UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT PURSUANT

TO SECTION 13 OR 15(D) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported) October 28, 2015

DHI Group, Inc.

(Exact Name of Registrant as Specified in Its Charter)

DELAWARE

(State or Other Jurisdiction of Incorporation)

|

| | | | | | | | |

001-33584 | | 20-3179218 |

(Commission File Number) | | (IRS Employer Identification No.) |

| | | | | | | | |

1040 AVENUE OF THE AMERICAS, 8TH FLOOR, NEW YORK, NEW YORK | | 10018 |

(Address of Principal Executive Offices) | | (Zip Code) |

(212) 725-6550

(Registrant's Telephone Number, Including Area Code)

NOT APPLICABLE

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

ITEM 2.02. RESULTS OF OPERATIONS AND FINANCIAL CONDITION.

On October 28, 2015, DHI Group, Inc. (the “Company”) reported its results of operations for the fiscal quarter ended September 30, 2015. A copy of the press release issued by the Company concerning the foregoing is furnished herewith as Exhibit 99.1 and is incorporated herein by reference.

The information in this Form 8-K, including the accompanying exhibit, is being furnished under Item 2.02 and shall not be deemed to be “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934 (the “Exchange Act”), or otherwise subject to the liability of such section, nor shall such information be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, regardless of the general incorporation language of such filing, except as shall be expressly set forth by specific reference in such filing.

ITEM 9.01. FINANCIAL STATEMENTS AND EXHIBITS.

| |

(a) | Financial Statements of Business Acquired. |

Not applicable.

| |

(b) | Pro Forma Financial Information. |

Not applicable.

| |

(c) | Shell Company Transactions. |

Not applicable.

EXHIBIT NO. DESCRIPTION

99.1 Press Release, dated October 28, 2015

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

| | | | |

| | | | |

| | DHI GROUP, INC. | | |

| | | | |

Date: | October 28, 2015 | By: /S/ JOHN J. ROBERTS | | |

| | Name: John J. Roberts | | |

| | Title: Chief Financial Officer | | |

| | | | |

| | | | |

EXHIBIT INDEX

99.1 Press Release, dated October 28, 2015

DHI Group, Inc. Reports Third Quarter 2015 Results

| |

• | Total revenues of $65.1 million, Adjusted EBITDA of $19.1 million and net income of $6.5 million or $0.12 per diluted share |

| |

• | Excluding Slashdot Media, total revenues of $61.6 million, Adjusted EBITDA of $18.8 million and net income of $6.4 million |

| |

• | Cash flow from operations of $12.4 million for Q3 2015 and $49.4 million for the first nine months, an increase of 4% year-over-year |

| |

• | Continued adoption of Open Web, with Dice’s Open Web customer count in the U.S. increasing 56% from year-end 2014 for annual customers and reaching more than 1,000 total customers |

New York, New York, October 28, 2015 - DHI Group, Inc. (formerly known as Dice Holdings, Inc.) (NYSE: DHX) (the “Company”), a leading provider of data, insights and employment connections through our specialized services for professional communities including technology and security clearance, financial services, energy, healthcare and hospitality, today reported financial results for the quarter ended September 30, 2015.

“Our third quarter results reflect the progress we are making on our path of innovation, integration and evolution, and we are confident our approach is helping us expand our market opportunity and strengthen our vertical leadership positioning,” said Michael Durney, President and Chief Executive Officer. “As we continue to enhance our product portfolio, we are seeing increased engagement with our customers, who are looking to expand the ways in which they find and interact with professionals. With a great deal of the integration and positioning work related to our recent acquisitions now complete, we are better positioned than ever before to leverage capabilities across our business and drive growth long-term.”

Q3 2015 Product and Business Highlights

New and Emerging Products

| |

• | Adoption of Open Web at Dice continues and the likely-to-switch feature launched in July, which gives customers the ability to narrow candidate searches based on the likelihood of candidates to change professional position, has generated positive initial feedback. |

| |

• | Value-add Sourcing Concierge and Branding Products growth provide an encouraging sign that the Company’s evolving product portfolio is beginning to gain greater traction. |

| |

• | Launched Spotlight in the Company’s Health eCareers service, a new employer branding product suite with rich content and unique features, such as employee-generated company reviews, that is seeing strong early customer demand. |

Q3 2015 Financial Highlights

The following summarizes consolidated financial results for the quarters ended September 30, 2015 and 2014 ($ in millions, except per share data):

|

| | | | | | | | | | |

| Q3 2015 |

| | Q3 2014 |

| YoY % Change |

| |

Revenues | $ | 65.1 |

| | $ | 67.6 |

| (4 | )% | * |

Operating income | $ | 11.0 |

| | $ | 13.4 |

| (18 | )% | |

Income before income taxes | $ | 10.1 |

| | $ | 12.5 |

| (19 | )% | |

Net income | $ | 6.5 |

| | $ | 9.5 |

| (32 | )% | |

Diluted earnings per share | $ | 0.12 |

| | $ | 0.18 |

| (33 | )% | |

Net cash provided by operating activities | $ | 12.4 |

| | $ | 14.3 |

| (13 | )% | |

| | | | | |

Adjusted Revenues | $ | 65.1 |

| | $ | 68.1 |

| (4 | )% | |

Adjusted EBITDA | $ | 19.1 |

| | $ | 22.4 |

| (15 | )% | |

Adjusted EBITDA margin | 29.3 | % | | 32.9 | % | n.m. |

| |

| | | | | |

Adjusted Revenues, excluding Slashdot Media | $ | 61.6 |

| | $ | 63.3 |

| (3 | )% | * |

Adjusted EBITDA, excluding Slashdot Media | $ | 18.8 |

| | $ | 21.0 |

| (10 | )% | |

Adjusted EBITDA margin, excluding Slashdot Media | 30.4 | % | | 33.1 | % | n.m. |

| |

* Excluding the negative impact of currency translation, revenues decreased 2%, and Adjusted Revenues, excluding Slashdot Media decreased 1%, year-over-year. |

