Current Report Filing (8-k)

June 03 2019 - 4:13PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported)

June 1, 2019

AMERIPRISE FINANCIAL, INC.

(Exact name of registrant as specified in its charter)

|

Delaware

|

|

001-32525

|

|

13-3180631

|

|

(State or other jurisdiction

|

|

(Commission

|

|

(IRS Employer

|

|

of incorporation)

|

|

File Number)

|

|

Identification No.)

|

|

55 Ameriprise Financial Center

Minneapolis, Minnesota

|

|

55474

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

Registrant’s telephone number, including area code

(612) 671-3131

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

o

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company

o

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

o

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class:

|

|

Trading Symbol(s)

|

|

Name of each exchange on which registered:

|

|

Common Stock (par value $.01 per share)

|

|

AMP

|

|

The New York Stock Exchange, Inc.

|

Item 5.02(b)

Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On June 1, 2019, upon the recommendation of its Nominating and Governance Committee, the Board of Directors (“Board”) of Ameriprise Financial, Inc. (“Company”) appointed Brian T. Shea as a director of the Company effective as of June 1, 2019. The Board has not yet made a determination regarding any committee assignments for Mr. Shea.

Mr. Shea, 58, previously served as Vice Chairman and Chief Executive Officer of Investment Services for BNY Mellon (where he also oversaw global technology and operations). He previously held a variety of executive roles at Pershing, LLC, a BNY Mellon company, including Chairman, CEO, President and COO. Mr. Shea was a member of the Board of Governors of the Financial Industry Regulatory Authority (FINRA), a director of the Depository Trust and Clearing Corp (DTCC), a director of the Insured Retirement Institute, and served as Chairman of the Membership Committee of the Securities Industry and Financial Markets Authority (SIFMA). He currently serves as an independent director on the board of Fidelity National Information Services, Inc. (NYSE:FIS), a financial services technology company, where he is a member of the Corporate Governance and Nominating Committee and the Risk Committee. Mr. Shea is also currently an independent director on the board of RBB Funds, Inc. and previously served as an independent director on the board of WisdomTree Investments, Inc. Mr. Shea received his B.S. in Business Management from St. John’s University (where he currently serves as a trustee) and an M.B.A. in Finance from Pace University.

Mr. Shea will participate in the Company’s outside director compensation program described in the Company’s proxy statement for the 2019 annual meeting of shareholders. He is eligible to receive a pro rata share of the $150,000 annual grant of deferred share units for the service period measured from June 1, 2019 through the date of the Company’s 2020 annual meeting of shareholders. He was not appointed to serve on the Board pursuant to any arrangement or understanding between Mr. Shea and any other persons, and there are no transactions between the Company and Mr. Shea or any of his immediate family members that require disclosure pursuant to Item 404(a) of Regulation S-K.

2

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, hereunto duly authorized.

|

|

AMERIPRISE FINANCIAL, INC.

|

|

|

(Registrant)

|

|

|

|

|

|

|

|

Date: June 3, 2019

|

By

|

/s/ Thomas R. Moore

|

|

|

|

Thomas R. Moore

|

|

|

|

Vice President, Chief Governance Officer

|

|

|

|

and Corporate Secretary

|

3

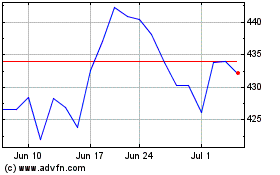

Ameriprise Financial (NYSE:AMP)

Historical Stock Chart

From Mar 2024 to Apr 2024

Ameriprise Financial (NYSE:AMP)

Historical Stock Chart

From Apr 2023 to Apr 2024