ParaZero Announces 2023 Financial Results

March 22 2024 - 6:30AM

ParaZero Technologies Ltd. (Nasdaq: PRZO) (the "company” or

“ParaZero”), an aerospace company focused on drone technologies for

commercial drones, defense drones, and urban air mobility aircraft,

reported today its financial results for year ended December 31,

2023.

Key Highlights of ParaZero’s

Achievements in 2023 & Recent

Highlights:

- ParaZero announced a new development agreement with

Colombia-based drone OEM, Black Square, an industrial drone

producer leader in the region that focuses on enterprise drone

platforms.

- ParaZero announced the formation of a working partnership with

KULR Technology Group, Inc., a global leader in sustainable energy

management, to leverage its business network within the defense

industry for applying KULR's vibration reduction technology on

helicopter and rotorcraft fleets.

- ParaZero facilitated one of its customers in obtaining the

first-ever light uncrewed aircraft system operator certificate

(LUC) in Denmark. The LUC is an organizational approval certificate

granted by the European Union Aviation Safety Agency (EASA) that

allows for cross-border operations throughout the European Union

without additional approvals required.

- The Australian Civil Aviation Safety Agency authorized drones

to operate over populated area and near people when using

ParaZero’s safety systems, the first such authorization of its kind

in Australia.

- The Human Environment and Transport Inspectorate (issued a

precedent-setting approval for the first drone flights over densely

populated areas for drones equipped with ParaZero SafeAir

ASTM-certified parachute recovery systems.

- ParaZero announced that it completed a drone safety project

with a Fortune 500 leading automotive manufacturer.

- ParaZero announced that it expanded its collaboration with Vayu

Aerospace Corporation, a US-based drone original equipment

manufacturer, where ParaZero will customize its SafeAir system to

be integrated at the design stage of Vayu’s G-1MKII VTOL aircraft

and jointly participate in performance-based regulatory compliance

testing and validation.

- ParaZero closed its IPO on July 31, 2023, issuing 1,950,000

ordinary shares. Gross proceeds for the offering were approximately

$7.8 million prior to deducting underwriting discounts and other

offering expenses.

- ParaZero closed a private placement on October 30, 2023,

issuing an aggregate of 1,136,364 ordinary shares, 3,500,000

pre-funded warrants, 4,636,364 series A warrants and 140,373 series

B warrants. Gross proceeds for the offering were approximately $5.1

million prior to deducting placement agent expenses and other

offering expenses.

ParaZero's CEO, Boaz Shetzer, stated, "2023 was a crucial year

for ParaZero, as we continued to push the boundaries of innovation

in drone safety. We believe that our strategic partnerships,

coupled with significant regulatory approvals, position us strongly

for continued growth and leadership in the drone safety industry.

We remain committed to our mission of enhancing the safety and

operational capabilities of drones and eVTOLs worldwide, ensuring

safer skies for tomorrow."

Full Year 2023 Financial

Highlights:

- Sales increased by $60,390, or 10.8% to $620,508 for the year

ended December 31, 2023, compared to $560,118 for the year

ended December 31, 2022. This increase was mainly attributed

to that fact, that the company shifted towards sales to OEMs

integrations that contributed to a higher volume of sales rather

than to the aftermarket segment. This shift is accompanied with

recuring revenues.

- Cost of sales increased by $139,045, or 41.2%, to $476,610 for

the year ended December 31, 2023, compared to $337,565 for the

year ended December 31, 2022. The increase was mainly due to

the increase in and the volume of sales during the year ended

December 31, 2023 and an inventory write off increase of

approximately $21,000 and partly due to the increase in sales.

- Research and development expenses decreased by $3,527, or 0.6%,

to $636,801 for the year ended December 31, 2023, compared to

$640,328 for the year ended December 31, 2022. Research and

development expenses mainly consist of labor and subcontractors’

cost.

- Sales and marketing expenses increased by $223,176, or 84.3%,

to $487,904 for the year ended December 31, 2023, compared to

$264,728 for the year ended December 31, 2022. The increase

resulted mainly from labor and more subcontractors’ costs of

$131,000 accompanied an increase in by travel and conferences

participation costs of $28,000.

- General and administrative expenses increased by $706,161, or

92.1%, to $1,472,872 for the year ended December 31, 2023,

compared to $766,711 for the year ended December 31, 2022. The

increase resulted mainly from expansion in labor and professional

services rendered after the IPO and costs associated with becoming

a public company, including an increase in D&O insurance and

certain filing services.

- Other finance income, net was $210,675 for the year ended

December 31, 2023, compared to finance income, net of $202,958

for the year ended December 31, 2022. Other finance income,

net, primarily includes income from interest on deposits and

exchange rate differences.