Q3 2015 Financial Highlights by Segment

“Our third quarter performance demonstrates the strength of our diversified business model. We delivered improved constant currency results in all of our core businesses with the exception of Energy, which continues to be negatively impacted by lower oil prices. At the same time, we generated solid free cash flow while continuing to invest in innovation for future growth, further reducing net debt and returning cash to shareholders. With a strong foundation now in place, we believe we are well positioned to drive improved financial performance beginning in 2016,” said John Roberts, Chief Financial Officer.

The following summarizes segment Adjusted Revenues, Adjusted EBITDA and Adjusted EBITDA Margin results for the quarters ended September 30, 2015 and 2014 ($ in millions):

|

| | | | | | | | | | | | | | | | | | | | | | | | |

| Adjusted Revenues by Segment | | Adjusted EBITDA by Segment | |

| Q3 2015 |

| | Q3 2014 |

| | YoY % Change | | Q3 2015 |

| | Q3 2015 Margin | | Q3 2014 |

| | Q3 2014 Margin | |

Tech & Clearance | $ | 35.3 |

| | $ | 34.0 |

| | 4% | | $ | 16.2 |

| | 46 | % | | $ | 15.8 |

| | 46 | % | |

Finance | 9.3 |

| | 9.4 |

| | (2)% | | 2.3 |

| | 25 | % | | 2.2 |

| | 23 | % | |

Energy | 4.7 |

| | 8.2 |

| | (42)% | | 0.9 |

| | 19 | % | | 4.0 |

| | 49 | % | |

Healthcare | 7.9 |

| | 7.1 |

| | 11% | | 1.2 |

| | 15 | % | | 0.6 |

| | 8 | % | |

Hospitality | 3.9 |

| | 3.8 |

| | 2% | | 1.7 |

| | 44 | % | | 1.6 |

| | 42 | % | |

Before Corporate & Other | 61.1 |

| | 62.6 |

| | (2)% | | 22.4 |

| | 37 | % | | 24.3 |

| | 39 | % | |

Slashdot Media | 3.5 |

| | 4.8 |

| | (26)% | | 0.3 |

| | 9 | % | | 1.4 |

| | 29 | % | |

Corporate & Other | 0.5 |

| | 0.7 |

| | (29)% | | (3.5 | ) | | n.m. |

| | (3.3 | ) | | n.m. |

| |

Total Corporate & Other | 4.0 |

| | 5.5 |

| | (27)% | | (3.2 | ) | | n.m. |

| | (1.9 | ) | | n.m. |

| |

Total | $ | 65.1 |

| | $ | 68.1 |

| | (4)% | | $ | 19.1 |

| | 29 | % | | $ | 22.4 |

| | 33 | % | |

Q3 2015 Primary Drivers of YoY % Change

| |

• | Adjusted Revenues growth in the Tech & Clearance segment was driven by growth of 23% at ClearanceJobs and 17% at Dice Europe. |

| |

• | Finance segment revenues increased 6% in constant currency, driven by increases of 10% in North America, 10% in the Asia Pacific region, 8% in the UK and 1% in Continental Europe. |

| |

• | The decline in Energy segment Adjusted Revenues reflects the negative impact on recruitment and advertising activity from the poor overall market in oil and gas. |

| |

• | Adjusted Revenues growth in the Healthcare segment primarily reflects an increase in usage of our services at Health eCareers driven by increased engagement with customers. |

Supplemental Information

|

| | | | | | | | | | | | | | | | | | | |

($ in millions) | September 30, 2015 |

| | December 31, 2014 |

| | September 30, 2014 |

| | YTD $ Change |

| | YoY $ Change |

|

Deferred revenue (excluding Slashdot Media) | $ | 81.9 |

| | $ | 85.0 |

| | $ | 80.5 |

| | $ | (3.1 | ) | | $ | 1.4 |

|

Slashdot Media deferred revenue (1) | 1.2 |

| | 1.4 |

| | 1.4 |

| | (0.2 | ) | | (0.2 | ) |

Total deferred revenue | $ | 83.1 |

| | $ | 86.4 |

| | $ | 81.9 |

| | $ | (3.3 | ) | | $ | 1.2 |

|

Net debt | $ | 67.7 |

| | $ | 83.7 |

| | $ | 86.1 |

| | $ | (16.0 | ) | | $ | (18.4 | ) |

(1) Slashdot Media deferred revenue is included in liabilities held for sale as of September 30, 2015 only. |

Q3 2015 Primary Drivers of YoY % Change in Supplemental Items

| |

• | The YTD decrease in deferred revenue (excluding Slashdot Media) primarily reflects decreases in the Energy segment, partially offset by increases in the Finance (10%) and Healthcare (12%) segments. |

| |

• | The YoY increase in deferred revenue (excluding Slashdot Media) primarily reflects increases in the Tech & Clearance (6%) and Finance (9%) segments, partially offset by a decrease in the Energy segment. |

Stock Repurchase Program

During the third quarter of 2015, the Company purchased approximately 1.2 million shares of its common stock at an average cost of $7.78 per share for a total cost of approximately $9.3 million. At September 30, 2015, approximately $19.3 million remained authorized for repurchase under a $50 million plan that expires in December 2015.

