--12-31False000172505700017250572024-01-312024-01-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): January 31, 2024

Dayforce, Inc.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

Delaware |

001-38467 |

46-3231686 |

(State or Other Jurisdiction of Incorporation) |

(Commission File Number) |

(IRS Employer Identification No.) |

|

|

|

3311 East Old Shakopee Road, Minneapolis, MN |

|

55425 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code: (952) 853-8100

Ceridian HCM Holding Inc.

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instructions A.2. below):

|

|

☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

Common stock, $0.01 par value |

|

DAY |

|

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 5.03 Amendments to Articles of Incorporation or Bylaws; Change in Fiscal Year.

On January 31, 2024, Ceridian HCM Holding Inc. (the “Company”) changed its corporate name to Dayforce, Inc. (the “Name Change”) pursuant to a Certificate of Amendment to the Fourth Amended and Restated Certificate of Incorporation (the “Certificate of Amendment”) and a Restated Certificate of Incorporation (the “Restated Certificate of Incorporation”) integrating the Certificate of Amendment. The Certificate of Amendment and Restated Certificate of Incorporation were each filed with the Delaware Secretary of State on January 29, 2024 and became effective on January 31, 2024. The Board of Directors of the Company (the “Board”) approved the Name Change pursuant to Section 242 of the General Corporation Law of the State of Delaware. The Name Change does not affect the rights of the Company’s stockholders.

In connection with the Name Change, effective January 31, 2024, the Board also amended and restated its Third Amended and Restated Bylaws to reflect the Name Change (the “Fourth Amended and Restated Bylaws”). The Fourth Amended and Restated Bylaws also reflect the adoption of a majority voting standard in uncontested director elections, as well as other administrative changes.

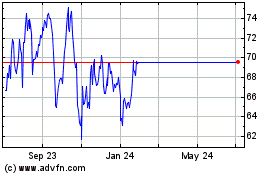

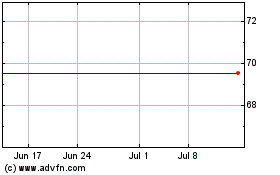

As previously announced by the Company on January 22, 2024, effective February 1, 2024, the Company’s common stock will cease trading under the ticker symbol “CDAY” and will begin trading under its new ticker symbol, “DAY” on the New York Stock Exchange and Toronto Stock Exchange.

The foregoing summary of the Certificate of Amendment, Restated Certificate of Incorporation, and Fourth Amended and Restated Bylaws does not purport to be complete and is subject to, and qualified in its entirety by, the full text of each document, copies of which are filed as Exhibit 3.1, Exhibit 3.2, and Exhibit 3.3, respectively, with this Current Report on Form 8-K.

Item 7.01 Regulation FD Disclosure.

On February 1, 2024, the Company issued a press release announcing the Name Change. A copy of the press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Dayforce, Inc. |

|

|

|

|

Date: |

February 1, 2024 |

By: |

/s/ William E. McDonald |

|

|

|

Name: William E. McDonald |

|

|

|

Title: Executive Vice President, General Counsel and Corporate Secretary |

Exhibit 3.1

CERTIFICATE OF AMENDMENT

OF

FOURTH AMENDED AND RESTATED CERTIFICATE OF INCORPORATION OF CERIDIAN HCM HOLDING INC.

Ceridian HCM Holding Inc. (the “Corporation”), a corporation organized and existing under the laws of the State of Delaware (the “DGCL”), does hereby certify as follows:

FIRST: The “Name” section in the Fourth Amended and Restated Certificate of Incorporation of the Corporation is hereby amended to read in its entirety as follows:

NAME

The name of the corporation (the “Corporation”) is “Dayforce, Inc.”

SECOND: This amendment and the change of name of the Corporation contemplated herein shall become effective at 11:58 P.M., Eastern Standard Time on January 31, 2024.

The foregoing amendment was duly adopted in accordance with Section 242 of the DGCL.

[signature page follows]

IN WITNESS WHEREOF, the undersigned has caused this Certificate of Amendment to be signed by its duly authorized officer on the date set forth below.

CERIDIAN HCM HOLDING INC.

By: /s/ William E. McDonald

Name: William E. McDonald

Title: Executive Vice President, General Counsel and Corporate Secretary

Date: January 29, 2024

2

Exhibit 3.2

RESTATED CERTIFICATE OF INCORPORATION

OF

DAYFORCE, INC.

Dayforce, Inc., a Delaware corporation (the “Corporation”), certifies as follows:

1. The original Certificate of Incorporation of the Corporation was filed with the Office of the Secretary of State of the State of Delaware on July 3, 2013. The Corporation was originally incorporated under the name Ceridian HCM Holding Inc.

2. This Restated Certificate of Incorporation, which only restates and integrates and does not further amend the provisions of the Fourth Amended and Restated Certificate of Incorporation of the Corporation as heretofore amended or supplemented, there being no discrepancies between those provisions and the provisions of this Restated Certificate of Incorporation, was duly adopted by the Board of Directors of the Corporation in accordance with Section 245 of the Delaware General Corporation Law.

3. This Restated Certificate of Incorporation shall become effective on January 31, 2024 at 11:59 P.M. Eastern Standard Time.

4. The text of the Fourth Amended and Restated Certificate of Incorporation of the Corporation as heretofore amended or supplemented is hereby restated in its entirety to read as follows:

Section 1. NAME

The name of the corporation (the “Corporation”) is “Dayforce, Inc.”

Section 2. REGISTERED AGENT

The address of the registered office of the Corporation in the State of Delaware is Corporation Service Company, 251 Little Falls Drive, in the city of Wilmington, County of New Castle, Zip Code 19808. The name of the Corporation’s registered agent at that address is “Corporation Service Company”.

Section 3. PURPOSE

The purpose of the Corporation is to engage in any lawful act or activity for which a corporation may now or hereafter be organized under the General Corporation Law of the State of Delaware (the “DGCL”).

Section 4. CAPITAL STOCK

Section 4.1. Authorized Shares. The total number of shares of all classes of capital stock that the Corporation shall have authority to issue is 510,000,000 shares, of which (i) 500,000,000 shares shall be designated shares of common stock, par value $0.01 per share (“Common Stock”) and (ii) 10,000,000 shares shall be designated shares of preferred stock, par value $0.01 per share (the “Preferred Stock”). Notwithstanding anything to the contrary contained herein, the rights and preferences of the Common Stock shall at all times be subject to the rights and preferences of the Preferred Stock as may be set forth in one or more certificates of designations filed with the Secretary of State of the State of Delaware from time to time in accordance with the DGCL and

this Certificate. The number of authorized shares of Preferred Stock and Common Stock may be increased or decreased (but not below the number of shares thereof then outstanding) from time to time by the affirmative vote of the holders of at least a majority of the voting power of the Corporation’s then outstanding shares of stock entitled to vote thereon, voting together as a single class, irrespective of the provisions of Section 242(b)(2) of the DGCL (or any successor provision thereto) (including, with respect to the Preferred Stock, the vote attaching to the Special Voting Share), and no vote of the holders of any of the Common Stock or the Preferred Stock voting separately as a class or series shall be required therefor.

