-- Record Third-Quarter Sales, Gross Profit

and Earnings per Share --

-- Third-Quarter Earnings per Share Up 17

Percent Year over Year --

Arrow Electronics, Inc. (NYSE:ARW) today reported third-quarter

2017 sales of $6.95 billion, an increase of 17 percent from sales

of $5.94 billion in the third quarter of 2016. Third-quarter net

income of $135 million, or $1.50 per share on a diluted basis,

compared with net income of $118 million, or $1.28 per share on a

diluted basis, in the third quarter of 2016. Excluding certain

items1, net income would have been $163 million, or $1.82 per share

on a diluted basis, in the third quarter of 2017, compared with net

income of $143 million, or $1.56 per share on a diluted basis, in

the third quarter of 2016.

“We are capitalizing on tremendous growth opportunities for the

business, and are delivering successful outcomes to both our

customers and suppliers. Our ability to provide solutions spanning

from sensor to sunset of electronic products’ lifecycles is

unmatched in the distribution and the broader technology

industries,” said Michael J. Long, chairman, president, and chief

executive officer. “Our third straight quarter of record results

highlights our leadership position.”

Global components third-quarter sales of $4.86 billion grew 25

percent year over year. Americas components sales grew 24 percent

year over year. Asia-Pacific components sales grew 24 percent year

over year. Europe components sales grew 25 percent year over year.

Sales in the region, as adjusted, grew 19 percent year over year.

Global components third-quarter operating income grew 21 percent

year over year and grew 20 percent year over year excluding

amortization of intangibles expense. “As we expected, we have

started to capture leverage on our market share gains as evidenced

by our accelerating profit growth,” said Mr. Long.

Global enterprise computing solutions third-quarter sales of

$2.09 billion grew 3 percent year over year. Europe enterprise

computing solutions sales grew 16 percent year over year. Sales in

the region, as adjusted, grew 11 percent year over year. Americas

enterprise computing solutions sales declined 2 percent year over

year. Global enterprise computing solutions third-quarter operating

income declined 1 percent year over year and declined 2 percent

year over year excluding amortization of intangibles expense.

“Continued growth in our infrastructure software and cloud

portfolio along with growth in servers drove sales higher this

quarter, and we remain confident in our strategy to return to

profitable growth in enterprise computing solutions,” added Mr.

Long.

“Third-quarter cash flow from operations was $135 million. We

made substantial investments to support our rapid growth this year,

and our disciplined approach to working capital management allowed

us to start seeing significant cash returns on those investments,”

said Chris Stansbury, senior vice president and chief financial

officer. “We remain committed to returning excess cash to

shareholders. During the third quarter we returned approximately

$25 million to shareholders through our stock repurchase program.

We had approximately $384 million of remaining authorization under

our share repurchase program at the end of the third quarter.”

NINE-MONTH RESULTS

In the first nine months of 2017, sales of $19.18 billion

increased 10 percent from sales of $17.38 billion in the first nine

months of 2016. Net income for the first nine months of 2017 was

$348 million, or $3.87 per share on a diluted basis, compared with

net income of $358 million, or $3.87 per share on a diluted basis

in the first nine months of 2016. Excluding certain items1, net

income would have been $455 million, or $5.06 per share on a

diluted basis, in the first nine months of 2017 compared with net

income of $428 million, or $4.63 per share on a diluted basis, in

the first nine months of 2016.

1 A reconciliation of non-GAAP adjusted financial measures,

including sales, as adjusted, operating income, as adjusted, net

income attributable to shareholders, as adjusted, and net income

per share, as adjusted, to GAAP financial measures is presented in

the reconciliation tables included herein.

GUIDANCE

“As we look to the fourth quarter, we believe that total sales

will be between $7.2 billion and $7.6 billion, with global

components sales between $4.75 billion and $4.95 billion, and

global enterprise computing solutions sales between $2.45 billion

and $2.65 billion. As a result of this outlook, we expect earnings

per share on a diluted basis, to be in the range of $1.86 to $2.02,

and earnings per share on a diluted basis, excluding certain

items1, to be in the range of $2.21 to $2.37 per share. Our

guidance assumes interest expense will be approximately $44

million. The increase compared to the third quarter is due to

slightly higher interest rates on our new long-term borrowings

compared to our short-term borrowings, as well as normal, higher

intra-quarter borrowings to support our seasonally largest quarter.