Business Outlook

Given the planned divestiture of Slashdot Media and our reporting of such business, we believe that, in order to provide more meaningful estimates of our future financial performance, it is more appropriate to discuss our estimated future financial performance excluding Slashdot Media operations going forward.

|

| | | |

Current Full-Year 2015 Business Outlook Excluding Slashdot Media |

($ in millions, except diluted earnings per share) | | Q4 2015 | FY 2015 |

Revenues excluding Slashdot Media* | | $61.5 - $62.5 | $245.0 - $246.0 |

Estimated Contribution by Segment | | | |

Tech & Clearance | | 57% | 56% |

Finance | | 15% | 15% |

Energy | | 8% | 8% |

Healthcare | | 13% | 13% |

Hospitality | | 6% | 7% |

Corporate & Other | | 1% | 1% |

Adjusted EBITDA | | $17.8 - $18.8 | $72.5 - $73.5 |

Depreciation and amortization | | $5.4 | $22.9 |

Non-cash stock compensation expense | | $2.5 | $9.7 |

Interest expense, net | | $0.8 | $3.3 |

Income taxes | | $3.6 - $4.0 | $14.2 - $14.6 |

Net income | | $5.5 - $6.1 | $22.4 - $23.0 |

Diluted earnings per share | | $0.11 - $0.12 | $0.42 - $0.43 |

Diluted share count | | 52 million | 53 million |

* For the full-year 2015, the Company now estimates Slashdot Media will generate $14 - $15 million in revenues. For Q4 2015, Slashdot Media is expected to generate $3 - $4 million in revenues. |

Estimated financial performance for 2015 reflects:

| |

• | Investments in new growth initiatives; |

| |

• | Ongoing investments related to product development including Open Web; |

| |

• | Anticipated negative impact of currency fluctuations compared to 2014; and |

| |

• | Anticipated negative impact on the Company’s Energy segment from the significant decline in oil prices. |

Conference Call Information

The Company will host a conference call to discuss third quarter results today at 8:30 a.m. Eastern Time. Hosting the call will be Michael Durney, President and Chief Executive Officer, and John Roberts, Chief Financial Officer.

The conference call can be accessed live over the phone by dialing 1-866-777-2509 or for international callers by dialing 1-412-317-5413. Please ask to be joined to the DHI Group, Inc. call. A replay will be available one hour after the call and can be accessed by dialing 1-877-344-7529 or 1-412-317-0088 for international callers; the replay passcode is 10074148. The replay will be available until November 5, 2015.

The call will also be webcast live from the Company’s website at www.dhigroupinc.com under the Investor Relations section.

Investor Contact

Jennifer Milan

Director, Investor Relations

DHI Group, Inc.

212-448-4181

ir@dhigroupinc.com

Media Contact

Rachel Ceccarelli

Director, Corporate Communications

DHI Group, Inc.

212-448-8288

media@dhigroupinc.com

About DHI Group, Inc.

DHI Group, Inc. (NYSE: DHX) (formerly known as Dice Holdings, Inc.) is a leading provider of data, insights and connections through our specialized services for professional communities including technology and security clearance, financial services, energy, healthcare and hospitality. Our mission is to empower professionals and organizations to compete and win through expert insights and relevant employment connections. Employers and recruiters use our websites and services to source and hire the most qualified professionals in select and highly-skilled occupations, while professionals use our websites and services to find the best employment opportunities in and the most timely news and information about their respective areas of expertise. For 25 years, we have built our company on providing employers and recruiters with efficient access to high-quality, unique professional communities, and offering the professionals in those communities access to highly-relevant career opportunities, news, tools and information. Today, we serve multiple markets located throughout North America, Europe, the Middle East and the Asia Pacific region.

Notes Regarding the Use of Non-GAAP Financial Measures

The Company has provided certain non-GAAP financial information as additional information for its operating results. These measures are not in accordance with, or an alternative for, generally accepted accounting principles in the United States (“GAAP”) and may be different from similarly titled non-GAAP measures reported by other companies. The Company believes that its presentation of non-GAAP measures, such as adjusted earnings before interest, taxes, depreciation, amortization, non-cash stock based compensation expense, and other non-recurring income or expense (“Adjusted EBITDA”), Adjusted EBITDA excluding Slashdot Media, free cash flow, Adjusted Revenues, Adjusted Revenues excluding Slashdot Media, Net Income excluding Slashdot Media, net cash and net debt, provides useful information to management and investors regarding certain financial and business trends relating to its financial condition and results of operations. In addition, the Company’s management uses these measures for reviewing the financial results of the Company and for budgeting and planning purposes. The Company has provided required reconciliations to the most comparable GAAP measures in the section entitled “Supplemental Information and Non-GAAP Reconciliations.”