Section 4.2. Common Stock. The Common Stock shall have the following powers, designations, preferences and rights and qualifications, limitations and restrictions:

(a) Voting. Each holder of record of shares of Common Stock shall be entitled to vote at all meetings of the stockholders of the Corporation and shall have one vote for each share of Common Stock held of record by such holder of record as of the applicable record date on any matter that is submitted to a vote of the stockholders of the Corporation; provided, however, that to the fullest extent permitted by law, holders of Common Stock, as such, shall have no voting power with respect to, and shall not be entitled to vote on, any amendment to this Certificate (including any certificate of designations relating to any series or class of Preferred Stock) that relates solely to the terms of one or more outstanding series or class(es) of Preferred Stock if the holders of such affected series or class(es) of Preferred Stock are entitled, either separately or together with the holders of one or more other such series or class(es), to vote thereon pursuant to applicable law or this Certificate (including any certificate of designations relating to any series or class of Preferred Stock); and provided further that the Board of Directors may issue or grant shares of Common Stock that are subject to vesting or forfeiture and that restrict or eliminate voting rights with respect to such shares until any such vesting criteria is satisfied or such forfeiture provisions lapse.

(b) Dividends and Distributions. Subject to the prior rights of all classes or series of stock at the time outstanding having prior rights as to dividends or other distributions, the holders of shares of Common Stock shall be entitled to receive such dividends and other distributions in cash, property, or stock as may be declared on the Common Stock by the Board of Directors from time to time out of assets or funds of the Corporation legally available therefor and shall share equally on a per share basis in all such dividends and other distributions.

(c) Liquidation, etc. Subject to the prior rights of creditors of the Corporation and the holders of all classes or series of stock at the time outstanding having prior rights as to distributions upon liquidation, dissolution or winding up of the Corporation, in the event of any liquidation, dissolution or winding up of the Corporation, either voluntary or involuntary, the holders of shares of Common Stock shall be entitled to receive their ratable and proportionate share of the remaining assets of the Corporation.

(d) No holder of shares of Common Stock shall have cumulative voting rights.

(e) No holder of shares of Common Stock shall be entitled to preemptive or subscription rights pursuant to this Certificate.

2

Section 4.3. Preferred Stock. The Board of Directors is hereby expressly authorized, to the fullest extent as may now or hereafter be permitted by the DGCL, by resolution or resolutions, at any time and from time to time, to provide for the issuance of a share or shares of Preferred Stock in one or more series or classes and to fix for each such series or class (i) the number of shares constituting such series or class and the designation of such series or class, (ii) the voting powers (if any), whether full or limited, of the shares of such series or class, (iii) the powers, preferences, and relative, participating, optional or other special rights of the shares of each such series or class, and (iv) the qualifications, limitations, and restrictions thereof, and to cause to be filed with the Secretary of State of the State of Delaware a certificate of designation with respect thereto. Without limiting the generality of the foregoing, to the fullest extent as may now or hereafter be permitted by the DGCL, the authority of the Board of Directors with respect to the Preferred Stock and any series or class thereof shall include, but not be limited to, determination of the following:

(a) the number of shares constituting any series or class, which number the Board of Directors may thereafter increase or decrease (but not below the number of shares thereof then outstanding) and the distinctive designation of that series or class;

(b) the dividend rate or rates on the shares of any series or class, the terms and conditions upon which and the periods in respect of which dividends shall be payable, whether dividends shall be cumulative and, if so, from which date or dates, and the relative rights of priority, if any, of payment of dividends on shares of that series or class;

(c) whether any series or class shall have voting rights, in addition to the voting rights provided by applicable law, and, if so, the number of votes per share and the terms and conditions of such voting rights;

(d) whether any series or class shall have conversion privileges and, if so, the terms and conditions of conversion, including provision for adjustment of the conversion rate upon such events as the Board of Directors shall determine;

(e) whether the shares of any series or class shall be redeemable and, if so, the terms and conditions of such redemption, including the date or dates upon or after which they shall be redeemable and the amount per share payable in case of redemption, which amount may vary under different conditions and at different redemption dates;

(f) whether any series or class shall have a sinking fund for the redemption or purchase of shares of that series or class, and, if so, the terms and amount of such sinking fund;

(g) the rights of the shares of any series or class in the event of voluntary or involuntary liquidation, dissolution or winding up of the Corporation, and the relative rights of priority, if any, of payment of shares of that series or class; and

(h) any other powers, preferences, rights, qualifications, limitations, and restrictions of any series or class.

The powers, preferences and relative, participating, optional and other special rights of the shares of each series or class of Preferred Stock, and the qualifications, limitations or restrictions thereof, if any, may differ from those of any and all other series or classes at any time outstanding. Unless

3

otherwise provided in the resolution or resolutions providing for the issuance of such series or class of Preferred Stock, shares of Preferred Stock, regardless of series or class, which shall be issued and thereafter acquired by the Corporation through purchase, redemption, exchange, conversion or otherwise shall return to the status of authorized but unissued Preferred Stock, without designation as to series or class of Preferred Stock, and the Corporation shall have the right to reissue such shares.

Section 4.4. Special Voting Preferred Stock. One (1) share of the authorized Preferred Stock of the Corporation is designated “Special Voting Preferred Stock” and shall have the rights, preferences, powers, privileges and restrictions, qualifications and limitations set forth herein. Unless otherwise indicated, references to “Sections” or “Subsections” in this Section 4.4 refer to sections and subsections of this Section 4.4. The one (1) share of Special Voting Preferred Stock is referred to herein as the “Special Voting Share”).

(a) Dividends. The holder of the Special Voting Share shall not be entitled to receive any portion of any dividend or distribution at any time.

(b) Voting Rights. The holder of the Special Voting Share shall have the following voting rights:

(1) In accordance with the terms contained herein and in that certain Voting and Exchange Trust Agreement dated as of April 25, 2018 (the “Trust Agreement”), among the Corporation, Ceridian Canada Ltd., Ceridian Acquisitionco ULC (“Exchangeco”), and the Trustee (as defined therein), the holder of the Special Voting Share shall, with respect to all meetings of stockholders of the Corporation at which holders of shares of Common Stock are entitled to vote (each, a “Ceridian Holding Meeting”) and with respect to all written consents sought from the holders of shares of Common Stock (a “Ceridian Holding Consent”), be entitled to cast a number of votes for each exchangeable share of Exchangeco (the “Exchangeable Shares”) owned of record at the close of business on the record date established by the Corporation or by applicable law for such Ceridian Holding Meeting or Ceridian Holding Consent, as the case may be, by registered holders of such Exchangeable Shares (excluding any such Exchangeable Shares owned by the Corporation or its subsidiaries) and for which the Trustee (as defined in Trust Agreement) has received voting instructions from the Beneficiaries (as defined in Trust Agreement), equal to the number of votes to which a holder of one share of Common Stock is entitled, in respect of each matter, question, proposal or proposition to be voted on at such Ceridian Holding Meeting or to be consented to in connection with such Ceridian Holding Consent.

(2) Except as otherwise provided herein or by law, the holder of the Special Voting Share and the holders of shares of Common Stock shall vote together as one class on all matters submitted to a vote of shareholders of the Corporation.

(3) Except as set forth herein, the holder of the Special Voting Share shall have no special voting rights, and its consent shall not be required (except to the extent it is entitled to vote with the holders of shares of Common Stock and Common Stock as set forth herein) for taking any corporate action.

4

(c) Additional Provisions.

(1) The holder of the Special Voting Share is entitled to exercise the voting rights attendant thereto in such manner as such holder desires.

(2) At such time as (A) there are no Exchangeable Shares of Exchangeco issued and outstanding that are not owned by the Corporation or any subsidiary of the Corporation, and (B) there is no share of stock, debt, option or other agreement, obligation or commitment of Exchangeco which could by its terms require Exchangeco to issue any Exchangeable Shares to any person other than the Corporation or any subsidiary of the Corporation, then the Special Voting Share shall thereupon be retired and cancelled promptly thereafter for no consideration and not be reissued.