Our guidance also assumes an average tax rate of 27 to 29 percent

and average diluted shares outstanding are expected to be 89

million. We are expecting the average USD-to-Euro exchange rate for

the fourth quarter to be approximately $1.18 to €1. At the

midpoints of our fourth-quarter guidance ranges, full-year 2017

sales would total approximately $26.58 billion, and would grow 12

percent compared to full-year 2016. Full-year 2017 earnings per

share, on a diluted basis, excluding certain items1, would total

approximately $7.35 and would grow 11 percent compared to full-year

2016,” said Mr. Stansbury.

Please refer to the CFO commentary, which can be found at

investor.arrow.com, as a supplement to the company’s earnings

release.

Arrow Electronics (www.arrow.com) is a global provider of

products, services and solutions to industrial and commercial users

of electronic components and enterprise computing solutions. Arrow

serves as a supply channel partner for more than 125,000 original

equipment manufacturers, contract manufacturers and commercial

customers through a global network of more than 465 locations

serving over 90 countries.

Information Relating to Forward-Looking

Statements

This press release includes forward-looking statements that are

subject to numerous assumptions, risks, and uncertainties, which

could cause actual results or facts to differ materially from such

statements for a variety of reasons, including, but not limited to:

industry conditions, the company's implementation of its new

enterprise resource planning system, changes in product supply,

pricing and customer demand, competition, other vagaries in the

global components and global enterprise computing solutions

markets, changes in relationships with key suppliers, increased

profit margin pressure, the effects of additional actions taken to

become more efficient or lower costs, risks related to the

integration of acquired businesses, changes in legal and regulatory

matters, and the company’s ability to generate additional cash

flow. Forward-looking statements are those statements which are not

statements of historical fact. These forward-looking statements can

be identified by forward-looking words such as "expects,"

"anticipates," "intends," "plans," "may," "will," "believes,"

"seeks," "estimates," and similar expressions. Shareholders and

other readers are cautioned not to place undue reliance on these

forward-looking statements, which speak only as of the date on

which they are made. The company undertakes no obligation to update

publicly or revise any of the forward-looking statements.

For a further discussion of factors to consider in connection

with these forward-looking statements, investors should refer to

Item 1A Risk Factors of the company’s Annual Report on Form 10-K

for the year ended Dec. 31, 2016.

Certain Non-GAAP Financial

Information

In addition to disclosing financial results that are determined

in accordance with accounting principles generally accepted in the

United States (“GAAP”), the company also provides certain non-GAAP

financial information relating to sales, operating income, net

income attributable to shareholders, and net income per basic and

diluted share. The company provides sales, income, or expense on a

non-GAAP basis adjusted for the impact of changes in foreign

currencies and the impact of acquisitions by adjusting the

company's operating results for businesses acquired, including the

amortization expense related to acquired intangible assets, as if

the acquisitions had occurred at the beginning of the earliest

period presented (referred to as "impact of acquisitions").

Operating income, net income attributable to shareholders, and net

income per basic and diluted share are adjusted to exclude

identifiable intangible amortization, restructuring, integration,

and other charges, and certain charges, credits, gains, and losses

that the company believes impact the comparability of its results

of operations. These charges, credits, gains, and losses arise out

of the company’s efficiency enhancement initiatives, acquisitions

(including intangible assets amortization expense), and financing

activities. A reconciliation of the company’s non-GAAP financial

information to GAAP is set forth in the tables below.

The company believes that such non-GAAP financial information is

useful to investors to assist in assessing and understanding the

company’s operating performance and underlying trends in the

company’s business because management considers these items

referred to above to be outside the company’s core operating

results. This non-GAAP financial information is among the primary

indicators management uses as a basis for evaluating the company’s

financial and operating performance. In addition, the company’s

Board of Directors may use this non-GAAP financial information in

evaluating management performance and setting management

compensation.

The presentation of this additional non-GAAP financial

information is not meant to be considered in isolation or as a

substitute for, or alternative to, sales, operating income, net

income and net income per basic and diluted share determined in

accordance with GAAP. Analysis of results and outlook on a non-GAAP

basis should be used as a complement to, and in conjunction with,

data presented in accordance with GAAP.

