false

0001739940

0001739940

2024-03-07

2024-03-07

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported) March

7, 2024

The Cigna Group

(Exact name of registrant as specified in its charter)

|

Delaware

(State or other jurisdiction of

incorporation) |

001-38769

(Commission File Number) |

82-4991898

(IRS Employer

Identification No.) |

900 Cottage Grove Road

Bloomfield, Connecticut 06002

(Address of principal executive offices) (Zip Code)

Registrant’s telephone number, including area

code:

(860) 226-6000

Not Applicable

(Former name or former address, if changed since last

report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously

satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities

Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange

Act (17 CFR 240.14a-12)

☐ Pre-commencement communications

pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications

pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

| Common Stock, Par Value $0.01 |

CI |

New York Stock Exchange, Inc. |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities

Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act. ☐

| Item 7.01 |

Regulation FD Disclosure. |

Outlook and Investor Day Information

On March 7, 2024, The Cigna

Group (the “Company”) issued a press release noting that the Company will host its Investor Day, both in person in New York,

New York and virtually, beginning at approximately 8:30 a.m. eastern time. The press release is furnished as Exhibit 99.1 to

this Current Report on Form 8-K. During Investor Day, as well as in meetings with investors and analysts over the next several weeks, The

Cigna Group officials expect to reaffirm projected full year 2024 consolidated adjusted revenues of at least $235 billion, and adjusted

income from operations of at least $28.25 per share. This 2024 outlook includes the impact of expected future share repurchases and anticipated

2024 dividends. The Cigna Group officials also expect to raise long-term average annual adjusted EPS growth target to 10%-14%.

The Cigna Group previously discussed its full year 2024 outlook

in its press release and investor presentation dated February 2, 2024 and during the related investor conference call. The press

release, presentation and the conference call transcript are available on the Investor Relations page of the Company’s website

located at www.thecignagroup.com. Forward-looking statements in these documents and the related call speak only as of the date they were

made.

The Investor Day presentations are expected to begin on March

7, 2024 at approximately 8:30 a.m. eastern time and conclude by 12:30 p.m. eastern time. Investors and analysts are invited

to listen to the presentation free over the Internet via webcast by visiting the Investor Relations page of the Company’s website

located at www.thecignagroup.com. The Investor Relations section of the Company’s website will also contain materials used

during and relating to the Investor Day presentations, including definitions of certain metrics not determined in accordance with

accounting principles generally accepted in the United States of America (“GAAP”) and reconciliations of certain historic

non-GAAP metrics to the most directly comparable GAAP measures.

Definitions and Financial Information

Adjusted income (loss) from operations is a principal financial

measure of profitability used by The Cigna Group’s management because it presents the underlying results of operations of the Company’s

businesses and permits analysis of trends in underlying revenue, expenses and shareholders’ net income. Adjusted income from operations

is defined as shareholders’ net income (or income before taxes less pre-tax income (loss) attributable to noncontrolling interests

for the segment metric) excluding net realized investment results, amortization of acquired intangible assets and special items. The Cigna

Group’s share of certain realized investment results of its joint ventures reported in the Cigna Healthcare segment using the equity

method of accounting are also excluded. Special items are matters that management believes are not representative of the underlying results

of operations due to their nature or size. Adjusted income (loss) from operations is measured on an after-tax basis for consolidated results

and on a pre-tax basis for segment results. Consolidated adjusted income (loss) from operations is not determined in accordance with GAAP

and should not be viewed as a substitute for the most directly comparable GAAP measure, shareholders’ net income.

Adjusted revenues is used by The Cigna Group’s management

because it permits analysis of trends in underlying revenue. The Company defines adjusted revenues as total revenues excluding the following

adjustments: special items and The Cigna Group's share of certain realized investment results of its joint ventures reported in the Cigna

Healthcare segment using the equity method of accounting. Special items are matters that management believes are not representative of

the underlying results of operations due to their nature or size. We exclude these items from this measure because management believes

they are not indicative of past or future underlying performance of the business. Adjusted revenues is not determined in accordance with

GAAP and should not be viewed as a substitute for the most directly comparable GAAP measure, total revenues. Additional definitions and

relevant reconciliations of The Cigna Group’s non-GAAP measures to their most directly comparable GAAP measure are set forth in

the appendix to these materials.

