truefalse0001811115X000-000000000018111152024-05-152024-05-150001811115rnlx:AmericanDepositarySharesMember2024-05-152024-05-15

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): May 15, 2024

Renalytix plc

(Exact name of registrant as specified in its Charter)

|

|

|

England and Wales |

001-39387 |

Not Applicable |

(State or other jurisdiction of incorporation) |

(Commission File Number) |

(IRS Employer Identification No.) |

|

2 Leman Street London E1W 9US United Kingdom |

(Address of principal executive offices) (Zip Code) |

+44 20 3139 2910

(Registrant’s telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

Title of each class |

Trading

Symbol(s) |

Name of each exchange

on which registered |

Ordinary shares, nominal value £0.0025 per ordinary share |

n/a |

The Nasdaq Stock Market LLC* |

American Depositary Shares, each representing two ordinary shares, nominal value £0.0025 per ordinary share |

RNLX |

The Nasdaq Stock Market LLC |

* Not for trading, but only in connection with the listing of the American Depositary Shares on The Nasdaq Stock Market LLC.

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

ITEM 2.02 RESULTS OF OPERATIONS AND FINANCIAL CONDITION

On May 15, 2024, Renalytix plc (the “Company”) issued a press release announcing its financial results for the quarter ended March 31, 2024, as well as information regarding a conference call to discuss these financial results and the Company’s recent corporate highlights. The Company’s press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K.

The information included in this Item 2.02 and Exhibit 99.1 attached hereto shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, regardless of any general incorporation language in such filing.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

renalytix plc |

|

|

|

Dated: May 15, 2024 |

By: |

/s/ James McCullough |

|

|

James McCullough

Chief Executive Officer |

Exhibit 99.1

Renalytix plc

(“Renalytix” or the “Company”)

Renalytix Reports Financial Results for Third Quarter of Fiscal Year 2024

LONDON and NEW YORK, May 15, 2024 – Renalytix plc (NASDAQ: RNLX) (LSE: RENX), an artificial intelligence-enabled in vitro diagnostics company, focused on optimizing clinical management of kidney disease to drive improved patient outcomes and advance value-based care, today reported financial results for the fiscal third quarter ended March 31, 2024.

The Company made continued progress towards commercial adoption with inclusion of KidneyIntelX in clinical guidelines, issuance of a Medicare coverage draft, performance of new direct to physician sales force, April launch of U.S. Food and Drug Administration (“FDA”) De Novo authorized kidneyintelX.dkd, and release of new real-world outcomes evidence. Optimization of shareholder value continues with year over year significant expense reductions, completion of equity financing, and the initiation of a strategic sale process.

Highlights include:

•KidneyIntelX included as only biomarker test for prognostic risk assessment in landmark update of international clinical practice guidelines (https://kdigo.org/guidelines/)

•Medicare Local Coverage Determination draft issued for FDA-authorized kidneyintelX.dkd by Medicare contractor National Government Services (NGS) with final issuance expected in the near term

•Formal launch of the FDA-authorized kidneyintelX.dkd in April 2024

•Customer experience improvements implemented including simplified physician order requisition, increased patient access to national blood draw network, revamped marketing and education materials

•New primary care sales force completed its first quarter of operations with a 33% quarter over quarter increase in independent primary care physician test order volume during the three months ended March 31, 2024

•Appointed Howard Doran to president concurrent with organizational changes to focus to accelerating sales and marketing of FDA-authorized kidneyintelX.dkd test

•Formal strategic sale process initiated with multiple potential acquirers now in discussions

•Completed common stock equity financings raising aggregate gross proceeds of $13.5 million (including post-period activity)

•Continued operating expense reduction with 50% year-over-year reduction in head count and approximately 40% total lower operating costs

•With FDA and clinical guidelines achieved, process initiated for potential ex-U.S. partners to improve non-dilutive company cash position and expand incremental sales opportunities

•U.S. government added the FDA-authorized kidneyintelX.dkd to 10-year Government-wide Acquisition Contract (GWAC) at a price of $950 per reportable result. The contract covers tests provided by any government healthcare facility

•Total volume of 806 tests during the quarter, of which 82% were billable

Third Quarter 2024 Financial Results

During the three months ended March 31, 2024, the Company recognized $0.5 million of revenue, compared to $0.7 million for the three months ended March 31, 2023. Cost of revenue for the three months ended March 31, 2024 and 2023, was $0.6 million.

Operating expenses for the three months ended March 31, 2024 were $6.5 million, compared to $11.0 million during the prior year period. Operating cash burn in the fiscal third quarter was $4.9 million, nearly 40% lower than the fiscal second quarter and a 50% reduction from the year ago period.

