Free Writing Prospectus - Filing Under Securities Act Rules 163/433 (fwp)

July 15 2019 - 5:01PM

Edgar (US Regulatory)

Filed Pursuant to Rule 433

Registration Statement

No. 333-228614

Pricing Term Sheet

Dated July 15, 2019

The Bank of Nova Scotia

US$500,000,000 2.375% SENIOR GREEN BONDS DUE 2023 (Bail-inable notes)

|

|

|

|

|

Issuer:

|

|

The Bank of Nova Scotia (the “Bank”)

|

|

|

|

|

Title of Securities:

|

|

2.375% Senior Green Bonds due 2023 (the “Notes”)

|

|

|

|

|

Issuer Ratings:*

|

|

A2 / A+ /

AA-

(Moody’s / S&P / Fitch)

|

|

|

|

|

Expected Security Ratings:*

|

|

A2 /

A-

/

AA-

(Moody’s / S&P / Fitch)

|

|

|

|

|

Principal Amount:

|

|

US$500,000,000

|

|

|

|

|

Maturity Date:

|

|

January 18, 2023

|

|

|

|

|

Price to Public:

|

|

99.953%, plus accrued interest, if any, from July 18, 2019

|

|

|

|

|

Underwriters’ Fee:

|

|

0.250%

|

|

|

|

|

Net Proceeds to the Bank After Underwriters’ Fee and Before Expenses:

|

|

US$498,515,000

|

|

|

|

|

Coupon (Interest Rate):

|

|

2.375%

|

|

|

|

|

Re-offer

Yield:

|

|

2.389%

|

|

|

|

|

Spread to Benchmark Treasury:

|

|

T + 58 basis points

|

|

|

|

|

Benchmark Treasury:

|

|

UST 1.750% due July 15, 2022

|

|

|

|

|

Benchmark Treasury Yield:

|

|

1.809%

|

|

|

|

|

Interest Payment Dates:

|

|

January 18 and July 18 of each year, commencing on January 18, 2020

|

|

|

|

|

Day Count / Business Day Convention:

|

|

30/360; Following, Unadjusted

|

|

|

|

|

Canadian

Bail-in

Powers Acknowledgment:

|

|

Yes. The Notes are subject to

bail-in

conversion under the Canadian

bail-in

regime.

|

|

|

|

|

Use of Proceeds:

|

|

The net proceeds to the Bank from the sale of the Notes will be used to fund the financing or refinancing, in whole or in part, of new or existing assets, businesses or projects that meet the Scotiabank Green Bond Framework

Eligibility Criteria.

|

|

|

|

|

Trade Date:

|

|

July 15, 2019

|

|

|

|

|

Settlement Date:

|

|

July 18, 2019 (T+3)

|

|

|

|

|

CUSIP / ISIN:

|

|

064159QD1 / US064159QD10

|

|

|

|

|

Joint Book-Running Managers:

|

|

Scotia Capital (USA) Inc.

BNP Paribas

Securities Corp.

ING Financial Markets LLC

J.P. Morgan

Securities LLC

|

|

*

|

Note: A rating is not a recommendation to buy, sell or hold securities and may be subject to revision or

withdrawal at any time. Each of the ratings above should be evaluated independently of any other rating.

|

US$500,000,000

2.375

% SENIOR GREEN BONDS DUE 2023

(Bail-inable notes)

|

|

|

|

|

|

|

Underwriter

|

|

Principal Amount

of Notes to Be

Purchased

|

|

|

Scotia Capital (USA) Inc.

|

|

US$

|

150,000,000

|

|

|

BNP Paribas Securities Corp.

|

|

|

150,000,000

|

|

|

ING Financial Markets LLC

|

|

|

100,000,000

|

|

|

J.P. Morgan Securities LLC

|

|

|

100,000,000

|

|

|

|

|

|

|

|

|

Total

|

|

US$

|

500,000,000

|

|

|

|

|

|

|

|

No PRIIPs KID. Not for retail investors in the EEA.

The Notes are bail-inable debt

securities (as defined in the Prospectus) and subject to conversion in whole or in part – by means of a transaction or series of transactions and in one or more steps – into common shares of the Bank or any of its affiliates under

subsection 39.2(2.3) of the Canada Deposit Insurance Corporation Act (Canada) (the “CDIC Act”) and to variation or extinguishment in consequence, and subject to the application of the laws of the Province of Ontario and the federal laws of

Canada applicable therein in respect of the operation of the CDIC Act with respect to the Notes.

We expect that delivery of

the Notes will be made against payment therefor on or about the third Business Day following the Trade Date (this settlement cycle being referred to as “T+3”). Under Rule

15c6-1

of the Securities

Exchange Act of 1934, as amended, trades in the secondary market generally are required to settle in two Business Days (“T+2”), unless the parties to any such trade expressly agree otherwise. Accordingly, purchasers who wish to trade

the Notes on the Trade Date will be required, by virtue of the fact that each Note initially will settle in three Business Days (T+3), to specify alternative settlement arrangements to prevent a failed settlement.

The Bank has filed a registration statement (File

No. 333-228614)

(including a base shelf prospectus dated

December 26, 2018) and a preliminary prospectus supplement dated July 15, 2019 (including the base shelf prospectus, the “Prospectus”) with the Securities and Exchange Commission (the “SEC”) for the offering to which

this communication relates. Before you invest, you should read the Prospectus and the documents incorporated therein by reference that the Bank has filed with the SEC for more complete information about the Bank and this offering. You may obtain

these documents for free by visiting EDGAR on the SEC website at www.sec.gov or by visiting the Canadian System for Electronic Document Analysis and Retrieval (SEDAR) website, which may be accessed at www.sedar.com. Alternatively, the Bank or any

underwriter participating in the offering will arrange to send you the Prospectus and any document incorporated therein by reference if you request such documents by calling Scotia Capital (USA) Inc. at 1 (800)

372-3930,

BNP Paribas Securities Corp. at 1 (800)

854-5674,

ING Financial Markets LLC at 1 (646)

424-8972

or J.P. Morgan

Securities LLC at 1 (212)

834-4533

(collect).

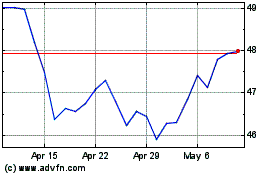

Bank Nova Scotia Halifax (NYSE:BNS)

Historical Stock Chart

From Mar 2024 to Apr 2024

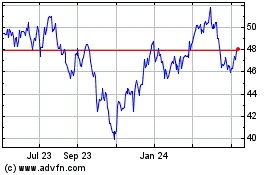

Bank Nova Scotia Halifax (NYSE:BNS)

Historical Stock Chart

From Apr 2023 to Apr 2024