ARROW ELECTRONICS, INC. CONSOLIDATED STATEMENTS OF

OPERATIONS (In thousands except per share data) (Unaudited)

Quarter Ended Nine

Months Ended September 30, 2017 October 1, 2016 September

30, 2017 October 1, 2016 Sales $

6,953,740 $ 5,936,092 $ 19,178,638 $ 17,382,370 Cost of sales

6,110,382 5,162,930 16,751,427 15,061,519

Gross profit 843,358 773,162 2,427,211

2,320,851 Operating expenses: Selling, general, and administrative

expenses 552,896 510,017 1,600,762 1,534,534 Depreciation and

amortization 38,574 40,194 113,096 121,516 Restructuring,

integration, and other charges 15,896 24,267 55,817

61,161 607,366 574,478 1,769,675

1,717,211 Operating income 235,992 198,684 657,536 603,640 Equity

in earnings of affiliated companies 1,216 1,311 2,865 5,394 Loss on

investment, net 15,000 — 14,250 — Loss on extinguishment of debt

786 — 59,545 — Interest and other financing expense, net 39,748

37,229 120,179 111,828 Income before income

taxes 181,674 162,766 466,427 497,206 Provision for income taxes

46,199 44,931 114,998 137,441 Consolidated net

income 135,475 117,835 351,429 359,765 Noncontrolling interests 845

108 3,352 1,533 Net income attributable to

shareholders $ 134,630 $ 117,727 $ 348,077 $

358,232 Net income per share: Basic $ 1.52 $ 1.29

$ 3.92 $ 3.92 Diluted $ 1.50 $ 1.28 $

3.87 $ 3.87 Weighted-average shares outstanding:

Basic 88,453 90,937 88,870 91,412 Diluted 89,540 91,938 89,936

92,487 ARROW ELECTRONICS, INC. CONSOLIDATED BALANCE SHEETS

(In thousands except par value) September 30, 2017

December 31, 2016 (Unaudited)

ASSETS Current assets: Cash

and cash equivalents $ 584,339 $ 534,320 Accounts receivable, net

7,070,629 6,746,687 Inventories 3,168,769 2,855,645 Other current

assets 215,431 180,069 Total current assets

11,039,168 10,316,721 Property, plant, and equipment,

at cost: Land 12,852 23,456 Buildings and improvements 158,865

175,141 Machinery and equipment 1,306,891 1,297,657

1,478,608 1,496,254 Less: Accumulated depreciation and amortization

(663,229 ) (739,955 ) Property, plant, and equipment, net 815,379

756,299 Investments in affiliated companies 86,626

88,401 Intangible assets, net 307,385 336,882 Goodwill 2,470,576

2,392,220 Other assets 337,832 315,843 Total assets $

15,056,966 $ 14,206,366

LIABILITIES AND EQUITY

Current liabilities: Accounts payable $ 5,799,723 $ 5,774,151

Accrued expenses 799,066 821,244 Short-term borrowings, including

current portion of long-term debt 380,208 93,827

Total current liabilities 6,978,997 6,689,222

Long-term debt 2,802,960 2,696,334 Other liabilities 349,717

355,190 Commitments and contingencies (Note L) Equity:

Shareholders' equity: Common stock, par value $1: Authorized -

160,000 shares in both 2017 and 2016 Issued - 125,424 shares in

both 2017 and 2016 125,424 125,424 Capital in excess of par value

1,107,125 1,112,114 Treasury stock (37,463 and 36,511 shares in

2017 and 2016, respectively), at cost (1,739,473 ) (1,637,476 )

Retained earnings 5,545,307 5,197,230 Accumulated other

comprehensive loss (159,315 ) (383,854 ) Total shareholders' equity

4,879,068 4,413,438 Noncontrolling interests 46,224 52,182

Total equity 4,925,292 4,465,620 Total

liabilities and equity $ 15,056,966 $ 14,206,366

ARROW ELECTRONICS, INC. CONSOLIDATED STATEMENTS OF CASH

FLOWS (In thousands) (Unaudited) Quarter Ended September 30,

2017 October 1, 2016 Cash flows from operating activities:

Consolidated net income $ 135,475 $ 117,835 Adjustments to

reconcile consolidated net income to net cash provided by

operations: Depreciation and amortization 38,574 40,194

Amortization of stock-based compensation 8,910 10,508 Equity in

earnings of affiliated companies (1,216 ) (1,311 ) Loss on

extinguishment of debt 786 — Deferred income taxes 1,437 2,522 Loss

on investments, net 14,250 — Other 2,207 1,510 Change in assets and

liabilities, net of effects of acquired businesses: Accounts

receivable (457,037 ) (193,791 ) Inventories (105,875 ) (95,184 )

