false

0001621672

0001621672

2024-03-12

2024-03-12

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) of the SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): March 12, 2024

Super League Enterprise, Inc.

(Exact name of registrant as specified in its charter)

|

Delaware

|

001-38819

|

47-1990734

|

|

(State or other jurisdiction of

incorporation)

|

(Commission File Number)

|

(IRS Employer

Identification Number)

|

2912 Colorado Avenue, Suite #203

Santa Monica, California 90404

(Address of principal executive offices)

(213) 421-1920

(Registrant’s telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

| |

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a -12)

|

| |

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d -2(b))

|

| |

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e -4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Common Stock, par value $0.001 per share

|

SLE

|

Nasdaq Capital Market

|

Indicate by check mark whether the Registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the Registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01 Entry into a Material Definitive Agreement.

On March 12, 2024, Super League Enterprise, Inc. (the “Company”), entered into that certain Mutual General Release and Settlement Agreement (the “Agreement”) with 3i, LP, a Delaware limited partnership (“3i”), Nomis Bay Ltd., a Bermuda Corporation (“Nomis”), and BPY Limited, a Bermuda Corporation (“BPY”) (together with 3i and Nomis, the “Investors”), whereby the Company, among other things, issued an aggregate of 500,000 shares of the Company’s common stock, $0.001 par value (the “Shares”), to the Investors in consideration of the mutual release of any and all claims between the Company and the Investors arising from that certain Securities Purchase Agreement, dated May 16, 2022, by and between the Company and the Investors (the “SPA”). Pursuant to the terms of the Agreement, the Company has agreed to register the Shares on a Registration Statement on Form S-3 to be filed with the Securities and Exchange Commission.

Other than with respect to the Agreement, there is no relationship between the Company or its affiliates with the Investors or their affiliates.

The forgoing description of the Agreement is qualified in its entirety by reference to the full text of the document, a copy of which is filed herewith as Exhibit 10.1. The forgoing description of the SPA and Note are qualified in their entirety by reference to the full text of the documents, copies of which are filed as Exhibits 10.1 and 10.2, respectively, to the Company’s Current Report on Form 8-K filed on May 16, 2022.

Item 3.02 Unregistered Sales of Equity Securities.

See Item 1.01.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits Index

|

Exhibit No.

|

|

Description

|

| |

|

|

|

10.1

|

|

|

|

104

|

|

Cover Page Interactive Data File (embedded within the Inline XBRL document)

|

Signatures

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| |

Super League Enterprise, Inc.

|

| |

|

|

|

Date: March 15, 2024

|

By:

|

/s/ Clayton Haynes

|

| |

|

Clayton Haynes

Chief Financial Officer

|

Exhibit 10.1

MUTUAL GENERAL RELEASE AND SETTLEMENT AGREEMENT

THIS MUTUAL GENERAL RELEASE and SETTLEMENT AGREEMENT (the “Agreement”) is effective as of March 12, 2024 (the “Effective Date”), and is entered into by and between Super League Enterprise, Inc. f/k/a Super League Gaming, Inc., a Delaware corporation with its principal office located at 2912 Colorado Ave., Suite 203, Santa Monica, CA 90404 (“SLE”), on the one hand, and 3i, LP, a Delaware limited partnership (“3i”), Nomis Bay Ltd., a Bermuda Corporation (“Nomis”), and BPY Limited, a Bermuda Corporation (“BPY”)(3i, Nomis and BPY are collectively referred to herein as the “Investors”), on the other hand. SLE and the Investors are collectively referred to herein as the “Parties”.

RECITALS

WHEREAS, the Investors made a series of investments in SLE during the period commencing in January 2021 and culminating in the issuance of a promissory note in favor of the Investors in the amount of Four Million Three Hundred Twenty Thousand Dollars ($4,320,000) (the “Note”) on May 16, 2022 and evidenced by that certain Securities Purchase Agreement (the “SPA”) of even date therewith;

WHEREAS, the Note has been repaid in full;

WHEREAS, the Parties now desire to settle all claims between them with respect to the SPA as follows: (i) SLE shall direct its transfer agent, Issuer Direct Corporation, to issue Investors the collective sum of five hundred thousand (500,000) shares of common stock, $0.001 par value, fully-paid and non-assessable (the “Shares”), as follows: (a) 3i shall be issued two hundred and fifty thousand (250,000) shares of common stock, (b) Nomis shall be issued one hundred and fifty thousand (150,000) shares of common stock; and (c) BPY shall be issued one hundred thousand (100,000) shares of common stock; (ii) the Shares shall be included in the pending SLE registration statement on Form S-3 (the “Registration Statement”) to be filed with the Securities and Exchange Commission (“SEC”) the first business day following execution of this Agreement; (iii) SLE shall use best-efforts to have the Registration Statement declared effective within thirty days of filing, subject to clearing all comments of the SEC as applicable (“S-3 Effectiveness Commitment”); (iv) SLE shall not file an additional registration statement in the thirty day period following effectiveness of the Registration Statement (“No Filing Period”); (v) Investors shall be subject to a cap on resale of the Shares equal to ten percent (10%) of the daily volume of SLE common stock (“Investor Leak-Out”); (vi) SLE shall have the right, in its sole discretion, to undertake a financing of equity or equity-linked securities, debt (convertible or otherwise) following the execution of this Agreement (“Securities Transaction Availability”); and (vii) the obligations of SLE under the SPA shall terminate upon the effectiveness of the Registration Statement (“SPA Termination”).

