Improved sales growth

CTS Corporation (NYSE: CTS) today announced second quarter 2017

results.

- Sales were $105.7 million, up 7.1%

year-over-year. Sales to automotive customers increased 5.6%, and

sales of electronic components increased 9.9%. The Noliac

acquisition, completed in May 2017, added $1.5 million of sales in

the second quarter of 2017. Organic sales of electronic components

increased 5.3%.

- Net earnings were $10.0 million or

$0.30 per diluted share compared to $14.5 million or $0.44 per

diluted share in the second quarter of 2016, which included a net

gain on the sale of the Company’s Canadian facility of $11.1

million or $0.21 per share.

- Adjusted EPS was $0.28 per diluted

share versus $0.26 in the second quarter of 2016.

- Total Booked Business was $1.542

billion at the end of the second quarter of 2017.

“We delivered mid-single digit organic sales growth,” said

Kieran O’Sullivan, CEO of CTS Corporation. “Adjusted EPS grew 8%

despite some one-time costs. The Noliac acquisition is another step

in advancing our strategy, adding multilayer piezoelectric

technology to our portfolio and expanding our capabilities in

Europe.”

2017 Guidance

Management reaffirms its prior guidance. Full year 2017 sales

are expected to be in the range of $405 to $420 million, as

management continues to monitor market conditions. Adjusted

earnings per diluted share for 2017 are expected to be in the range

of $1.12 to $1.22.

Conference Call

As previously announced, the Company has scheduled a conference

call at 11:00 a.m. (EDT) today to discuss the second quarter

financial results. The dial-in number is 888-490-2759

(719-457-2663, if calling from outside the U.S.). The passcode is

317965. There will be a replay of the conference call from 2:00

p.m. (EDT) today through 2:00 p.m. (EDT) on Thursday, August 10,

2017. The telephone number for the replay is 888-203-1112

(719-457-0820, if calling from outside the U.S.). The replay

passcode is 2589157. A live audio webcast of the conference call

will be available and can be accessed directly from the Investors

section of the website of CTS Corporation at www.ctscorp.com.

About CTS

CTS (NYSE: CTS) is a leading designer and manufacturer of

products that Sense, Connect and Move. CTS manufactures sensors,

actuators and electronic components in North America, Europe and

Asia, and supplies these products to OEMs in the aerospace,

communications, defense, industrial, information technology,

medical and transportation markets.

For more information visit www.ctscorp.com.

Safe Harbor

This document contains statements that are, or may be deemed to

be, forward-looking statements within the meaning of the Private

Securities Litigation Reform Act of 1995. These forward-looking

statements include, but are not limited to, any financial or other

guidance, statements that reflect our current expectations

concerning future results and events, and any other statements that

are not based solely on historical fact. Forward-looking statements

are based on management's expectations, certain assumptions and

currently available information. Readers are cautioned not to place

undue reliance on these forward-looking statements, which speak

only as of the date hereof and are based on various assumptions as

to future events, the occurrence of which necessarily are subject

to uncertainties. These forward-looking statements are made subject

to certain risks, uncertainties and other factors, which could

cause our actual results, performance or achievements to differ

materially from those presented in the forward-looking statements.

Many of these, and other, risks and uncertainties are discussed in

further detail in Item 1A. of CTS’ Annual Report on Form 10-K. We

undertake no obligation to publicly update our forward-looking

statements to reflect new information or events or circumstances

that arise after the date hereof, including market or industry

changes.

CTS CORPORATION AND SUBSIDIARIES CONDENSED CONSOLIDATED

STATEMENTS OF EARNINGS - UNAUDITED (In thousands of dollars,

except per share amounts) Three

Months Ended Six Months Ended June 30,

June 30, June 30, June

30, 2017 2016 2017

2016 Net sales $ 105,686 $ 98,693 $ 205,840 $ 195,398

Cost of goods sold 69,892 64,236

135,822 127,472

Gross Margin 35,794 34,457

70,018 67,926 Selling, general and administrative expenses 15,809

15,764 31,055 30,411 Research and development expenses 6,049 5,967

12,052 12,130 Restructuring charges 729 206 1,507 206 (Gain) loss

on sale of assets (1 ) (11,577 ) 1 (11,351 )

Operating earnings 13,208 24,097 25,403 36,530 Other income

(expense): Interest expense (752 ) (1,009 ) (1,436 ) (1,829 )

Interest income 298 331 551 879 Other income (expense)

1,170 (1,240 ) 1,631 (1,436 ) Total other

income (expense) 716 (1,918 ) 746

(2,386 ) Earnings before income taxes 13,924 22,179 26,149 34,144

Income tax expense 3,958 7,692 7,699

11,794

Net earnings $ 9,966

$ 14,487 $ 18,450 $ 22,350

Earnings

per share: Basic 0.30 0.44 0.56 0.68 Diluted 0.30

0.44 0.55 0.67

Basic weighted

– average common shares outstanding: 32,890 32,759 32,846

32,695 Effect of dilutive securities 461 466

493 485

Diluted weighted – average common

shares outstanding 33,351 33,225

33,339 33,180

Cash dividends declared per

share 0.04 0.04 0.08 0.08

CTS CORPORATION AND SUBSIDIARIES CONDENSED

CONSOLIDATED BALANCE SHEETS (In thousands of dollars)

