Filed Pursuant to Rule 424(b)(3)

Registration No. 333-261284

PROSPECTUS SUPPLEMENT NO. 6

(to Prospectus dated April 11, 2023)

Up to 1,582,025 Shares of Class A Common Stock

This prospectus supplement updates

and supplements the prospectus dated April 11, 2023 (the “Prospectus”), which forms a part of our Registration Statement on

Form S-3 (No. 333-261284), as amended by Post-Effective Amendment No. 1 to Form S-3 on Form S-1 filed with the U.S. Securities and Exchange

Commission (the “SEC”) on April 3, 2023 (the “Registration Statement”), relating to the offer and sale from time

to time by the selling stockholders identified in the Prospectus, and any of their respective permitted assignees, (each, a “Selling

Stockholder” and collectively, the “Selling Stockholders”) of up to 1,582,025 shares of Class A common stock, par value

$0.0001 (the “common stock”), of Shift Technologies, Inc. (the “Company”). These shares are issuable upon conversion

or redemption of the Company’s 4.75% Convertible Senior Notes due 2026. We are not selling any shares covered by the Prospectus

and will not receive any proceeds from the sale of shares of common stock by the Selling Stockholders pursuant to the Prospectus.

This

prospectus supplement is being filed to update and supplement the information in the Prospectus with the information contained in our

(i) Current Report on Form 8-K, filed with the SEC on August 28, 2023 (the “Current Report No. 1”), (ii) Current Report on

Form 8-K, filed with the SEC on August 30, 2023 (the “Current Report No. 2”), and (iii) Current Report on Form 8-K, filed

with the SEC on September 5, 2023 (the “Current Report No. 3” and, together with Current Report No. 1 and Current Report No.

2, the “Current Reports”) in each case other than portions of the Current Reports deemed to have been furnished and not filed

in accordance with SEC rules. Accordingly, we have attached the Current Reports to this prospectus supplement.

This prospectus supplement updates

and supplements the information in the Prospectus and is not complete without, and may not be delivered or utilized except in combination

with, the Prospectus, including any amendments or supplements thereto. This prospectus supplement should be read in conjunction with the

Prospectus, and if there is any inconsistency between the information in the Prospectus and this prospectus supplement, you should rely

on the information in this prospectus supplement.

We are an “emerging growth

company” as defined under U.S. federal securities laws and, as such, are subject to reduced public company reporting requirements.

Investing in our securities

involves risks that are described in the “Risk Factors” section beginning on page 7 of the Prospectus and under similar headings

in any amendments or supplements to the Prospectus.

Neither the SEC, nor any state

securities commission has approved or disapproved of these securities or determined if the Prospectus or this prospectus supplement is

truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus supplement is September

5, 2023

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D. C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported) September 5, 2023 (September 5, 2023)

SHIFT

TECHNOLOGIES, INC.

(Exact

name of registrant as specified in its charter)

| Delaware |

|

001-38839 |

|

82-5325852 |

(State or other jurisdiction

of

incorporation or organization) |

|

(Commission File Number) |

|

(I.R.S. Employer

Identification No.) |

| 290

Division Street, Suite 400, San Francisco, CA |

|

94103 |

| (Address of principal executive

offices) |

|

(Zip Code) |

Registrant's

telephone number, including area code: (855) 575-6739

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☐ |

Written communications

pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant

to Rule 14a-12 under the Exchange Act (17 CFR 240a-12) |

| ☐ |

Pre-commencement communications

pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications

pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13a-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which

registered |

| Class A common stock, par

value $0.0001 per share |

|

SFT |

|

Nasdaq Capital Market |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☒

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) if the Exchange Act. ☐

Item

2.05. Costs Associated with Exit or Disposal Activities.

On

September 5, 2023, Shift Technologies, Inc. (the “Company,” “Shift,” “we” or “us”) announced

the closing of its Portland-based vehicle storage and sales facility and additional streamlining of its corporate organization (collectively,

the “Restructuring”). The Restructuring will result in an estimated workforce reduction of approximately 25%. The Company

expects that the Restructuring and associated workforce reduction will result in total annualized cost savings of up to $23 million,

which includes up to $13 million in expected net cost savings related to the Restructuring and up to $10 million in expected net costs

savings related to the workforce reduction. The Company expects the Restructuring and associated workforce reduction will be substantially

completed by September 5, 2023.