Accounts payable 487,904 93,313 Accrued expenses 48,291 11,826

Other assets and liabilities (38,817 ) 38,199 Net cash

provided by operating activities 134,889 25,621

Cash flows from investing activities: Cash consideration

paid for acquired businesses (1,094 ) (23,473 ) Acquisition of

property, plant, and equipment (47,691 ) (38,005 ) Other 533

— Net cash used for investing activities (48,252 ) (61,478 )

Cash flows from financing activities: Change in short-term

and other borrowings (54,697 ) (35,670 ) Proceeds from (repayments

of) long-term bank borrowings, net (324,584 ) 87,000 Proceeds from

note offerings, net 492,519 — Redemption of notes 2,214 — Proceeds

from exercise of stock options 726 1,842 Repurchases of common

stock (25,462 ) (120,345 ) Other (675 ) (1,183 ) Net cash provided

by (used for) financing activities 90,041 (68,356 ) Effect

of exchange rate changes on cash (12,257 ) (7,143 ) Net increase

(decrease) in cash and cash equivalents 164,421 (111,356 ) Cash and

cash equivalents at beginning of period 419,918 495,771

Cash and cash equivalents at end of period $ 584,339

$ 384,415 ARROW ELECTRONICS, INC. CONSOLIDATED

STATEMENTS OF CASH FLOWS (In thousands) (Unaudited) Nine

Months Ended September 30, 2017 October 1, 2016 Cash flows

from operating activities: Consolidated net income $ 351,429 $

359,765 Adjustments to reconcile consolidated net income to

net cash provided by operations: Depreciation and amortization

113,096 121,516 Amortization of stock-based compensation 30,301

29,783 Equity in earnings of affiliated companies (2,865 ) (5,394 )

Loss on extinguishment of debt 59,545 — Deferred income taxes

13,262 30,191 Loss on investments, net 14,250 — Other 7,415 4,464

Change in assets and liabilities, net of effects of acquired

businesses: Accounts receivable (59,084 ) 335,455 Inventories

(255,820 ) (117,674 ) Accounts payable (113,804 ) (513,365 )

Accrued expenses (41,810 ) (102,915 ) Other assets and liabilities

(114,136 ) (1,121 ) Net cash provided by operating activities 1,779

140,705 Cash flows from investing activities:

Cash consideration paid for acquired businesses (3,628 ) (68,946 )

Acquisition of property, plant, and equipment (149,597 ) (126,341 )

Proceeds from sale of property, plant, and equipment 24,433 — Other

(2,467 ) (12,000 ) Net cash used for investing activities (131,259

) (207,287 ) Cash flows from financing activities: Change in

short-term and other borrowings (14,423 ) 31,941 Proceeds from

(repayments of) long-term bank borrowings, net (82,766 ) 320,000

Proceeds from note offerings, net 987,144 — Redemption of notes

(555,886 ) — Proceeds from exercise of stock options 21,423 16,686

Repurchases of common stock (149,125 ) (167,178 ) Purchase of

shares from noncontrolling interest (23,350 ) — Other (1,620 )

(3,000 ) Net cash provided by financing activities 181,397

198,449 Effect of exchange rate changes on cash (1,898 )