Within operating expenses, research and development expenses were $2.2 million for the three months ended March 31, 2024, decreasing by $1.7 million from $3.9 million for the three months ended March 31, 2023. The decrease was attributable to a $1.3 million decrease related to external R&D projects and studies with Mount Sinai, Wake Forest and Joslin, a decrease of $0.3 million in compensation and related benefits, and a $0.1 million decrease in other operating expenses.

General and administrative expenses were $3.9 million for the three months ended March 31, 2024, decreasing by $3.2 million from $7.1 million for the three months ended March 31, 2023. The decrease was driven by even further cost cutting measures, which resulted in a $2.6 million decrease in compensation and related benefits, a $0.3 million decrease in other operating expenses, and a $0.3 million decrease in insurance costs.

Net loss was $7.7 million for the three months ended March 31, 2024, compared with $12.1 million for the prior year period.

Cash and cash equivalents totaled $4.7 million as of March 31, 2024.

The Company will host a corresponding conference call and live webcast today to discuss the financial results and key topics including business strategy, partnerships and regulatory and reimbursement processes, at 8:30 a.m. EDT / 1:30 p.m. BST.

Conference Call Details:

To participate in the live conference call via telephone, please register here. Upon registering, a dial-in number and unique PIN will be provided in order for interested parties to join the conference call.

Webcast Registration link: https://edge.media-server.com/mmc/p/k57ufszy

For further information, please contact:

|

|

Renalytix plc |

www.renalytix.com |

James McCullough, CEO |

Via Walbrook PR |

|

|

Stifel (Nominated Adviser, Joint Broker) |

Tel: 020 7710 7600 |

Alex Price / Nicholas Moore / Nick Harland / Samira Essebiyea |

|

|

|

Investec Bank plc (Joint Broker) |

Tel: 020 7597 4000 |

Gary Clarence / Shalin Bhamra |

|

|

|

|

|

Walbrook PR Limited |

Tel: 020 7933 8780 or renalytix@walbrookpr.com |

Paul McManus / Alice Woodings |

Mob: 07980 541 893 / 07407 804 654 |

|

|

CapComm Partners |

|

Peter DeNardo |

Tel: 415-389-6400 or investors@renalytix.com |

About Renalytix

Renalytix (NASDAQ: RNLX) (LSE: RENX) is an artificial intelligence enabled in-vitro diagnostics and laboratory services company that is the global founder and leader in the field of bioprognosis™ for kidney health. In late 2023, our kidneyintelX.dkd test was recognized as the first and only FDA-authorized prognostic test to enable early-stage CKD (stages 1-3b) risk assessment for progressive decline in kidney function in T2D patients. By understanding how disease will progress, patients and clinicians can take action earlier to improve outcomes and reduce overall health system costs. For more information, visit www.renalytix.com.

Forward-Looking Statements

Statements contained in this press release regarding matters that are not historical facts are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, as amended. Examples of these forward-looking statements include statements concerning: the commercial prospects of KidneyIntelX, including whether KidneyIntelX will be successfully adopted by physicians and distributed and marketed, the rate of testing with KidneyIntelX in health care systems, expectations and timing of announcement of real-world testing evidence, the potential for KidneyIntelX to be approved for additional indications, the Company’s expectations regarding the timing and outcome of regulatory and reimbursement decisions, the ability of KidneyIntelX to curtail costs of chronic and end-stage kidney disease, optimize care delivery and improve patient outcomes, the Company’s expectations and guidance related to partnerships, testing volumes and revenue for future periods, the Company’s expectations regarding the Company’s ability to obtain and maintain intellectual property protection for its diagnostic products and the Company’s ability to operate its business without infringing on the intellectual property rights of others, and the forecast of the Company’s cash runway and the implementation and potential for additional financing activities and cost-saving initiatives. Words such as “anticipates,” “believes,” “estimates,” “expects,” “intends,” “plans,” “seeks,” and similar expressions are intended to identify forward-looking statements. The Company may not actually achieve the plans and objectives disclosed in the forward-looking statements, and you should not place undue reliance on the Company’s forward-looking statements. Any forward-looking statements are based on management’s current views and assumptions and involve risks and uncertainties that could cause actual results, performance or events to differ materially from those expressed or implied in such statements. These risks and uncertainties include, among others: that KidneyIntelX is based on novel artificial intelligence technologies that are rapidly evolving and potential acceptance, utility and clinical practice remains uncertain; the Company has only recently commercially launched KidneyIntelX; and risks relating to the impact on the Company’s business of the COVID-19 pandemic or similar public health crises. These and other risks are described more fully in the Company’s filings with the Securities and Exchange Commission (SEC), including the “Risk Factors” section of its annual report on Form 10-K filed with the SEC on September 28, 2023, the Company’s Quarterly Report on Form 10-Q for the quarter ended September 30, 2023 filed with the SEC on November 14, 2023, the Company’s Quarterly Report on Form 10-Q for the quarter ended December 31, 2024 filed with the SEC on February 14, 2024 and other filings the Company makes with the SEC from time to time. All information in this press release is as of the date of the release, and the Company undertakes no obligation to publicly update any forward-looking statement, whether as a result of new information, future events, or otherwise, except as required by law.

