Free Writing Prospectus - Filing Under Securities Act Rules 163/433 (fwp)

October 12 2017 - 6:08AM

Edgar (US Regulatory)

Filed Pursuant to Rule 433

Issuer Free Writing Prospectus dated October

11, 2017

Relating to Preliminary Prospectus Supplement

dated September 26, 2017

to Prospectus dated May 2, 2016

Registration No. 333-211071

Bancolombia S.A.

US$750,000,000 4.875% Subordinated Notes due 2027

Pricing Term Sheet

October 11, 2017

|

Issuer:

|

Bancolombia S.A.

|

|

Title of Security:

|

4.875% Subordinated Notes due 2027

|

|

Offering Format:

|

SEC Registered

|

|

Principal Amount:

|

US$750,000,000

|

|

Maturity Date:

|

October 18, 2027

|

|

Reset Date:

|

October 18, 2022

|

|

Ranking:

|

The Notes will rank junior to all existing and future Senior External Liabilities,

pari passu

with present or future Tier Two Capital subordinated Indebtedness (to be determined in accordance with Colombian law and regulations), and senior only to the Issuer’s capital stock and subordinated instruments constituting Tier One Capital.

|

|

Optional Redemption:

|

On the Reset Date, the Issuer has the right to redeem the Notes at 100% of the outstanding aggregate principal amount thereof plus accrued and unpaid interest and Additional Amounts, if any.

|

Optional Redemption upon Tax Event

or Regulatory Event:

|

The Issuer has the right to redeem the Notes in whole, but not in part, at a price equal to 100% of the outstanding principal plus accrued and unpaid interest and Additional Amounts, if any, following the occurrence of a Regulatory Event or a Tax Event. These optional redemption rights are not permitted under current Colombian regulations and the Issuer will not be able to exercise these optional redemption rights unless regulations are implemented permitting the issuer to do so.

|

|

Interest Payment Dates:

|

Each April 18 and October 18, commencing April 18, 2018

|

|

Yield to Maturity:

|

4.875%

|

|

Coupon:

|

4.875% fixed rate per annum from and including the issuance date of the Notes to, but excluding, the Reset Date, payable semi-annually in arrears. If the Notes are not redeemed on the Reset Date, the outstanding principal amount of the Notes will bear interest at a rate per annum equal to the sum of the Benchmark Reset Rate plus 292.9 basis points.

|

|

Loss Absorption:

|

Permanent write-down (

pro rata

with other Tier Two Capital subordinated indebtedness as to which a write-down event has occurred) if Basic Individual Solvency Ratio or Basic Consolidated Solvency Ratio is below 4.5%, or the SFC, in its discretion, otherwise so determines in writing, the outstanding principal, accrued and unpaid interest and any other amounts due on the Notes will be permanently reduced by an amount needed to restore Basic Individual Solvency Ratio to 6%, to restore Basic Consolidated Solvency Ratio to 6%, or to comply with the SFC order to restore the Basic Individual Solvency Ratio or Basic Consolidated Solvency Ratio to 6%.

|

|

Price to Public:

|

100.000%

|

|

Benchmark Treasury:

|

1.875% due September 30, 2022

|

|

Benchmark Treasury Price and Yield:

|

99-212; 1.946%

|

|

Spread to Benchmark Treasury:

|

+292.9 basis points

|

|

Benchmark Reset Rate:

|

Rate per annum corresponding to the semi-annual equivalent yield to maturity of the 5-Year U.S. Treasury Bond calculated on the third business day preceding the Reset Date.

|

|

Pricing Date:

|

October 11, 2017

|

|

Expected Settlement Date:

|

October 18, 2017 (T+5)

|

|

CUSIP:

|

05968L AK8

|

|

ISIN:

|

US05968LAK89

|

|

Day Count:

|

30/360

|

|

Minimum Denominations:

|

US$200,000 x US$1,000

|

|

Listing:

|

The Issuer intends to apply to list the Notes on the New York Stock Exchange.

|

|

Ratings*:

|

Ba3 (Moody’s) / BB+ (Fitch)

|

|

Joint Book-Running Managers:

|

Citigroup Global Markets Inc.

Merrill Lynch, Pierce, Fenner & Smith

Incorporated

UBS Securities

LLC

|

|

Co-Manager:

|

Valores Banistmo S.A.

|

*Note: A security rating is not a recommendation

to buy, sell or hold securities and may be subject to suspension, reduction or withdrawal at any time by the assigning rating agency.

Terms used herein but not defined herein

shall have the respective meanings as set forth in the Preliminary Prospectus Supplement dated September 26, 2017.

This communication shall not constitute

an offer to sell or the solicitation of any offer to buy securities, nor shall there be any sale of securities in any jurisdiction

in which such offer, solicitation or sale would be unlawful prior to the registration or qualification of such securities under

the securities law of any such jurisdiction.

This communication is only being distributed

to and is only directed at (i) persons who are outside the United Kingdom or (ii) investment professionals falling within Article

19(5) of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 (the “Order”) or (iii) high net

worth companies, and other persons to whom it may lawfully be communicated, falling within Article 49(2)(a) to (d) of the Order

(all such persons together being referred to as “relevant persons”). The securities are only available to, and any

invitation, offer or agreement to subscribe, purchase or otherwise acquire such securities will be engaged in only with, relevant

persons. Any person who is not a relevant person should not act or rely on this communication or any of its contents.

The securities are not intended to be

sold and should not be sold to retail clients in the EEA, as defined in the rules set out in the Product Intervention (Contingent

Convertible Instruments and Mutual Society Shares) Instrument 2015, as amended or replaced from time to time, other than in circumstances

that do not and will not give rise to a contravention of those rules by any person. Prospective investors are referred to the section

headed “Restrictions on marketing and sales to retail investors” on page i of the Preliminary Prospectus Supplement

for further information.

The issuer

has filed a registration statement (including a prospectus and prospectus supplement) with the SEC for the offering to which this

communication relates. Before you invest, you should read the prospectus and prospectus supplement in that registration statement,

the documents incorporated by reference therein, and other documents the issuer has filed with the SEC for more complete information

about the issuer and this offering. You may get these documents for free by visiting EDGAR on the SEC Web site at www.sec.gov.

Alternatively, the issuer, any underwriter or any dealer participating in the offering will arrange to send you the prospectus

and the accompanying prospectus supplement if you request it from Citigroup Global Markets Inc., telephone: 1-800-831-9146, Merrill

Lynch, Pierce, Fenner & Smith Incorporated, telephone: 1-800-294-1322 or UBS Securities LLC, telephone: 1

-

888-827-7275.

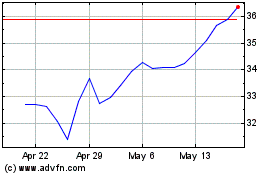

Bancolombia (NYSE:CIB)

Historical Stock Chart

From Mar 2024 to Apr 2024

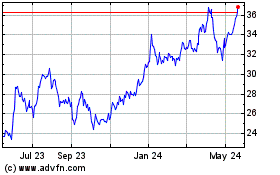

Bancolombia (NYSE:CIB)

Historical Stock Chart

From Apr 2023 to Apr 2024