(20,542 ) Net increase in cash and cash equivalents 50,019 111,325

Cash and cash equivalents at beginning of period 534,320

273,090 Cash and cash equivalents at end of period $ 584,339

$ 384,415 ARROW ELECTRONICS, INC. NON-GAAP

SALES RECONCILIATION (In thousands) (Unaudited) Quarter

Ended September 30, 2017 October 1, 2016 % Change

Consolidated sales, as reported $ 6,953,740 $ 5,936,092 17.1

% Impact of changes in foreign currencies — 82,751 Impact of

acquisitions — 1,387 Consolidated sales, as adjusted $ 6,953,740 $

6,020,230 15.5 % Global components sales, as reported $

4,864,361 $ 3,904,447 24.6 % Impact of changes in foreign

currencies — 55,516 Impact of acquisitions — 1,387 Global

components sales, as adjusted $ 4,864,361 $ 3,961,350 22.8 %

Europe components sales, as reported $ 1,262,048 $ 1,008,135 25.2 %

Impact of changes in foreign currencies — 48,533 Impact of

acquisitions — — Europe components sales, as adjusted $ 1,262,048 $

1,056,668 19.4 % Asia components sales, as reported $

1,785,541 $ 1,436,316 24.3 % Impact of changes in foreign

currencies — 6,497 Impact of acquisitions — — Asia components

sales, as adjusted $ 1,785,541 $ 1,442,813 23.8 % Global ECS

sales, as reported $ 2,089,379 $ 2,031,645 2.8 % Impact of changes

in foreign currencies — 27,235 Impact of acquisitions — — Global

ECS sales, as adjusted $ 2,089,379 $ 2,058,880 1.5 % Europe

ECS sales, as reported $ 624,393 $ 539,932 15.6 % Impact of changes

in foreign currencies — 21,589 Impact of acquisitions — — Europe

ECS sales, as adjusted $ 624,393 $ 561,521 11.2 % Americas

ECS sales, as reported $ 1,464,986 $ 1,491,713 (1.8 )% Impact of

changes in foreign currencies — 5,646 Impact of acquisitions — —

Americas ECS sales, as adjusted $ 1,464,986 $ 1,497,359 (2.2 )%

ARROW ELECTRONICS, INC. NON-GAAP SALES RECONCILIATION (In

thousands) (Unaudited) Nine Months Ended September

30, 2017 October 1, 2016 % Change Consolidated sales,

as reported $ 19,178,638 $ 17,382,370 10.3 % Impact of changes in

foreign currencies — (47,238 ) Impact of acquisitions — 48,148

Consolidated sales, as adjusted $ 19,178,638 $ 17,383,280

10.3 % Global components sales, as reported $

13,385,514 $ 11,413,348 17.3 % Impact of changes in foreign

currencies — (13,155 ) Impact of acquisitions — 9,711 Global

components sales, as adjusted $ 13,385,514 $ 11,409,904 17.3

% Europe components sales, as reported $ 3,572,720 $

3,123,258 14.4 % Impact of changes in foreign currencies — (29,236

) Impact of acquisitions — — Europe components sales, as

adjusted $ 3,572,720 $ 3,094,022 15.5 % Asia

components sales, as reported $ 4,732,236 $ 3,912,613 20.9 % Impact

of changes in foreign currencies — 14,100 Impact of acquisitions —

— Asia components sales, as adjusted $ 4,732,236 $ 3,926,713

20.5 % Global ECS sales, as reported $ 5,793,124 $

5,969,022 (2.9 )% Impact of changes in foreign currencies — (34,082

) Impact of acquisitions — 38,437 Global ECS sales, as

adjusted $ 5,793,124 $ 5,973,377 (3.0 )% Europe ECS

sales, as reported $ 1,833,611 $ 1,867,715 (1.8 )% Impact of

changes in foreign currencies — (44,291 ) Impact of acquisitions —

— Europe ECS sales, as adjusted $ 1,833,611 $ 1,823,424

0.6 % Americas ECS sales, as reported $ 3,959,513 $

4,101,307 (3.5 )% Impact of changes in foreign currencies — 10,209

Impact of acquisitions — 38,437 Americas ECS sales, as

adjusted $ 3,959,513 $ 4,149,953 (4.6 )% ARROW

ELECTRONICS, INC. NON-GAAP EARNINGS RECONCILIATION (In thousands

except per share data) (Unaudited) Three months ended

September 30, 2017 ReportedGAAPmeasure

Intangibleamortizationexpense Restructuring&

Integrationcharges Other* Non-GAAPmeasure Operating

income $ 235,992 $ 12,645 $ 15,896 $ — $ 264,533 Income before

income taxes 181,674 12,645 15,896 15,786 226,001 Provision for

income taxes 46,199 4,474 5,319 6,089 62,081 Consolidated net

income 135,475 8,171 10,577 9,697 163,920 Noncontrolling interests

845 146 — — 991 Net income attributable to shareholders $ 134,630 $

