CURO Group Holdings Corp. (NYSE: CURO) (“CURO” or the

“Company”), a market leader in providing short-term credit to

underbanked consumers, today announced financial results for first

quarter 2019.

“We are pleased to report that first quarter results exceeded

our expectations and 2019 is off to a very solid start,” said Don

Gayhardt, President and Chief Executive Officer. “We are especially

encouraged by the continued progress in Canada with

better-than-expected sequential earnings contribution affirming the

success of our product transition in the second half of 2018.

Adjusted EBITDA for Canada increased 8.9% versus the same quarter a

year ago despite reduced Single-Pay yields and strategic mix shift

away from Single-Pay loans in Ontario. Our U.S. business continues

to do well and posted 10.5% revenue growth on 18.4% loan

growth.”

Consolidated Summary Results

For the Three Months Ended (1) (in thousands, except

per share data) 3/31/2019 3/31/2018

Variance Revenue $ 277,939 $ 250,843

10.8

%

Gross Margin 105,497 105,846 (0.3 )% Company Owned Gross Loans

Receivable 553,215 369,330 49.8

%

Net Income from continuing operations 28,673 24,913 15.1

%

Adjusted Net Income (2) 37,950 37,212 2.0

%

Diluted Earnings per Share from continuing operations $ 0.61 $ 0.53

15.1

%

Adjusted Diluted Earnings per Share (2) $ 0.80 $ 0.78 2.6

%

EBITDA (2) 61,329 63,269 (3.1 )% Adjusted EBITDA (2) 72,854 76,751

(5.1 )% Weighted Average Shares - diluted 47,319

47,416 (1)

Excludes discontinued operations; see "Results of Discontinued

Operations" for additional details of the discontinued operations

impact (2) These are non-GAAP metrics; see "Results of Operations -

CURO Group Consolidated Operations" for a reconciliation to the

nearest GAAP metric for each of these non-GAAP metrics; see

"Non-GAAP Financial Measures" for definition of non-GAAP metric

First quarter 2019 financial developments included:

- Revenue of $277.9 million, an increase

of 10.8% over the prior year period, driven primarily by organic

growth in the U.S. and Open-End growth in Canada. Year-over-year

comparisons included an $8.9 million benefit from the Open-End loss

recognition change (“Q1 2019 Open-End Loss Recognition Change”)

discussed below offset by a similar increase in provision

expense.

- Growth in Company Owned gross loans

receivable and Gross combined loans receivables of 49.8% and 44.2%,

respectively. Year-over-year comparisons benefited from the Q1 2019

Open-End Loss Recognition Change. Excluding the impact of this

change, Company Owned gross loans receivable and Gross combined

loans receivables grew 41.0% and 36.6%, respectively.

- Adjusted Diluted Earnings per Share of

$0.80, an increase of 2.6% over the prior-year period.

- Completed exit from U.K. market.

Discontinued operations for our two U.K. subsidiaries through

February 25, 2019 resulted in Net Income from Discontinued

Operations of $8.4 million for the three months ended March 31,

2019 compared to the $1.6 million Net Loss in the prior-year

quarter.

- Recognition of the loss on investment

in U.K. subsidiaries resulted in an estimated tax benefit of $47.4

million and is expected to result in the elimination of U.S.

federal cash income tax payments for 2019.

- Pay down of our Senior Secured

Revolving Loan Facility from $20.0 million to zero and reduction of

the net balances drawn on our Non-Recourse Canada SPV Facility by

$20.9 million.

- Launched our new demand deposit

account, Revolve Finance, sponsored by Republic Bank of Chicago.

Revolve is being rolled out across our U.S. branches and provides

customers with a checking account solution that combines a

Visa-branded debit card, a number of technology-enabled tools and

optional overdraft protection.

- Our Board of Directors authorized a

share repurchase program providing for the repurchase of up to

$50.0 million of our common stock. The repurchase program will

continue until completed or terminated. We expect the purchases to

be made from time-to-time in the open market and/or in privately

negotiated transactions at our discretion, subject to market

conditions and other factors. Any repurchased shares will be

available for use in connection with equity plans and for other

corporate purposes.

Fiscal 2019 Outlook

The Company affirms full-year 2019 guidance as disclosed in its

Current Report on Form 8-K filed with the Securities and Exchange

Commission on March 1, 2019 as follows:

- Revenue in the range of $1.154 billion

to $1.173 billion, an increase from 2018 revenue of $1.094 billion

of approximately $60 million, or 5% to $80 million, or 7%

- Adjusted Net Income in the range of

$112.0 million to $128.0 million, an increase from 2018 Adjusted

Net Income of $89.5 million of approximately $23 million, or 25%,

to $39 million, or 43%

- Adjusted EBITDA in the range of $240.0

million to $260.0 million, an increase from 2018 Adjusted EBITDA of

$218 million of approximately $22 million, or 10%, to $42 million,

or 20%

- Estimated income tax rate in the range

of 25% to 27%

- Adjusted Diluted Earnings per Share in

the range of $2.35 to $2.65, an increase from 2018 Adjusted Diluted

Earnings per Share of $1.86 of $0.49 per share, or 26%, to $0.79

per share, or 42%

See "Fiscal 2019 Outlook - Reconciliations" at the end of this

release for a reconciliation to the nearest GAAP metric and

"Non-GAAP Financial Measures" for description of non-GAAP

metrics.

Discussion of Consolidated Revenue by Product and

Segment

Three Months Ended March 31,

2019

The following table summarizes revenue by product, including

credit services organization ("CSO") fees, for the periods

indicated. Year-over-year comparisons for Open-End were affected by

the Q1 2019 Open-End Loss Recognition Change. Throughout the

release, data omits our former U.K. operations for all periods

presented, which we discontinued in February 2019.

For the Three Months Ended March

31, 2019 March 31, 2018 (in thousands, unaudited)

U.S. Canada Total U.S.

Canada Total Unsecured Installment $

134,003 $ 1,775 $ 135,778 $ 120,476 $ 4,903 $ 125,379 Secured

Installment 27,477 — 27,477 26,856 — 26,856 Open-End 32,593 20,276

52,869 25,834 1,389 27,223 Single-Pay 27,168 19,593 46,761 26,065

34,292 60,357 Ancillary 4,878 10,176

15,054 5,362 5,666

11,028 Total revenue $ 226,119

$ 51,820 $ 277,939

$ 204,593 $ 46,250

$ 250,843

During the three months ended March 31, 2019, total revenue

grew $27.1 million, or 10.8%, to $277.9 million, compared to the

prior-year period, predominantly driven by growth in Installment

and Open-End loans from strong customer demand and product

introductions in new markets. Geographically, total revenue in the

U.S. and Canada grew 10.5% and 12.0%, respectively. From a product

perspective, Unsecured Installment and Secured Installment revenues

rose 8.3% and 2.3%, respectively, driven by related loan growth.

Year-over-year Single-Pay usage was negatively impacted by

regulatory changes in Ontario as well as a continued general

product mix shift from Single-Pay to Installment and Open-End loans

in the U.S. and Canada. Open-End revenues rose 94.2% on organic

growth in legacy states in the U.S. and growth in Canada, primarily

after the introduction of Open-End products in Ontario in the third

quarter of 2018. Open-End loans in Canada grew $26.0 million, or

16.4%, sequentially (defined within this release as the change from

the fourth quarter of 2018 to the first quarter of 2019) and

Single-Pay loan balances stabilized in Canada sequentially.

Ancillary revenues increased 36.5% versus the same quarter a year

ago, primarily due to the sale of insurance to Installment and

Open-End loan customers in Canada.