Management is not able to provide a reconciliation of adjusted income

from operations to shareholders’ net income (including on a per share basis) or adjusted revenues to total revenues on a forward-looking

basis because we are unable to predict, without unreasonable effort, certain components thereof including (i) future net realized investment

results (from equity method investments with respect to adjusted revenues) and (ii) future special items. These items are inherently uncertain

and depend on various factors, many of which are beyond our control. As such, any associated estimate and its impact on shareholders’

net income and total revenues could vary materially.

The Cigna Group currently intends to pay regular quarterly dividends,

with future declarations subject to approval by its Board of Directors and the Board’s determination that the declaration of dividends

remains in the best interests of the Company and its shareholders. The decision of whether to pay future dividends and the amount of any

such dividends will be based on the Company’s financial position, results of operations, cash flows, capital requirements, the requirements

of applicable law and any other factors the Board of Directors may deem relevant.

The timing and actual number of shares repurchased will depend on

a variety of factors, including price, general business and market conditions, and alternate uses of capital. The share repurchase program

may be affected through open market purchases in compliance with Rule 10b-18 under the Securities Exchange Act of 1934, as amended, including

through Rule 10b5-1 trading plans, or privately negotiated transactions. The program may be suspended or discontinued at any time.

This information, including Exhibit 99.1, shall not be deemed “filed”

for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or incorporated by reference

in any filing under the Securities Act of 1933, as amended, or the Exchange Act whether made before or after the date of this Current

Report on Form 8-K, except as shall be expressly set forth by specific reference in such a filing.

|

|

Item 9.01 |

Financial Statements and Exhibits. |

(d) Exhibits.

The following exhibits are being furnished as part of this report:

| |

104 |

Cover Page Interactive Data File (embedded within the Inline XBRL). |

| |

|

|

Forward-Looking Statements

CAUTIONARY NOTE REGARDING FORWARD-LOOKING

STATEMENTS

This Current Report on Form 8-K (the “Report”), and oral

statements made with respect to information contained in this Report, may contain forward-looking statements within the meaning of

the Private Securities Litigation Reform Act of 1995. Forward-looking statements are based on The Cigna Group's current expectations and

projections about future trends, events and uncertainties. These statements are not historical facts. Forward-looking statements may include,

among others, statements concerning our projected adjusted income from operations outlook for 2024 on a consolidated and per share basis;

projected adjusted revenue outlook for 2024; projected adjusted earnings per share outlook on a long-term basis; projected capital deployment,

including share repurchases and future dividends, including projected shareholder dividends for 2024; business strategy and strategic

or operational initiatives (including our announced solutions or initiatives for certain health care challenges); and other statements

regarding The Cigna Group's future beliefs, expectations, plans, intentions, liquidity, cash flows, financial condition or performance.

You may identify forward-looking statements by the use of words such as "believe," "expect," "project,"

"plan," "intend," "anticipate," "estimate," "predict," "potential," "may,"

"should," "will" or other words or expressions of similar meaning, although not all forward-looking statements contain

such terms.

Forward-looking statements are subject to risks and uncertainties,

both known and unknown, that could cause actual results to differ materially from those expressed or implied in forward-looking statements.

Such risks and uncertainties include, but are not limited to: our ability to achieve our strategic and operational initiatives; our ability

to adapt to changes in an evolving and rapidly changing industry; our ability to compete effectively, differentiate our products and services

from those of our competitors and maintain or increase market share; price competition, inflation and other pressures that could compress

our margins or result in premiums that are insufficient to cover the cost of services delivered to our customers; the potential for actual

claims to exceed our estimates related to expected medical claims; our ability to develop and maintain satisfactory relationships with

physicians, hospitals, other health service providers and with producers and consultants; our ability to maintain relationships with one

or more key pharmaceutical manufacturers or if payments made or discounts provided decline; changes in the pharmacy provider marketplace

or pharmacy networks; changes in drug pricing or industry pricing benchmarks; our ability to invest in and properly maintain our information

technology and other business systems; our ability to prevent or contain effects of potential cyberattack or other privacy or data security

incidents; risks related to our use of artificial intelligence and machine learning; political, legal, operational, regulatory, economic

and other risks that could affect our multinational operations, including currency exchange rates; risks related to strategic transactions

and realization of the expected benefits of such transactions, as well as integration or separation difficulties or underperformance relative