Adjusted EBITDA

Adjusted EBITDA is a non-GAAP metric used by management to measure operating performance. Management uses Adjusted EBITDA as a performance measure for internal monitoring and planning, including preparation of annual budgets, analyzing investment decisions and evaluating profitability and performance comparisons between us and our competitors. The Company also uses this measure to calculate amounts of performance based compensation under the senior management incentive bonus program. Adjusted EBITDA, as defined in our Credit Agreement, represents net income plus (to the extent deducted in calculating such net income) interest expense, income tax expense, depreciation and amortization, non-cash stock option expenses, losses resulting from certain dispositions outside the ordinary course of business, certain writeoffs in connection with indebtedness, impairment charges with respect to long-lived assets, expenses incurred in connection with an equity offering, extraordinary or non-recurring non-cash expenses or losses, transaction costs in connection with the Credit Agreement up to $250,000, deferred revenues written off in connection with acquisition purchase accounting adjustments, writeoff of non-cash stock compensation expense, and business interruption insurance proceeds, minus (to the extent included in calculating such net income) non-cash income or gains, interest income, and any income or gain resulting from certain dispositions outside the ordinary course of business.

We consider Adjusted EBITDA, as defined above, to be an important indicator to investors because it provides information related to our ability to provide cash flows to meet future debt service, capital expenditures and working capital requirements and to fund future growth as well as to monitor compliance with financial covenants. We present Adjusted EBITDA as a supplemental performance measure because we believe that this measure provides our board of directors, management and investors with additional information to measure our performance, provide comparisons from period to period and company to company by excluding potential differences caused by variations in capital structures (affecting interest expense) and tax positions (such as the impact on periods or companies of changes in effective tax rates or net operating losses), and to estimate our value.

We present Adjusted EBITDA because covenants in our Credit Agreement contain ratios based on this measure. Our Credit Agreement is material to us because it is one of our primary sources of liquidity. If our Adjusted EBITDA were to decline below certain levels, covenants in our Credit Agreement that are based on Adjusted EBITDA may be violated and could cause a default and acceleration of payment obligations under our Credit Agreement.

Adjusted EBITDA is not a measurement of our financial performance under GAAP and should not be considered as an alternative to net income, operating income or any other performance measures derived in accordance with GAAP or as an alternative to cash flow from operating activities as a measure of our profitability or liquidity.

Adjusted EBITDA Excluding Slashdot Media

Adjusted EBITDA excluding Slashdot Media is a non-GAAP metric used by management to measure operating performance. Management uses Adjusted EBITDA excluding Slashdot Media as a measure of our financial performance going forward due to our plans to divest of Slashdot Media. Adjusted EBITDA excluding Slashdot Media, represents Adjusted EBITDA defined above, less Slashdot Media EBITDA.

Adjusted Revenues

Adjusted Revenues is a non-GAAP metric used by management to measure operating performance. Adjusted Revenues represents Revenues plus the add back of the fair value adjustment to deferred

revenue related to purchase accounting of acquisitions. We consider Adjusted Revenues to be an important measure to evaluate the performance of our acquisitions.

Adjusted Revenues Excluding Slashdot Media

Adjusted Revenues excluding Slashdot Media is a non-GAAP metric used by management to measure operating performance. Adjusted Revenues excluding Slashdot Media represents Adjusted Revenues as defined above less Slashdot Media revenue. We consider Adjusted Revenues excluding Slashdot Media to be an important measure to evaluate our financial performance going forward due to our plans to divest of Slashdot Media.

Net Income Excluding Slashdot Media

Net Income excluding Slashdot Media is a non-GAAP metric used by management to measure operating performance. Net Income excluding Slashdot Media is defined as Net Income less Slashdot Media Net Income. We consider Net Income excluding Slashdot Media to be an important measure of our financial performance going forward due to our plans to divest of Slashdot Media.

Free Cash Flow

We define free cash flow as net cash provided by operating activities minus capital expenditures. We believe free cash flow is an important non-GAAP measure as it provides useful cash flow information regarding our ability to service, incur or pay down indebtedness or repurchase our common stock. We use free cash flow as a measure to reflect cash available to service our debt as well as to fund our expenditures. A limitation of using free cash flow versus the GAAP measure of net cash provided by operating activities is that free cash flow does not represent the total increase or decrease in the cash balance from operations for the period since it includes cash used for capital expenditures during the period and is adjusted for acquisition related payments within operating cash flows.

Net Cash/Net Debt

Net Cash is defined as cash and cash equivalents less total debt. Net Debt is defined as total debt less cash and cash equivalents. We consider Net Cash and Net Debt to be important measures of liquidity and indicators of our ability to meet ongoing obligations. We also use Net Cash and Net Debt, among other measures, in evaluating our choices for capital deployment. Net Cash and Net Debt presented herein are non-GAAP measures and may not be comparable to similarly titled measures used by other companies.

Forward-Looking Statements

This press release and oral statements made from time to time by our representatives contain forward-looking statements. You should not place undue reliance on those statements because they are subject to numerous uncertainties and factors relating to our operations and business environment, all of which are difficult to predict and many of which are beyond our control. Forward-looking statements include information without limitation concerning our possible or assumed future results of operations, including descriptions of our business strategy. These statements often include words such as “may,” “will,” “should,” “believe,” “expect,” “anticipate,” “intend,” “plan,” “estimate” or similar expressions. These statements are based on assumptions that we have made in light of our experience in the industry as well as our perceptions of historical trends, current conditions, expected future developments and other factors we believe are appropriate under the circumstances. Although we believe that these forward-looking statements are based on reasonable assumptions, you should be aware that many factors could affect our actual financial results or results of operations and could cause actual results to differ materially from those in the forward-looking statements. These factors include, but are not limited to, competition from existing and future competitors in the highly competitive market in which we operate, failure to adapt our

business model to keep pace with rapid changes in the recruiting and career services business, failure to maintain and develop our reputation and brand recognition, failure to increase or maintain the number of customers who purchase recruitment packages, cyclicality or downturns in the economy or industries we serve, failure to attract qualified professionals to our websites or grow the number of qualified professionals who use our websites, failure to successfully identify or integrate acquisitions, U.S. and foreign government regulation of the Internet and taxation, our ability to borrow funds under our revolving credit facility or refinance our indebtedness and restrictions on our current and future operations under such indebtedness. These factors and others are discussed in more detail in the Company’s filings with the Securities and Exchange Commission, all of which are available on the Investors page of our website at www.dhigroupinc.com, including the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2014 (Dice Holdings, Inc. as of December 31, 2014), under the headings “Risk Factors,” “Forward-Looking Statements” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations.”