The following table presents revenue composition, including CSO

fees, of the products and services that we currently offer:

Three Months Ended March 31,

2019 2018 Installment 58.7 %

60.7 % Canada Single-Pay 7.0 % 13.7 % U.S. Single-Pay 9.8 %

10.4 % Open-End 19.0 % 10.8 % Ancillary 5.5 % 4.4 % Total

100.0 % 100.0 %

For both the three months ended March 31, 2019 and 2018,

revenue generated through the online channel as a percentage of

consolidated revenue was 46%.

Loan Volume and Portfolio Performance Analysis

The following table summarizes Company Owned gross loans

receivable, a GAAP balance sheet measure, and reconciles it to

gross combined loans receivable, a non-GAAP measure(1), including

loans originated by third-party lenders through CSO programs, which

are not included in the Consolidated Financial Statements but from

which we earn revenue and for which we provide a guarantee to the

lender:

For the Period Ended (in millions, unaudited)

March 31,2019 December 31,2018

September 30,2018 June 30,2018 March

31,2018 Company Owned gross loans receivable $ 553.2

$ 571.5 $ 537.8 $ 420.6 $

369.3 Gross loans receivable Guaranteed by the Company 61.9

80.4 78.8

69.2 57.1 Gross combined loans receivable (1)

$ 615.1 $ 651.9

$ 616.6 $ 489.8 $

426.4 (1) See "Non-GAAP Financial Measures" at the end of

this release for definition and more information.

Gross combined loans receivable by product are presented below

(year-over-year and sequential comparisons for Open-End are

affected by the Q1 2019 Open-End Loss Recognition Change):

For the Period Ended (in millions, unaudited)

March 31,2019 December 31,2018

September 30,2018 June 30,2018 March

31,2018 Unsecured Installment $ 161.7 $ 190.4

$ 185.1 $ 160.3 $ 156.0 Secured

Installment 81.0 93.0 91.2 84.6 79.8 Single-Pay 69.7 80.8 77.4 84.7

82.0 Open-End 240.8 207.3 184.1 91.0 51.5 CSO 61.9

80.4 78.8 69.2

57.1 Total $ 615.1

$ 651.9 $ 616.6 $

489.8 $ 426.4

Gross combined loans receivable increased $188.7 million, or

44.2%, to $615.1 million as of March 31, 2019 compared to

$426.4 million as of March 31, 2018. Geographically, gross

combined loans receivable grew 18.4% and 125.8%, respectively, in

the U.S. and Canada, explained further by product in the following

sections. Sequentially, gross combined loans receivable declined

$36.8 million, or 5.7%, for the three months ended March 31,

2019 compared to $65.6 million, or 13.3%, for the three months

ended March 31, 2018 on expected and normal seasonal trends

from U.S. federal income tax refunds. The sequential decline for

the three months ended March 31, 2019 was offset by the

continued growth in Canada Open-End products, discussed further

below.

Unsecured Installment Loans

Unsecured Installment revenue and gross combined loans

receivable increased from the prior year quarter due to growth in

the U.S., primarily in California and CSO. Unsecured Installment

gross combined loans receivable grew $11.2 million, or 5.3%,

compared to March 31, 2018, despite a decline in Canada of

$22.6 million due to mix shift to Open-End loans. In the U.S.,

Unsecured Installment gross combined loans receivable increased

19.5% year-over-year. Canada was negatively impacted by the growth

and customer preference of Open-End during 2018, as further

discussed below. In Canada, total Unsecured Installment loan

originations declined $14.5 million, or 66.3%, from the first

quarter of 2018 also due to mix shift. U.S. originations were up

$12.1 million, or 9.5%, versus the prior-year quarter.

The net charge-off (“NCO”) rate for Company Owned Unsecured

Installment gross loans receivables in the first quarter of 2019

increased approximately 377 bps from the first quarter of 2018,

primarily due to geographic mix shift from Canada to the U.S.

Canadian balances were down $22.6 million compared to the prior

year due to shifting customer preference from Installment to

Open-End, while U.S. balances grew $28.4 million due to customer

demand and higher advertising spend. As a result, the U.S.

percentage mix of total Company Owned Unsecured Installment gross

loans receivable rose from 76.4% last year to 91.2% this year. The

absolute level of NCO rates in the U.S. is higher than Canada, so

the relative growth in the U.S. balances resulted in an overall

increase in the consolidated NCO rate for Company Owned Unsecured

Installment loans. In addition, the NCO rate in the U.S. rose from

20.5% in the first quarter of 2018 to 23.3% in the first quarter of

2019, because of both credit-line increases and expansion of the

Avio brand. As an immature portfolio, Avio has higher relative NCO

rates.

The required Unsecured Installment Allowance for loan losses as

a percentage of Company Owned Unsecured Installment gross loans

receivable ("allowance coverage") increased sequentially from 19.8%

to 20.8%, primarily as a result of higher NCO rates. Past-due

Company Owned Unsecured Installment gross combined loans receivable

as a percentage of related total receivables increased 230 bps to

25.2% from 22.9% in the prior-year quarter on a consolidated basis.

NCO rates for Unsecured Installment loans Guaranteed by the Company

decreased 314 bps compared to the same quarter in 2018. The

required CSO liability for losses decreased sequentially from 15.0%

to 14.4% during the first quarter of 2019 due to improving NCO and

past-due rate comparisons.

2019 2018 (dollars in thousands,

unaudited) First Quarter Fourth Quarter

Third Quarter Second Quarter First

Quarter

Unsecured Installment loans:

Revenue - Company Owned $ 65,542 $ 69,748 $

64,146 $ 54,868 $ 58,437 Provision for losses - Company Owned

33,845 39,565 32,946 23,219 24,739

Net revenue - Company Owned $ 31,697 $ 30,183

$ 31,200 $ 31,649 $ 33,698 Net charge-offs -

Company Owned $ 37,919 $ 37,951 $ 27,308 $ 26,527 $ 30,001 Revenue

- Guaranteed by the Company $ 70,236 $ 75,559 $ 73,514 $ 60,069 $

66,942 Provision for losses - Guaranteed by the Company 27,422

37,352 39,552 26,974 23,556 Net

revenue - Guaranteed by the Company $ 42,814 $ 38,207

$ 33,962 $ 33,095 $ 43,386 Net charge-offs -

Guaranteed by the Company $ 30,421 $ 38,522 $ 37,995 $ 25,667 $

30,743

Unsecured Installment gross combined loans

receivable: Company Owned $ 161,716 $ 190,403 $ 185,130 $

160,285 $ 155,957 Guaranteed by the Company (1)(2) 59,740

77,451 75,807 66,351 54,332 Unsecured

Installment gross combined loans receivable(1)(2) $ 221,456

$ 267,854 $ 260,937 $ 226,636 $ 210,289

Average gross loans receivable: Average Unsecured

Installment gross loans receivable - Company Owned $ 176,060 $

187,767 $ 172,708 $ 158,121 $ 168,773 Average Unsecured Installment

gross loans receivable - Guaranteed by the Company $ 68,596 $

76,629 $ 71,079 $ 60,342 $ 64,744

Allowance for loan losses and

CSO liability for losses: Unsecured Installment Allowance for

loan losses (3) $ 33,666 $ 37,716 $ 36,160 $ 30,291 $ 33,638

Unsecured Installment CSO liability for losses (3) $ 8,583 $ 11,582

$ 12,750 $ 11,193 $ 9,886 Unsecured Installment Allowance for loan

losses as a percentage of Unsecured Installment gross loans

receivable 20.8 % 19.8 % 19.5 % 18.9 % 21.6 % Unsecured Installment

CSO liability for losses as a percentage of Unsecured Installment

gross loans guaranteed by the Company 14.4 % 15.0 % 16.8 % 16.9 %

18.2 %

Unsecured Installment past-due balances: Unsecured

Installment gross loans receivable $ 40,801 $ 49,087 $ 49,637 $

36,125 $ 35,647 Unsecured Installment gross loans guaranteed by the

Company $ 7,967 $ 11,708 $ 12,120 $ 10,319 $ 8,410 Past-due

Unsecured Installment gross loans receivable -- percentage (2) 25.2

% 25.8 % 26.8 % 22.5 % 22.9 % Past-due Unsecured Installment gross

loans guaranteed by the Company -- percentage (2) 13.3 % 15.1 %

16.0 % 15.6 % 15.5 %

Unsecured Installment other

information: Originations - Company Owned $ 78,515 $ 114,182 $

121,415 $ 114,038 $ 89,183 Originations - Guaranteed by the Company

(1) $ 68,899 $ 89,319 $ 91,828 $ 84,082 $ 60,593

Unsecured

Installment ratios: Provision as a percentage of gross loans

receivable - Company Owned 20.9 % 20.8 % 17.8 % 14.5 % 15.9 %

Provision as a percentage of gross loans receivable - Guaranteed by

the Company 45.9 % 48.2 %

52.2 % 40.7 % 43.4 %

(1)

Includes loans originated by third-party

lenders through CSO programs, which are not included in the

Consolidated Financial Statements.