to expectations; dependence on success of relationships with third parties; risk of significant disruption within our operations or among

key suppliers or third parties; potential liability in connection with managing medical practices and operating pharmacies, onsite clinics

and other types of medical facilities; the substantial level of government regulation over our business and the potential effects of new

laws or regulations or changes in existing laws or regulations; uncertainties surrounding participation in government-sponsored programs

such as Medicare; the outcome of litigation, regulatory audits and investigations; compliance with applicable privacy, security and data

laws, regulations and standards; potential failure of our prevention, detection and control systems; unfavorable economic and market conditions,

the risk of a recession or other economic downturn and resulting impact on employment metrics, stock market or changes in interest rates

and risks related to a downgrade in financial strength ratings of our insurance subsidiaries; the impact of our significant indebtedness

and the potential for further indebtedness in the future; credit risk related to our reinsurers; as well as more specific risks and uncertainties

discussed in our most recent report on Form 10-K and subsequent reports on Forms 10-Q and 8-K available through the Investor Relations

section of www.thecignagroup.com. You should not place undue reliance on forward-looking statements, which speak only as of the date they

are made, are not guarantees of future performance or results, and are subject to risks, uncertainties and assumptions that are difficult

to predict or quantify. The Cigna Group undertakes no obligation to update or revise any forward-looking statement, whether as a result

of new information, future events or otherwise, except as may be required by law.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the

registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

THE CIGNA GROUP |

| |

|

| Date: March 7, 2024 |

By: |

/s/ Brian C. Evanko |

| |

|

Brian C. Evanko |

| |

|

Executive Vice President, Chief Financial Officer, The Cigna Group, and President and Chief Executive Officer, Cigna Healthcare |

Exhibit 99.1

PRESS RELEASE

The Cigna Group Raises Long-Term Growth Target,

and Launches New Innovative Solutions at 2024 Investor Day

Highlights:

| · | Raises

long-term average annual adjusted EPS1 growth target to 10%-14% |

| · | Affirms

2024 adjusted EPS1 guidance of at least $28.25 |

| · | Announces

solutions and innovations for some of the greatest health care challenges: GLP-1 spend, mental

health care access and support, and access to biosimilars |

BLOOMFIELD, Conn., March 7, 2024 — Today, global health

company The Cigna Group (NYSE:CI), will outline its growth and innovation strategies at its 2024 Investor Day. In addition, the

company is raising its long-term average annual adjusted EPS1 growth target to 10%-14% and is reaffirming its 2024

adjusted EPS1 guidance of at least $28.25.

“With a strong track record of impact and performance, we have purposefully

built The Cigna Group to sustain our leadership in improving choice, access and affordability, and clinical outcomes,” said David

M. Cordani, chairman and CEO of The Cigna Group. “Our success – and confidence in our future – stems from our proven

ability to evolve our company to meet the changing market needs and create value for those we serve.”

The company is also announcing a series of innovative solutions that

address some of health care’s greatest challenges:

| · | Express Scripts by Evernorth, a leading pharmacy services provider,

announced the industry’s first financial guarantee for GLP-1s, leveraging its deep supply chain expertise to help companies and

other clients manage the rising costs of treating cardiodiabesity. |

| · | Evernorth Behavioral Health announced a new mental health practice

that provides value-based, outcome-driven care through a simpler care delivery experience. |

| · | Evernorth Health Services plans

to have a Humira biosimilar available for $0 out of pocket to eligible patients of Accredo, its leading specialty pharmacy, by the end

of the year. |

EncircleRx Offers Industry-First Financial Guarantee To Manage

Cost of GLP-1s

Evernorth is helping companies and client organizations manage the costly

landscape of treating cardiodiabesity – the confluence of obesity, diabetes and cardiovascular disease - by launching the industry’s

first financial guarantee for GLP-1s through EncircleRxSM. By providing financial predictability through a cost cap or savings

guarantee, EncircleRx allows companies and organizations to better manage GLP-1 spend, which will help ensure access for eligible patients.

“Our industry-first financial guarantee offers employers and health

plans greater predictability and control of their GLP-1 spend,” said Adam Kautzner, president of Express Scripts and Evernorth Care

Management. “EncircleRx also gives employers and health plans access to our deep insights and clinical expertise to help ensure

GLP-1s are accessed by patients who need them most – whether it’s to control their diabetes or achieve significant weight

loss. Our clinically proven lifestyle modification program, coupled with GLP-1s, surrounds patients with support to help them achieve

the best possible health outcomes.”

