0000098338

false

0000098338

2023-10-27

2023-10-27

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of earliest event reported: October

27, 2023

TSR, Inc.

(Exact Name of Registrant as Specified in Charter)

| Delaware |

|

00-8656 |

|

13-2635899 |

(State or Other Jurisdiction

of Incorporation) |

|

(Commission File Number) |

|

(I.R.S. Employer

Identification No.) |

400 Oser Avenue, Suite 150, Hauppauge, NY 11788

(Address of Principal Executive Offices) (Zip

Code)

(631) 231-0333

(Registrant’s telephone number, including

area code)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2.

below):

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title

of Each Class |

|

Trading

Symbol(s) |

|

Name

of Each Exchange On Which Registered |

| Common Stock, par value $0.01 per share |

|

TSRI |

|

NASDAQ Capital Market |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange

Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 5.02 Departure of Directors or Certain

Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On October 27, 2023, TSR,

Inc. (the “Company”) entered into an Addendum to Employment Agreement (the “Addendum”) with its Chief Financial

Officer, John Sharkey (the “CFO”), which supplements and replaces certain terms to the Amended and Restated Employment Agreement

between the Company and the CFO made and entered into as of November 2, 2020 (the “Original Agreement”). Per the Addendum,

the modifications to the Original Agreement shall become effective on November 3, 2023. Except as specifically modified by the Addendum,

all other provisions of the Original Agreement remain in full force and effect.

Employment Term. Except

in the event of an earlier termination as provided in Section 4 of the Original Agreement, the term of employment for the CFO shall renew

on November 3, 2023 (“Effective Date”) and will continue thereafter until March 31, 2025 (“Term of Employment”).

Base Salary and Annual

Bonus Program. The CFO’s compensation as modified by the Addendum is as follows:

Base Salary. The Company

will pay to employee a base salary at the following rates (“Base Salary”):

| ● | During the period from November 4, 2023 until

December 31, 2023, the CFO will continue to be employed full-time and the Company will pay the CFO at the rate of $6,750 per week, less

applicable taxes and withholdings. |

| ● | During the period from January 1, 2024 until

June 30, 2024, the CFO will be employed part-time for three (3) days per week and the Company will pay the CFO at the rate of $4,050 per

week, less applicable taxes and withholdings. |

| ● | During the period from July 1, 2024 until March

31, 2025, the CFO shall be employed on a part-time basis and the CFO shall work on such dates and at such times as the Company and the

CFO mutually agree, and the Company will pay the CFO at a rate of $200 per hour or $1,600 per day, to be determined in the sole discretion

of the Company, less applicable taxes and withholding. |

| ● | The CFO and the Company may mutually agree to

different compensation and/or days of work during the Term of Employment. For purposes of calculating the Severance Payment, as defined

under the Original Agreement, the Base Salary shall be $351,000 during the time period from November 4, 2023 to December 31, 2023; and

$210,600 for the time period of January 1, 2024 to June 30, 2024. The CFO shall not be entitled to a Severance Payment if the CFO’s

employment is terminated by the Company pursuant to Section 4.4 of the Addendum during the period from July 1, 2024 to March 31, 2025.

|

Annual Bonus Program.

In addition to the Base Salary, the CFO shall be eligible to participate in the Company’s discretionary annual bonus program (the

“Annual Bonus”) until June 30, 2024, with a total bonus potential of up to 20% of Base Salary, based on the annualized Base

Salary (i.e., total bonus potential of up to $70,000), for each applicable fiscal year (the “Target Bonus Amount”)

based upon performance metrics as determined by the Company. The CFO shall only be eligible for the Annual Bonus if there are no publicly

reportable audit findings that materially reduce reported net income for that fiscal year, and provided the CFO is employed as an active

employee on the last day of the fiscal year in which the Annual Bonus relates.

Benefits. The CFO’s

benefits are modified by the Addendum as follows:

Vacation. During the

CFO’s employment until June 30, 2024, the CFO shall be entitled to four (4) weeks of paid vacation per calendar year (as pro-rated

for partial years), and other paid time off offered under the Company’s policies, in accordance with the Company’s policy

with respect to vacation accrual and use applicable to employees as in effect from time to time, to be accrued beginning on the Effective

Date. Unless otherwise required by law, the CFO shall not be paid any accrued and unused vacation upon separation of employment for any

reason.