(d) Reacquired Share. If the Special Voting Share is purchased or otherwise acquired by the Corporation in accordance with the terms of Section 4.4(c)(2) or Section 4.4(e), then the Special Voting Share shall be retired and cancelled promptly after the acquisition thereof.

(e) Redemption. The Special Voting Share is not redeemable, except as at such time as contemplated by Section 4.4(c)(2).

(f)Dissolution, Liquidation or Winding Up. Upon any liquidation, dissolution or winding up of the Corporation, the holder of the Special Voting Share shall not be entitled to any portion of any related distribution.

Section 5. DIRECTORS

Section 5.1. The business and affairs of the Corporation shall be managed by or under the direction of the Board of Directors, consisting of not less than one (1) nor more than fourteen (14) members with the exact number of directors to be set forth in the Corporation’s Bylaws or determined from time to time by resolution adopted by the Board of Directors. Prior to the election of directors at the Corporation’s 2024 annual meeting of stockholders, the directors, other than those who may be elected by the holders of any class or series of Preferred Stock as set forth in this Certificate of Incorporation, shall be divided into three classes, designated Class I, Class II and Class III. Each class shall consist, as nearly as may be possible, of one-third of the total number of directors constituting the entire Board of Directors. At the 2022 annual meeting of stockholders, successors to the directors whose terms expire at that annual meeting shall be elected to hold office for a one-year term expiring at the 2023 annual meeting of stockholders; at the 2023 annual meeting of stockholders, successors to the directors whose terms expire at that annual meeting shall be elected to hold office for a one-year term expiring at the 2024 annual meeting of the stockholders; and at the 2024 annual meeting of stockholders and at each annual meeting of stockholders thereafter, all directors shall be elected to hold office for a one-year term expiring at the next annual meeting of stockholders. A director shall hold office until such director’s term expires and until such director’s successor is elected and qualified for office, subject, however, to such director’s prior death, resignation, retirement, disqualification or removal from office.

Section 5.2. If, prior to the election of directors at the Corporation’s 2024 annual meeting of stockholders, the number of directors on the Board of Directors is changed, any increase or decrease shall be apportioned among the classes so as to maintain the number of directors in each

5

class as nearly equal as possible. In no case will a decrease in the number of directors shorten the term of any incumbent director.

Section 5.3. Subject to the terms of any one or more series or classes of Preferred Stock, any vacancy on the Board of Directors, however resulting, may be filled only by an affirmative vote of the majority of the directors then in office, even if less than a quorum, or by an affirmative vote of the sole remaining director. Any director elected to fill a vacancy prior to the election of directors at the Corporation’s 2024 annual meeting of stockholders shall hold office for a term that shall coincide with the term of the class to which such director shall have been elected. Any director elected to fill a vacancy after the election of directors at the Corporation’s 2024 annual meeting of stockholders shall hold office for a term that shall expire at the next annual meeting of stockholders.

Section 5.4. Notwithstanding any of the foregoing provisions, whenever the holders of any one or more classes or series of Preferred Stock issued by the Corporation shall have the right, voting separately by class or series, to elect directors at an annual or special meeting of stockholders, the election, term of office, filling of vacancies and other features of such directorships shall be governed by the terms of this Certificate of Incorporation, or the resolution or resolutions adopted by the Board of Directors pursuant to Section 4.4 of this Certificate of Incorporation applicable thereto, and such directors so elected shall not be divided into classes pursuant to this Section 5 unless expressly provided by such terms.

Section 6. CORPORATE OPPORTUNITIES

Section 6.1. In anticipation of the possibility (a) that the officers and/or directors of the Corporation may also serve as officers and/or directors of Cannae (as defined below) or THL (as defined below) and (b) that the Corporation on one hand, and Cannae or THL on the other hand, may engage in the same or similar activities or lines of business and have an interest in the same corporate opportunities, and in recognition of the benefits to be derived by the Corporation through its continued contractual, corporate and business relations with Cannae and THL, the provisions of this Section 6 are set forth to regulate, to the fullest extent permitted by law, the conduct of certain affairs of the Corporation as they relate to Cannae and THL and their respective officers and directors, and the powers, rights, duties and liabilities of the Corporation and its officers, directors and stockholders in connection therewith.

Section 6.2 (a) Except as may be otherwise provided in a written agreement between the Corporation on one hand, and Cannae or THL on the other hand, Cannae and THL shall have no duty to refrain from engaging in the same or similar activities or lines of business as the Corporation, and, to the fullest extent permitted by law, neither Cannae nor THL nor any officer or director thereof (except in the event of any violation of Section 6.3 hereof, to the extent such violation would create liability under applicable law) shall be liable to the Corporation or its stockholders for breach of any fiduciary duty by reason of any such activities of Cannae or THL.

(b) The Corporation may from time to time be or become a party to and perform, and may cause or permit any subsidiary of the Corporation to be or become a party to and perform, one or more

6

agreements (or modifications or supplements to pre-existing agreements) with Cannae and/or THL. Subject to Section 6.3 hereof, to the fullest extent permitted by law, no such agreement, nor the performance thereof in accordance with its terms by the Corporation or any of its subsidiaries, Cannae or THL, shall be considered contrary to any fiduciary duty to the Corporation or to its stockholders of any director or officer of the Corporation who is also a director, officer or employee of Cannae or THL. Subject to Section 6.3 hereof, to the fullest extent permitted by law, no director or officer of the Corporation who is also a director, officer or employee of Cannae or THL shall have or be under any fiduciary duty to the Corporation or its stockholders to refrain from acting on behalf of the Corporation or any of its subsidiaries, Cannae or THL in respect of any such agreement or performing any such agreement in accordance with its terms.

Section 6.3. In the event that a director or officer of the Corporation who is also a director or officer of Cannae or THL acquires knowledge of a potential transaction or matter which may be a corporate opportunity of both the Corporation on one hand, and Cannae or THL on the other hand, such director or officer of the Corporation shall, to the fullest extent permitted by law, have fully satisfied and fulfilled the fiduciary duty of such director or officer to the Corporation and its stockholders with respect to such corporate opportunity, if such director or officer acts in a manner consistent with the following policy:

(a) a corporate opportunity offered to any person who is an officer of the Corporation, and who is also a director but not an officer of Cannae or THL, shall belong to the Corporation, unless such opportunity is expressly offered to such person in a capacity other than such person’s capacity as an officer of the Corporation, in which case it shall not belong to the Corporation;

(b) a corporate opportunity offered to any person who is a director but not an officer of the Corporation, and who is also a director or officer of Cannae or THL, shall belong to the Corporation only if such opportunity is expressly offered to such person in such person’s capacity as a director of the Corporation; and

(c) a corporate opportunity offered to any person who is an officer of both the Corporation on one hand, and Cannae or THL on the other hand, shall belong to the Corporation only if such opportunity is expressly offered to such person in such person’s capacity as an officer of the Corporation.

Notwithstanding the foregoing, the Corporation shall not be prohibited from pursuing any corporate opportunity of which the Corporation becomes aware.

Section 6.4. Any person purchasing or otherwise acquiring any interest in shares of the capital stock of the Corporation shall be deemed to have notice of and to have consented to the provisions of this Section 6.

Section 6.5. (a) For purposes of this Section 6, a director of any company who is the chair of the board of directors of that company shall not be deemed to be an officer of the company solely by reason of holding such position.