Expands Behavioral Value-Based Care With Launch of Evernorth Behavioral

Care Group

Evernorth is launching a behavioral health practice to expand timely access

to quality, in-network therapy. Evernorth Behavioral Care Group provides value-based, outcome-driven care through a simpler care

delivery experience. The group is already treating patients in select states, with plans to scale fully by 2025.

Patients are guaranteed an appointment – either in person or virtually

– within 72 hours of scheduling. This practice enables behavioral health clinicians to work with payers with greater ease, efficiency,

and integration, reducing their administrative burden and empowering them to focus on patient care.

“The vast majority of people struggle to get help when

they need it, and individual practitioners lack the tools and technology to make access easy and to measure quality,” said Eva Borden,

president, Behavioral Health, Evernorth Health Services. “Evernorth is committed to building a care experience that quickly and

seamlessly connects a patient with the right clinician, while empowering clinicians to focus on patient care by removing administrative

burdens.”

Plans To Have Humira Biosimilar Available at $0 Patient Out-of-Pocket

Cost for Eligible Accredo Patients

In an important step toward driving significant long-term affordability

and access, Evernorth Health Services plans to have a Humira biosimilar available for $0 out of pocket to eligible patients of its leading

specialty pharmacy Accredo later this year.

“Biosimilars can help drive significant savings for health

plans and patients,” said Matt Perlberg, president of the Evernorth Health Services pharmacy and care delivery businesses. “Because

of the leading capabilities we have within Evernorth, our specialty pharmacy Accredo, and across the supply chain, we are uniquely positioned

to make patients’ experiences as simple as possible. Accredo helps patients manage all elements of their specialty medication –

from working with their health care provider, counseling on therapy, and administering their medications, to coordinating copay assistance

and working with the patient’s health plan to secure coverage.”

Investor Day Webcast

The Investor Day will begin today at 8:30 a.m. ET and a live webcast of

the presentation will be available at https://investors.thecignagroup.com/events-and-presentations/default.aspx in the Investor Relations

section of The Cigna Group's website.

To listen to this presentation live on the Internet, visit https://investors.thecignagroup.com/events-and-presentations/default.aspx

at least 15 minutes prior to the presentation to download and install any necessary audio software.

About The Cigna Group

The Cigna Group (NYSE: CI) is a global health company committed to creating

a better future built on the vitality of every individual and every community. We relentlessly challenge ourselves to partner and innovate

solutions for better health. The Cigna Group includes products and services marketed under Evernorth Health Services, Cigna Healthcare,

or its subsidiaries. The Cigna Group maintains sales capabilities in more than 30 countries and jurisdictions, and has approximately 183

million customer relationships around the world. Learn more at thecignagroup.com.

NOTES

1. Adjusted income (loss) from operations is a principal financial measure

of profitability used by The Cigna Group’s management because it presents the underlying results of operations of the Company’s

businesses and permits analysis of trends in underlying revenue, expenses and shareholders’ net income. Adjusted income from operations

is defined as shareholders’ net income (or income before taxes less pre-tax income (loss) attributable to noncontrolling interests

for the segment metric) excluding net realized investment results, amortization of acquired intangible assets and special items. The Cigna

Group’s share of certain realized investment results of its joint ventures reported in the Cigna Healthcare segment using the equity

method of accounting are also excluded. Special items are matters that management believes are not representative of the underlying results

of operations due to their nature or size. Adjusted income (loss) from operations is measured on an after-tax basis for consolidated results

and on a pre-tax basis for segment results. Consolidated adjusted income (loss) from operations is not determined in accordance with GAAP

and should not be viewed as a substitute for the most directly comparable GAAP measure, shareholders’ net income.