You should keep in mind that any forward-looking statement made by the Company or its representatives herein, or elsewhere, speaks only as of the date on which it is made. New risks and uncertainties come up from time to time, and it is impossible to predict these events or how they may affect us. We have no obligation to update any forward-looking statements after the date hereof, except as required by applicable law.

|

| | | | | | | | | | | | | | | | | | |

DHI GROUP, INC. |

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS |

(Unaudited) |

(in thousands except per share amounts) |

| | | | | | | | | | |

| | | | For the three months ended September 30, | | For the nine months ended September 30, |

| | | | 2015 | | 2014 | | 2015 | | 2014 |

| | | | | | | | | | |

Revenues | $ | 65,138 |

| | $ | 67,615 |

| | $ | 194,710 |

| | $ | 194,849 |

|

| | | | | | | | | | |

Operating expenses: | | | | | | | |

Cost of revenues | 9,765 |

| | 9,418 |

| | 29,255 |

| | 27,803 |

|

Product development | 7,938 |

| | 6,487 |

| | 22,082 |

| | 19,254 |

|

Sales and marketing | 19,779 |

| | 20,746 |

| | 60,984 |

| | 60,032 |

|

General and administrative | 10,958 |

| | 10,760 |

| | 34,059 |

| | 32,131 |

|

Depreciation | 2,364 |

| | 2,930 |

| | 6,821 |

| | 8,647 |

|

Amortization of intangible assets | 3,376 |

| | 3,798 |

| | 10,875 |

| | 12,552 |

|

Change in acquisition related contingencies | — |

| | 44 |

| | — |

| | 134 |

|

| | Total operating expenses | 54,180 |

| | 54,183 |

| | 164,076 |

| | 160,553 |

|

Operating income | 10,958 |

| | 13,432 |

| | 30,634 |

| | 34,296 |

|

Interest expense | (831 | ) | | (927 | ) | | (2,472 | ) | | (2,875 | ) |

Other income (expense) | 7 |

| | 8 |

| | (2 | ) | | (129 | ) |

Income before income taxes | 10,134 |

| | 12,513 |

| | 28,160 |

| | 31,292 |

|

Income tax expense | 3,623 |

| | 3,020 |

| | 10,879 |

| | 10,196 |

|

Net income | $ | 6,511 |

| | $ | 9,493 |

| | $ | 17,281 |

| | $ | 21,096 |

|

| | | | | | | | | | |

Basic earnings per share | $ | 0.13 |

| | $ | 0.18 |

| | $ | 0.33 |

| | $ | 0.40 |

|

Diluted earnings per share | $ | 0.12 |

| | $ | 0.18 |

| | $ | 0.33 |

| | $ | 0.39 |

|

| | | | | | | | | | |

Weighted average basic shares outstanding | 51,228 |

| | 52,089 |

| | 51,792 |

| | 52,486 |

|

Weighted average diluted shares outstanding | 52,230 |

| | 54,106 |

| | 53,056 |

| | 54,545 |

|

| | | | | | | | | | |

| | | | | | | | | | |

|

| | | | | | | | | | | | | | | | | | |

DHI GROUP, INC. |

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS |

(Unaudited) |

(in thousands) |

| | | | | | | | | | |

| | | | For the three months ended September 30, | | For the nine months ended September 30, |

| | | | 2015 | | 2014 | | 2015 | | 2014 |

Cash flows from operating activities: | | | | | | | | |

| Net income | | $ | 6,511 |

| | $ | 9,493 |

| | $ | 17,281 |

| | $ | 21,096 |

|

Adjustments to reconcile net income to net cash flows from operating activities: | | | | | | | | |