- Net loss and comprehensive loss increased by $2,118,341, or

128.1%, to $3,771,379 for the year ended December 31, 2023,

compared to a net loss of $1,653,038 for the year ended

December 31, 2022. The increase was the result of increase

with non-cash items such as changes in fair value of convertible

note, changes in fair value of derivative warrant liabilities,

along with increase in operating expenses, as described above.

- The loss per share in 2023, was $0.77 compared to net loss per

share of $0.49 in 2022.

- As of December 31, 2023, the company’s cash and cash

equivalents was $7,428,405 and the company’s total shareholders'

equity was $6,105,058.

About ParaZero Technologies

ParaZero (https://parazero.com/) is a world-leading developer of

autonomous parachute safety systems for commercial and defense

unmanned systems, drone and urban air mobility (UAM) aircraft.

Started in 2014 by a passionate group of aviation professionals and

drone industry veterans, ParaZero designs smart, autonomous

parachute safety systems designed to enable safe flight operations

in advanced use cases, including flight over populated areas and

beyond-visual-line-of-sight (BVLOS).

Forward-Looking Statements

This press release contains “forward-looking statements” within

the meaning of the Private Securities Litigation Reform Act and

other securities laws. Words such as “expects,” “anticipates,”

“intends,” “plans,” “believes,” “seeks,” “estimates” and similar

expressions or variations of such words are intended to identify

forward-looking statements. For example, ParaZero is using

forward-looking statements when it discusses its belief that its

strategic partnerships, coupled with significant regulatory

approvals, position it strongly for continued growth and leadership

in the drone safety industry and its mission of enhancing the

safety and operational capabilities of drones and eVTOLs worldwide,

ensuring safer skies for tomorrow. Forward-looking statements are

not historical facts, and are based upon management’s current

expectations, beliefs and projections, many of which, by their

nature, are inherently uncertain. Such expectations, beliefs and

projections are expressed in good faith. However, there can be no

assurance that management’s expectations, beliefs and projections

will be achieved, and actual results may differ materially from

what is expressed in or indicated by the forward-looking

statements. Forward-looking statements are subject to risks and

uncertainties that could cause actual performance or results to

differ materially from those expressed in the forward-looking

statements. For a more detailed description of the risks and

uncertainties affecting the Company, reference is made to the

Company’s reports filed from time to time with the Securities and

Exchange Commission (“SEC”), including, but not limited to, the

risks detailed in the Company’s Annual Report on Form 20-F filed

with the SEC on March 21, 2024. Forward-looking statements speak

only as of the date the statements are made. The Company assumes no

obligation to update forward-looking statements to reflect actual

results, subsequent events or circumstances, changes in assumptions

or changes in other factors affecting forward-looking information

except to the extent required by applicable securities laws. If the

Company does update one or more forward-looking statements, no

inference should be drawn that the Company will make additional

updates with respect thereto or with respect to other

forward-looking statements. References and links to websites have

been provided as a convenience, and the information contained on

such websites is not incorporated by reference into this press

release. ParaZero is not responsible for the content of third-party

websites.

Investor Relations Contact:

Michal EfratyInvestor Relations,

Israel+972-(0)52-3044404michal@efraty.com

ParaZero Technologies Ltd. | 30 Dov Hoz, Kiryat

Ono, Israel 5555626P: +972-36885252 |

E: contact@parazero.com | F: +972-3-688-5246

|

ParaZero Technologies Ltd.BALANCE

SHEET(U.S. dollars in thousands, except share data

and per share data) |

| |

|

December 31,2023 |

|

|

December 31,2022 |

|

| ASSETS |

|

(audited) |

|

| CURRENT

ASSETS: |

|

|

|

|

|

|

|

Cash and cash equivalents |

|

|

7,428,405 |

|

|

|

89,806 |

|

|

Trade receivables |

|

|

22,376 |

|

|

|

184,064 |

|

|

Other current assets |

|

|

651,560 |

|

|

|

179,541 |

|

|

Deferred prospective initial public offering costs |

|

|

- |

|

|

|

291,133 |

|

|

Inventories |

|

|

264,468 |

|

|

|

304,823 |

|

| TOTAL CURRENT

ASSETS |

|

|

8,366,809 |

|

|

|

1,049,367 |

|

| |

|

|

|

|

|

|

|

|

| NON-CURRENT

ASSETS: |

|

|

|

|

|

|

|

|

|

Operating lease right-of-use asset |

|

|

8,127 |

|

|

|

56,893 |

|

|

Property and equipment, net |

|

|

49,981 |

|

|

|

41,311 |

|

| TOTAL NON-CURRENT

ASSETS |

|

|

58,108 |

|

|

|

98,204 |

|

| |

|

|

|

|

|

|

|

|

| TOTAL

ASSETS |

|

|

8,424,917 |

|

|

|

1,147,571 |

|

|

LIABILITIES AND SHAREHOLDERS' EQUITY(U.S.