Management is not able to provide a reconciliation of adjusted income (loss)

from operations to shareholders’ net income (including on a per share basis) because we are unable to predict, without unreasonable

effort, certain components thereof including (i) future net realized investment results (from equity method investments with respect to

adjusted revenues) and (ii) future special items. These items are inherently uncertain and depend on various factors, many of which are

beyond our control. As such, any associated estimate and its impact on shareholders’ net income COULD vary materially.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This press release may contain forward-looking statements within the meaning

of the Private Securities Litigation Reform Act of 1995. Forward-looking statements are based on The Cigna Group's current expectations

and projections about future trends, events and uncertainties. These statements are not historical facts. Forward-looking statements may

include, among others, statements concerning our projected adjusted income from operations outlook for 2024 on a consolidated and per

share basis; projected adjusted earnings per share outlook on a long-term basis business strategy and strategic or operational initiatives

(including our announced solutions or initiatives for certain health care challenges); and other statements regarding The Cigna Group's

future beliefs, expectations, plans, intentions, liquidity, cash flows, financial condition or performance. You may identify forward-looking

statements by the use of words such as "believe," "expect,"

"project," "plan," "intend," "anticipate,"

"estimate," "predict," "potential," "may," "should," "will" or other words

or expressions of similar meaning, although not all forward-looking statements contain such terms.

Forward-looking statements are subject to risks and uncertainties, both

known and unknown, that could cause actual results to differ materially from those expressed or implied in forward-looking statements.

Such risks and uncertainties include, but are not limited to: our ability to achieve our strategic and operational initiatives; our ability

to adapt to changes in an evolving and rapidly changing industry; our ability to compete effectively, differentiate our products and services

from those of our competitors and maintain or increase market share; price competition, inflation and other pressures that could compress

our margins or result in premiums that are insufficient to cover the cost of services delivered to our customers; the potential for actual

claims to exceed our estimates related to expected medical claims; our ability to develop and maintain satisfactory relationships with

physicians, hospitals, other health service providers and with producers and consultants; our ability to maintain relationships with one

or more key pharmaceutical manufacturers or if payments made or discounts provided decline; changes in the pharmacy provider marketplace

or pharmacy networks; changes in drug pricing or industry pricing benchmarks; our ability to invest in and properly maintain our information

technology and other business systems; our ability to prevent or contain effects of potential cyberattack or other privacy or data security

incidents; risks related to our use of artificial intelligence and machine learning; political, legal, operational, regulatory, economic

and other risks that could affect our multinational operations, including currency exchange rates; risks related to strategic transactions

and realization of the expected benefits of such transactions, as well as integration or separation difficulties or underperformance relative

to expectations; dependence on success of relationships with third parties; risk of significant disruption within our operations or among

key suppliers or third parties; potential liability in connection with managing medical practices and operating pharmacies, onsite clinics

and other types of medical facilities; the substantial level of government regulation over our business and the potential effects of new

laws or regulations or changes in existing laws or regulations; uncertainties surrounding participation in government-sponsored programs

such as Medicare; the outcome of litigation, regulatory audits and investigations; compliance with applicable privacy, security and data

laws, regulations and standards; potential failure of our prevention, detection and control systems; unfavorable economic and market conditions,

the risk of a recession or other economic downturn and resulting impact on employment metrics, stock market or changes in interest rates

and risks related to a downgrade in financial strength ratings of our insurance subsidiaries; the impact of our

significant indebtedness and the potential for further indebtedness in

the future; credit risk related to our reinsurers; as well as more specific risks and uncertainties discussed in our most recent report

on Form 10-K and subsequent reports on Forms 10-Q and 8-K available through the Investor Relations section of www.thecignagroup.com. You

should not place undue reliance on forward-looking statements, which speak only as of the date they are made, are not guarantees of future

performance or results, and are subject to risks, uncertainties and assumptions that are difficult to predict or quantify. The Cigna Group

undertakes no obligation to update or revise any forward-looking statement, whether as a result of new information, future events or otherwise,

except as may be required by law.

INVESTOR RELATIONS CONTACT:

Ralph Giacobbe

860-787-7968

Ralph.Giacobbe@TheCignaGroup.com

MEDIA CONTACT:

Justine Sessions

860-810-6523

Justine.Sessions@Evernorth.com

v3.24.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

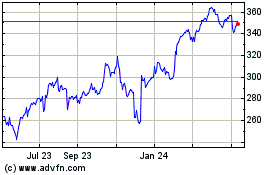

Cigna (NYSE:CI)

Historical Stock Chart

From Mar 2024 to Apr 2024

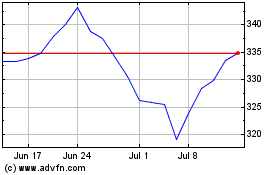

Cigna (NYSE:CI)

Historical Stock Chart

From Apr 2023 to Apr 2024