Benefits. While the

CFO is employed, including during any period of part-time employment during the Term of Employment, the CFO shall be entitled to all standard

Company benefits generally available to executives under the Company’s health plan or any successor health plan, from time to time,

including, but not limited to, group medical health, group insurance and similar benefits, subject to the terms and conditions of the

applicable policy, plan or program. If the CFO ceases to be eligible for the Company’s health benefits plan or any successor plan

during the Term of Employment, and is not entitled to elect continuation coverage under the Consolidated Omnibus Budget Reconciliation

Act of 1985, as amended (“COBRA”), the Company will reimburse the CFO for obtaining comparable health coverage at the same

level he currently elects to the extent permitted by applicable law.

Car Allowance. The

Company will provide the CFO with a monthly car allowance of $800.00 (“Car Allowance”) until June 30, 2024.

Sale of Business Success

Fee. The CFO shall be eligible to earn an incentive payment if there is a Sale of the Business during the Term of Employment, as follows:

(A) $100,000 for the Sale of Business; and (B) an additional $15,000 for every full dollar in share price that exceeds $12 per share price

at the time of a Sale of Business. “Sale of Business” for purposes of the Addendum means a transfer of the majority of

the ownership by sale, acquisition, merger, or other method of the equity or tangible or intangible assets of the Company.

Severance and Continued

Coverage upon Termination. In the event the CFO is terminated during the Term of Employment on or before June 30, 2024, other than

a termination under Sections 4.1, 4.2, or 4.3 of the Original Agreement, or if the CFO is forced to relocate more than 25 miles from his

current residence on or before June 30, 2024, the CFO will receive, subject to certain conditions and restrictions provided in the Addendum,

(i) a Severance Payment and (ii) continued participation in the Company’s group health plan or any successor health plan which covers

the CFO (and the CFO’s eligible dependents) until March 31, 2025 at the Company’s expense, provided that the CFO is eligible

and remains eligible for coverage under COBRA, or by reimbursement to the CFO in an amount equivalent to such cost. During the Severance

Period, as defined in the Original Agreement, the CFO will not be entitled to any additional awards or to continue elective deferrals

in or accrue additional benefits under the Company’s 401(k) plan or any other qualified or nonqualified retirement programs maintained

by the Company.

The description of the Addendum

is qualified in its entirety by reference to the complete text thereof, which has been filed with this Current Report on Form 8-K as Exhibit

10.1 and is incorporated herein by reference. For a summary of the remaining provisions of the Original Agreement, please refer to the

Company’s Current Report on Form 8-K filed on November 6, 2020, as well as the Company’s other periodic filings with the Securities

and Exchange Commission.

Item 9.01 Financial Statements and Exhibits.

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| |

TSR, Inc. |

| |

|

|

| |

By: |

/s/ John G. Sharkey |

| |

|

John G. Sharkey |

| |

|

Senior Vice President and Chief Financial Officer |

Dated: October 27, 2023

3

Exhibit 10.1

ADDENDUM TO EMPLOYMENT AGREEMENT

This Addendum supplements

and replaces certain terms to the Amended and Restated Employment Agreement between TSR, Inc., a Delaware corporation (the “Company”)

and John Sharkey (“Employee”), made and entered into as of November 2, 2020 (the “Agreement”). Employee and the

Company hereby agree to the modifications herein. Unless stated otherwise, the modifications shall be effective November 3, 2023. Any

provision of the Agreement shall remain in full force and effect unless specifically modified by this Addendum.

1. Term of Employment.

Except for earlier termination as provided in Section 4 of the Agreement, the term of employment under the Agreement will renew on

November 3, 2023, (“Effective Date”) and will continue thereafter until March 31, 2025, as described herein (“Term of

Employment”).

3. Compensation and

Other Remuneration. In exchange for services rendered by Employee under the terms of the Agreement, the Company shall provide

the following:

3.1 Base

Salary. The Company will pay to employee a base salary at the following rates (“Base Salary”):

(a) During

the period from November 4, 2023 until December 31, 2023, Employee will continue to be employed full-time and the Company will pay Employee

at the rate of $6,750 per week, less applicable taxes and withholdings.