(2)

Non-GAAP measure - Refer to "Non-GAAP

Financial Measures" for further details.

(3)

Allowance for loan losses is reported as a

contra-asset reducing gross loans receivable while the CSO

liability for losses is reported as a liability on the Consolidated

Balance Sheets.

Secured Installment Loans

Secured Installment gross combined loans receivable balances as

of March 31, 2019 increased by $0.6 million, or 0.7%, compared

to March 31, 2018 while related Secured Installment revenue

grew 2.3%. The NCO rate was fairly stable and the past-due rate

improved 120 bps year-over-year. Secured Installment Allowance for

loan losses and CSO liability for losses as a percentage of Secured

Installment gross combined loans receivable decreased sequentially

from 13.2% to 11.9% during the first quarter of 2019.

2019 2018 (dollars in thousands,

unaudited) First Quarter Fourth Quarter

Third Quarter Second Quarter First

Quarter

Secured Installment loans:

Revenue $ 27,477 $ 29,482 $ 28,562 $ 25,777 $

26,856 Provision for losses 7,080 12,035 10,188

7,650 6,640 Net revenue $ 20,397 $

17,447 $ 18,374 $ 18,127 $ 20,216 Net

charge-offs $ 9,822 $ 11,132 $ 9,285 $ 9,003 $ 8,669

Secured

Installment gross combined loan balances: Secured Installment

gross combined loans receivable (2)(3) $ 83,087 $ 95,922 $ 94,194 $

87,434 $ 82,534 Average Secured Installment gross combined loans

receivable $ 89,505 $ 95,058 $ 90,814 $ 84,984 $ 87,676 Secured

Installment Allowance for loan losses and CSO liability for losses

(3) $ 9,874 $ 12,616 $ 11,714 $ 10,812 $ 12,165 Secured Installment

Allowance for loan losses and CSO liability for losses as a

percentage of Secured Installment gross combined loans receivable

11.9 % 13.2 % 12.4 % 12.4 % 14.7 %

Secured Installment past-due

balances: Secured Installment past-due gross loans receivable

and gross loans guaranteed by the Company $ 13,866 $ 17,835 $

17,754 $ 15,246 $ 14,756 Past-due Secured Installment gross loans

receivable and gross loans guaranteed by the Company --

percentage(2) 16.7 % 18.6 % 18.8 % 17.4 % 17.9 %

Secured

Installment other information: Originations (1) $ 33,490 $

49,217 $ 51,742 $ 53,597 $ 34,750

Secured Installment

ratios: Provision as a percentage of gross combined loans

receivable 8.5 % 12.5 %

10.8 % 8.7 % 8.0 %

(1)

Includes loans originated by third-party

lenders through CSO programs, which are not included in the

Consolidated Financial Statements.

(2)

Non-GAAP measure - Refer to "Non-GAAP

Financial Measures" for further details.

(3)

Allowance for loan losses is reported as a

contra-asset reducing gross loans receivable while the CSO

liability for losses is reported as a liability on the Consolidated

Balance Sheets.

Open-End Loans

Open-End loan balances as of March 31, 2019 increased by

$189.2 million compared to March 31, 2018, primarily due to

the launch of Open-End in Canada in late 2017, which amounted to

$167.1 million of the total loan growth. Open-End balances in

Canada grew $26.0 million sequentially from the fourth quarter of

2018 ($22.2 million on a constant currency basis). Remaining

year-over-year loan growth was driven by the organic growth in

seasoned markets, such as Virginia, Tennessee and Kansas.

Q1 2019 Open-End Loss Recognition Change

Effective January 1, 2019, we modified the timeframe in which we

charge-off Open-End loans and made related refinements to our loss

provisioning methodology. Prior to January 1, 2019, we deemed

Open-End loans uncollectible and charged-off when a customer missed

a scheduled payment and the loan was considered past-due. Because

of our continuing shift to Open-End loans in Canada and our

analysis of payment patterns on early-stage versus late-stage

delinquencies, we revised our estimates and now consider Open-End

loans uncollectible when the loan has been contractually past-due

for 90 consecutive days. Consequently, past-due Open-End loans and

related accrued interest now remain in loans receivable for 90 days

before being charged off against the allowance for loan losses. All

recoveries on charged-off loans are credited to the allowance for

loan losses. We evaluate the adequacy of the allowance for loan

losses compared to the related gross loans receivable balances that

include accrued interest.

The aforementioned change was treated as a change in accounting

estimate for accounting purposes and applied prospectively

beginning January 1, 2019.

The change affects comparability to prior periods as

follows:

- Gross combined

loans receivable: balances as of March 31, 2019 include

$32.4 million of Open-End loans that are up to 90 days past-due

with related accrued interest, while such balances for prior

periods do not include any past-due loans.

- Revenues:

for the quarter ended March 31, 2019, revenues include accrued

interest on past-due loan balances of $8.9 million, while revenues

in prior periods do not include comparable amounts.

- Provision for

Losses: prospectively, past-due, unpaid balances plus

related accrued interest charge-off on day 91. Provision expense is

affected by NCOs (total charge-offs less total recoveries) plus

changes to the required Allowance for loan losses. Because NCOs

prospectively include unpaid principal and up to 90 days of related

accrued interest, NCO amounts and rates are higher and the required

Open-End Allowance for loan losses as a percentage of Open-End

gross loans receivable is higher. The Open-End Allowance for loan

losses as a percentage of Open-End gross loans receivable rose from

9.6% as of December 31, 2018 to 19.5% as of March 31, 2019.

The following table reports first quarter Open-End loan

performance including the effect of the Q1 2019 Open-End Loss

Recognition Change:

2019 2018 (dollars in thousands,

unaudited) First Quarter Fourth Quarter

Third Quarter Second Quarter First

Quarter

Open-End loans:

Revenue $ 52,869 $ 47,228 $ 40,290 $ 27,222 $ 27,223

Provision for losses 25,317 28,337 31,686

14,848 11,428 Net revenue $ 27,552 $ 18,891

$ 8,604 $ 12,374 $ 15,795 Net

charge-offs $ (1,521 ) $ 25,218 $ 23,579 $ 11,924 $ 10,972

Open-End gross loan balances: Open-End gross loans

receivable $ 240,790 $ 207,333 $ 184,067 $ 91,033 $ 51,564 Average

Open-End gross loans receivable $ 224,062 $ 195,700 $ 137,550 $

71,299 $ 49,756

Open-End allowance for loan losses:

Allowance for loan losses $ 46,963 $ 19,901 $ 18,013 $ 9,717 $

6,846 Open-End Allowance for loan losses as a percentage of

Open-End gross loans receivable 19.5 % 9.6 % 9.8 % 10.7 % 13.3 %

Open-End past-due balances: Open-End past-due gross loans

receivable $ 32,444 $ — $ — $ — $ — Past-due Open-End gross loans

receivable - percentage 13.5 % — %

— % — % — %

In addition, the following table illustrates, on a pro forma

basis, the first quarter of 2019 results if the Q1 2019 Open-End

Loss Recognition Change had been applied to our outstanding

Open-End loan portfolio as of December 31, 2018. This table is

illustrative of retrospective application to determine the net

charge-offs that would have been incurred in first quarter of 2019

from the December 31, 2018 loan book. The purpose of this pro forma

illustration is primarily to provide a representative level of NCO

rates from applying the Q1 2019 Open-End Loss Recognition

Change.