(b) The term “Corporation” shall mean, for purposes of this Section 6, the Corporation and all corporations, partnerships, joint ventures, associations and other entities in which the Corporation beneficially owns (directly or indirectly) fifty percent or more of the outstanding voting stock,

7

voting power, partnership interests or similar voting interests. The term “Cannae” shall mean, for purposes of this Section 6, Cannae Holdings, Inc., a Delaware corporation, and any successor thereof, and all corporations, partnerships, joint ventures, associations and other entities in which it beneficially owns (directly or indirectly) fifty percent or more of the outstanding voting stock, voting power, partnership interests or similar voting interests other than the Corporation. The term “THL” shall mean, for purposes of this Section 6, Thomas H. Lee Partners, L.P., a Delaware limited partnership, and any successor thereof, and all corporations, partnerships, joint ventures, associations and other entities in which it or one or more of its affiliates beneficially owns (directly or indirectly) fifty percent or more of the outstanding voting stock, voting power, partnership interests or similar voting interests other than the Corporation and its subsidiaries.

Section 6.6. Anything in this Certificate of Incorporation to the contrary notwithstanding, the foregoing provisions of this Section 6 shall not apply at any time that no person who is a director or officer of the Corporation is also a director or officer of Cannae or THL. Neither the alteration, amendment, termination, expiration or repeal of this Section 6 nor the adoption of any provision of this Certificate of Incorporation inconsistent with this Section 6 shall eliminate or reduce the effect of this Section 6 in respect of any matter occurring, or any cause of action, suit or claim that, but for this Section 6, would accrue or arise, prior to such alteration, amendment, termination, expiration, repeal or adoption.

Section 7. REMOVAL OF DIRECTORS

Subject to the rights, if any, of the holders of shares of Preferred Stock then outstanding, (a) any director who prior to the 2022 annual meeting of stockholders was elected to a three-year term (a “Classified Term”) that continues beyond the date of the 2022 annual meeting (a “Classified Director”) may be removed from office at any time, but only for cause and only by the affirmative vote of the holders of a majority of the outstanding capital stock of the Corporation then entitled to vote generally in the election of directors, considered for purposes of this Section 7 as one class; and (b) any director that is not a Classified Director may be removed from office by the stockholders of the Corporation, with or without cause, by the affirmative vote of the holders of a majority of the outstanding capital stock of the Corporation then entitled to vote generally in the election of directors, considered for the purposes of this Section 7 as one class. For purposes of this Section 7, “cause” shall mean, with respect to any director, (x) the willful failure by such director to perform, or the gross negligence of such director in performing, the duties of a director, (y) the engaging by such director in willful or serious misconduct that is injurious to the Corporation or (z) the conviction of such director of, or the entering by such director of a plea of nolo contendere to, a crime that constitutes a felony.

Section 8. ELECTION OF DIRECTORS

Elections of directors at an annual or special meeting of stockholders shall be by written ballot unless the bylaws of the Corporation (as in effect from time to time, the “Bylaws”) shall otherwise provide.

8

Section 9. WRITTEN CONSENT OF STOCKHOLDERS

Except as otherwise provided for or fixed by or pursuant to the provisions of this Certificate of Incorporation or any resolution or resolutions of the Board of Directors providing for the issuance of Preferred Stock, any action required or permitted to be taken by the stockholders of the Corporation may be effected only at a duly called annual or special meeting of stockholders of the Corporation and may not be effected by any consent in writing by such stockholders; provided, however, that at any time when the THL and Cannae beneficially own (determined in accordance with Rule 13d-3 of the Securities Exchange Act of 1934, as amended), in the aggregate, more than fifty percent (50%) in voting power of the stock of the Corporation entitled to vote generally in the election of directors, any action required or permitted to be taken by the stockholders of the Corporation at any meeting of stockholders may be taken without a meeting if a consent in writing, setting forth the action so taken, is signed by stockholders holding not less than the minimum number of votes that would be necessary to authorize or take such action at a meeting at which all shares entitled to vote thereon were present and voted.

Section 10. SPECIAL MEETINGS

Special meetings of the stockholders of the Corporation for any purposes may be called at any time by a majority vote of the Board of Directors or the Chair of the Board or Chief Executive Officer of the Corporation. Except as required by law or provided by resolutions adopted by the Board of Directors designating the rights, powers and preferences of any Preferred Stock, special meetings of the stockholders of the Corporation may not be called by any other person or persons.

Section 11. OFFICERS

The officers of the Corporation shall be chosen in such manner, shall hold their offices for such terms and shall carry out such duties as are determined solely by the Board of Directors, subject to the right of the Board of Directors to remove any officer or officers at any time with or without cause.

Section 12. INDEMNITY

The Corporation shall indemnify to the full extent authorized or permitted by law any person made, or threatened to be made, a party to any action or proceeding (whether civil or criminal or otherwise) by reason of the fact that such person is or was a director or officer of the Corporation or by reason of the fact that such director or officer, at the request of the Corporation, is or was serving any other corporation, partnership, joint venture, trust, employee benefit plan or other enterprise, in any capacity. Nothing contained herein shall affect any rights to indemnification to which employees other than directors and officers may be entitled by law. No director of the Corporation shall be personally liable to the Corporation or its stockholders for monetary damages for any breach of fiduciary duty by such a director as a director. Notwithstanding the foregoing sentence, a director shall be liable to the extent provided by applicable law (a) for any breach of the director’s duty of loyalty to the Corporation or its stockholders, (b) for acts or omissions not in good faith or which involve intentional misconduct or a knowing violation of law, (c) pursuant to Section 174 of the DGCL or (d) for any transaction from which such director derived an improper personal benefit. No amendment to or repeal of this Section 12 shall apply to or have

9

any effect on the liability or alleged liability of any director of the Corporation for or with respect to any acts or omissions of such director occurring prior to such amendment.

Section 13. BUSINESS COMBINATIONS

The Corporation shall not be governed by Section 203 of the DGCL.

Section 14. AMENDMENT

The Corporation reserves the right at any time from time to time to amend, alter, change or repeal any provision contained in this Certificate of Incorporation, and any other provisions authorized by the laws of the State of Delaware at any time may be added or inserted, in the manner now or hereafter prescribed by law. All rights, preferences and privileges of whatsoever nature conferred upon stockholders, directors or any other persons whomsoever by and pursuant to this Certificate of Incorporation in its present form or as hereafter amended are granted subject to the right reserved in this Section 14. In addition to any affirmative vote of the holders of any series of Preferred Stock required by law, by this Certificate of Incorporation or by the resolution or resolutions adopted by the Board of Directors designating the rights, powers and preferences of such Preferred Stock, the provisions (a) of the Bylaws may be adopted, amended or repealed if approved by a majority of the Board of Directors then in office or approved by holders of the Common Stock in accordance with applicable law and this Certificate of Incorporation and (b) of this Certificate of Incorporation may be adopted, amended or repealed as provided by applicable law.

Section 15. SEVERABILITY

If any provision (or any part thereof) of this Certificate of Incorporation shall be held to be invalid, illegal or unenforceable as applied to any circumstance for any reason whatsoever: (i) the validity, legality and enforceability of such provisions in any other circumstance and of the remaining provisions of this Certificate of Incorporation including, without limitation, each portion of any section of this Certificate of Incorporation containing any such provision held to be invalid, illegal or unenforceable that is not itself held to be invalid, illegal or unenforceable) shall not in any way be affected or impaired thereby and (ii) to the fullest extent possible, the provisions of this Certificate of Incorporation (including, without limitation, each such containing any such provision held to be invalid, illegal or unenforceable) shall be construed so as to permit the Corporation to protect its directors, officers, employees and agents from personal liability in respect of their good faith service or for the benefit of the Corporation to the fullest extent permitted by law.