NOW, THEREFORE, in consideration of the mutual premises and covenants set forth in the recitals above, the receipt and sufficiency of which is hereby mutually acknowledged, the Parties agree as follows:

| |

1.

|

Mutual General Release and Settlement.

|

1.1 Release of SLE. In consideration for the issuance of the Shares, filing of the Registration Statement, the S-3 Effectiveness Commitment, and strict adherence by SLE to the No Filing Period, the Investors, on behalf of each of them and their respective officers, directors, employees, agents, representatives, successors and assigns (collectively, “Investors Releasor”), intending to be bound, hereby and forever release, acquit, and discharge SLE, and its present or former subsidiaries, divisions, affiliates, principals, officers, directors, agents, representatives, predecessors, successors, and assigns, and their respective representatives, heirs, executors, personal representatives, administrators and assigns (collectively, the “SLE Releasees”), of and from any and all claims, causes of action, debts, suits, rights of action, dues, sums of money, accounts, bonds, bills, covenants, contracts, controversies, agreements, promises, damages, judgments, variances, executions, demands or obligations of any kind or nature whatsoever, matured or unmatured, liquidated or unliquidated, absolute or contingent, known or unknown, present or future, at law, or in equity which Investors Releasor ever had, now has or hereinafter shall, or may have, from the beginning of time to the Effective Date against the SLE Releasees.

1.2 Release of Investors. In consideration for the release set forth in Section 1.1 hereof, the Investor Leak-Out, the Securities Transaction Availability and the SPA Termination, SLE, on behalf of itself and its subsidiaries, divisions, affiliates, principals, officers, directors, agents, representatives, predecessors, successors, and assigns (collectively, the “SLE Releasors”), intending to be bound, hereby and forever release, acquit, and discharge the Investors, and each of their respective officers, directors, employees, agents, representatives, successors, and assigns (collectively, the “SLE Releasees”), of and from any and all claims, causes of action, debts, suits, rights of action, dues, sums of money, accounts, bonds, bills, covenants, contracts, controversies, agreements, promises, damages, judgments, variances, executions, demands or obligations of any kind or nature whatsoever, matured or unmatured, liquidated or unliquidated, absolute or contingent, known or unknown, present or future, at law, or in equity, which the SLE Releasors ever had, now have or hereinafter can, shall, or may have, from the beginning of time to the Effective Date against the SLE Releasees.

2.1 Governing Law. This Release shall be governed by, and construed in accordance with, the laws of the State of New York.

2.2 No Construction Against Drafting Party. Each Party expressly recognizes that this Release results from a negotiation process in which each was represented by counsel and contributed to the drafting hereof. Given this fact, no legal or other presumptions against the Party drafting this Release concerning its construction, interpretation, or otherwise accrue to the benefit of any Party to this Release, and each Party expressly waives the right to assert such a presumption in any proceedings or disputes connected with arising out of, or involving this Release.

2.3 Counterparts. This Release may be executed in multiple counterparts, any of which will be deemed an original, but all of which when taken together will constitute one and the same instrument.

IN WITNESS WHEREOF, this Agreement has been executed as of the Effective Date.

SUPER LEAGUE ENTERPRISE, INC.

By: /s/ Ann Hand

Ann Hand

CEO

3I, L.P.

By: /s/ Maier J. Tarlow

Maier J. Tarlow

Manager on behalf of the General Partner

NOMIS BAY, LTD.

By: /s/ James Keyes

James Keyes

Director

BPY LIMITED

By: /s/ James Keyes

James Keyes

Director

v3.24.0.1

Document And Entity Information

|

Mar. 12, 2024 |

| Document Information [Line Items] |

|

| Entity, Registrant Name |

Super League Enterprise, Inc.

|

| Document, Type |

8-K

|

| Document, Period End Date |

Mar. 12, 2024

|

| Entity, Incorporation, State or Country Code |

DE

|

| Entity, File Number |

001-38819

|

| Entity, Tax Identification Number |

47-1990734

|

| Entity, Address, Address Line One |

2912 Colorado Avenue

|

| Entity, Address, Address Line Two |

Suite #203

|

| Entity, Address, City or Town |

Santa Monica

|

| Entity, Address, State or Province |

CA

|

| Entity, Address, Postal Zip Code |

90404

|

| City Area Code |

213

|

| Local Phone Number |

421-1920

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock

|

| Trading Symbol |

SLE

|

| Security Exchange Name |

NASDAQ

|

| Entity, Emerging Growth Company |

true

|

| Entity, Ex Transition Period |

false

|

| Amendment Flag |

false

|

| Entity, Central Index Key |

0001621672

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

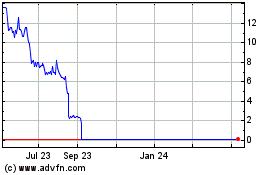

Super League Gaming (NASDAQ:SLGG)

Historical Stock Chart

From Mar 2024 to Apr 2024

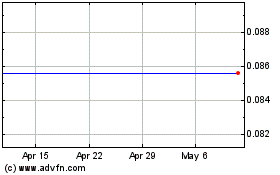

Super League Gaming (NASDAQ:SLGG)

Historical Stock Chart

From Apr 2023 to Apr 2024