| Depreciation | | 2,364 |

| | 2,930 |

| | 6,821 |

| | 8,647 |

|

| Amortization of intangible assets | | 3,376 |

| | 3,798 |

| | 10,875 |

| | 12,552 |

|

| Deferred income taxes | | 1,455 |

| | (1,632 | ) | | (373 | ) | | (4,317 | ) |

| Amortization of deferred financing costs | | 104 |

| | 93 |

| | 313 |

| | 278 |

|

| Stock based compensation | | 2,410 |

| | 1,739 |

| | 7,490 |

| | 5,886 |

|

| Change in acquisition related contingencies | | — |

| | 44 |

| | — |

| | 134 |

|

| Change in accrual for unrecognized tax benefits | | 8 |

| | 613 |

| | 172 |

| | 893 |

|

Changes in operating assets and liabilities: | | | | | | | | |

| Accounts receivable | | (1,392 | ) | | (1,427 | ) | | 3,437 |

| | (232 | ) |

| Prepaid expenses and other assets | | 474 |

| | 1,726 |

| | 1,601 |

| | (446 | ) |

| Accounts payable and accrued expenses | | 1,481 |

| | 4,600 |

| | (2,332 | ) | | (16 | ) |

| Income taxes receivable/payable | | (280 | ) | | (4,879 | ) | | 6,050 |

| | (956 | ) |

| Deferred revenue | | (4,165 | ) | | (3,347 | ) | | (2,132 | ) | | 3,581 |

|

| Other, net | | 34 |

| | 528 |

| | 166 |

| | 544 |

|

Net cash flows from operating activities | | 12,380 |

| | 14,279 |

| | 49,369 |

| | 47,644 |

|

Cash flows from investing activities: | | | | | | | | |

| Payments for acquisitions, net of cash acquired | | — |

| | — |

| | — |

| | (27,001 | ) |

| Purchases of fixed assets | | (1,782 | ) | | (1,838 | ) | | (6,710 | ) | | (6,784 | ) |

Net cash flows from investing activities | | (1,782 | ) | | (1,838 | ) | | (6,710 | ) | | (33,785 | ) |

Cash flows from financing activities: | | | | | | | | |

| Payments on long-term debt | | (7,625 | ) | | (9,625 | ) | | (28,875 | ) | | (23,875 | ) |

| Proceeds from long-term debt | | 5,000 |

| | 6,000 |

| | 20,000 |

| | 18,000 |

|

| Payments under stock repurchase plan | | (8,182 | ) | | (8,362 | ) | | (29,561 | ) | | (26,909 | ) |

| Payment of acquisition related contingencies | | — |

| | — |

| | (3,829 | ) | | (824 | ) |

| Proceeds from stock option exercises | | 758 |

| | 4,654 |

| | 5,897 |

| | 7,974 |

|

| Purchase of treasury stock related to vested restricted stock | | (119 | ) | | (112 | ) | | (1,665 | ) | | (1,223 | ) |

| Excess tax benefit over book expense from stock based compensation | | 693 |

| | 869 |

| | 2,114 |

| | 1,504 |

|

Net cash flows from financing activities | | (9,475 | ) | | (6,576 | ) | | (35,919 | ) | | (25,353 | ) |

Effect of exchange rate changes | | 127 |

| | 1,103 |

| | 394 |

| | (839 | ) |

Net change in cash and cash equivalents for the period | | 1,250 |

| | 6,968 |

| | 7,134 |

| | (12,333 | ) |

Cash and cash equivalents, beginning of period | | 32,661 |

| | 20,050 |

| | 26,777 |

| | 39,351 |

|

Cash and cash equivalents, end of period | | $ | 33,911 |

| | $ | 27,018 |

| | $ | 33,911 |

| | $ | 27,018 |

|

|

| | | | | | | | | |

DHI GROUP, INC. |

CONDENSED CONSOLIDATED BALANCE SHEETS |

(Unaudited) |

(in thousands) |

| | | | | |

ASSETS | September 30, 2015 | | December 31, 2014 |

Current assets | | | |

| Cash and cash equivalents | $ | 33,911 |

| | $ | 26,777 |

|

| Accounts receivable, net | 40,567 |

| | 49,048 |

|

| Deferred income taxes—current | 3,163 |

| | 3,373 |

|

| Income taxes receivable | 1,068 |

| | 3,973 |

|

| Prepaid and other current assets | 3,308 |

| | 4,764 |

|

| Assets held for sale | 4,683 |

| | — |

|

| | Total current assets | 86,700 |

| | 87,935 |

|

Fixed assets, net | 15,495 |

| | 16,066 |

|

Acquired intangible assets, net | 68,675 |

| | 81,345 |

|

Goodwill | 235,445 |

| | 239,256 |

|

Deferred financing costs, net | 1,007 |

| | 1,320 |

|

Deferred income taxes—non-current | 344 |

| | 399 |

|

Other assets | 645 |

| | 926 |

|

| | Total assets | $ | 408,311 |

| | $ | 427,247 |

|

LIABILITIES AND STOCKHOLDERS’ EQUITY | | | |

Current liabilities | | | |

| Accounts payable and accrued expenses | $ | 23,042 |

| | $ | 25,714 |

|

| Deferred revenue | 81,872 |

| | 86,444 |

|

| Current portion of acquisition related contingencies | — |

| | 3,883 |

|

| Current portion of long-term debt | 4,375 |

| | 2,500 |

|

| Deferred income taxes—current | — |

| | 3 |

|

| Income taxes payable | 4,319 |

| | 1,205 |

|

| Liabilities held for sale | 2,379 |

| | — |

|

| | Total current liabilities | 115,987 |

| | 119,749 |

|

Long-term debt | 97,250 |

| | 108,000 |

|

Deferred income taxes—non-current | 14,703 |

| | 15,478 |

|

Accrual for unrecognized tax benefits | 3,564 |

| | 3,392 |

|

Other long-term liabilities | 2,985 |

| | 2,830 |

|

| | Total liabilities | 234,489 |

| | 249,449 |

|

Total stockholders’ equity | 173,822 |

| | 177,798 |

|

| | Total liabilities and stockholders’ equity | $ | 408,311 |

| | $ | 427,247 |

|

| | | | | |

Supplemental Information and Non-GAAP Reconciliations

On the pages that follow, the Company has provided certain supplemental information that we believe will

assist the reader in assessing our business operations and performance, including certain non-GAAP

financial information and required reconciliations to the most comparable GAAP measures. Certain non-GAAP financial information and required reconciliations exclude Slashdot Media and are used as an important measure of our estimates of financial performance going forward. A statement of operations and statement of cash flows for the three and nine month periods ended September 30, 2015 and 2014 and a balance sheet as of September 30, 2015 and December 31, 2014 are provided elsewhere in this press release.