10

IN WITNESS WHEREOF, the undersigned has caused this Restated Certificate of Incorporation to be signed by its duly authorized officer on the date set forth below.

Dayforce, Inc.

By: /s/ William E. McDonald

Name: William E. McDonald

Title: Executive Vice President, General Counsel and Corporate Secretary

Date: January 29, 2024

11

Exhibit 3.3

FOURTH AMENDED AND RESTATED BYLAWS OF

dayforce, inc.

AS ADOPTED ON january 31, 2024.

Section 1.1Registered Office. The registered office of Dayforce, Inc. (the “Corporation”) shall be 251 Little Falls Drive, in the city of Wilmington, County of New Castle, Zip Code 19808 and the name and address of its registered agent is “Corporation Service Company”.

Section 1.2Other Offices. The Corporation may also have offices at such other places both within and without the State of Delaware as the Board of Directors of the Corporation (the “Board of Directors”) may from time to time determine.

ARTICLE II.

MEETINGS OF STOCKHOLDERS

Section 2.1Place of Meetings. Meetings of the stockholders for the election of directors or for any other purpose shall be held at such time and place, either within or without the State of Delaware, as shall be designated from time to time by the Board of Directors, which may or may not be held by means of remote communication, and stated in the notice of the meeting or in a duly executed waiver of notice thereof.

Section 2.2Annual Meetings. The annual meetings of stockholders (the “Annual Meeting”) shall be held on such date and at such time as shall be designated from time to time by the Board of Directors and stated in the notice of the meeting, at which meetings the stockholders shall elect directors and transact such other business as may properly be brought before the meeting. Written notice of the Annual Meeting shall be given in accordance with Section 232 of the Delaware General Corporation Law (the “DGCL”) or any successor provision thereto and shall state the place, date and hour of the meeting, and the means of remote communication, if any, by which stockholders and proxy holders may be deemed to be present in person and vote at such meeting and such notice shall be given to each stockholder entitled to vote at such meeting not less than ten days nor more than sixty days before the date of the meeting. If notice is given by electronic transmission, such notice shall be deemed to be given in accordance with and at the times provided in Section 232 of the DGCL or any successor provision thereto.

(a)No business may be transacted at an Annual Meeting, other than business that is either (i) specified in the notice of meeting (or any supplement thereto) given by or at the direction of the Board of Directors (or any duly authorized committee thereof), (ii) otherwise

properly brought before the Annual Meeting by or at the direction of the Board of Directors (or any duly authorized committee thereof) or (iii) otherwise properly brought before the Annual Meeting by any stockholder of the Corporation (A) who is a stockholder of record on the date of the giving of the notice provided for in this Section 2.2 and on the record date for the determination of stockholders entitled to vote at such Annual Meeting and (B) who complies with the notice procedures set forth in this Section 2.2.

(b)In addition to any other applicable requirements, for business to be properly brought before an Annual Meeting by a stockholder, such stockholder must have given timely notice thereof in proper written form to the Secretary of the Corporation and followed the procedures set forth in this Section 2.2. To be timely, a stockholder's notice to the Secretary must be delivered to or mailed and received at the principal executive offices of the Corporation not less than one-hundred and twenty days prior to the anniversary date of the date of the proxy statement for the immediately preceding Annual Meeting; provided, however, that in the event that the Annual Meeting is called for a date that is not within thirty days before or after the anniversary date of the immediately preceding Annual Meeting, notice by the stockholder in order to be timely must be so received not later than the close of business on the tenth day following the day on which public disclosure of the date of the Annual Meeting was first made. To be in proper written form, a stockholder's notice to the Secretary must be signed by the stockholder of record who intends to introduce the other business, and by the beneficial owner or owners, if any, on whose behalf the stockholder is acting and shall set forth as to each matter such stockholder proposes to bring before the Annual Meeting:

(i)a brief description of the business desired to be brought before the Annual Meeting and the reasons for conducting such business at the Annual Meeting;

(ii) the name and record address of such stockholder and the beneficial owner or owners, if any, on whose behalf the proposal is made;

(iii)the Share Information (which Share Information required by this clause (iii) shall be supplemented by such stockholder and any such beneficial owner or owners, if any, not later than ten (10) days after the record date for the Annual Meeting to disclose such Share Information as of the record date of the Annual Meeting);

(iv)a description of all arrangements or understandings between such stockholder and any other person or persons (including their names) in connection with the proposal of such business by such stockholder and any material interest of such stockholder in such business;

(v)a representation that such stockholder is a holder of record of shares of the Corporation entitled to vote at the Annual Meeting and intends to appear in person or by proxy at the Annual Meeting to bring such business before the meeting as specified in the notice; and

(vi)any other information relating to such stockholder and any such beneficial owner that would be required to be disclosed in a proxy statement or other filings required to be made in connection with solicitations of proxies for, as applicable, the proposal and/or for the election of directors in a contested election

pursuant to Section 14 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) and the rules and regulations promulgated thereunder.

(c)No business shall be conducted at the Annual Meeting except business brought before the Annual Meeting in accordance with the procedures set forth in this Section 2.2, provided, however, that, once business has been properly brought before the Annual Meeting in accordance with such procedures, nothing in this Section 2.2 shall be deemed to preclude discussion by any stockholder of any such business. If the Chair of an Annual Meeting determines that business was not properly brought before the Annual Meeting in accordance with the foregoing procedures, the Chair shall declare to the meeting that the business was not properly brought before the meeting and such business shall not be discussed or transacted.

(d)Notwithstanding the foregoing provisions of this Section 2.2, unless otherwise required by law, if any stockholder (or a qualified representative thereof) providing notice as other business that such stockholder proposes to bring before a meeting does not appear at the meeting to present such proposed business, such proposed business shall not be transacted, notwithstanding that proxies in respect of such vote may have been received by the Corporation.

(e)Any stockholder directly or indirectly soliciting proxies from other stockholders must use a proxy card color other than white, which shall be reserved for the exclusive use by the Board of Directors.

(f)The term “Share Information” shall mean

(i)the class or series and number of shares of the Corporation that are owned, directly or indirectly, of record and/or beneficially by a stockholder, any beneficial owner on whose behalf the stockholder is acting and any of their respective affiliates,

(ii)any option, warrant, convertible security, stock appreciation right or similar right with an exercise or conversion privilege or a settlement payment or mechanism at a price related to any class or series of shares of the Corporation or with a value derived in whole or in part from the value of any class or series of shares of the Corporation, whether or not such instrument or right shall be subject to settlement in the underlying class or series of capital stock of the Corporation or otherwise (a “Derivative Instrument’) directly or indirectly owned beneficially by such stockholder, any such beneficial owner and any of their respective affiliates, and any other direct or indirect opportunity to profit or share in any profit derived from any increase or decrease in the value of shares of the Corporation,

(iii)any proxy, contract, arrangement, understanding, or relationship pursuant to which such stockholder has a right to vote any shares of any security of the Corporation,

(iv)any short interest in any security of the Corporation (for purposes of these Fourth Amended and Restated Bylaws (these “Bylaws”), a person shall be deemed to have a short interest in a security if such person directly or indirectly, through any contract, arrangement, understanding, relationship or otherwise, has the opportunity to profit or share in any profit derived from any decrease in the value of the subject security),

(v)any rights to dividends on the shares of the Corporation owned

beneficially by such stockholder that are separated or separable from the underlying shares of the Corporation,

(vi)any proportionate interest in shares of the Corporation or Derivative Instruments held, directly or indirectly, by a general or limited partnership in which such stockholder or beneficial owner is a general partner or, directly or indirectly, beneficially owns an interest in a general partner and

(vii)any performance-related fees (other than asset-based fee) that such stockholder, any such beneficial owner and any of their respective affiliates are entitled to based on any increase or decrease in the value of shares of the Corporation or Derivative Instruments, if any, as of the date of such notice, including without limitation any such interests held by members of such person’s immediate family sharing the same household.