Pro Forma 2019 (dollars in thousands,

unaudited) First Quarter

Open-End

loans: Revenue $ 52,869 Provision for losses 25,317 Net

revenue $ 27,552 Net charge-offs $ 31,788

Open-End gross

loan balances: Open-End gross loans receivable $ 240,790

Average Open-End gross loans receivable $ 245,096 Net-charge offs

as a percentage of average gross loans receivable 13.0 %

Open-End allowance for loan losses: Allowance for loan

losses $ 46,963 Open-End Allowance for loan losses as a percentage

of Open-End gross loans receivable 19.5 %

Open-End past-due

balances: Open-End past-due gross loans receivable $ 32,444

Past-due Open-End gross loans receivable - percentage

13.5 %

Single-Pay

Single-Pay revenue and related loans receivable during the three

months ended March 31, 2019 declined year-over-year compared

to the three months ended March 31, 2018, primarily due to

regulatory changes in Canada (rate changes in Ontario and British

Columbia) that accelerated the shift to Open-End loans, as well as

a continued general product shift away from Single-Pay to

Installment and Open-End loans in the U.S. and Canada. The

aforementioned Open-End growth in Canada ($167.1 million

year-over-year) in part came at the expense of Single-Pay loan

balances, which shrank year-over-year by $15.4 million. The

Single-Pay NCO rate improved 160 bps year-over-year.

2019 2018 (dollars in thousands,

unaudited) First Quarter Fourth Quarter

Third Quarter Second Quarter First

Quarter

Single-Pay loans:

Revenue $ 46,761 $ 49,696 $ 50,614 $ 58,325 $ 60,357

Provision for losses 8,268 12,825 12,757

13,101 9,892 Net revenue $ 38,493 $ 36,871

$ 37,857 $ 45,224 $ 50,465 Net

charge-offs $ 8,610 $ 11,838 $ 12,892 $ 12,976 $ 11,518

Single-Pay gross loan balances: Single-Pay gross loans

receivable $ 69,753 $ 80,823 $ 77,390 $ 84,665 $ 82,041 Average

Single-Pay gross loans receivable $ 75,288 $ 79,107 $ 81,028 $

83,353 $ 88,285 Single-Pay Allowance for loan losses $ 3,897 $

4,189 $ 3,293 $ 3,604 $ 3,514 Single-Pay Allowance for loan losses

as a percentage of Single-Pay gross loans receivable

5.6 % 5.2 % 4.3 % 4.3 %

4.3 %

Results of Operations - CURO Group

Consolidated Operations

Condensed Consolidated Statements of

Operations

(Unaudited)

(in thousands, unaudited) Three Months Ended March 31,

2019 2018 Change $

Change % Revenue $ 277,939 $ 250,843

$ 27,096 10.8

%

Provision for losses 102,385 76,883 25,502

33.2

%

Net revenue 175,554 173,960 1,594 0.9

%

Advertising costs 7,786 7,885 (99 ) (1.3 )% Non-advertising costs

of providing services 62,271 60,229 2,042 3.4

%

Total cost of providing services 70,057 68,114 1,943

2.9

%

Gross margin 105,497 105,846 (349 ) (0.3 )%

Operating expense Corporate, district and other expenses

49,088 35,429 13,659 38.6

%

Interest expense 17,690 22,354 (4,664 ) (20.9 )% Loss on

extinguishment of debt — 11,683 (11,683 ) # Total

operating expense 66,778 69,466 (2,688 ) (3.9 )%

Net income from continuing operations before income taxes

38,719 36,380 2,339 6.4

%

Provision for income taxes 10,046 11,467 (1,421 )

(12.4 )% Net income from continuing operations 28,673 24,913 3,760

15.1

%

Net income (loss) from discontinued operations, net of tax 8,375

(1,621 ) 9,996 #

Net income $

37,048 $ 23,292 $ 13,756

59.1

%

# - Change greater than 100% or not meaningful.

Reconciliation of Net income from continuing operations and

Diluted Earnings per Share to Adjusted Net Income and Adjusted

Diluted Earnings per Share, non-GAAP measures

(in thousands, except per share data, unaudited)

Three Months Ended March 31, 2019 2018

Change $ Change % Net income from

continuing operations $ 28,673 $ 24,913

$ 3,760 15.1 % Adjustments: Loss on extinguishment of

debt (1) — 11,683 Restructuring costs (2) 1,752 — U.K. related

costs (3) 7,817 — Share-based cash and non-cash compensation (4)

2,172 1,842 Intangible asset amortization 796 663 Impact of tax law

changes (5) — 1,800 Cumulative tax effect of adjustments (3,260 )

(3,689 ) Adjusted Net Income $

37,950 $ 37,212 $ 738 2.0 % Net income from continuing

operations $ 28,673 $ 24,913 Diluted Weighted Average Shares

Outstanding 47,319 47,416 Diluted Earnings per Share from

continuing operations $ 0.61 $ 0.53 $ 0.08 15.1 % Per Share impact

of adjustments to Net Income 0.19 0.25

Adjusted Diluted Earnings per Share

$ 0.80 $ 0.78 $

0.02 2.6 %

Reconciliation of Net income from continuing operations to

EBITDA and Adjusted EBITDA, non-GAAP measures

Three Months Ended March 31, (in thousands, except

per share data, unaudited) 2019 2018

Change $ Change % Net income from

continuing operations $ 28,673 $ 24,913

$ 3,760 15.1

%

Provision for income taxes 10,046 11,467 (1,421 ) (12.4 )% Interest

expense 17,690 22,354 (4,664 ) (20.9 )% Depreciation and

amortization 4,920 4,535

385 8.5

%

EBITDA 61,329 63,269 (1,940 ) (3.1 )% Loss on extinguishment of

debt (1) — 11,683 Restructuring costs (2) 1,752 — U.K. related

costs (3) 7,817 — Share-based cash and non-cash compensation (4)

2,172 1,842 Other adjustments (6) (216 ) (43 ) Adjusted

EBITDA $ 72,854 $ 76,751

$ (3,897 ) (5.1 )% Adjusted EBITDA Margin 26.2 %

30.6 % (1)

For the three months ended March 31, 2018, the $11.7 million

of loss on extinguishment of debt was for the redemption of $77.5

million of the CURO Financial Technologies Corp.'s ("CFTC") 12.00%

Senior Secured Notes due 2022. (2) Restructuring costs of $1.8

million for the three months ended March 31, 2019 were due to

eliminating 121 positions in North America. The store employee

reductions help better align store staffing with in-store customer

traffic and volume patterns, as more of our growth comes from

online channels and as store customers require less time in stores

as they conduct more of the follow-up activities online. The

elimination of certain corporate positions relate to efficiency

initiatives and will allow the Company to reallocate investment to

strategic growth activities. (3) U.K. related costs of $7.8 million

for the three months ended March 31, 2019 relate to placing the

U.K. subsidiaries into administration on February 25, 2019, which

includes $7.6 million to obtain consent from the holders of the

8.25% Senior Secured Notes to deconsolidate the U.K. Segment and

$0.2 million for other costs. (4) We approved the adoption of

share-based compensation plans during 2010 and 2017 for key members

of senior management. The estimated fair value of share-based

awards is recognized as non-cash compensation expense on a

straight-line basis over the vesting period. (5) As a result of the

Tax Cuts and Jobs Act of 2017 ("2017 Tax Act"), which became law on

December 22, 2017, we provided an estimate of the new repatriation

tax as of December 31, 2017. Subsequent to further guidance

published in the first quarter of 2018, we booked additional tax

expense of $1.2 million for the 2017 repatriation tax.