|

| | | | | | | | | | | | | | | | |

DHI GROUP, INC. |

NON-GAAP AND QUARTERLY SUPPLEMENTAL DATA |

(Unaudited) |

(dollars in thousands except per customer data) |

| | | | | | | | |

| | For the three months ended September 30, | | For the nine months ended September 30, |

| | 2015 | | 2014 | | 2015 | | 2014 |

Revenues by Segment (GAAP Revenue) | | | | | | | |

Tech & Clearance (1) | $ | 35,326 |

| | $ | 34,028 |

| | $ | 103,330 |

| | $ | 99,075 |

|

Finance | 9,286 |

| | 9,449 |

| | 26,799 |

| | 27,493 |

|

Energy | 4,734 |

| | 8,043 |

| | 16,795 |

| | 22,465 |

|

Healthcare | 7,857 |

| | 6,921 |

| | 22,742 |

| | 19,995 |

|

Hospitality | 3,900 |

| | 3,668 |

| | 12,217 |

| | 10,050 |

|

Corporate & Other (1) | 4,035 |

| | 5,506 |

| | 12,827 |

| | 15,771 |

|

| | $ | 65,138 |

| | $ | 67,615 |

| | $ | 194,710 |

| | $ | 194,849 |

|

| | | | | | | |

Add back fair value adjustment to deferred revenue | | | | | | | |

Tech & Clearance | $ | — |

| | $ | — |

| | $ | — |

| | $ | 262 |

|

Energy | — |

| | 160 |

| | — |

| | 617 |

|

Healthcare | — |

| | 153 |

| | — |

| | 839 |

|

Hospitality | — |

| | 164 |

| | — |

| | 1,027 |

|

| | $ | — |

| | $ | 477 |

| | $ | — |

| | $ | 2,745 |

|

Adjusted Revenues by Segment | | | | | | | |

Tech & Clearance | $ | 35,326 |

| | $ | 34,028 |

| | $ | 103,330 |

| | $ | 99,337 |

|

Finance | 9,286 |

| | 9,449 |

| | 26,799 |

| | 27,493 |

|

Energy | 4,734 |

| | 8,203 |

| | 16,795 |

| | 23,082 |

|

Healthcare | 7,857 |

| | 7,074 |

| | 22,742 |

| | 20,834 |

|

Hospitality | 3,900 |

| | 3,832 |

| | 12,217 |

| | 11,077 |

|

Corporate & Other | 4,035 |

| | 5,506 |

| | 12,827 |

| | 15,771 |

|

| | $ | 65,138 |

| | $ | 68,092 |

| | $ | 194,710 |

| | $ | 197,594 |

|

| | | | | | | |

| | | | | | | |

Dice Recruitment Package Customers | | | | | | | |

Beginning of period | 7,750 |

| | 8,000 |

| | 7,800 |

| | 8,100 |

|

End of period | 7,700 |

| | 8,000 |

| | 7,700 |

| | 8,000 |

|

Average for the period (2) | 7,700 |

| | 8,000 |

| | 7,750 |

| | 8,000 |

|

| | | | | | | | |

Dice Average Monthly Revenue per

Recruitment Package Customer (3) | $ | 1,101 |

| | $ | 1,047 |

| | $ | 1,087 |

| | $ | 1,035 |

|

| | | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

|

| | | | | | | | | | | | | | | | |

| | | | | | | |

DHI GROUP, INC. |

NON-GAAP AND QUARTERLY SUPPLEMENTAL DATA (CONTINUED) |

(Unaudited) |

| | | | | | | |

| For the three months ended September 30, | | For the nine months ended September 30, |

| 2015 | | 2014 | | 2015 | | 2014 |

Reconciliation of Net Income to Adjusted EBITDA: | | | | | | | |

Net income | $ | 6,511 |

| | $ | 9,493 |

| | $ | 17,281 |

| | $ | 21,096 |

|

| Interest expense | 831 |

| | 927 |

| | 2,472 |

| | 2,875 |

|

| Income tax expense | 3,623 |

| | 3,020 |

| | 10,879 |

| | 10,196 |

|

| Depreciation | 2,364 |

| | 2,930 |

| | 6,821 |

| | 8,647 |

|

| Amortization of intangible assets | 3,376 |

| | 3,798 |

| | 10,875 |

| | 12,552 |

|

| Change in acquisition related contingencies | — |

| | 44 |

| | — |

| | 134 |

|

| Non-cash stock compensation expense | 2,410 |

| | 1,739 |

| | 7,490 |

| | 5,886 |

|

| Deferred revenue adjustment | — |

| | 477 |

| | — |

| | 2,745 |

|

| Other | (7 | ) | | (8 | ) | | 2 |

| | 129 |

|

Adjusted EBITDA | $ | 19,108 |

| | $ | 22,420 |

| | $ | 55,820 |

| | $ | 64,260 |

|

| | | | | | | |

Reconciliation of Operating Cash Flows to Adjusted EBITDA: | | | | | | | |

Net cash provided by operating activities | $ | 12,380 |

| | $ | 14,279 |

| | $ | 49,369 |

| | $ | 47,644 |

|

| Interest expense | 831 |

| | 927 |

| | 2,472 |

| | 2,875 |

|

| Amortization of deferred financing costs | (104 | ) | | (93 | ) | | (313 | ) | | (278 | ) |