Section 2.3Special Meetings. Unless otherwise prescribed by law or by the Certificate of Incorporation, Special Meetings of Stockholders (“Special Meetings”), for any purpose or purposes, may be called by the majority vote of the Board of Directors or by a Chief Executive Officer. Special Meetings may not be called by any other person or persons, except as required by law or provided by resolutions adopted by the Board of Directors designating the rights, powers and preferences of any shares of one or more series of Preferred Stock of the Corporation, par value $0.01 per share (the “Preferred Stock”). Written notice of a Special Meeting shall be given in accordance with Section 232 of the DGCL or any successor provision thereto and shall state the place, date and hour of the meeting, and the means of remote communication, if any, by which stockholders and proxy holders may be deemed to be present in person and vote at such meeting and such notice shall be given to each stockholder entitled to vote at such meeting not less than ten days nor more than sixty days before the date of the meeting. If notice is given by electronic transmission, such notice shall be deemed to be given in accordance with and at the times provided in Section 232 of the DGCL or any successor provision thereto. Only such business shall be conducted at a Special Meeting as shall have been described in the notice of meeting sent to stockholders pursuant to this Section 2.3. Only persons who are nominated in accordance and compliance with the procedures set forth in Section 3.1 shall be eligible for election to the Board of Directors at a Special Meeting.

Section 2.4Quorum. Except as otherwise required by law, these Bylaws or by the Certificate of Incorporation, holders of a majority of the capital stock issued and entitled to vote thereat present in person or represented by proxy shall constitute a quorum at all meetings of the stockholders for the transaction of business. For purposes of determining the presence of a quorum, “capital stock issued and entitled to vote thereat” shall be deemed to include that number of shares of Common Stock in the capital of the Corporation equal to the number of votes that the Trustee is entitled to vote from time to time pursuant to the Special Voting Share in the capital of the Corporation (which Special Voting Share is governed by the terms of the Certificate of Incorporation and the Voting and Exchange Trust Agreement dated April 25, 2018, between the Corporation, Ceridian Acquisitionco ULC, Ceridian Canada Ltd. and the trustee appointed thereunder from time-to-time (the “Trustee”)). Where a separate vote by one or more classes or series of the capital stock is required, the presence in person or by proxy of the holders of record of a majority in voting power of the shares entitled to vote shall constitute a quorum entitled to take action with respect to that vote on that matter.

Section 2.5Adjournment. Any meeting of the stockholders may be adjourned from time to time to reconvene at the same or some other place, if any, and notice need not be given of any such adjourned meeting if the time, place, if any, thereof and the means of remote communication, if any, are provided in accordance with applicable law. At such adjourned meeting, any business may be transacted which might have been transacted at the meeting as originally noticed. If the adjournment is for more than thirty days, or if after the adjournment a new record date is fixed for the adjourned meeting, a notice of the adjourned meeting shall be given to each stockholder entitled to vote at the meeting.

Section 2.6Voting. Unless otherwise required by law, the Certificate of Incorporation or these Bylaws, any question brought before any meeting of stockholders shall be decided by the vote of the holders of a majority of the stock represented and voting on the subject matter. Such votes may be cast in person or by proxy but no proxy shall be voted on or after three years from its date, unless such proxy provides for a longer period. The Board of Directors, in its discretion, or the officer of the Corporation presiding at a meeting of stockholders, in his discretion, may require that any votes cast at such meeting shall be cast by written ballot.

Section 2.7Consent of Stockholders in Lieu of a Meeting. Actions required or permitted to be taken at any annual or special meeting of stockholders may be taken without a meeting upon the written consent of the stockholders, but only if such action is taken in accordance with the provisions of Article IX of the Certificate of Incorporation.

Section 2.8List of Stockholders Entitled to Vote. The officer of the Corporation who has charge of the stock ledger of the Corporation shall prepare and make, at least ten days before every meeting of stockholders, a complete list of the stockholders entitled to vote at the meeting, arranged in alphabetical order, and showing the address of each stockholder and the number of shares registered in the name of each stockholder. Such list shall be open to the examination of any stockholder, for any purpose germane to the meeting, during ordinary business hours, for a period of at least ten days ending on the day before the meeting date, either at a place within the city where the meeting is to be held, which place shall be specified in the notice of the meeting, or, if not so specified, at the place where the meeting is to be held.

Section 2.9Stock Ledger. The stock ledger of the Corporation shall be the only evidence as to who are the stockholders entitled to examine the stock ledger, the list required by Section 2.8 hereof or the books of the Corporation, or to vote in person or by proxy at any meeting of stockholders.

Section 3.1Number and Election of Directors.

(a)Subject to the rights, if any, of holders of Preferred Stock to elect directors of the Corporation, the Board of Directors shall consist of not less than one (1) nor more than fourteen (14) members with the exact number of directors to be determined from time to time exclusively by resolution duly adopted by the Board of Directors. Except in a contested election, directors shall be elected by a majority of the votes cast at the Annual Meeting and, unless otherwise

provided by the Certificate of Incorporation, each director so elected shall hold office until the Annual Meeting at which such director’s term expires and until such director’s successor shall be elected and shall qualify for office, subject, however to prior death, resignation, retirement, disqualification or removal from office. If, as of the date that is ten (10) days in advance of the date the Corporation files its definitive proxy statement (regardless of whether or not thereafter revised or supplemented) with the Securities and Exchange Commission the number of nominees exceeds the number of nominees elected in such election (a “contested election”), the directors shall be elected by the plurality of the votes cast. For purposes of this Section 3.1, a “majority of the votes cast” means the number of votes cast “for” a director must exceed the number of votes cast “against” that director (with “abstentions” and “broker non-votes” not counted as a vote either “for” or “against” that director’s election). Any director may resign at any time effective upon giving written notice to the Corporation, unless the notice specifies a later time for the effectiveness of such resignation. Directors need not be stockholders.

(b)Only persons who are nominated in accordance with the following procedures shall be eligible for election as directors of the Corporation, except as may be otherwise provided in the Certificate of Incorporation with respect to the right of holders of Preferred Stock of the Corporation to nominate and elect a specified number of directors in certain circumstances. Nominations of persons for election to the Board of Directors may be made at any Annual Meeting or at any Special Meeting called by a majority vote of the Board of Directors or by a Chief Executive Officer for the purpose of electing directors (i) by or at the direction of the Board of Directors (or any duly authorized committee thereof) or (ii) by any stockholder of the Corporation (A) who is a stockholder of record on the date of the giving of the notice provided for in this Section 3.1 and on the record date for the determination of stockholders entitled to vote at such Annual or Special Meeting and (B) who complies with the notice and other procedures set forth in this Section 3.1.