8,025 $ 10,577 $ 9,697 $ 162,929 Net income per diluted share 1.50

0.09 0.12 0.11 1.82 Effective tax rate 25.4 % 27.5 %

Three months ended October 1, 2016 ReportedGAAPmeasure

Intangibleamortizationexpense Restructuring& Integrationcharges

Other Non-GAAPmeasure Operating income 198,684 13,893 24,267 —

236,844 Income before income taxes 162,766 13,893 24,267 — 200,926

Provision for income taxes 44,931 4,959 7,439 — 57,329 Consolidated

net income 117,835 8,934 16,828 — 143,597 Noncontrolling interests

108 347 — — 455 Net income attributable to shareholders $ 117,727

8,587 16,828 — 143,142 Net income per diluted share** 1.28 0.09

0.18 — 1.56 Effective tax rate 27.6 % 28.5 %

Nine months

ended September 30, 2017 ReportedGAAPmeasure

Intangibleamortizationexpense Restructuring& Integrationcharges

Other* Non-GAAPmeasure Operating income $ 657,536 37,909 55,817 —

751,262 Income before income taxes 466,427 37,909 55,817 73,795

633,948 Provision for income taxes 114,998 13,423 17,892 28,466

174,779 Consolidated net income 351,429 24,486 37,925 45,329

459,169 Noncontrolling interests 3,352 554 — — 3,906 Net income

attributable to shareholders $ 348,077 23,932 37,925 45,329 455,263

Net income per diluted share 3.87 0.27 0.42 0.50 5.06 Effective tax

rate 24.7 % 27.6 %

Nine months ended October 1, 2016

ReportedGAAPmeasure Intangibleamortizationexpense

Restructuring& Integrationcharges Other Non-GAAPmeasure

Operating income $ 603,640 41,252 61,161 — 706,053 Income before

income taxes 497,206 41,252 61,161 — 599,619 Provision for income

taxes 137,441 12,357 19,242 — 169,040 Consolidated net income

359,765 28,895 41,919 — 430,579 Noncontrolling interests 1,533 940

— — 2,473 Net income attributable to shareholders $ 358,232 27,955

41,919 — 428,106 Net income per diluted share** 3.87 0.30 0.45 —

4.63 Effective tax rate 27.6 % 28.2 %

* Other includes

loss on extinguishment of debt and loss on investment. **The sum of

the components for diluted EPS, as adjusted may not agree to

totals, as presented, due to rounding. ARROW ELECTRONICS,

INC. SEGMENT INFORMATION (In thousands) (Unaudited)

Quarter Ended Nine Months Ended September 30, 2017

October 1, 2016 September 30, 2017 October 1, 2016

Sales: Global components $ 4,864,361 $ 3,904,447 $ 13,385,514 $

11,413,348 Global ECS 2,089,379 2,031,645 5,793,124

5,969,022 Consolidated $ 6,953,740 $ 5,936,092

$ 19,178,638 $ 17,382,370 Operating income

(loss): Global components $ 212,993 $ 175,507 $ 583,690 $ 524,662

Global ECS 94,797 96,181 282,379 283,792 Corporate (a) (71,798 )

(73,004 ) (208,533 ) (204,814 ) Consolidated $ 235,992 $

198,684 $ 657,536 $ 603,640 (a)

Includes restructuring, integration, and other charges of $15.9

million and $55.8 million for the third quarter and nine months

ended 2017 and $24.3 million and $61.2 million for the third

quarter and nine months ended 2016, respectively. NON-GAAP

SEGMENT RECONCILIATION Quarter Ended

Nine Months Ended September 30, 2017 October 1, 2016

September 30, 2017 October 1, 2016 Global components

operating income, as reported $ 212,993 $ 175,507 $ 583,690 $

524,662 Intangible assets amortization expense 6,984 7,679 21,210

24,124 Global components operating income, as adjusted $ 219,977 $

183,186 $ 604,900 $ 548,786 Global ECS operating income, as

reported $ 94,797 $ 96,181 $ 282,379 $ 283,792 Intangible assets

amortization expense 5,661 6,214 16,699 17,128 Global ECS operating

income, as adjusted $ 100,458 $ 102,395 $ 299,078 $ 300,920

View source

version on businesswire.com: http://www.businesswire.com/news/home/20171102005307/en/

Arrow Electronics, Inc.Contact:Steven O’Brien,

303-824-4544Vice President, Investor RelationsorMedia Contact:John

Hourigan, 303-824-4586Vice President, Global Communications

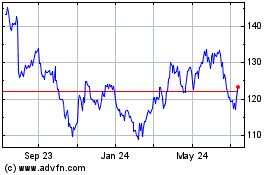

Arrow Electronics (NYSE:ARW)

Historical Stock Chart

From Mar 2024 to Apr 2024

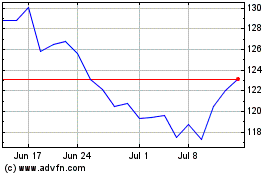

Arrow Electronics (NYSE:ARW)

Historical Stock Chart

From Apr 2023 to Apr 2024