The

Company expects to incur charges related to the Restructuring and associated workforce reduction. As a result of the Restructuring and

associated workforce reduction, we expect to incur approximately $0.5 million in one-time cash severance payments, and approximately

$8.5 million in one-time non-cash charges associated primarily with the decommissioning of certain technology assets. The Company has

not yet completed its analysis of additional charges associated with implementation of the Restructuring and associated workforce reduction,

and therefore is not able to make a good faith determination of an estimate of the amount, or range of amounts, of any additional charges

such as contract termination costs. The Company will provide additional disclosure through an amendment to this Current Report on Form

8-K once it makes a determination of an estimate or range of estimates of such charges, if any.

The

charges that the Company expects to incur are subject to a number of assumptions, and actual expenses may differ materially from the

estimates disclosed above.

The

Company’s previously announced review of strategic alternatives by its Board of Directors, management team, and advisors remains

ongoing.

Forward-Looking

Statements

Certain

statements in this Current Report on Form 8-K constitute “forward-looking statements” within the meaning of the U.S. Private

Securities Litigation Reform Act of 1995. Words contained in this Current Report on Form 8-K such as “believe,” “anticipate,”

“expect,” “estimate,” “plan,” “intend,” “should,” “would,” “could,”

“may,” “might,” “will” and variations of such words and similar future or conditional expressions,

are intended to identify forward-looking statements. These forward-looking statements include, but are not limited to, statements related

to the Company’s expectations related to the Restructuring and the associated workforce reduction. These forward-looking statements

are not guarantees of future results and are subject to a number of risks and uncertainties, many of which are difficult to predict and

beyond our control. Important assumptions and other important factors that may cause actual results to differ materially from those in

the forward-looking statements include, but are not limited to, a material delay in consummating the Restructuring, the Company may incur

additional costs not currently contemplated or that the savings may be less than anticipated, the risk that the Restructuring and associated

workforce reduction may negatively impact the Company’s business operations and reputation, the Company’s ability to recruit

and retain key management and employees, and those additional risks, uncertainties and factors described in more detail in the Company’s

filings with the Securities and Exchange Commission (“SEC”) from time to time, including under the caption “Risk Factors”

in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2022 (including any amendments thereto), and

in the Company’s other filings with the SEC (including any amendments thereto). The Company disclaims any obligation or undertaking

to update, supplement or revise any forward-looking statements contained in this Current Report on Form 8-K except as required by applicable

law or regulation. Given these risks and uncertainties, readers are cautioned not to place undue reliance on the forward-looking statements,

which speak only as of the date hereof.

Item

2.06 Material Impairments.

To

the extent required, the information contained in Item 2.05 of this Current Report on Form 8-K is incorporated by reference herein.

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

SHIFT TECHNOLOGIES, INC. |

| |

|

| Dated: September 5, 2023 |

/s/

Oded Shein |

| |

Name: |

Oded Shein |

| |

Title: |

Chief Financial Officer |

2

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D. C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities

Exchange Act of 1934

Date of Report (Date of earliest event reported)

August 30, 2023 (August 29, 2023)

SHIFT TECHNOLOGIES, INC.

(Exact name of registrant as specified in its charter)

| Delaware |

|

001-38839 |

|

82-5325852 |

(State or other jurisdiction of

incorporation or organization) |

|

(Commission File Number) |

|

(I.R.S. Employer

Identification No.) |

| 290 Division Street, Suite 400, San Francisco, CA |

|

94103 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including

area code: (855) 575-6739

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☐ | Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240a-12) |

| ☐ | Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13a-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Class A common stock, par value $0.0001 per share |

|

SFT |

|

Nasdaq Capital Market |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) if the Exchange Act. ☐

Item 5.02 Departure of Directors or Certain

Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On August 29, 2023, Toby Russell, a member of

the Board of Directors (the “Board”) of Shift Technologies, Inc. (the “Company”), informed the Company

of his decision to resign as a director of the Company, effective August 29, 2023. Mr. Russell served as a Class III director and Chair

of the Finance Committee of the Board. Mr. Russell’s decision to resign from the Board was not the result of any disagreement relating

to the Company’s operations, policies or practices. The Company thanks Mr. Russell for his commitment and service to the Company.

In addition, as previously disclosed on August 28, 2023, Victoria McInnis resigned as a member of the Board of the Company, effective

August 22, 2023. After giving effect to the foregoing director resignations of Mr. Russell and Ms. McInnis from the Board, the Board consists

of five (5) directors and has two (2) vacancies.

In connection with Mr.

