Current Report Filing (8-k)

October 14 2020 - 5:05PM

Edgar (US Regulatory)

false

0000910612

0000915140

0000910612

2020-10-14

2020-10-14

0000910612

cbl:CBLAssociatesLimitedPartnershipMember

2020-10-14

2020-10-14

0000910612

us-gaap:CommonClassAMember

2020-10-14

2020-10-14

0000910612

us-gaap:SeriesDPreferredStockMember

2020-10-14

2020-10-14

0000910612

us-gaap:SeriesEPreferredStockMember

2020-10-14

2020-10-14

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported): October 14, 2020

CBL & ASSOCIATES PROPERTIES, INC.

CBL & ASSOCIATES LIMITED PARTNERSHIP

(Exact Name of Registrant as Specified in its Charter)

|

|

|

|

|

|

|

|

|

Delaware

|

|

1-12494

|

|

62-1545718

|

|

Delaware

|

|

333-182515-01

|

|

62-1542285

|

|

(State or Other Jurisdiction of

Incorporation or Organization)

|

|

(Commission File Number)

|

|

(I.R.S. Employer Identification No.)

|

2030 Hamilton Place Blvd., Suite 500, Chattanooga, TN 37421-6000

(Address of principal executive office, including zip code)

423-855-0001

(Registrant's telephone number, including area code)

N/A

(Former name, former address and former fiscal year, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered under Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

Title of each Class

|

|

Trading

Symbol(s)

|

|

Name of each exchange on which registered

|

|

Common Stock, $0.01 par value

|

|

CBL

|

|

New York Stock Exchange

|

|

7.375% Series D Cumulative Redeemable Preferred Stock, $0.01 par value

|

|

CBLprD

|

|

New York Stock Exchange

|

|

6.625% Series E Cumulative Redeemable Preferred Stock, $0.01 par value

|

|

CBLprE

|

|

New York Stock Exchange

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

ITEM 1.01 Entry into a Material Definitive Agreement

The information set forth under Item 8.01 of this Current Report on Form 8-K is incorporated into this Item 1.01 by reference.

ITEM 7.01 Regulation FD Disclosure

In January 2020, CBL & Associates Properties. Inc. (the “REIT”) and its majority owned subsidiary CBL & Associates Limited Partnership (the “Operating Partnership”, and together with CBL & Associates Properties, Inc., the “Company”) engaged Weil, Gotshal & Manges LLP and Moelis & Company LLC (the “Advisors”) to assist the Company in exploring several alternatives to reduce overall leverage and interest expense and to extend the maturity of its debt, among other things. The Company’s Advisors began discussions in May 2020 with advisors to certain holders of its senior unsecured notes and the advisors to certain lenders under the senior secured credit facility. As previously disclosed, on August 18, 2020, the Company entered into the Restructuring Support Agreement (the “RSA”) with certain beneficial owners and/or investment advisors or managers of discretionary funds, accounts or other entities for the holders of beneficial owners (the “Consenting Noteholders”) in excess of 60%, including joining noteholders added pursuant to joinder agreements, of the aggregate principal amount of the Operating Partnership’s Notes (as defined below).

As discussions with the advisors to the Consenting Noteholders and lenders under the Company’s secured credit facility continue, the Company has elected to not make the $6.9 million interest payment (the “Interest Payment”) due and payable on October 15, 2020, with respect to the Operating Partnership’s 4.60% senior unsecured notes due 2024 (the “2024 Notes”). Under the indenture governing the 2024 Notes, the Operating Partnership has a 30-day grace period to make the Interest Payment before the nonpayment is considered an “event of default” with respect to the 2024 Notes. Any event of default under the 2024 Notes for nonpayment of the Interest Payment would also be considered an event of default under the Operating Partnership’s senior secured credit facility which could lead to an acceleration of amounts due under the facility, however, as previously reported, on August 19, 2020, the Operating Partnership received a notice of acceleration of obligations under the secured credit facility based on the events of default previously asserted by the Administrative Agent under the secured credit facility, which the Company continues to dispute. Further, if the trustee for the 2024 Notes should exercise its right to accelerate the maturity of the full balance owed on the 2024 Notes as a result of such an “event of default,” that would also constitute an “event of default” under the Operating Partnership’s 5.25% senior unsecured notes due 2023 (the “2023 Notes”) and the Operating Partnership’s 5.95% senior unsecured notes due 2026 (the “2026 Notes,” together with the 2023 Notes and 2024 Notes, the “Notes”), which could lead to the acceleration of all amounts due under those notes.