| Income tax expense | 3,623 |

| | 3,020 |

| | 10,879 |

| | 10,196 |

|

| Deferred income taxes | (1,455 | ) | | 1,632 |

| | 373 |

| | 4,317 |

|

| Change in accrual for unrecognized tax benefits | (8 | ) | | (613 | ) | | (172 | ) | | (893 | ) |

| Change in accounts receivable | 1,392 |

| | 1,427 |

| | (3,437 | ) | | 232 |

|

| Change in deferred revenue | 4,165 |

| | 3,347 |

| | 2,132 |

| | (3,581 | ) |

| Deferred revenue adjustment | — |

| | 477 |

| | — |

| | 2,745 |

|

| Changes in working capital and other | (1,716 | ) | | (1,983 | ) | | (5,483 | ) | | 1,003 |

|

Adjusted EBITDA | $ | 19,108 |

| | $ | 22,420 |

| | $ | 55,820 |

| | $ | 64,260 |

|

| | | | | | | | |

Adjusted EBITDA Margin (4) | 29.3 | % | | 32.9 | % | | 28.7 | % | | 32.5 | % |

| | | | | | | | |

Calculation of Free Cash Flow | | | | | | | |

Net cash provided by operating activities | $ | 12,380 |

| | $ | 14,279 |

| | $ | 49,369 |

| | $ | 47,644 |

|

Purchases of fixed assets | (1,782 | ) | | (1,838 | ) | | (6,710 | ) | | (6,784 | ) |

Free Cash Flow | $ | 10,598 |

| | $ | 12,441 |

| | $ | 42,659 |

| | $ | 40,860 |

|

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

|

| | | | | | | | | | | | | | | | |

| | | | | | | | |

| DHI GROUP, INC. |

| NON-GAAP AND QUARTERLY SUPPLEMENTAL DATA (CONTINUED) |

| (Unaudited) |

| | | | |

| | For the three months ended September 30, | | For the nine months ended September 30, |

| | 2015 | | 2014 | | 2015 | | 2014 |

Adjusted Revenues | $ | 65,138 |

| | $ | 68,092 |

| | $ | 194,710 |

| | $ | 197,594 |

|

Less impact of Slashdot Media | 3,506 |

| | 4,751 |

| | 11,173 |

| | 13,509 |

|

Adjusted Revenues, excluding Slashdot Media | $ | 61,632 |

| | $ | 63,341 |

| | $ | 183,537 |

| | $ | 184,085 |

|

| | | | | | | | |

Net Income | $ | 6,511 |

| | $ | 9,493 |

| | $ | 17,281 |

| | $ | 21,096 |

|

Less impact of Slashdot Media | 118 |

| | 675 |

| | 431 |

| | 1,885 |

|

Net Income, excluding Slashdot Media | $ | 6,393 |

| | $ | 8,818 |

| | $ | 16,850 |

| | $ | 19,211 |

|

| | | | | | | | |

Adjusted EBITDA | $ | 19,108 |

| | $ | 22,420 |

| | $ | 55,820 |

| | $ | 64,260 |

|

Less impact of Slashdot Media | 292 |

| | 1,446 |

| | 1,144 |

| | 4,091 |

|

Adjusted EBITDA, excluding Slashdot Media | $ | 18,766 |

| | $ | 20,974 |

| | $ | 54,676 |

| | $ | 60,169 |

|

| | | | | | | | |

Adjusted EBITDA Margin, excluding Slashdot Media (5) | 30.4 | % | | 33.1 | % | | 29.8 | % | | 32.7 | % |

| | | | | | | |

| | | | | | | | |

| | | | | | | | |

Segment Definitions: | | | | | | | |

Tech & Clearance: Dice, ClearanceJobs, Dice Europe (formerly known as The IT Job Board) and related career fairs |

Finance: eFinancialCareers | | | | |

Energy: Rigzone, OilCareers (from acquisition, March 2014 and integrated into the Rigzone platform in March 2015) and related career fairs |

Healthcare: Health eCareers and BioSpace |

Hospitality: Hcareers |

Corporate & Other: Corporate related costs, Slashdot Media and WorkDigital |

| | | | | | | | |

(1) The 2014 period reflects a reclassification of certain revenue from the Tech & Clearance segment to the Corporate & Other segment. |

(2) Reflects the daily average of recruitment package customers during the period. | | | | |

(3) Reflects the simple average of each period presented. | | | | |

(4) Adjusted EBITDA margin is computed as Adjusted EBITDA divided by Adjusted Revenues. |

(5) Adjusted EBITDA margin, excluding Slashdot Media, is computed as Adjusted EBITDA, excluding Slashdot Media, divided by Adjusted Revenues, excluding Slashdot Media. |

| | | | |

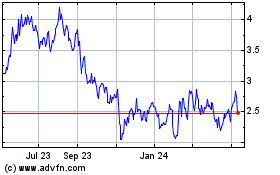

DHI (NYSE:DHX)

Historical Stock Chart

From Mar 2024 to Apr 2024

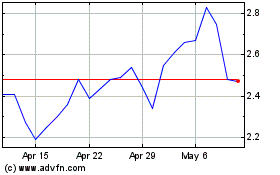

DHI (NYSE:DHX)

Historical Stock Chart

From Apr 2023 to Apr 2024