(c)In addition to any other applicable requirements, for a nomination to be made by a stockholder, such stockholder must have given timely notice thereof in proper written form to the Secretary of the Corporation and followed the procedures set forth in this Section 3.1. To be timely, a stockholder's notice to the Secretary must be delivered to or mailed and received at the principal executive offices of the Corporation (i) in the case of an Annual Meeting, not less than one-hundred and twenty days prior to the anniversary date of the date of the proxy statement for the immediately preceding Annual Meeting; provided, however, that in the event that the Annual Meeting is called for a date that is not within thirty days before or after the anniversary date of the immediately preceding Annual Meeting, notice by the stockholder in order to be timely must be so received not later than the close of business on the tenth day following the day on which public disclosure of the date of the Annual Meeting was first made; and (ii) in the case of a Special Meeting called for the purpose of electing directors, not later than the close of business on the tenth day following the day on which public disclosure of the date of the Special Meeting was first made.

(d)To be in proper written form, a stockholder's notice to the Secretary must be signed by the stockholder of record who intends to make the nomination, and by the beneficial owner or owners, if any, on whose behalf the stockholder is acting and shall set forth

(i)as to each person whom the stockholder proposes to nominate for election as a director

(A)the name, age, business address and residence address of the person,

(B)the principal occupation or employment of the person,

(C)the Share Information with respect to each person whom the stockholder proposes to nominate (which Share Information required by this clause (C) shall be supplemented by such stockholder and any such beneficial owner not later than ten (10) days after the record date for the meeting to disclose such Share Information as of the record date for the meeting) and

(D)any other information relating to the person that would be required to be disclosed in a proxy statement or other filing required to be made in connection with solicitations of proxies for election of directors pursuant to Section 14 of the Exchange Act and the rules and regulations promulgated thereunder; and

(ii)as to the stockholder giving the notice

(A)the name and record address of such stockholder and the beneficial owner or owners, if any, on whose behalf the nomination is made,

(B)the Share Information with respect to the stockholder making the nomination and the beneficial owner or owners, if any (which Share Information required by this clause (B) shall be supplemented by such stockholder and any such beneficial owner not later than ten (10) days after the record date for the meeting to disclose such Share Information as of the record date for the meeting),

(C)a description of all arrangements or understandings between such stockholder or beneficial owner or owners and each proposed nominee and any other person or persons (including their names) pursuant to which the nomination(s) are to be made by such stockholder and any such beneficial owner, including without limitation any arrangement or understanding with any person as to how such nominee, if elected as a director of the Corporation, will act or vote on any issue or question,

(D)a representation that such stockholder is a holder of record of shares of the Corporation entitled to vote at the Annual Meeting and intends to appear in person or by proxy at the Annual Meeting to nominate the persons named in its notice,

(E)a description of all direct and indirect compensation and other material monetary agreements, arrangements and understandings during the past three years, and any other material relationships, between or among such stockholder and any such beneficial owner and their respective affiliates and associates, or others acting in concert therewith, on the one hand, and each proposed nominee, and his or her respective affiliates and associates, or others acting in concert therewith, on the other hand, including, without limitation, all information that would be required to be disclosed pursuant to Rule 404 promulgated under Regulation S-K if the stockholder making the

nomination and any beneficial owner on whose behalf the nomination is made, or any affiliate or associate thereof or person acting in concert therewith, were the “registrant” for purposes of such rule and the nominee were a director or executive officer of such registrant, and

(F)any other information relating to such stockholder that would be required to be disclosed in a proxy statement or other filings required to be made in connection with solicitations of proxies for election of directors pursuant to Section 14 of the Exchange Act and the rules and regulations promulgated thereunder, including a representation that such stockholder and any such beneficial owner intends, or is part of a group that intends, to deliver a proxy statement and form of proxy to solicit the holders of at least 67% of the voting power of shares entitled to vote in the election of directors in support of director nominees other than the Corporation’s nominees in accordance with Rule 14a-19 under the Exchange Act (“Rule 14a-19”). Such notice must be accompanied by a written consent of each proposed nominee to being named as a nominee to be named in a proxy statement relating to such meeting and accompanying proxy cards and to serve as a director if elected. A notice as to a nomination must also be accompanied by

(1)a written representation and agreement of the nominee (in the form provided by the Corporation upon written request of any stockholder of record thereof) that such nominee (I) is not and will not become a party to (a) any compensatory, payment, reimbursement, indemnification or other financial agreement, arrangement or understanding with any person or entity in connection with service or action as a director of the Corporation that has not been disclosed to the Corporation, (b) any agreement, arrangement or understanding with any person or entity as to how the nominee would vote or act on any issue or question as a director (a “Voting Commitment”) that has not been disclosed to the Corporation or (c) any Voting Commitment that could limit or interfere with the nominee’s ability to comply, if elected as a director of the Corporation, with his or her fiduciary duties under applicable law, (II) has read and agrees, if elected as a director of the Corporation, to sign and adhere to the Corporation’s corporate governance guidelines and codes of conduct and any other Corporation policies and guidelines applicable to directors, and (III) if elected as a director of the Corporation, intends to serve the entire term until the next Annual Meeting and

(2)a written questionnaire required of the Corporation’s directors and officers completed by the nominee (in the form provided by the Corporation upon written request of any stockholder of record thereof). In the case of any proposed nomination for election or re-election as a director, the Corporation may require any proposed nominee to furnish, within five (5) Business Days of any such request, such other information as may reasonably be required by the Corporation to determine the eligibility of such proposed nominee to serve as an independent director of the Corporation or that could be material to a reasonable stockholder’s understanding of the independence, or lack thereof, of such nominee. For purposes of these Bylaws, “Business Day” shall mean any day other than a Saturday, a Sunday, or a day on which banking institutions in the State of Minnesota are authorized or obligated by law or executive order to close.

(e)No person shall be eligible for election as a director of the Corporation unless nominated in accordance with the procedures set forth in this Section 3.1. In no event may a stockholder provide notice as to nominations pursuant to this Section 3.1 with respect to a greater number of director candidates (as alternates or otherwise) than are subject to election by stockholders at the applicable Annual Meeting or Special Meeting. If the Chair of the meeting determines that a nomination was not made in accordance with the foregoing procedures, the Chair shall declare to the meeting that the nomination was defective and such defective nomination shall be disregarded.

(f)Notwithstanding the foregoing provisions of this Section 3.1, unless otherwise required by law,

(i)no stockholder giving notice as to other business pursuant to Section 2.2 or nominations pursuant to this Section 3.1 shall solicit proxies in support of director nominees other than the Corporation’s nominees unless such stockholder has complied with Rule 14a-19 in connection with the solicitation of such proxies, including the provision to the Corporation of notices required hereunder in a timely manner, and

(ii)if any such stockholder (A) provides notice pursuant to Rule 14a-19(b) and (B) subsequently fails to comply with the requirements of Rule 14a-19(a)(2) and Rule 14a-19(a)(3), including the provision to the Corporation of notices required thereunder in a timely manner, or (C) fails to timely provide reasonable evidence sufficient to satisfy the Corporation that such stockholder has met the requirements of Rule 14a-19(a)(3) in accordance with the following sentence, then the Corporation shall disregard any proxies or votes solicited for such stockholder’s nominees.

If any stockholder providing notice as to nominations pursuant to this Section 3.1 provides notice pursuant to Rule 14a-19(b), then such stockholder shall (A) promptly notify the Corporation if it subsequently fails to comply with the requirements of Rule 14a-19(a)(2) and Rule 14a-19(a)(3) and (B) deliver to the Corporation, no later than seven (7) Business Days prior to the applicable meeting, reasonable evidence that it has met the requirements of Rule 14a-19(a)(3).

