Initial Statement of Beneficial Ownership (3)

August 27 2021 - 9:03AM

Edgar (US Regulatory)

FORM 3

|

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

INITIAL STATEMENT OF BENEFICIAL OWNERSHIP OF SECURITIES

|

OMB APPROVAL

OMB Number:

3235-0104

Estimated average burden

hours per response...

0.5

|

|

Filed pursuant to Section 16(a) of the Securities Exchange Act of 1934 or Section 30(h) of the Investment Company Act of 1940

|

|

|

1. Name and Address of Reporting Person

*

Cornils Kevin |

2. Date of Event Requiring Statement (MM/DD/YYYY)

8/18/2021

|

3. Issuer Name and Ticker or Trading Symbol

PELOTON INTERACTIVE, INC. [PTON]

|

|

(Last)

(First)

(Middle)

C/O PELOTON INTERACTIVE, INC., 441 NINTH AVENUE, SIXTH FLOOR |

4. Relationship of Reporting Person(s) to Issuer (Check all applicable)

_____ Director _____ 10% Owner

___X___ Officer (give title below) _____ Other (specify below)

Chief Commercial Officer / |

|

(Street)

NEW YORK, NY 10001

(City)

(State)

(Zip)

| 5. If Amendment, Date Original Filed(MM/DD/YYYY)

| 6. Individual or Joint/Group Filing(Check Applicable Line)

_X_ Form filed by One Reporting Person

___ Form filed by More than One Reporting Person

|

Table I - Non-Derivative Securities Beneficially Owned

|

1.Title of Security

(Instr. 4) | 2. Amount of Securities Beneficially Owned

(Instr. 4) | 3. Ownership Form: Direct (D) or Indirect (I)

(Instr. 5) | 4. Nature of Indirect Beneficial Ownership

(Instr. 5) |

| Class A Common Stock | 0 | D | |

Table II - Derivative Securities Beneficially Owned (e.g., puts, calls, warrants, options, convertible securities)

|

1. Title of Derivate Security

(Instr. 4) | 2. Date Exercisable and Expiration Date

(MM/DD/YYYY) | 3. Title and Amount of Securities Underlying Derivative Security

(Instr. 4) | 4. Conversion or Exercise Price of Derivative Security | 5. Ownership Form of Derivative Security: Direct (D) or Indirect (I)

(Instr. 5) | 6. Nature of Indirect Beneficial Ownership

(Instr. 5) |

| Date Exercisable | Expiration Date | Title | Amount or Number of Shares |

| Stock Option (right to buy Class B Common Stock) | (1) | 10/25/2027 | Class B Common Stock (2) | 250000.0 | $2.89 | D | |

| Stock Option (right to buy Class B Common Stock) | (3) | 4/25/2029 | Class B Common Stock (2) | 200000.0 | $14.59 | D | |

| Stock Option (right to buy Class B Common Stock) | (4) | 4/25/2029 | Class B Common Stock (2) | 200000.0 | $14.59 | D | |

| Stock Option (right to buy Class A Common Stock) | (5) | 2/27/2030 | Class A Common Stock | 400000.0 | $26.69 | D | |

| Stock Option (right to buy Class A Common Stock) | (6) | 9/15/2030 | Class A Common Stock | 100672.0 | $82.59 | D | |

| Stock Option (right to buy Class A Common Stock) | (7) | 2/28/2031 | Class A Common Stock | 63473.0 | $123.81 | D | |

| Explanation of Responses: |

| (1) | The option vested as to 25% of the total shares on October 23, 2018, then 2.0833% of the total shares vest monthly, with 100% of the total shares vested on October 23, 2021, subject to the reporting person's provision of service to the issuer on each vesting date. The option provides for an early-exercise provision and is exercisable as to unvested shares, subject to the issuer's right of repurchase. |

| (2) | Each share of the issuer's Class B Common Stock will automatically convert into one (1) share of the issuer's Class A Common Stock (a) at the option of the holder and (b) immediately prior to the close of business on the earliest of (i) ten (10) years from the closing of the issuer's initial public offering, (ii) the date on which the outstanding shares of Class B Common Stock represent less than one percent (1%) of the aggregate number of shares of Class A Common Stock and Class B Common Stock then outstanding or (iii) the date specified by the affirmative vote of the holders of Class B Common Stock representing not less than two-thirds (2/3) of the voting power of the outstanding shares of Class B Common Stock, voting separately as a single class, and has no expiration date. |

| (3) | The option vests as to 2.0833% of the total shares monthly, commencing May 24, 2019, with 100% of the total shares vested on April 24, 2023, subject to the reporting person's provision of service to the issuer on each vesting date. |

| (4) | The option vests as to 40% of the total shares on February 1, 2022, 30% of the total shares on February 1, 2024 and 30% of the total shares on February 1, 2026, subject to the reporting person's provision of service to the issuer on each vesting date. |

| (5) | The option vests as to 2.0833% of the total shares monthly, commencing March 28, 2020, with 100% of the total shares vested on February 28, 2024, subject to the reporting person's provision of service to the issuer on each vesting date. |

| (6) | The option vests as to 6.25% of the total shares quarterly, commencing November 15, 2020, with 100% of the total shares vested and exercisable on August 15, 2024, subject to the reporting person's provision of service to the issuer on each vesting date. |

| (7) | The option vests as to 6.25% of the total shares quarterly, commencing May 15, 2021, with 100% of the total shares vested and exercisable on February 15, 2025, subject to the reporting person's provision of service to the issuer on each vesting date. |

Remarks:

Exhibit 24 - Power of Attorney |

Reporting Owners

|

| Reporting Owner Name / Address | Relationships |

| Director | 10% Owner | Officer | Other |

Cornils Kevin

C/O PELOTON INTERACTIVE, INC.

441 NINTH AVENUE, SIXTH FLOOR

NEW YORK, NY 10001 |

|

| Chief Commercial Officer |

|

Signatures

|

| /s/ Bart Goldstein as attorney-in-fact for Kevin Cornils | | 8/27/2021 |

| **Signature of Reporting Person | Date |

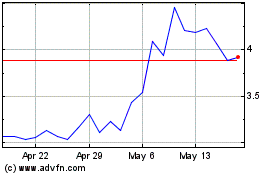

Peloton Interactive (NASDAQ:PTON)

Historical Stock Chart

From Mar 2024 to Apr 2024

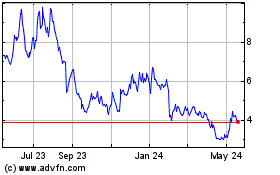

Peloton Interactive (NASDAQ:PTON)

Historical Stock Chart

From Apr 2023 to Apr 2024