adjustments; risks related to the financing of the Proposed Transaction, Everi’s overall debt levels and its ability to repay principal and interest on its outstanding debt, including debt assumed or incurred in connection with the Proposed Transaction; future exchange and interest rates; changes in tax and other laws, regulations, rates and policies and other external factors that Everi and IGT cannot control; regulation and litigation matters relating to the Proposed Transaction or otherwise impacting Everi, IGT, Spinco, the combined company or the gaming industry generally; unanticipated liabilities of acquired businesses; unanticipated adverse effects or liabilities from business divestitures; effects on earnings of any significant impairment of goodwill or intangible assets; risks related to intellectual property, privacy matters, and cyber security (including losses and other consequences from failures, breaches, attacks, or disclosures involving information technology infrastructure and data); other business effects (including the effects of industry, market, economic, political, or regulatory conditions); and other risks and uncertainties, including, but not limited to, those described in Everi’s Annual Report on Form 10-K on file with the SEC and from time to time in other filed reports including Everi’s Quarterly Reports on Form 10-Q, and those described in IGT’s Annual Report on Form 20-F on file with the SEC and from time to time in other filed reports including IGT’s Current Reports on Form 6-K.

A further description of risks and uncertainties relating to Everi can be found in its most recent Annual Report on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K, and relating to IGT can be found in its most recent Annual Report on Form 20-F and Current Reports on Form 6-K, all of which are filed with the SEC and available at www.sec.gov.

Everi does not intend to update forward-looking statements as the result of new information or future events or developments, except as required by law.

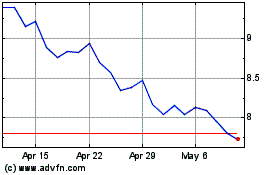

Everi (NYSE:EVRI)

Historical Stock Chart

From Mar 2024 to Apr 2024

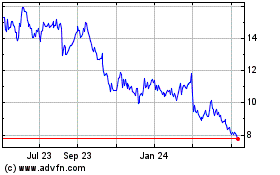

Everi (NYSE:EVRI)

Historical Stock Chart

From Apr 2023 to Apr 2024