Russell’s and Ms. McInnis’ resignation from the Board, on August 30, 2023, Ayman Moussa, Chief Executive Officer of

the Company and member of the Board, resigned from his position as a Class II director of the Company, effective August 30, 2023, subject

to and conditioned upon his immediate reappointment as a Class I director of the Company. The Board accepted Mr. Moussa’s resignation

and immediately reappointed him to serve as a Class I director of the Company, effective August 30, 2023. The resignation and reappointment

of Mr. Moussa was effected solely for the purpose of achieving a more equal apportionment in the number of directors in each class of

directors resulting from the vacancies on the Board as a result of Mr. Russell’s and Ms. McInnis’ resignation from the Board.

After giving effect to the foregoing resignation and reappointment, our directors serve in the three classes of directors as follows:

two (2) in Class I, two (2) in Class II and one (1) in Class III. For all other purposes, Mr. Moussa’s service on the Board and

as Chief Executive Officer of the Company is deemed to have continued uninterrupted, without any break in service since the date Mr. Moussa

first joined the Board in June 2023.

In addition, on August 30, 2023, the Board resolved

that Luis I. Solorzano will serve as a member of the Audit Committee, Kimberly H. Sheehy will serve as a member of the Leadership Development,

Compensation and Governance Committee, and Adam Nash will serve as the Chair of the Leadership Development, Compensation and Governance

Committee. Also, in connection with Ms. McInnis’ resignation from the Board, on August 30, 2023, the Board appointed James E. Skinner

to replace Ms. McInnis as Lead Director of the Board, effective August 30, 2023.

Pursuant to Shift’s Director Compensation Policy,

Mr. Solorzano will receive an additional cash retainer of $10,000 for his service on the Audit Committee, Ms. Sheehy will receive an

additional cash retainer of $5,000 for her service on the Leadership Development, Compensation and Governance Committee, Mr. Nash will

receive an additional cash retainer of $15,000 for his service as Chair of the Leadership Development, Compensation and Governance Committee

and Mr. Skinner will receive an additional cash retainer of $50,000 for serving as the Lead Director, in each case prorated for service

for less than an entire annual period.

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

SHIFT TECHNOLOGIES, INC. |

| |

|

| Dated: August 30, 2023 |

/s/ Oded Shein |

| |

Name: |

Oded Shein |

| |

Title: |

Chief Financial Officer |

2

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D. C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities

Exchange Act of 1934

Date of Report (Date of earliest event reported)

August 28, 2023 (August 22, 2023)

SHIFT TECHNOLOGIES, INC.

(Exact name of registrant as specified in its charter)

| Delaware |

|

001-38839 |

|

82-5325852 |

(State or other jurisdiction of

incorporation or organization) |

|

(Commission File Number) |

|

(I.R.S. Employer

Identification No.) |

| 290 Division Street, Suite 400, San Francisco, CA |

|

94103 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including

area code: (855) 575-6739

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ | Written communications pursuant to Rule 425 under the Securities

Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange

Act (17 CFR 240a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under

the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under

the Exchange Act (17 CFR 240.13a-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Class A common stock, par value $0.0001 per share |

|

SFT |

|

Nasdaq Capital Market |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) if the Exchange Act. ☐

Item 5.02 Departure of Directors or Certain

Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On August 22, 2023, Victoria McInnis, member

of the Board of Directors (the “Board”) of Shift Technologies, Inc. (the

“Company”), informed the Company of her decision to resign as a director

of the Company, effective August 22, 2023. Ms. McInnis served as a Class I director, a member of the Audit Committee and Chair of the

Leadership Development, Compensation and Governance Committee of the Board. Ms. McInnis’ decision to resign from the Board was

not the result of any disagreement relating to the Company’s operations, policies or practices. The Company thanks Ms. McInnis

for her commitment and service to the Company. After giving effect to the foregoing director resignation of Ms. McInnis from the Board,

the Board consists of six (6) directors and one (1) vacancy.

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

SHIFT TECHNOLOGIES, INC. |

| |

|

| Dated: August 28, 2023 |

/s/ Oded Shein |

| |

Name: |

Oded Shein |

| |

Title: |

Chief Financial Officer |

2

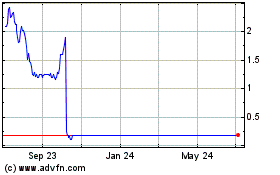

Shift Technologies (NASDAQ:SFT)

Historical Stock Chart

From Mar 2024 to Apr 2024

Shift Technologies (NASDAQ:SFT)

Historical Stock Chart

From Apr 2023 to Apr 2024