RENALYTIX PLC

Consolidated Statements of Operations and Comprehensive Loss (Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the Three Months Ended March 31, |

|

|

For the Nine Months Ended March 31, |

|

(in thousands, except share data) |

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

Revenue |

|

$ |

535 |

|

|

$ |

724 |

|

|

$ |

1,703 |

|

|

$ |

2,885 |

|

Cost of revenue |

|

|

601 |

|

|

|

603 |

|

|

|

1,583 |

|

|

|

2,010 |

|

Gross profit (loss) |

|

|

(66 |

) |

|

|

121 |

|

|

|

120 |

|

|

|

875 |

|

Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

Research and development |

|

|

2,216 |

|

|

|

3,943 |

|

|

|

8,228 |

|

|

|

11,026 |

|

General and administrative |

|

|

3,854 |

|

|

|

7,095 |

|

|

|

15,252 |

|

|

|

22,155 |

|

Impairment loss on property, equipment and other long-lived assets |

|

|

417 |

|

|

|

— |

|

|

|

723 |

|

|

|

— |

|

Performance of contract liability to affiliate |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(19 |

) |

Total operating expenses |

|

|

6,487 |

|

|

|

11,038 |

|

|

|

24,203 |

|

|

|

33,162 |

|

Loss from operations |

|

|

(6,553 |

) |

|

|

(10,917 |

) |

|

|

(24,083 |

) |

|

|

(32,287 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Equity in net losses of affiliate |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(9 |

) |

Foreign currency gain (loss), net |

|

|

15 |

|

|

|

(461 |

) |

|

|

215 |

|

|

|

238 |

|

Fair value adjustment to VericiDx investment |

|

|

40 |

|

|

|

129 |

|

|

|

(205 |

) |

|

|

(1,070 |

) |

Fair value adjustment to convertible notes |

|

|

(1,196 |

) |

|

|

(1,168 |

) |

|

|

(2,517 |

) |

|

|

(1,898 |

) |

Other (expense) income, net |

|

|

(49 |

) |

|

|

310 |

|

|

|

212 |

|

|

|

521 |

|

Net loss before income taxes |

|

|

(7,743 |

) |

|

|

(12,107 |

) |

|

|

(26,378 |

) |

|

|

(34,505 |

) |

Income tax (expense) benefit |

|

|

— |

|

|

|

1 |

|

|

|

(4 |

) |

|

|

2 |

|

Net loss |

|

$ |

(7,743 |

) |

|

$ |

(12,106 |

) |

|

$ |

(26,382 |

) |

|

$ |

(34,503 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss per ordinary share—basic |

|

$ |

(0.08 |

) |

|

$ |

(0.14 |

) |

|

$ |

(0.27 |

) |

|

$ |

(0.44 |

) |

Net loss per ordinary share—diluted |

|

$ |

(0.08 |

) |

|

$ |

(0.14 |

) |

|

$ |

(0.27 |

) |

|

$ |

(0.44 |

) |

Weighted average ordinary shares—basic |

|

|

97,654,961 |

|

|

|

85,560,783 |

|

|

|

98,184,650 |

|

|

|

78,366,984 |

|

Weighted average ordinary shares—diluted |

|

|

97,654,961 |

|

|

|

85,560,783 |

|

|

|

98,184,650 |

|

|

|

78,366,984 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other comprehensive income (loss): |

|

|

|

|

|

|

|

|

|

|

|

|

Changes in the fair value of the convertible notes |

|

$ |

155 |

|

|

$ |

593 |

|

|

$ |

230 |

|

|

$ |

70 |

|

Foreign exchange translation adjustment |

|

|

21 |

|

|

|

505 |

|

|

|

(338 |

) |

|

|

6 |

|

Comprehensive loss |

|

$ |

(7,567 |

) |

|

$ |

(11,008 |

) |

|

$ |

(26,490 |

) |

|

$ |

(34,427 |

) |

RENALYTIX PLC

CONSOLIDATED BALANCE SHEETS (Unaudited)