(Unaudited) June 30,

December 31, 2017 2016

ASSETS Current Assets Cash and cash equivalents $ 107,814 $

113,805 Accounts receivable, net 66,737 62,612 Inventories, net

36,094 28,652 Other current assets 11,925

10,638 Total current assets 222,570 215,707 Property, plant

and equipment, net 85,174 82,111 Other Assets Prepaid pension asset

50,107 46,183 Goodwill 69,582 61,744 Other intangible assets, net

69,059 64,370 Deferred income taxes 40,373 45,839 Other

1,525 1,743 Total other assets

230,646 219,879

Total Assets $

538,390 $ 517,697

LIABILITIES AND SHAREHOLDERS’

EQUITY Current Liabilities Short-term notes payable $ 1,059 $

1,006 Accounts payable 42,660 40,046 Accrued payroll and benefits

8,631 11,369 Accrued liabilities 42,213 45,708

Total current liabilities 94,563 98,129 Long-term debt

92,800 89,100 Post retirement obligations 6,913 7,006 Other

long-term obligations 7,634 5,580

Total Liabilities 201,910 199,815

Commitments and

Contingencies (Note 9) Shareholders’ Equity Common stock

304,715 302,832 Additional contributed capital 38,764 40,521

Retained earnings 426,797 410,979 Accumulated other comprehensive

loss (90,540 ) (93,194 ) Total shareholders’ equity

before treasury stock 679,736 661,138 Treasury stock

(343,256 ) (343,256 ) Total shareholders’ equity

336,480 317,882

Total Liabilities and

Shareholders’ Equity $ 538,390 $ 517,697

CTS CORPORATION AND SUBSIDIARIESOTHER

SUPPLEMENTAL INFORMATION

Earnings Per Share

The following table reconciles GAAP diluted earnings per share

to adjusted diluted earnings per share for the Company:

Additional Information

The following table includes other financial information not

presented in the preceding financial statements.

Three Months Ended Six Months

Ended June 30, 2017

June 30, 2016 June 30, 2017

June 30, 2016 GAAP diluted earnings per share $ 0.30

$ 0.44 $ 0.55 $ 0.67 Tax affected charges to

reported diluted earnings per share: Restructuring charges 0.01 —

0.03 — Foreign currency (gain) loss (0.03 ) 0.03 (0.04 ) 0.04

Discrete tax items (0.01 ) — (0.01 ) — Transaction costs 0.01 —

0.01 0.01 Gain on sale of facilities, net of expenses

$ — $ (0.21 ) $ — $ (0.21

) Adjusted diluted earnings per share $ 0.28 $

0.26 $ 0.54 $ 0.51

Additional Information

The following table includes other financial information not

presented in the preceding financial statements.

Three Months Ended Six Months

Ended June 30, 2017 June

30, 2016 June 30, 2017 June 30,

2016 Depreciation and amortization expense $ 4,965 $ 4,904 $

9,673 $ 8,925 Stock-based compensation expense

$ 807 $ 685 $ 1,687 $ 967

Non-GAAP Financial

Measures

Adjusted earnings per share is a non-GAAP financial measure. The

most directly comparable GAAP financial measure is diluted earnings

per share.

CTS adjusts for these items because they are discrete events,

which have a significant impact on comparable GAAP financial

measures and could distort an evaluation of our normal operating

performance.

CTS uses an adjusted earnings per share measure to evaluate

overall performance, establish plans and perform strategic

analysis. Using this measure avoids distortion in the evaluation of

operating results by eliminating the impact of events which are not

related to normal operating performance. Because this measure is

based on the exclusion or inclusion of specific items, they may not

be comparable to measures used by other companies which have

similar titles. CTS' management compensates for this limitation

when performing peer comparisons by evaluating both GAAP and

non-GAAP financial measures reported by peer companies. CTS

believes that this measure is useful to its management, investors

and stakeholders in that it:

- provides a meaningful measure of CTS'

operating performance,

- reflects the results used by management

in making decisions about the business, and

- helps review and project CTS'

performance over time.

We recommend that investors consider both actual and adjusted

measures in evaluating the performance of CTS with peer

companies.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20170727005261/en/

CTS CorporationAshish Agrawal, +1 630-577-8800Vice President and

Chief Financial Officerashish.agrawal@ctscorp.com

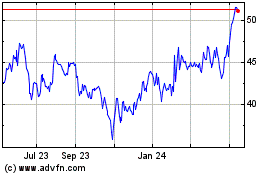

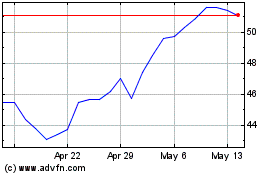

CTS (NYSE:CTS)

Historical Stock Chart

From Mar 2024 to Apr 2024

CTS (NYSE:CTS)

Historical Stock Chart

From Apr 2023 to Apr 2024