(b) During

the period from January 1, 2024 until June 30, 2024, Employee will be employed part-time for three (3) days per week and the Company will

pay Employee at the rate of $4,050 per week, less applicable taxes and withholdings.

(c) During

the period from July 1, 2024 until March 31, 2025, Employee shall be employed part-time and Employee shall work on such dates and at such

times as the Company and Employee mutually agree, and the Company will pay Employee at a rate of $200 per hour or $1,600 per day, to be

determined in the sole discretion of the Company, less applicable taxes and withholding.

(d) Employee

shall primarily work from the Company’s offices located in Hauppauge, New York or remotely from a location of Employee’s choosing.

Employee agrees and understands that Employee may be required to travel from time to time if necessary, as reasonably and mutually agreed

upon, to carry out the duties and responsibilities of Employee’s position. Employee and the Company may mutually agree to different

compensation and/or days of work during the Term of Employment. For purposes of calculating the Severance Payment, the Base Salary shall

be $351,000 during the time period from November 4, 2023 to December 31, 2023; and $210,600 for the time period of January 1, 2024 to

June 30, 2024. Employee shall not be entitled to a Severance Payment if Employee’s employment is terminated by the Company pursuant

to Section 4.4 during the period from July 1, 2024 to March 31, 2025.

3.2 Annual

Bonus Program. In addition to the Base Salary, Employee shall be eligible to participate in the Company’s discretionary annual

bonus program (“Annual Bonus”) until June 30, 2024, with a total bonus potential of up to 20% of Employee’s Base

Salary, based on the annualized Base Salary set forth in 3.1(a) (i.e., total bonus potential of up to $70,000), for each applicable

fiscal year (the “Target Bonus Amount”) based upon performance metrics as determined by the Company. Employee shall only be

eligible for the Annual Bonus if there are no publicly reportable audit findings that materially reduce reported net income for that fiscal

year, and if Employee is employed as an active employee on the last day of the fiscal year in which the Annual Bonus relates. The Annual

Bonus amounts, if any, will be paid in accordance with the Company’s customary payroll practices in effect from time to time. The

final amount of the Annual Bonus earned shall not be determined until the Company’s annual 10-k filing.

3.4 Vacation.

During Employee’s employment until June 30, 2024, Employee shall be entitled to four (4) weeks of paid vacation per calendar year

(as pro-rated for partial years), and other paid time off offered under the Company’s policies, in accordance with the Company’s

policy with respect to vacation accrual and use applicable to employees as in effect from time to time, to be accrued beginning on the

Effective Date. Vacation may be taken at such times and intervals as Employee determines, subject to the business needs of the Company

as determined by the Board. At no time shall Employee accrue more than four (4) weeks of vacation. Unless otherwise required by law, Employee

shall not be paid any accrued and unused vacation upon separation of employment for any reason.

3.5 Benefits.

While Employee is employed hereunder, including during any period of part-time employment during the Term of Employment, Employee

shall be entitled to all standard Company benefits generally available to executives under the Company’s Health Plan or any applicable

successor health plan, from time to time, including, but not limited to, group medical health, group insurance and similar benefits, subject

to the terms and conditions of the applicable policy, plan or program. Employee’s participation in such employee benefit plans will

be subject to the terms of the applicable plan documents and generally applicable Company policies. If Employee ceases to be eligible

for the Company’s health benefits plan or any successor plan during the Term of Employment, and is not entitled to elect continuation

coverage under the Consolidated Omnibus Budget Reconciliation Act of 1985, as amended (“COBRA”), to the extent permitted by

applicable law, Company will reimburse Employee for obtaining comparable health coverage at the same level Employee currently elects.

Notwithstanding the foregoing, the Company, in its sole discretion, may modify or terminate any employee benefit plan at any time.

3.6 Car

Allowance. The Company will provide Employee with a monthly car allowance of $800.00 (“Car Allowance”) until June 30,

2024.