Additionally, the 2017 Tax Act provided for a new GILTI ("Global

Intangible Low-Taxed Income") tax starting in 2018 and we estimated

and provided tax expense of $0.6 million as of March 31, 2018. (6)

Other adjustments include deferred rent and the intercompany

foreign exchange impact. Deferred rent represents the non-cash

component of rent expense.

For the three months ended March 31, 2019 and 2018

Revenue and Net Revenue

Revenue increased $27.1 million, or 10.8%, to $277.9 million for

the three months ended March 31, 2019 from $250.8 million for the

three months ended March 31, 2018. Revenue for the three months

ended March 31, 2019 includes accrued interest on past-due Open-End

loan balances of $8.9 million from the Q1 2019 Open-End Loss

Recognition Change, offset by higher provision rate and higher

allowance discussed further below. U.S. revenue increased 10.5%

driven by volume growth. Canadian revenue increased 12.0% (13.9% on

a constant currency basis) as volume growth offset yield

compression from negative regulatory impacts on Single-Pay loan

rates and the significant product mix-shift to Open-End loans.

Provision for losses increased $25.5 million, or 33.2%, to

$102.4 million for the three months ended March 31, 2019 from $76.9

million for the three months ended March 31, 2018 because of the Q1

2019 Open-End Loss Recognition Change, increased earning asset

volume year-over-year and higher NCO rates as further described in

the "Segment Analysis" below.

Cost of Providing Services

The total cost of providing services increased $1.9 million, or

2.9%, to $70.1 million in the three months ended March 31, 2019,

compared to $68.1 million in the three months ended March 31, 2018,

primarily because of increased loan servicing costs on higher

volume, higher performance-based variable compensation and $0.2

million of restructuring costs to better align our store staffing

with in-store customer traffic growth as more of our customers

transact with us digitally.

Operating Expenses

Corporate, district and other expenses increased $13.7 million,

or 38.6%, primarily as a result of $7.8 million for the bondholder

consent associated with discontinuing our U.K. operations and other

related U.K. separation costs, $1.5 million of restructuring costs

from our previously-announced reduction-in-force during January

2019, higher professional fees associated with our first year-end

for full compliance with Sarbanes-Oxley, and higher

performance-based variable compensation.

Provision for Income Taxes

The effective income tax rate from continuing operations for the

three months ended March 31, 2019 was 25.9%, compared to 31.5% for

the three months ended March 31, 2018. As a result of the 2017 Tax

Act, the corporate income tax rate for the U.S. decreased from 35%

in 2017 to 21%, effective 2018. The income tax provision for the

three months ended March 31, 2018 includes accruals of $1.2 million

for adjustments to estimates of the tax on prior years' foreign

repatriation and $0.6 million for the then-new GILTI tax. The $1.2

million additional provision on prior years' foreign repatriation

was the result of additional interpretative guidance from the IRS

issued during the first quarter of 2018. These two items increased

the effective income tax rate by 4.9 percentage points. Excluding

the impact of these items, the effective income tax rate for the

three months ended March 31, 2018 would have been 26.6%.

Segment Analysis

We report financial results for two reportable segments: the

U.S. and Canada. Following is a summary of results of operations

for the segment and period indicated:

U.S. Segment Results Three Months Ended March

31, (dollars in thousands, unaudited) 2019

2018 Change $ Change % Revenue $

226,119 $ 204,593 $ 21,526

10.5

%

Provision for losses 84,980 64,333

20,647 32.1

%

Net revenue 141,139 140,260 879 0.6

%

Advertising costs 6,354 5,159 1,195 23.2

%

Non-advertising costs of providing services 44,982

43,757 1,225 2.8

%

Total cost of providing services 51,336 48,916

2,420 4.9

%

Gross margin 89,803 91,344 (1,541 ) (1.7 )% Corporate,

district and other expenses 43,880 30,532 13,348 43.7

%

Interest expense 14,728 22,297 (7,569 ) (33.9 )% Loss on

extinguishment of debt — 11,683

(11,683 ) # Total operating expense 58,608

64,512 (5,904 ) (9.2 )%

Segment

operating income 31,195 26,832 4,363 16.3

%

Interest expense 14,728 22,297 (7,569 ) (33.9 )% Depreciation and

amortization 3,726 3,407

319 9.4

%

EBITDA 49,649 52,536 (2,887 ) (5.5 )% Loss on extinguishment

of debt — 11,683 (11,683 ) Restructuring and other costs 1,617 —

1,617 Other adjustments (105 ) (59 ) (46 ) Transaction-related

costs 7,817 — 7,817 Share-based cash and non-cash compensation

2,172 1,842 330

Adjusted EBITDA $ 61,150

$ 66,002 $ (4,852 ) (7.4 )% # -

Change greater than 100% or not meaningful

U.S. Segment Results - For the three

months ended March 31, 2019 and 2018

First quarter U.S. revenues increased by $21.5 million, or

10.5%, to $226.1 million. U.S. revenue growth was driven by a $59.6

million, or 18.4%, increase in gross combined loans receivable to

$383.4 million at March 31, 2019, compared to $323.8 million at

March 31, 2018. Additionally, U.S. revenue for the three months

ended March 31, 2019 includes accrued interest on past-due Open-End

loan balances of $7.6 million from the Q1 2019 Open-End Loss

Recognition Change, offset by higher provision rate and higher

allowance discussed further below. Unsecured Installment

receivables increased year-over-year $33.8 million, or 19.5%.

Open-End receivables increased $22.2 million, or 64.2%

year-over-year, primarily because of organic growth in Virginia,

Tennessee and Kansas. Secured Installment gross combined

receivables increased from the prior year period by $0.6 million,

or 0.7%, while Single-Pay receivables grew $3.1 million, or

9.3%.

The increase of $20.6 million, or 32.1%, in the provision for

losses was due to (i) the Q1 2019 Open-End Loss Recognition Change,

(ii) year-over-year higher earning asset volume for Unsecured

Installment loans, (iii) higher NCO rates, primarily for Company

Owned Unsecured Installment loans, and (iv) the first quarter 2018

provision for losses, which was impacted favorably by adjustments

to allowance coverage levels. The provision for loan losses and

related loan portfolio performance is further analyzed under

"Consolidated Revenue Summary--Loan Volume and Performance

Analysis" above.

U.S. cost of providing services for the three months ended March

31, 2019 was $51.3 million, an increase of $2.4 million, or 4.9%,

compared to $48.9 million for the three months ended March 31,

2018. The increase was due to $1.2 million, or 23.2%, higher

advertising costs, concentrated in the online channel. Advertising

as a percentage of revenue was 2.8% for the three months ended

March 31, 2019, up slightly from the prior-year period of 2.5%. The

remaining increase is due to higher performance-based variable

compensation costs and the aforementioned restructuring costs.

Corporate, district and other operating expenses increased $13.3

million, or 43.7%, compared to the same period in the prior year,

primarily due to $7.8 million of U.K. disposition-related costs,

$1.9 million higher performance-based variable compensation costs,

$1.4 million of restructuring costs and $1.3 million higher

professional fees.

