ADM's Head of Grain Trading Departs -- WSJ

April 20 2019 - 3:02AM

Dow Jones News

Agricultural firms shuffle executives as trade disputes, low

prices upend business

By Jacob Bunge

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (April 20, 2019).

Archer Daniels Midland Co.'s top grain-trading executive is

departing as the agricultural giant restructures its operations and

confronts a challenging farm economy.

Wes Uhlmeyer, president of ADM's grain business, chose to leave

the Chicago-based company for personal reasons, people close to the

matter said, not because of a disagreement over strategy. An ADM

spokeswoman said Chris Boerm, president of ADM's transportation

division, also will take on the grain role, which he has held

previously.

The change atop ADM's grain unit follows similar leadership

shuffles at rival agricultural firms, including Cargill Inc., Bunge

Ltd., Louis Dreyfus Co. and Gavilon Group. Those shifts come as the

world's largest crop merchants grapple with trade disputes that

have upended the global flow of commodities. Years of low crop

prices due to record output have also made it tougher to turn a

profit trading farm goods.

ADM, which also processes crops into fuel and flavorings, is

revamping operations after an acquisition spree in recent years

that bulked up its ingredients business. Chief Executive Juan

Luciano has invested to build up ADM's business in flavorings and

plant-based proteins, which tend to be more profitable than the

company's core commodity-trading operations.

Minnesota-based Cargill this month appointed longtime executive

Joe Stone to run its global agricultural supply chain, taking over

from G.J. van den Akker, who will retire in 2020. Also this month,

Louis Dreyfus said Anthony Tancredi would take over the Dutch

company's grain business, replacing Adrian Isman, who took over as

chairman of an affiliated sugar business.

Meanwhile, Gavilon, a major U.S. grain company based in Omaha,

Neb., on April 1 named Steven Zehr its new CEO following the

retirement of Lewis Batchelder. Bunge in January named Gregory

Heckman, a former Gavilon CEO, as its acting chief executive.

Bouts of dry weather in South America and trade disputes between

the U.S. and major buyers like China and Mexico last year injected

volatility into agricultural markets. Livelier markets were a

welcome change for commodity traders after a string of big harvests

held prices low for years. But global crop traders like ADM,

Cargill and Bunge have struggled in recent months as trade disputes

have cut into U.S. crop exports and further weighed on commodity

prices.

ADM in February said its quarterly profit declined by 60%,

partly because of lower earnings in its grain-trading unit, which

recorded an "extremely small volume of U.S. soybean exports to

China." Bunge that month reported a $65 million quarterly loss.

Cargill in March said the near-absence of Chinese buyers for 2018's

bumper U.S. soybean crop cut into profits for its trading and

processing business.

Flooding and persistent winter storms across the U.S. Farm Belt

have posed a new challenge to agricultural companies in recent

weeks. Rain and snowstorms disrupted ADM's train, truck and barge

operations and forced a Nebraska corn plant to temporarily shut

down, disruptions that ADM estimated would reduce its quarterly

profit by $50 million to $60 million.

ADM last week told employees it would seek voluntary early

retirements in the U.S. and Canada, and could lay off staff as part

of restructuring efforts. A spokeswoman said the reduction would

affect a very small percentage of ADM's 31,600 global employees,

and was being made in response to recent acquisitions.

Write to Jacob Bunge at jacob.bunge@wsj.com

(END) Dow Jones Newswires

April 20, 2019 02:47 ET (06:47 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

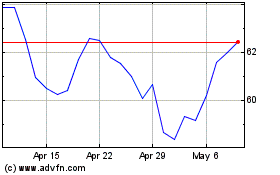

Archer Daniels Midland (NYSE:ADM)

Historical Stock Chart

From Mar 2024 to Apr 2024

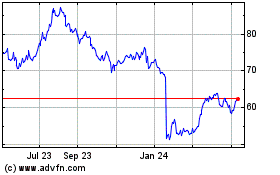

Archer Daniels Midland (NYSE:ADM)

Historical Stock Chart

From Apr 2023 to Apr 2024