3.8 Sales

of Business Success Fee. In addition, Employee shall be eligible to earn an incentive payment if there is a Sale of the Business during

the Term of Employment, as follows: (A) $100,000 for the Sale of Business; and (B) an additional $15,000 for every full dollar in share

price that exceeds $12 per share price at the time of a Sale of Business. “Sale of Business” for purposes of this Addendum

means a transfer of the majority of the ownership by sale, acquisition, merger, or other method of the equity or tangible or intangible

assets of the Company.

4.4 Other Termination by

the Company. The Company may also terminate Employee’s employment during the Term of Employment, other than a termination under

Sections 4.1, 4.2, or 4.3, at any time upon written notice to Employee. In the event that Employee’s employment is so terminated

during the Term of Employment on or before June 30, 2024 for reasons other than that provided in Sections 4.1, 4.2 or 4.3, or if Employee

is forced to relocate more than 25 miles from his current residence subject to 4.4(c) on or before June 30, 2024, in addition to the Termination

Entitlement, Employee will receive, subject to the requirements of Section 4.8, a “Health Benefit” and a “Severance

Payment,” as defined and detailed below:

(f) In

addition to the Severance Payment, subject to (i) Employee’s timely election of continuation coverage under the COBRA; and

(ii) Employee’s continued copayment of premiums at the same level and cost to Employee as if Employee were an employee of the

Company, or if a Sale of Business occurs, an employee of any successor of the Company (excluding, for purposes of calculating cost, an

employee’s ability to pay premiums with pre-tax dollars), continued participation in the Company’s group health plan or any

successor health plan (to the extent permitted under applicable law and the terms of such plan) which covers Employee (and Employee’s

eligible dependents) until March 31, 2025 at the Company’s expense, provided that Employee is eligible and remains eligible for

COBRA coverage, or by reimbursement to Employee in an amount equivalent to such cost (the “Health Benefit”). Notwithstanding

the foregoing, the Company shall not be obligated to provide the continuation coverage contemplated by this Section 4.4(f) if it

would result in the imposition of excise taxes on the Company for failure to comply with the nondiscrimination requirements of the Patient

Protection and Affordable Care Act of 2010, as amended, and the Health Care and Education Reconciliation Act of 2010, as amended (to the

extent applicable). During the Severance Period, Employee will not be entitled to any additional awards or to continue elective deferrals

in or accrue additional benefits under the Company’s 401(k) plan or any other qualified or nonqualified retirement programs maintained

by the Company.

By signing below, Employee acknowledges that

Employee has read this Addendum, or it has been read to Employee; Employee understands and voluntarily accepts the terms and conditions

set out within it, and that this Addendum, together with the Agreement, establish the terms and conditions of Employee’s employment

with the Company, and supersedes any other agreements, verbal or written, on this subject matter.

CONFIRMED AND AGREED:

| TSR, Inc. |

|

|

|

| |

|

|

|

|

|

| By: |

/s/

Bradley M. Tirpak |

|

By: |

/s/ John

Sharkey |

| |

Bradley M. Tirpak |

|

|

John Sharkey |

| |

Title: |

Chairman of the Board |

|

|

|

3

v3.23.3

Cover

|

Oct. 27, 2023 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Oct. 27, 2023

|

| Entity File Number |

00-8656

|

| Entity Registrant Name |

TSR, Inc.

|

| Entity Central Index Key |

0000098338

|

| Entity Tax Identification Number |

13-2635899

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

400 Oser Avenue

|

| Entity Address, Address Line Two |

Suite 150

|

| Entity Address, City or Town |

Hauppauge

|

| Entity Address, State or Province |

NY

|

| Entity Address, Postal Zip Code |

11788

|

| City Area Code |

631

|

| Local Phone Number |

231-0333

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, par value $0.01 per share

|

| Trading Symbol |

TSRI

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

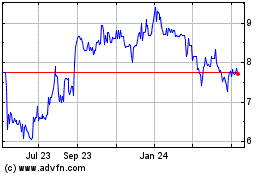

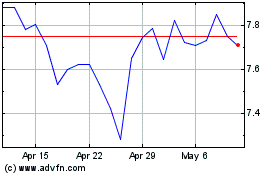

TSR (NASDAQ:TSRI)

Historical Stock Chart

From Mar 2024 to Apr 2024

TSR (NASDAQ:TSRI)

Historical Stock Chart

From Apr 2023 to Apr 2024