A state-controlled Chinese company's plan to invest about $2

billion in the Taiwanese semiconductor industry has intensified

election-year concerns in Taiwan that could set back China's

ambitions to develop a leading-edge microchip industry.

The dispute revolves around recent Chinese inroads into Taiwan's

chip sector, a major source of Taiwanese economic growth, pride and

an important supplier of components for the world's gadgets. It is

part of a broader debate in Taiwan—an island that Beijing's

political leaders consider a renegade province—about growing

economic ties with the mainland.

On Thursday, Xu Jinghong, chairman of state-controlled

conglomerate Tsinghua Holdings Ltd., addressed Taiwanese worries

about Chinese investment in its chip industry. Tsinghua Holdings'

chip arm, Tsinghua Unigroup Ltd., has in recent days unveiled plans

to invest to Taiwanese companies.

"What's so bad about cooperation between the mainland and

Taiwan?" he said. "If Taiwan can continue to close itself, it will

lose opportunities for future development."

Mr. Xu was responding to questions about Tuesday comments from

Tsai Ing-wen, the Taiwanese opposition leader who is the favorite

to become Taiwan's next president in elections next month. Citing

Tsinghua Unigroup's ties to Beijing, she said she believed the

deals were part of broader efforts to control Taiwan's

semiconductor sector.

"This is a very, very large threat to Taiwan's industry," she

said in Taiwan. "If these issues are not clarified, I don't think

there is any room for opening up."

Ms. Tsai's wariness reflects broader sentiment in Taiwan. Her

main rival Eric Chu is from the ruling party, the Kuomintang, which

traditionally supports more cross-strait investment. But Mr. Chu

has taken an even stronger stance than Ms. Tsai against China chip

investment ahead of the election, which analysts say is a play to

win voters.

"Tsinghua Unigroup has announced so many rapid-fire investments,

it scares the people," said Mark Li, a Bernstein Research

technology analyst. "It's too fast, too much."

Speaking on the sidelines of China's Wuzhen Internet Conference,

Tsinghua Holdings's Mr. Xu said his company is seeking "a win-win

situation." "It is not, as some narrow-minded people in Taiwan

would say, that the mainland is trying to occupy or invade

Taiwan."

The back-and-forth illustrates the increasingly complex

relationship between China and Taiwan. Chinese President Xi Jinping

and Taiwanese President Ma Ying-jeou met in November, the first

meeting between the leaders of the two governments since the island

and the mainland split in 1949. Trade has also grown. At the same

time, China's Foreign Ministry on Thursday criticized U.S. approval

of its first major sale of weapons to Taiwan in four years.

Both the Chinese and Taiwanese chip industries see benefits in

cooperation. China needs Taiwan's technology to build advanced

chips. Taiwanese companies need Chinese capital and could benefit

from lower-cost labor if it made more chips on the mainland.

Tsinghua Unigroup has become China's semiconductor champion. It

has announced investments totaling more than $20 billion so far

this year, making it one of the chip sector's most acquisitive

companies. It is part of China's efforts to nurture a chip industry

so that it no longer relies on foreign suppliers.

Tsinghua Unigroup recently announced plans to become the largest

shareholder in three Taiwan chip packaging companies: Siliconware

Precision Industries Co., ChipMOS Technologies Inc. and Powertech

Technology Inc. The proposed deal with Siliconware—known as

SPIL—was controversial due to SPIL's status in Taiwan's tech

industry and importance as an Apple Inc. supplier. SPIL's largest

shareholder, the Taiwanese firm Advanced Semiconductor Engineering

Inc., offered to buy out the rest of SPIL at Tsinghua Unigroup's

bid price.

While Chinese investment is allowed in Taiwan's chip packaging

sector, chip design companies are still off limits. Analysts say a

swing factor is whether Mr. Ma, the Taiwanese president, will try

to open up chip design investment before his term ends in May, as

some Taiwanese chip design firms have requested, although the tight

timeline would make it difficult.

T.C. Tu, general director of the competitiveness center for

Taiwan's state-funded Industrial Technology Research Institute,

said China will become a major competitor to Taiwan in microchips

within a decade and said Taipei should carefully consider growing

industry ties.

"Taiwan should cooperate with China in chips in areas where

China dominates the market, but maybe should refrain in areas where

Taiwan sells mostly to Europe or the U.S.," he said.

Sun Lih-chyun, a spokesman for the executive branch of Taiwan's

government, said Thursday that Tsinghua Unigroup has yet to

officially submit its investment plans for government review. When

it does, Taiwanese regulators will consider whether it poses a risk

to Taiwan's chip sector, he said.

Tsinghua Unigroup Chairman Zhao Weiguo said in a statement

Thursday that his company hasn't been in contact with Ms. Tsai's

party. He said Tsinghua Unigroup isn't a government department and

he hopes the company will be treated the same in Taiwan as

companies from other countries are.

"After all, we and Taiwanese people are all Chinese, we have the

same roots and ethnicity," he said.

Write to Gillian Wong at gillian.wong@wsj.com and Eva Dou at

eva.dou@wsj.com

(END) Dow Jones Newswires

December 17, 2015 08:05 ET (13:05 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

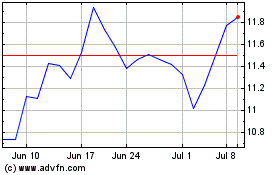

ASE Technology (NYSE:ASX)

Historical Stock Chart

From Mar 2024 to Apr 2024

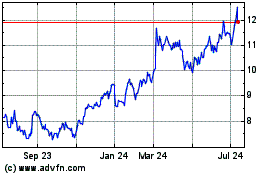

ASE Technology (NYSE:ASX)

Historical Stock Chart

From Apr 2023 to Apr 2024