|

|

|

|

|

|

|

|

|

|

|

(in thousands, except share and per share data) |

|

|

|

March 31, 2024 |

|

|

June 30, 2023 |

|

Assets |

|

|

|

|

|

|

|

|

Current assets: |

|

|

|

|

|

|

|

|

Cash and cash equivalents |

|

|

|

$ |

4,704 |

|

|

$ |

24,682 |

|

Accounts receivable |

|

|

|

|

554 |

|

|

|

776 |

|

Prepaid expenses and other current assets |

|

|

|

|

1,082 |

|

|

|

1,424 |

|

Total current assets |

|

|

|

|

6,340 |

|

|

|

26,882 |

|

Property and equipment, net |

|

|

|

|

230 |

|

|

|

1,027 |

|

Right of Use Asset |

|

|

|

|

— |

|

|

|

159 |

|

Investment in VericiDx |

|

|

|

|

1,060 |

|

|

|

1,460 |

|

Other Assets |

|

|

|

|

1,139 |

|

|

|

1,101 |

|

Total assets |

|

|

|

$ |

8,769 |

|

|

$ |

30,629 |

|

|

|

|

|

|

|

|

|

|

Liabilities and Shareholders’ Equity |

|

|

|

|

|

|

|

|

Current liabilities: |

|

|

|

|

|

|

|

|

Accounts payable |

|

|

|

$ |

2,101 |

|

|

$ |

1,485 |

|

Accounts payable – related party |

|

|

|

|

3,027 |

|

|

|

1,451 |

|

Accrued expenses and other current liabilities |

|

|

|

|

4,273 |

|

|

|

6,644 |

|

Accrued expenses – related party |

|

|

|

|

1,060 |

|

|

|

1,963 |

|

Current lease liability |

|

|

|

|

78 |

|

|

|

130 |

|

Convertible notes-current |

|

|

|

|

4,449 |

|

|

|

4,463 |

|

Total current liabilities |

|

|

|

|

14,988 |

|

|

|

16,136 |

|

Convertible notes-noncurrent |

|

|

|

|

4,892 |

|

|

|

7,485 |

|

Noncurrent lease liability |

|

|

|

|

— |

|

|

|

41 |

|

Total liabilities |

|

|

|

|

19,880 |

|

|

|

23,662 |

|

|

|

|

|

|

|

|

|

|

Commitments and contingencies (Note 10) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Shareholders’ equity: |

|

|

|

|

|

|

|

|

Ordinary shares, £0.0025 par value per share: 128,042,743 shares

authorized; 119,916,187 and 93,781,478 shares issued and

outstanding at March 31, 2024 and June 30, 2023, respectively |

|

|

|

|

368 |

|

|

|

286 |

|

Additional paid-in capital |

|

|

|

|

194,786 |

|

|

|

186,456 |

|

Accumulated other comprehensive loss |

|

|

|

|

(1,558 |

) |

|

|

(1,450 |

) |

Accumulated deficit |

|

|

|

|

(204,707 |

) |

|

|

(178,325 |

) |

Total shareholders’ (deficit) equity |

|

|

|

|

(11,111 |

) |

|

|

6,967 |

|

Total liabilities and shareholders’ (deficit) equity |

|

|

|

$ |

8,769 |

|

|

$ |

30,629 |

|

RENALYTIX PLC

CONSOLIDATED STATEMENTS OF CASH FLOWS (Unaudited)

