Current Report Filing (8-k)

May 22 2019 - 4:37PM

Edgar (US Regulatory)

4

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

May 22, 2019

AXA Equitable Holdings, Inc.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

Delaware

|

001-38469

|

90-0226248

|

|

(State or other jurisdiction of

|

(Commission File Number)

|

(I.R.S. Employer

|

|

incorporation or organization)

|

|

Identification No.)

|

|

|

|

|

1290 Avenue of the Americas,

New York, New York

|

10104

|

|

(Address of principal executive offices)

|

(Zip Code)

|

(212) 554-1234

(Registrant’s telephone number, including area code)

Not Applicable

(Former name or address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 under the Securities Act (17 CFR 230.405) or Rule 12b-2 under the Exchange Act (17 CFR 240.12b-2).

Emerging growth company

☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

☐

Item 5.07 Submission of Matters to a Vote of Security Holders.

On May 22, 2019, the Company held its Annual Meeting of Stockholders (the “Annual Meeting”). At the Annual Meeting, four proposals were submitted to the Company’s stockholders. The proposals are described in more detail in the Company’s definitive proxy statement filed with the U.S. Securities and Exchange Commission (the “SEC”) on April 9, 2019 (the “2019 Proxy Statement”). The final voting results are as follows:

Proposal 1

: The Company’s stockholders elected the nine director nominees named in the Company’s 2019 Proxy Statement to serve for a one-year term ending at the 2020 Annual Meeting of Stockholders. The voting results are set forth below:

|

|

|

|

|

|

|

|

|

Director Nominee

|

|

For

|

|

Withheld

|

|

Broker Non-Vote

|

|

Thomas Buberl

|

|

450,000,906

|

|

9,168,296

|

|

10,449,640

|

|

Gérald Harlin

|

|

447,922,586

|

|

11,246,616

|

|

10,449,640

|

|

Daniel G. Kaye

|

|

458,069,552

|

|

1,099,650

|

|

10,449,640

|

|

Kristi A. Matus

|

|

458,064,125

|

|

1,105,077

|

|

10,449,640

|

|

Ramon de Oliveira

|

|

391,725,843

|

|

67,443,359

|

|

10,449,640

|

|

Mark Pearson

|

|

457,387,930

|

|

1,781,272

|

|

10,449,640

|

|

Bertram L. Scott

|

|

458,822,996

|

|

346,206

|

|

10,449,640

|

|

George Stansfield

|

|

451,689,342

|

|

7,479,860

|

|

10,449,640

|

|

Charles G.T. Stonehill

|

|

391,726,046

|

|

67,443,156

|

|

10,449,640

|

Proposal 2:

The Company’s stockholders ratified the appointment of PricewaterhouseCoopers LLP as the Company’s independent registered public accounting firm for fiscal year 2019. The voting results are set forth below:

|

|

|

|

|

|

|

|

|

For

|

|

Against

|

|

Abstain

|

|

Broker Non-Vote

|

|

467,612,736

|

|

1,996,846

|

|

9,260

|

|

N/A

|

Proposal 3:

The Company’s stockholders

approved an advisory resolution approving the compensation of the Company’s named executive officers (the “Say-on-Pay” vote). The voting results are set forth below:

|

|

|

|

|

|

|

|

|

For

|

|

Against

|

|

Abstain

|

|

Broker Non-Vote

|

|

453,602,286

|

|

5,556,557

|

|

10,359

|

|

10,449,640

|

Proposal 4:

The Company’s stockholders

recommended, on an advisory basis, a one year frequency for future Say-on-Pay votes. There were 14,219 abstentions from voting and 10,449,640 broker non-votes on Proposal 4. The voting results are set forth below:

|

|

|

|

|

|

|

|

Frequency of Votes to Approve the Compensation

Paid to the Company’s NEOs

|

|

For

|

|

|

|

|

|

One year:

|

|

457,609,314

|

|

|

|

|

|

Two years:

|

|

12,818

|

|

|

|

|

|

Three years:

|

|

1,532,851

|

|

|

|

|

After taking into consideration the foregoing voting results and the prior recommendation of the Company’s board of directors for a one year frequency for future Say-on-Pay votes, the board of directors has determined that the Company will hold such future Say-on-Pay votes every year.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

AXA EQUITABLE HOLDINGS, INC.

|

|

|

|

|

|

|

|

Date: May 22, 2019

|

|

|

By:

|

/s/ Dave S. Hattem

|

|

|

|

|

Name:

|

Dave S. Hattem

|

|

|

|

|

Title:

|

Senior Executive Vice President, General Counsel and Secretary

|

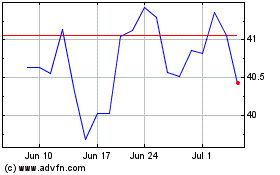

Equitable (NYSE:EQH)

Historical Stock Chart

From Mar 2024 to Apr 2024

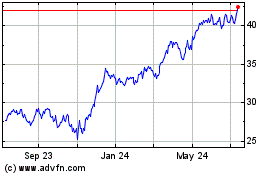

Equitable (NYSE:EQH)

Historical Stock Chart

From Apr 2023 to Apr 2024