NEW YORK, Oct. 27, 2016 /PRNewswire/ -- Sotheby's is

pleased to announce the acquisition of The Mei Moses Art Indices,

which will now be known as Sotheby's Mei

Moses. Widely recognized as the preeminent measure of

the state of the art market, the indices use repeat sales - the

sale of the same object at different points in time - to track

changes in value. Through this acquisition, Sotheby's has unique

access to an analytic tool that provides objective and verifiable

information to complement the world-class expertise of the

Company's specialists.

The indices comprise a constantly updated database of 45,000

repeat sales of objects in eight collecting categories,

approximately 4,000 of which change hands each year. The

methodology enables Sotheby's to compare the investment performance

of Art against various asset classes, analyze its performance

against myriad benchmarks and competitors and measure the impact of

macro-economic and societal forces on the art market. Sotheby's

Mei Moses uses existing data model

and computation methodology to ensure consistency of the index.

"The collecting community is increasingly sophisticated and, in

many cases, looking to analysis to understand the overall market,

individual artist and category trends, the value of their

collections, as well as gain insight into the timing of their

consignments and purchases," says Adam

Chinn, Sotheby's Executive Vice President. "We are

very happy to be in a position to provide collectors with

proprietary information tailored to their needs, while at the same

time helping us identify and examine trends that can inspire

further innovations within Sotheby's to better serve an expanding

client base."

FOR MORE NEWS FROM SOTHEBY'S

Visit: www.sothebys.com

Follow: www.twitter.com/sothebys

Join: www.facebook.com/sothebys &

www.weibo.com/sothebyshongkong

Watch: www.youtube.com/sothebys

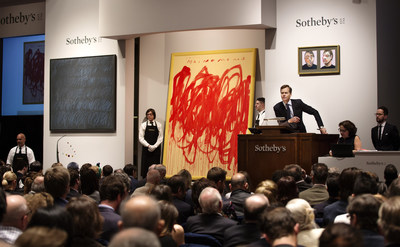

Sotheby's has been uniting collectors with world-class works of

art since 1744. Sotheby's became the first international auction

house when it expanded from London

to New York (1955), the first to

conduct sales in Hong Kong (1973)

and France (2001), and the first

international fine art auction house in China (2012). Today, Sotheby's presents

auctions in eight different salesrooms, including New York, London, Hong

Kong and Paris, and

Sotheby's BidNow program allows visitors to view all auctions live

online and place bids in real-time from anywhere in the world.

Sotheby's offers collectors the resources of Sotheby's Financial

Services, the world's only full-service art financing company, as

well as private sale opportunities in more than 70 categories,

including S|2, the gallery arm of Sotheby's Contemporary Art

department, as well as Sotheby's Diamonds and Sotheby's Wine.

Sotheby's has a global network of 90 offices in 40 countries and is

the oldest company listed on the New York Stock Exchange (BID).

Images are available upon request

All

catalogues are available online at www.sothebys.com or through

Sotheby's Catalogue iPad App.

New York | +1 212 606 7176 |

Lauren Gioia |

Lauren.Gioia@Sothebys.com |

Dan Abernethy |

Dan.Abernethy@Sothebys.com |

Photo -

http://photos.prnewswire.com/prnh/20161027/433301

To view the original version on PR Newswire,

visit:http://www.prnewswire.com/news-releases/sothebys-acquires-the-mei-moses-art-indices-300352710.html

SOURCE Sotheby's