dollars in thousands, except share data and per share

data) |

| |

|

December 31,2023 |

|

|

December 31,2022 |

|

| LIABILITIES AND

SHAREHOLDERS’ EQUITY (DEFICIT) |

|

(audited) |

|

| CURRENT

LIABILITIES: |

|

|

|

|

|

|

|

Trade payables |

|

|

56,682 |

|

|

|

47,260 |

|

|

Operating lease liabilities |

|

|

7,543 |

|

|

|

45,097 |

|

|

Other current liabilities |

|

|

690,861 |

|

|

|

774,647 |

|

|

Convertible notes |

|

|

- |

|

|

|

1,514,928 |

|

| TOTAL CURRENT

LIABILITIES |

|

|

755,086 |

|

|

|

2,381,932 |

|

| |

|

|

|

|

|

|

|

|

| NON-CURRENT

LIABILITIES: |

|

|

|

|

|

|

|

|

|

Derivative warrant liabilities |

|

|

1,564,773 |

|

|

|

— |

|

|

Operating lease liabilities, net of current portion |

|

|

— |

|

|

|

7,775 |

|

|

Loan from a related party |

|

|

|

|

|

|

399,794 |

|

| TOTAL NON-CURRENT

LIABILITIES |

|

|

1,564,773 |

|

|

|

407,569 |

|

| |

|

|

|

|

|

|

|

|

| COMMITMENTS AND

CONTINGENCIES |

|

|

|

|

|

|

|

|

| SHAREHOLDERS’ EQUITY

(DEFICIT): |

|

|

|

|

|

|

|

|

|

Ordinary shares, NIS 0.02 par value: Authorized 25,000,000 as of

December 31, 2023 and December 31, 2022; Issued and

outstanding 10,073,956 and 3,597,442 shares as of December 31,

2023 and as of December 31, 2022, respectively |

|

|

56,227 |

|

|

|

21,456 |

|

|

Additional paid-in capital |

|

|

24,471,888 |

|

|

|

12,988,292 |

|

|

Accumulated losses |

|

|

(18,423,057 |

) |

|

|

(14,651,678 |

) |

| TOTAL SHAREHOLDERS’

EQUITY (DEFICIT) |

|

|

6,105,058 |

|

|

|

(1,641,930 |

) |

| |

|

|

|

|

|

|

|

|

| TOTAL LIABILITIES AND

SHAREHOLDERS’ EQUITY (DEFICIT) |

|

|

8,424,917 |

|

|

|

1,147,571 |

|

|

STATEMENTS OF COMPREHENSIVE LOSS(U.S.

dollars in thousands, except share data and per share

data) |

| |

|

Year ended December 31, |

|

| |

|

2023 |

|

|

2022 |

|

|

2021 |

|

| |

|

|

(audited) |

|

|

Sales |

|

|

620,508 |

|

|

|

560,118 |

|

|

|

724,391 |

|

|

Cost of Sales |

|

|

476,610 |

|

|

|

337,565 |

|

|

|

464,715 |

|

| Gross

profit |

|

|

143,898 |

|

|

|

222,553 |

|

|

|

259,676 |

|

|

Research and development expenses |

|

|

636,801 |

|

|

|

640,328 |

|

|

|

603,702 |

|

|

Selling and marketing expenses |

|

|

487,904 |

|

|

|

264,728 |

|

|

|

168,700 |

|

|

General and administrative expenses |

|

|

1,472,872 |

|

|

|

766,711 |

|

|

|

474,703 |

|

|

Prospective initial public offering expenses |

|

|

345,925 |

|

|

|

389,396 |

|

|

|

—_ |

|

| Operating

loss |

|

|

2,799,604 |

|

|

|

1,838,610 |

|

|

|

987,429 |

|

|

Change in fair value of convertible notes |

|

|

504,976 |

|

|

|

— |

|

|

|

— |

|

|

Change in fair value of derivative warrant liabilities |

|

|

277,600 |

|

|

|

— |

|

|

|

— |

|

|

Issuance expenses attributable to derivate warrant liability |

|

|

247,129 |

|

|

|

— |

|

|

|

— |

|

|

Interest expenses on related party loan |

|

|

152,745 |

|

|

|

17,386 |

|

|

|

— |

|

|

Other finance income, net |

|

|

(210,675 |

) |

|

|

(202,958 |

) |

|

|

(372,048 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Net loss and

comprehensive loss |

|

|

3,771,379 |

|

|

|

1,653,038 |

|

|

|

615,381 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Net loss per ordinary