U.S. interest expense for the first quarter of 2019 decreased by

$7.6 million compared to the prior-year period, primarily due to

our refinancing activities in 2018. During the third quarter of

2018, we issued $690.0 million of 8.25% Senior Secured Notes and

used the proceeds from the issuance to extinguish our higher

interest-rate $527.5 million 12.00% Senior Secured Notes. In

addition, we entered into a Non-Recourse Canada SPV Facility in the

third quarter of 2018 with a lower interest rate than our previous

U.S. SPV facility, which we fully repaid with the proceeds from our

the 8.25% Senior Secured Notes.

Canada Segment Results Three Months Ended

December 31, (dollars in thousands, unaudited) 2019

2018 Change $ Change %

Revenue $ 51,820 $ 46,250 $ 5,570

12.0

%

Provision for losses 17,405 12,550

4,855 38.7

%

Net revenue 34,415 33,700 715 2.1

%

Advertising costs 1,432 2,726 (1,294 ) (47.5 )% Non-advertising

costs of providing services 17,289 16,472

817 5.0

%

Total cost of providing services 18,721 19,198

(477 ) (2.5 )%

Gross margin 15,694

14,502 1,192 8.2

%

Corporate, district and other expenses 5,208 4,897 311 6.4

%

Interest expense 2,962 57

2,905 # Total operating expense 8,170

4,954 3,216 64.9

%

Segment operating income 7,524 9,548 (2,024 ) (21.2 )%

Interest expense 2,962 57 2,905 # Depreciation and amortization

1,194 1,128 66 5.9

%

EBITDA 11,680 10,733 947 8.8

%

Restructuring and other costs 135 — 135 Other adjustments (111 )

16 (127 )

Adjusted EBITDA

$ 11,704 $ 10,749

$ 955 8.9

%

# - Change greater than 100% or not meaningful.

Canada Segment Results - For the three

months ended March 31, 2019 and 2018

Canada revenue increased $5.6 million, or 12.0%, to $51.8

million for the three months ended March 31, 2019 from $46.3

million in the prior year period. On a constant currency basis,

revenue increased $6.5 million, or 13.9%. Revenue growth in Canada

was impacted by the significant asset growth and product mix shift

from the accelerated transition from Single-Pay and Unsecured

Installment loans to Open-End loans that have a lower yield.

Additionally, Canada revenues for the three months ended March 31,

2019 includes accrued interest on past-due Open-End loan balances

of $1.3 million from the Q1 2019 Open-End Loss Recognition Change,

offset by higher provision rate and higher allowance discussed

further below. Single-Pay yields were negatively affected by

regulatory rate changes in Ontario and British Columbia. On a

constant currency basis, total gross loan receivables grew by

$137.3 million, or 133.8%, compared to the same period in the prior

year.

As expected, Single-Pay revenue decreased $14.7 million, or

42.9%, to $19.6 million for the three months ended March 31, 2019,

and Single-Pay receivables decreased $15.4 million, or 31.5%, to

$33.4 million from $48.7 million in the prior year. The decreases

in Single-Pay revenue and receivables were due to the product mix

shift in Canada from Single-Pay loans to Open-End loans and by

regulatory changes effective January and July 2018 that lowered

Single Pay pricing year-over-year.

Canadian non-Single-Pay revenue increased $20.3 million, or

169.5%, to $32.2 million compared to $12.0 million the same quarter

a year ago, on $144.5 million, or 268.2%, growth in related loan

balances. The increase was primarily related to the launch of

Open-End products in Alberta and Ontario in the fourth quarter of

2017, and significant expansion of the Open-End product in Ontario

in late 2018.

The provision for losses increased $4.9 million, or 38.7%, to

$17.4 million for the three months ended March 31, 2019 compared to

$12.6 million in the prior-year period, because of upfront

provisioning on Open-End loan volumes and mix shift from Single-Pay

loans and Unsecured Installment to Open-End loans. Total Open-End

and Installment loans grew by $24.8 million sequentially during the

first quarter of 2019, compared to sequential growth of $1.9

million in the first quarter of 2018. On a constant currency basis,

provision for losses increased by $5.1 million, or 41.0%.

The total cost of providing services in Canada remained

consistent for the three months ended March 31, 2019 compared to

the prior-year period. Advertising costs were lower by $1.3

million, or 47.5%, partially offset by an increase in

non-advertising cost of providing services of $0.8 million. There

was no material impact on the cost of providing services from

exchange rate changes.

Canada operating expenses increased $3.2 million, or 64.9%, to

$8.2 million in the three months ended March 31, 2019 from $5.0

million in the prior year period, primarily due to interest expense

on the Non-Recourse Canada SPV Facility that began in August

2018.

Results of Discontinued Operations

On February 25, 2019, in accordance with the provisions of the

U.K. Insolvency Act 1986 and as approved by the boards of directors

of the Company’s U.K. subsidiaries, Curo Transatlantic Limited

("CTL") and SRC Transatlantic Limited (collectively with CTL, “the

U.K. Subsidiaries”), insolvency practitioners from KPMG were

appointed as administrators (“Administrators”) in respect of the

U.K. Subsidiaries. The effect of the U.K. Subsidiaries’ entry into

administration was to place the management, affairs, business and

property of the U.K. Subsidiaries under the direct control of the

Administrators. Accordingly, the Company deconsolidated the U.K.

Subsidiaries as of February 25, 2019, which are classified as

Discontinued Operations for the first quarter of 2019. The

following is a summary of the financial results of the U.K.

business, which meet the criteria of Discontinued Operations and,

therefore, are excluded from the Company’s results of continuing

operations:

(in thousands, unaudited) Three Months Ended March

31, 2019 2018 Revenue (1) $ 6,957

$ 10,915 Provision for losses (1) 1,703 4,148

Net revenue 5,254 6,767 Cost of

providing services (1) 1,082 3,368 Corporate, district and other

(1) 3,806 4,899 Interest income (1) — (5 ) Depreciation and

amortization (1) — 126 Loss on disposition (1) 39,414 —

Pre-tax loss from Discontinued Operations (39,048 )

(1,621 ) Income tax benefit Benefit related to disposition (47,423

) —

Income (loss) from discontinued operations $

8,375 $ (1,621 )

Income (loss) from discontinued

operations $ 8,375 $ (1,621 ) Income tax benefit (47,423 ) —

Interest income — (5 ) Depreciation and amortization — 126

EBITDA (2) (39,048 ) (1,500 ) U.K.

disposition, redress and related costs 40,845 — Other adjustments

(10 ) (36 )

Adjusted EBITDA (2) $ 1,787

$ (1,536 )

(1)

For the three months ended March 31, 2019,

includes operations through February 25, 2019

(2)

See "Non-GAAP Financial Measures" at the

end of this release for description of non-GAAP metric.

Revenue and expenses related to discontinued operations include

activity prior to the deconsolidation of the Company’s U.K.

subsidiaries effective February 25, 2019. In previously issued

financial statements, the $1.5 million of Adjusted EBITDA loss

ascribed to discontinued operations for the three months ended

March 31, 2018 was included in the Company's consolidated Adjusted

EBITDA. For the three months ended March 31, 2019, "Loss on

disposition" of $39.4 million includes the non-cash effect of

eliminating assets and liabilities of the U.K. Subsidiaries as of

the date of deconsolidation, as well as the effect of cumulative

currency exchange rate differences on the U.S. investment in the

U.K.

In connection with the disposition of the U.K. Subsidiaries, the

U.S. entity that owned our interests in the U.K. Subsidiaries

recognized a loss on investment. This loss resulted in an estimated

U.S. tax benefit of $47.4 million which will be available to offset

the Company's future U.S. federal and state cash income tax

obligations.