|

|

|

|

|

|

|

|

|

|

|

For the Nine Months Ended March 31, |

|

(in thousands) |

|

2024 |

|

|

2023 |

|

Cash flows from operating activities: |

|

|

|

|

|

|

Net loss |

|

$ |

(26,382 |

) |

|

$ |

(34,503 |

) |

Adjustments to reconcile net loss to net cash used in operating activities: |

|

|

|

|

|

|

Depreciation and amortization |

|

|

304 |

|

|

|

388 |

|

Impairment loss on property, equipment and other long-lived assets |

|

|

723 |

|

|

|

— |

|

Stock-based compensation |

|

|

1,291 |

|

|

|

2,358 |

|

Equity in losses of affiliate |

|

|

— |

|

|

|

9 |

|

Reduction of Kantaro liability |

|

|

— |

|

|

|

(55 |

) |

Fair value adjustment to VericiDx investment |

|

|

205 |

|

|

|

1,070 |

|

Unrealized foreign exchange loss |

|

|

— |

|

|

|

327 |

|

Realized loss on sale of ordinary shares in VericiDx |

|

|

94 |

|

|

|

— |

|

Realized foreign exchange gain |

|

|

(144 |

) |

|

|

— |

|

Fair value adjustment to convertible debt, net interest paid |

|

|

2,255 |

|

|

|

1,898 |

|

Non cash lease expense |

|

|

67 |

|

|

|

78 |

|

Changes in operating assets and liabilities: |

|

|

|

|

|

|

Accounts receivable |

|

|

222 |

|

|

|

154 |

|

Prepaid expenses and other current assets |

|

|

310 |

|

|

|

(77 |

) |

Accounts payable |

|

|

617 |

|

|

|

358 |

|

Accounts payable – related party |

|

|

1,576 |

|

|

|

370 |

|

Accrued expenses and other current liabilities |

|

|

(2,519 |

) |

|

|

2,704 |

|

Accrued expenses – related party |

|

|

(904 |

) |

|

|

(485 |

) |

Deferred revenue |

|

|

— |

|

|

|

(46 |

) |

Net cash used in operating activities |

|

|

(22,285 |

) |

|

|

(25,452 |

) |

|

|

|

|

|

|

|

Cash flows from investing activities: |

|

|

|

|

|

|

Purchase of equipment |

|

|

(3 |

) |

|

|

— |

|

Payment for long term deferred expense |

|

|

— |

|

|

|

(59 |

) |

Net cash used in investing activities |

|

|

(3 |

) |

|

|

(59 |

) |

|

|

|

|

|

|

|

Cash flows from financing activities: |

|

|

|

|

|

|

Payment of convertible notes principal |

|

|

(1,660 |

) |

|

|

(3,262 |

) |

Proceeds from issuance of ordinary shares in Private Placement |

|

|

5,072 |

|

|

|

20,296 |

|

Payment of offering costs |

|

|

(1,044 |

) |

|

|

(666 |

) |

Proceeds from purchase of ordinary shares under employee share

purchase plan |

|

|

93 |

|

|

|

116 |

|

Net cash provided by financing activities |

|

|

2,461 |

|

|

|

16,484 |

|

Effect of exchange rate changes on cash |

|

|

(151 |

) |

|

|

721 |

|

Net decrease in cash and cash equivalents |

|

|

(19,978 |

) |

|

|

(8,306 |

) |

Cash and cash equivalents, beginning of period |

|

|

24,682 |

|

|

|

41,333 |

|

Cash and cash equivalents, end of period |

|

$ |

4,704 |

|

|

$ |

33,027 |

|

Supplemental noncash investing and financing activities: |

|

|

|

|

|

|

Cash paid for interest on convertible debt |

|

$ |

249 |

|

|

$ |

— |

|

v3.24.1.1.u2

Document And Entity Information

|

May 15, 2024 |

| Document Information [Line Items] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

May 15, 2024

|

| Entity Registrant Name |

Renalytix plc

|

| Entity Central Index Key |

0001811115

|

| Entity Emerging Growth Company |

true

|

| Entity Ex Transition Period |

false

|

| Securities Act File Number |

001-39387

|

| Entity Incorporation, State or Country Code |

X0

|

| Entity Tax Identification Number |

00-0000000

|

| Entity Address, Address Line One |

2 Leman Street

|

| Entity Address, City or Town |

London E1W 9US

|

| Entity Address, Country |

GB

|

| Entity Address, Postal Zip Code |

E1W 9US

|

| City Area Code |

+44

|

| Local Phone Number |

20 3139 2910

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Ordinary shares, nominal value £0.0025 per ordinary share

|

| No Trading Symbol Flag |

true

|

| Security Exchange Name |

NASDAQ

|

| American Depositary Shares [Member] |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

American Depositary Shares, each representing two ordinary shares, nominal value £0.0025 per ordinary share

|

| Trading Symbol |

RNLX

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionISO 3166-1 alpha-2 country code.

| Name: |

dei_EntityAddressCountry |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:countryCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true only for a security having no trading symbol.

| Name: |

dei_NoTradingSymbolFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:trueItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

dei_LegalEntityAxis=rnlx_AmericanDepositarySharesMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

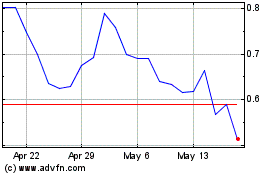

Renalytix (NASDAQ:RNLX)

Historical Stock Chart

From Apr 2024 to May 2024

Renalytix (NASDAQ:RNLX)

Historical Stock Chart

From May 2023 to May 2024