As discussed below, the Company and the Required Consenting Noteholders (as defined in the RSA) extended the RSA milestone date by which the Company is required to commence the Chapter 11 Cases (as defined below) and the Company elected to not make the Interest Payment and enter the 30-day grace period in order to continue to engage in negotiations and discussions with the Consenting Noteholders and lenders under their senior credit facilities.

The information disclosed in this Item 7.01 is being furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that Section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, regardless of any general incorporation language in such a filing.

ITEM 8.01 Other Events

As previously disclosed, on August 18, 2020, the Company entered into the RSA with the Consenting Noteholders. On September 26, 2020, in accordance with the terms of the RSA, the Company and the Required Consenting Noteholders agreed to extend the date by which the Company is required to commence cases (the “Chapter 11 Cases”) pursuant to title 11 of the United States Code in the Bankruptcy Court to implement the restructuring transactions as set forth in the terms of the RSA, from October 1, 2020 to no later than October 15, 2020 (such date of commencement, the “Petition Date”). Further, on October 14, 2020, in accordance with the terms of the RSA, the Company and the Required Consenting Noteholders agreed to extend the Petition Date, from October 15, 2020 to no later than November 2, 2020. The Company issued a press release on October 14, 2020 announcing the Amendment to the RSA and nonpayment of the Interest Payment with respect to the 2024 Notes, which is furnished as Exhibit 99.1 to this Current Report.

Additionally, on October 14, 2020, the Board of Directors of CBL & Associates Properties, Inc. (the “Board”), appointed a special committee (the “Special Committee”) of the Board consisting of two independent directors of the Board, Carolyn B. Tiffany and Scott D. Vogel. The Special Committee is authorized to, among other things, review, approve, and act upon any transactions for and on behalf of the Company in which the General Counsel or outside counsel advises that a conflict exists between the Company and its equity holders, its affiliates, or its managers and officers in the context of a Chapter 11 restructuring case. In carrying out its responsibilities, the Special Committee will coordinate and consult with the Board, management, and the Company’s professional advisors, as appropriate.

ITEM 9.01 Financial Statements and Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

CBL & ASSOCIATES PROPERTIES, INC.

|

|

|

|

|

|

|

|

|

/s/ Farzana Khaleel

|

|

|

|

|

|

Farzana Khaleel

|

|

|

Executive Vice President -

|

|

|

Chief Financial Officer and Treasurer

|

|

|

|

|

|

CBL & ASSOCIATES LIMITED PARTNERSHIP

|

|

|

|

|

|

By: CBL HOLDINGS I, INC., its general partner

|

|

|

|

|

|

|

|

|

/s/ Farzana Khaleel

|

|

|

|

|

|

Farzana Khaleel

|

|

|

Executive Vice President -

|

|

|

Chief Financial Officer and Treasurer

|

|

|

|

|

Date: October 14, 2020

|

|

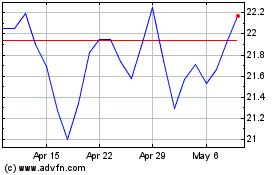

CBL and Associates Prope... (NYSE:CBL)

Historical Stock Chart

From Mar 2024 to Apr 2024

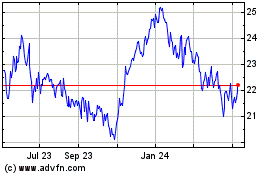

CBL and Associates Prope... (NYSE:CBL)

Historical Stock Chart

From Apr 2023 to Apr 2024