CURO GROUP HOLDINGS CORP. AND

SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS

(in thousands)

March 31, 2019(unaudited)

December 31,2018

ASSETS Cash $ 82,859 $ 61,175 Restricted cash (includes

restricted cash of consolidated VIEs of $15,460 and $12,840 as of

March 31, 2019 and December 31, 2018, respectively) 34,319 25,439

Gross loans receivable (includes loans of consolidated VIEs of

$180,631 and $148,876 as of March 31, 2019 and December 31, 2018,

respectively) 553,215 571,531 Less: allowance for loan losses

(includes allowance for losses of consolidated VIEs of $22,764 and

$12,688 as of March 31, 2019 and December 31, 2018, respectively)

(94,322 ) (73,997 ) Loans receivable, net 458,893 497,534 Right of

use asset - operating leases 135,405 — Deferred income taxes 5,014

1,534 Income taxes receivable 40,872 16,741 Prepaid expenses and

other 36,511 43,588 Property and equipment, net 75,260 76,750

Goodwill 119,878 119,281

Other intangibles, net of accumulated

amortization of $35,662 and $34,576 as of March 31, 2019 and

December 31, 2018, respectively

29,968 29,784 Other 15,151 12,930 Assets of discontinued operations

— 34,861 Total Assets $ 1,034,130 $ 919,617

LIABILITIES AND STOCKHOLDERS' EQUITY Accounts payable

and accrued liabilities $ 52,042 $ 49,146 Deferred revenue 7,851

9,483 Lease liability - operating leases 143,412 — Income taxes

payable 4,425 1,579 Accrued interest (includes accrued interest of

consolidated VIEs of $848 and $831 as of March 31, 2019 and

December 31, 2018, respectively) 5,593 20,904 Liability for losses

on CSO lender-owned consumer loans 8,662 12,007 Deferred rent —

10,851 Long-term debt (includes long-term debt and issuance costs

of consolidated VIEs of $92,718 and $3,803 and $111,335 and $3,856

as of March 31, 2019 and December 31, 2018, respectively) 766,068

804,140 Subordinated shareholder debt 2,243 2,196 Other long-term

liabilities 6,686 5,800 Deferred tax liabilities 404 13,730

Liabilities of discontinued operations — 8,882 Total

Liabilities $ 997,386 $ 938,718 Stockholders' Equity

Total Stockholders' Equity (Deficit) $ 36,744 $ (19,101 )

Total Liabilities and Stockholders' Equity $

1,034,130 $ 919,617

Balance Sheet Changes - March 31, 2019 compared to December

31, 2018

Cash - Cash balance increased from

December 31, 2018 primarily because of seasonal trends in consumer

loan receivables.

Gross Loans Receivable and Allowance for

Loan Losses - As noted in "Consolidated Revenue

Summary--Loan Volume and Portfolio Performance Analysis" above,

changes in Gross Loans Receivable and related Allowance for Loan

Losses were due to expected and normal seasonality trends resulting

from higher customer demand and loan origination volumes during the

fourth quarter of 2018 as well as the product mix shift from

Single-Pay to Installment and Open-End loans (primarily in

Canada).

Right of use asset and lease liability and

Deferred rent - Due to the adoption of ASU No. 2016-02,

which requires lessees to record leases on the balance sheet and

disclose key information about leasing arrangements, we recorded a

right of use asset of $135.4 million and a lease liability of

$143.4 million as of January 1, 2019.

Income taxes receivable - The

increase from December 31, 2018 is primarily due to the current tax

benefit realized from the loss on disposal of the U.K. entities.

See "Results of Discontinued Operations" section for additional

details.

Long-term debt (including current

maturities) and Accrued Interest - During the first quarter

ended March 31, 2019, we made a $20.0 million payment on the Senior

Revolver to reduce the outstanding balance to zero and made net

repayments of $20.9 million on the Non-Recourse Canada SPV

Facility.

Fiscal 2019 Outlook - Reconciliations

Reconciliation of Net income from continuing operations and

Diluted Earnings per Share to Adjusted Net Income and Adjusted

Diluted Earnings per share, non-GAAP measures (1)

(unaudited)

Fiscal 2019 Outlook Year Ending December

31, 2019 (in thousands, except per share data)

Low High Net income from

continuing operations $ 103,500 $ 119,500

Adjustments: Non-cash rent expense and foreign currency exchange

rate impact (2) (3) — — Share-based cash and non-cash compensation

9,000 9,000 Intangible asset amortization 2,500 2,500 Cumulative

tax effect of adjustments (3,000 ) (3,000 )

Adjusted Net

Income $ 112,000 $ 128,000 Net income $ 103,500 $

119,500 Diluted Weighted Average Shares Outstanding 47,700 48,300

Diluted Earnings per Share $ 2.17 $ 2.47 Per Share impact of

adjustments to Net Income 0.18 0.18

Adjusted

Diluted Earnings per Share $ 2.35

$ 2.65

Reconciliation of Net Income to EBITDA and Adjusted EBITDA,

non-GAAP measures (1) (unaudited)

Fiscal 2019 Outlook Year Ending December

31, 2019 (in thousands)

Low

High Net income $ 103,500

$ 119,500 Provision for income taxes 36,200 40,200 Interest expense

73,000 73,000 Depreciation and amortization 18,300 18,300

EBITDA 231,000 251,000 Non-cash rent expense and foreign currency

exchange rate impact (2) (3) — — Share-based cash and non-cash

compensation 9,000 9,000

Adjusted EBITDA

$ 240,000 $ 260,000 (1) See

"Non-GAAP Financial Measures" at the end of this release for more

information. (2) We have historically excluded the impact of

non-cash interest expense from adjusted earnings metrics. With the

adoption of ASU No.2016.02 - Leases, effective January 1, 2019, we

anticipate the difference between GAAP-basis rent expense and cash

rent paid will grow. However, the we will continue to adjust for

this difference. (3) We have historically excluded the impact of

foreign currency translation and hedges from adjusted earnings

metrics. We do not include the impact of any hedge settlement or

realized currency gains or losses in our outlook.

About CURO

CURO Group Holdings Corp. (NYSE: CURO), operating in two

countries and powered by its fully integrated technology platform,

is a market leader by revenues in providing short-term credit to

underbanked consumers. In 1997, the Company was founded in

Riverside, California by three Wichita, Kansas childhood friends to

meet the growing consumer need for short-term loans. Their success

led to opening stores across the United States and expanding to

offer online loans and financial services across two countries.

Today, CURO combines its market expertise with a fully integrated

technology platform, omni-channel approach and advanced credit

decisioning to provide an array of short-term credit products

across all mediums. CURO operates under a number of brands

including Speedy Cash, Rapid Cash, Cash Money, LendDirect, Avío

Credit, and Opt+. With over 20 years of operating experience, CURO

provides financial freedom to the underbanked.

Conference Call

CURO will host a conference call to discuss these results at

8:15 a.m. Eastern Time on Tuesday, April 30, 2019. The live

webcast of the call can be accessed at the CURO Investor Relations

website at http://ir.curo.com/.

You may access the call at 1-800-347-6311 (1-786-460-7199 for

international callers). Please ask to join the CURO Group Holdings

call. A replay of the conference call will be available until May

7, 2019, at 11:15 a.m. Eastern Time. An archived version

of the webcast will be available on the CURO Investors website for

90 days. You may access the conference call replay at

1-888-203-1112 (1-719-457-0820 for international callers). The

replay access code is 7779569.

Final Results

The financial results presented and discussed herein are on a

preliminary and unaudited basis; final audited data will be

included in the Company’s Quarterly Report on Form 10-Q for the

period ended March 31, 2019.