(g)Any stockholder directly or indirectly soliciting proxies from other stockholders must use a proxy card color other than white, which shall be reserved for the exclusive use by the Board of Directors.

Section 3.2Chair of the Board of Directors. The Board of Directors may appoint from its members a Chair of the Board of Directors, who need not be an employee or officer of the Corporation. The Chair of the Board of Directors, if there is one, shall preside at all meetings of the stockholders and of the Board of Directors and may adopt rules and regulations for the conduct of such meetings. Except where by law the signature of a Chief Executive Officer or the President is required, the Chair of the Board of Directors shall possess the same power as a Chief Executive Officer or the President to sign all contracts, certificates and other instruments of the Corporation which may be authorized by the Board of Directors. During the absence or disability of all Chief Executive Officers or the President, the Chair of the Board of Directors shall exercise all the powers and discharge all the duties of a Chief Executive Officer or the President. The Chair of the Board of Directors shall also perform such other duties and may exercise such other powers as from time to time may be assigned to him by these Bylaws or by the Board of Directors.

Section 3.3Vacancies. Subject to the terms of any one or more series or classes of Preferred Stock, any vacancy on the Board of Directors, however created, may be filled only by a majority of the directors then in office, though less than a quorum or by a sole remaining director. Any director elected to fill a vacancy shall hold office for a term that shall expire at the next annual meeting of stockholders.

Section 3.4Duties and Powers. The business of the Corporation shall be managed by or under the direction of the Board of Directors which may exercise all such powers of the Corporation and do all such lawful acts and things as are not by statute or by the Certificate of Incorporation or

by these Bylaws directed or required to be exercised or done by the stockholders.

Section 3.5Meetings. The Board of Directors may hold meetings, both regular and special, either within or without the State of Delaware. Regular meetings of the Board of Directors may be held without notice at such time and at such place as may from time to time be determined by the Board of Directors. Special meetings of the Board of Directors may be called by a Chief Executive Officer, the Chair of the Board of Directors, if there is one, the President, or any directors. Notice thereof stating the place, date and hour of the meeting shall be given to each director either by mail not less than forty-eight hours before the date of the meeting, by telephone or facsimile on twenty-four hours' notice, or on such shorter notice as the person or persons calling such meeting may deem necessary or appropriate in the circumstances.

Section 3.6Quorum. Except as may be otherwise specifically provided by law, the Certificate of Incorporation or these Bylaws, at all meetings of the Board of Directors, a majority of the entire Board of Directors shall constitute a quorum for the transaction of business and the act of a majority of the directors present at any meeting at which there is a quorum shall be the act of the Board of Directors. If a quorum shall not be present at any meeting of the Board of Directors, the directors present thereat may adjourn the meeting from time to time, without notice other than announcement at the meeting, until a quorum shall be present.

Section 3.7Actions of Board. Unless otherwise provided by the Certificate of Incorporation or these Bylaws, any action required or permitted to be taken at any meeting of the Board of Directors or of any committee thereof may be taken without a meeting, if all the members of the Board of Directors or committee, as the case may be, consent thereto in writing or by electronic transmission, and the writing, writings, electronic transmission or electronic transmissions are filed with the minutes of proceedings of the Board of Directors or committee.

Section 3.8Meetings by Means of Conference Telephone. Unless otherwise provided by the Certificate of Incorporation or these Bylaws, members of the Board of Directors of the Corporation, or any committee designated by the Board of Directors, may participate in a meeting of the Board of Directors or such committee by means of a conference telephone or similar communications equipment by means of which all persons participating in the meeting can hear each other, and participation in a meeting pursuant to this Section 3.7 shall constitute presence in person at such meeting.

Section 3.9Committees. The Board of Directors may, by resolution passed by a majority of the entire Board of Directors, designate one or more committees, each committee to consist of one or more of the directors of the Corporation. The Board of Directors may designate one or more directors as alternate members of any committee, who may replace any absent or disqualified member at any meeting of any such committee. In the absence or disqualification of a member of a committee, and in the absence of a designation by the Board of Directors of an alternate member to replace the absent or disqualified member, the member or members thereof present at any meeting and not disqualified from voting, whether or not he or they constitute a quorum, may unanimously appoint another member of the Board of Directors to act at the meeting in the place of any absent or disqualified member. In the event any person shall cease to be a director of the Corporation, such person shall simultaneously therewith cease to be a member of any committee appointed by the Board of Directors. Any committee, to the extent allowed by law and provided in the resolution establishing such committee, shall have and may exercise all the powers and authority

of the Board of Directors in the management of the business and affairs of the Corporation, subject to the limitations set forth in applicable Delaware law. Each committee shall keep regular minutes and report to the Board of Directors when required.

Section 3.10Audit Committee. The Board of Directors, by resolution adopted by a majority of the whole Board of Directors, may designate three or more directors to constitute an Audit Committee, to serve as such until the next annual meeting of the Board of Directors or until their respective successors are designated. The audit committee will carry out its responsibilities as set forth in an audit committee charter to be adopted by the Board of Directors.

Section 3.11Compensation. At the discretion of the Board of Directors, the directors may be paid their expenses, if any, of attendance at each meeting of the Board of Directors and may be paid a fixed sum for attendance at each meeting of the Board of Directors or a stated salary as director. No such payment shall preclude any director from serving the Corporation in any other capacity and receiving compensation therefor. At the discretion of the Board of Directors, members of special or standing committees may be allowed like compensation for attending committee meetings.

Section 3.12Interested Directors. No contract or transaction between the Corporation and one or more of its directors or officers, or between the Corporation and any other corporation, partnership, association, or other organization in which one or more of its directors or officers are directors or officers, or have a financial interest, shall be void or voidable solely for this reason, or solely because the director or officer is present at or participates in the meeting of the Board of Directors or committee thereof which authorizes the contract or transaction, or solely because his or their votes are counted for such purpose if: (a) the material facts as to his or their relationship or interest and as to the contract or transaction are disclosed or are known to the Board of Directors or the committee, and the Board of Directors or committee in good faith authorizes the contract or transaction by the affirmative votes of a majority of the disinterested directors, even though the disinterested directors be less than a quorum; or (b) the material facts as to his or their relationship or interest and as to the contract or transaction are disclosed or are known to the stockholders entitled to vote thereon, and the contract or transaction is specifically approved in good faith by vote of the stockholders; or (c) the contract or transaction is fair as to the Corporation as of the time it is authorized, approved or ratified by the Board of Directors, a committee thereof or the stockholders. Common or interested directors may be counted in determining the presence of a quorum at a meeting of the Board of Directors or of a committee which authorizes the contract or transaction.

Section 3.13Entire Board of Directors. As used in these Bylaws generally, the term “entire Board of Directors” means the total number of directors which the Corporation would have if there were no vacancies.

Section 4.1General. The officers of the Corporation shall be chosen by the Board of Directors and shall include up to two Chief Executive Officers, a President and a Secretary. The

Board of Directors, in its discretion, may also appoint a Chief Financial Officer, Assistant Chief Financial Officers, Controller, Treasurer, Assistant Treasurers and one or more Vice Presidents, Assistant Secretaries, and other officers, who shall have such authority and perform such duties as may be prescribed in such appointment. Any number of offices may be held by the same person, unless otherwise prohibited by law, the Certificate of Incorporation or these Bylaws. The officers of the Corporation need not be stockholders of the Corporation nor need such officers be directors of the Corporation.