Current Report Filing (8-k)

June 30 2017 - 4:12PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): June 26, 2017

Commercial Metals Company

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

Delaware

|

|

1-4304

|

|

75-0725338

|

|

(State or other jurisdiction

of incorporation)

|

|

(Commission

File Number)

|

|

(IRS Employer

Identification No.)

|

|

|

|

|

6565 N. MacArthur Blvd.

Irving, Texas

|

|

75039

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

(214)

689-4300

(Registrant’s telephone number, including area code)

Not Applicable

(Former

name or former address, if changed since last report)

Check the appropriate box below

if the Form

8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

☐

|

Soliciting material pursuant to Rule

14a-12

under the Exchange Act (17 CFR

240.14a-12)

|

|

|

☐

|

Pre-commencement

communications pursuant to Rule

14d-2(b)

under the Exchange Act (17 CFR

240.14d-2(b))

|

|

|

☐

|

Pre-commencement

communications pursuant to Rule

13e-4(c)

under the Exchange Act (17 CFR

240.13e-4(c))

|

Indicate by check mark whether the registrant is an emerging growth company as

defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule

12b-2

of the Securities Exchange Act of 1934

(§240.12b-2

of this chapter).

Emerging growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange

Act. ☐

Section 1 – Registrant’s Business and Operations

|

Item 1.01

|

Entry into a Material Definitive Agreement.

|

Underwriting Agreement

On June 29, 2017, Commercial Metals Company (the “

Company

”) entered into an underwriting agreement (the

“

Underwriting Agreement

”) with Citigroup Global Markets Inc. (“

Citigroup

”) as the representative of the several underwriters named therein (the “

Underwriters

”), relating to the

issuance and sale by the Company of $300.0 million aggregate principal amount of 5.375% Senior Notes due 2027 (the “

2027 Notes

”). The issuance and sale of the 2027 Notes has been registered under the Securities Act of

1933, as amended, pursuant to a Registration Statement on Form

S-3

(the “

Registration Statement

”) filed with the Securities and Exchange Commission (the

“

Commission

”) on June 26, 2017 (Registration

No. 333-218970).

The Underwriting Agreement contains customary representations, warranties, covenants, closing conditions and termination provisions. The

Underwriting Agreement also provides for customary indemnification by each of the Company and the Underwriters against certain liabilities arising out of, or in connection with, the sale of the 2027 Notes and customary contribution provisions in

respect of those liabilities. Subject to customary closing conditions, the sale of the 2027 Notes is expected to close on or about July 11, 2017.

The Company intends to use the net proceeds from the sale of the 2027 Notes, which net proceeds are expected to be approximately

$295.2 million, after deducting underwriting discounts and commissions and estimated offering expenses payable by the Company, to fund the repurchase of a portion of the Company’s outstanding $400.0 million aggregate principal amount

of 7.35% Senior Notes due 2018 (the “

2018 Notes

”) in the Tender Offer (as defined below) and to redeem a portion any remaining 2018 Notes that are not tendered following the expiration of the Tender Offer, in each case

together with accrued interest and expenses related thereto.

Certain of the Underwriters and their respective affiliates have from time

to time performed, and may in the future perform, various financial advisory, commercial banking, investment banking and other services for the Company or its affiliates in the ordinary course of their business for which they have received, or may

in the future receive, customary compensation. In particular, certain of the Underwriters and affiliates of certain of the Underwriters are lenders and/or agents under the Company’s credit facility and sale of accounts receivables program. In

addition, Citigroup is the dealer manager and solicitation agent for the Tender Offer. Further, U.S. Bancorp Investments, Inc. is serving as an Underwriter and is an affiliate of U.S. Bank National Association, the trustee of the 2027 Notes.

Additionally, certain of the Underwriters or their affiliates may be holders of the 2018 Notes.

The foregoing description of the

Underwriting Agreement does not purport to be complete and is qualified in its entirety by reference to the Underwriting Agreement, a copy of which is filed as Exhibit 1.1 to this Current Report on Form

8-K

and is incorporated herein by reference. The indication of intent to redeem the 2018 Notes above shall not constitute a notice of redemption under the indenture governing the 2018 Notes. Any such notice, if made, will only be made in accordance with

the provisions of such indenture.

Section 8 – Other Events

Tender Offer

On June 26, 2017, the Company announced that it commenced a cash tender offer (the “

Tender Offer

”) to purchase up

to the maximum aggregate principal amount of 2018 Notes that will not result in an aggregate purchase price that exceeds $300.0 million, excluding accrued interest.

A copy of the press release announcing the Tender Offer, which describes the Tender Offer in greater detail, is filed as Exhibit 99.1 to this

Current Report on Form

8-K

and is incorporated herein by reference.

Launch of the Note Offering

On June 26, 2017, the Company issued a press release announcing the public offering of the 2027 Notes. A copy of the press release is

filed as Exhibit 99.2 to this Current Report on Form

8-K

and is incorporated herein by reference.

Pricing of

the Notes

On June 29, 2017, the Company issued a press release announcing the pricing of its public offering of the 2027 Notes. A

copy of the press release is filed as Exhibit 99.3 to this Current Report on Form

8-K

and is incorporated herein by reference.

Section 9 – Financial Statements and Exhibits

|

Item 9.01.

|

Financial Statements and Exhibits.

|

(d) Exhibits.

|

|

|

|

|

Exhibit

No.

|

|

Description

|

|

|

|

|

1.1

|

|

Underwriting Agreement, dated June 29, 2017, among Commercial Metals Company, Citigroup Global Markets Inc. and Wells Fargo Securities, LLC, as representatives of the several underwriters named therein.

|

|

|

|

|

99.1

|

|

Press Release issued by Commercial Metals Company on June 26, 2017.

|

|

|

|

|

99.2

|

|

Press Release issued by Commercial Metals Company on June 26, 2017.

|

|

|

|

|

99.3

|

|

Press Release issued by Commercial Metals Company on June 29, 2017.

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on

its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

COMMERCIAL METALS COMPANY

|

|

|

|

|

|

|

Date: June 30, 2017

|

|

|

|

By:

|

|

/s/ Mary Lindsey

|

|

|

|

|

|

Name:

|

|

Mary Lindsey

|

|

|

|

|

|

Title:

|

|

Vice President and Chief Financial Officer

|

EXHIBIT INDEX

|

|

|

|

|

Exhibit

No.

|

|

Description

|

|

|

|

|

1.1

|

|

Underwriting Agreement, dated June 29, 2017, among Commercial Metals Company, Citigroup Global Markets Inc. and Wells Fargo Securities, LLC, as representatives of the several underwriters named therein.

|

|

|

|

|

99.1

|

|

Press Release issued by Commercial Metals Company on June 26, 2017.

|

|

|

|

|

99.2

|

|

Press Release issued by Commercial Metals Company on June 26, 2017.

|

|

|

|

|

99.3

|

|

Press Release issued by Commercial Metals Company on June 29, 2017.

|

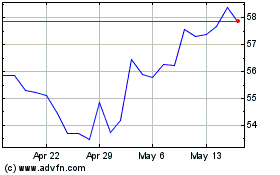

Commercial Metals (NYSE:CMC)

Historical Stock Chart

From Mar 2024 to Apr 2024

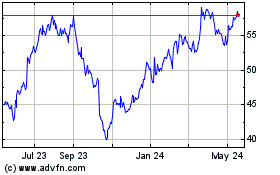

Commercial Metals (NYSE:CMC)

Historical Stock Chart

From Apr 2023 to Apr 2024