Forward-Looking Statements

This press release contains forward-looking statements. These

forward-looking statements include statements related to our

expectations regarding product transition in Canada, our

anticipated elimination of U.S. federal cash income tax payments

for 2019, our expectations regarding our share repurchase program,

our fiscal 2019 outlook and our expectation that the difference

between GAAP basis rent expense and cash rent paid will grow. In

addition, words such as “as “guidance,” “estimate,” “anticipate,”

“believe,” “forecast,” “step,” “plan,” “predict,” “focused,”

“project,” “is likely,” “expect,” “intend,” “should,” “will,”

“confident,” variations of such words and similar expressions are

intended to identify forward-looking statements. Our ability

to achieve these forward-looking statements is based on certain

assumptions and judgments, including our ability to execute on our

business strategy and our ability to accurately predict our future

financial results. These assumptions and judgments may prove to be

inaccurate in the future. These forward-looking statements are not

guarantees of future performance and involve known and unknown

risks and uncertainties that are difficult to predict with regard

to timing, extent, likelihood and degree of occurrence. There are

important factors both within and outside of our control that could

cause our actual results to differ materially from those in the

forward-looking statements. These factors include our level of

indebtedness; errors in our internal forecasts; our dependence on

third-party lenders to provide the cash we need to fund our loans

and our ability to affordably access third-party financing; actions

of regulators and the negative impact of those actions on our

business; our ability to protect our proprietary technology and

analytics and keep up with that of our competitors; disruption of

our information technology systems that adversely affect our

business operations; ineffective pricing of the credit risk of our

prospective or existing customers; inaccurate information supplied

by customers or third parties would could lead to errors in judging

customers’ qualifications to receive loans; improper disclosure of

customer personal data; failure or third parties who provide

products, services or support to us; any failure of

third-party-lenders upon whom we rely to conduct business in

certain states; disruption to our relationships with banks and

other third-part electronic payment solutions providers; disruption

caused by employee or third-party theft and errors in our stores as

well as other factors discussed in our filings with the Securities

and Exchange Commission. Given these risks and uncertainties,

investors should not place undue reliance on forward-looking

statements as a prediction of actual future results. We undertake

no obligation to update, amend or clarify any forward-looking

statement for any reason.

Non-GAAP Financial Measures

In addition to the financial information prepared in conformity

with U.S. GAAP, we provide certain “non-GAAP financial

measures,” including:

- Adjusted Net Income and Adjusted

Earnings Per Share, or the Adjusted Earnings Measures (net income

from continuing operations plus or minus gain (loss) on

extinguishment of debt, restructuring and other costs, goodwill and

intangible asset impairments, transaction-related costs,

share-based compensation, intangible asset amortization and

cumulative tax effect of adjustments, on a total and per share

basis);

- EBITDA (earnings before interest,

income taxes, depreciation and amortization);

- Adjusted EBITDA (EBITDA plus or minus

certain non-cash and other adjusting items); and

- Gross Combined Loans Receivable

(includes loans originated by third-party lenders through CSO

programs which are not included in the Consolidated Financial

Statements).

We believe that presentation of non-GAAP financial information

is meaningful and useful in understanding the activities and

business metrics of the Company's operations. We believe that these

non-GAAP financial measures reflect an additional way of viewing

aspects of the business that, when viewed with the Company's U.S.

GAAP results, provide a more complete understanding of factors and

trends affecting the business.

We believe that investors regularly rely on non-GAAP financial

measures, such as Adjusted Net Income, Adjusted Earnings per Share,

EBITDA and Adjusted EBITDA, to assess operating performance and

that such measures may highlight trends in the business that may

not otherwise be apparent when relying on financial measures

calculated in accordance with U.S. GAAP. In addition, we believe

that the adjustments shown above are useful to investors in order

to allow them to compare our financial results during the periods

shown without the effect of each of these income or expense items.

In addition, we believe that Adjusted Net Income, Adjusted Earnings

per Share, EBITDA and Adjusted EBITDA are frequently used by

securities analysts, investors and other interested parties in the

evaluation of public companies in our industry, many of which

present Adjusted Net Income, Adjusted Earnings per Share, EBITDA

and/or Adjusted EBITDA when reporting their results.

In addition to reporting loans receivable information in

accordance with U.S. GAAP, we provide Gross Combined Loans

Receivable consisting of owned loans receivable plus loans

originated by third-party lenders through the CSO programs, which

we guarantee but do not include in the Consolidated Financial

Statements. Management believes this analysis provides investors

with important information needed to evaluate overall lending

performance.

We provide non-GAAP financial information for informational

purposes and to enhance understanding of the U.S. GAAP Consolidated

Financial Statements. Adjusted Net Income, Adjusted Earnings per

Share, EBITDA, Adjusted EBITDA and Gross Combined Loans Receivable

should not be considered as alternatives to income from continuing

operations, segment operating income, or any other performance

measure derived in accordance with U.S. GAAP, or as an alternative

to cash flows from operating activities or any other liquidity

measure derived in accordance with U.S. GAAP. Readers should

consider the information in addition to, but not instead of or

superior to, the financial statements prepared in accordance with

U.S. GAAP. This non-GAAP financial information may be determined or

calculated differently by other companies, limiting the usefulness

of those measures for comparative purposes.

Description and Reconciliations of Non-GAAP Financial

Measures

Adjusted Net Income, Adjusted Earnings per Share, EBITDA and

Adjusted EBITDA Measures have limitations as analytical tools, and

you should not consider these measures in isolation or as a

substitute for analysis of our income or cash flows as reported

under U.S. GAAP. Some of these limitations are:

- they do not include cash expenditures

or future requirements for capital expenditures or contractual

commitments;

- they do not include changes in, or cash

requirements for, working capital needs;

- they do not include the interest

expense, or the cash requirements necessary to service interest or

principal payments on debt;

- depreciation and amortization are

non-cash expense items reported in the statements of cash flows;

and

- other companies in our industry may

calculate these measures differently, limiting their usefulness as

comparative measures.

We calculate Adjusted Earnings per Share utilizing diluted

shares outstanding at year-end. If the Company records a loss from

continuing operations under U.S. GAAP, shares outstanding utilized

to calculate Diluted Earnings per Share from continuing operations

are equivalent to basic shares outstanding. Shares outstanding

utilized to calculate Adjusted Earnings per Share from continuing

operations reflect the number of diluted shares the Company would

have reported if reporting net income from continuing operations

under U.S. GAAP.

As noted above, Gross Combined Loans Receivable includes loans

originated by third-party lenders through CSO programs which are

not included in the consolidated financial statements but from

which we earn revenue and for which we provide a guarantee to the

lender. Management believes this analysis provides investors with

important information needed to evaluate overall lending

performance.

We evaluate stores based on revenue per store, provision for

losses at each store and store-level EBITDA, with consideration

given to the length of time a store has been open and its

geographic location. We monitor newer stores for their progress to

profitability and their rate of revenue growth.

We believe Adjusted Net Income, Adjusted Earnings per Share,

EBITDA and Adjusted EBITDA are used by investors to analyze

operating performance and to evaluate our ability to incur and

service debt and the capacity for making capital expenditures.

Adjusted EBITDA is also useful to investors to help assess our

estimated enterprise value. The computation of Adjusted EBITDA as

presented in this release may differ from the computation of

similarly-titled measures provided by other companies.

(CURO-NWS)

View source

version on businesswire.com: https://www.businesswire.com/news/home/20190429005774/en/

Investor Relations:Roger DeanExecutive Vice President and Chief

Financial Officer844-200-0342IR@curo.comorGlobal IR GroupGar

Jackson,949-873-2789gar@globalirgroup.com

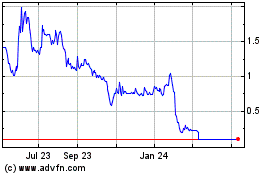

CURO (NYSE:CURO)

Historical Stock Chart

From Mar 2024 to Apr 2024

CURO (NYSE:CURO)

Historical Stock Chart

From Apr 2023 to Apr 2024