share, basic and diluted |

|

|

0.77 |

|

|

|

0.49 |

|

|

|

1.71 |

|

| Weighted-average

number of ordinary shares outstanding, basic

and diluted |

|

|

4,891,071 |

|

|

|

3,349,071 |

|

|

|

359,743 |

|

|

STATEMENTS OF CHANGES IN SHAREHOLDERS’ EQUITY

(DEFICIT)(U.S. dollars in thousands, except share

data and per share data) |

|

|

|

Ordinary shares |

|

|

Additional |

|

|

|

|

|

|

|

|

|

|

Number ofshares |

|

|

Amount |

|

|

paid-inCapital |

|

|

Accumulated Losses |

|

|

Total |

|

|

|

|

U.S. dollars |

|

|

BALANCE AS OF JANUARY 1,2021 |

|

|

359,743 |

|

|

|

1,945 |

|

|

|

6,380,403 |

|

|

|

(12,383,259 |

) |

|

|

(6,000,911 |

) |

|

Comprehensive loss |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(615,381 |

) |

|

|

(615,381 |

) |

| BALANCE AS OF DECEMBER

31,2021 |

|

|

359,743 |

|

|

|

1,945 |

|

|

|

6,380,403 |

|

|

|

(12,998,640 |

) |

|

|

(6,616,292 |

) |

|

Conversion of Former Parent Company’s debt into ordinary shares and

warrants |

|

|

3,237,699 |

|

|

|

19,511 |

|

|

|

6,403,797 |

|

|

|

— |

|

|

|

6,423,308 |

|

|

Stock based compensation |

|

|

— |

|

|

|

— |

|

|

|

91,377 |

|

|

|

— |

|

|

|

91,377 |

|

|

Benefit to the Company by an equity holder with respect to funding

transactions |

|

|

— |

|

|

|

— |

|

|

|

112,715 |

|

|

|

— |

|

|

|

112,715 |

|

|

Comprehensive and net loss |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(1,653,038 |

) |

|

|

(1,653,038 |

) |

| BALANCE AS OF DECEMBER

31,2022 |

|

|

3,597,442 |

|

|

|

21,456 |

|

|

|

12,988,292 |

|

|

|

(14,651,678 |

) |

|

|

(1,641,930 |

) |

|

Stock based compensation |

|

|

|

|

|

|

|

|

|

|

490,015 |

|

|

|

— |

|

|

|

490,015 |

|

|

Conversion of convertible note into ordinary shares |

|

|

504,976 |

|

|

|

2,734 |

|

|

|

2,017,170 |

|

|

|

— |

|

|

|

2,019,904 |

|

|

Issuance of ordinary shares and warrants upon initial public

offering, net of issuance costs |

|

|

1,950,000 |

|

|

|

10,561 |

|

|

|

5,919,064 |

|

|

|

— |

|

|

|

5,929,625 |

|

|

Issuance of ordinary shares, pre-funded warrants, and warrants upon

private placement, net of issuance costs |

|

|

4,021,538 |

|

|

|

21,476 |

|

|

|

3,045,180 |

|

|

|

— |

|

|

|

3,066,656 |

|

|

Benefit to the Company by an equity holder with respect to funding

transactions |

|

|

— |

|

|

|

— |

|

|

|

12,167 |

|

|

|

— |

|

|

|

12,167 |

|

|

Comprehensive loss |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(3,771,379 |

) |

|

|

(3,771,379 |

) |

| BALANCE AS OF DECEMBER

31,2023 |

|

|

10,073,956 |

|

|

|

56,227 |

|

|

|

24,471,888 |

|

|

|

(18,423,057 |

) |

|

|

6,105,058 |

) |

|

STATEMENTS OFCASH

FLOWS(U.S. dollars in thousands, except share data

and per share data) |

| |

|

Year ended December 31 |

|

| |

|

2023 |

|

|

2022 |

|

|

2021 |

|

| CASH FLOWS FROM

OPERATING ACTIVITIES: |

|

(audited) |

|

|

Net loss |

|

|

(3,771,379 |

) |

|

|

(1,653,038 |

) |

|

|

(615,381 |

) |

| Adjustments required to

reconcile net loss to net cash used in operating activities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Depreciation |

|

|

17,087 |

|

|

|

18,495 |

|

|

|

17,627 |

|

|

Stock based compensation |

|

|

14,815 |

|

|

|

52,286 |

|

|

|

— |

|

|

Interest expenses with respect to funding from related party |

|

|

112,373 |

|

|

|

12,509 |

|

|

|

— |

|

|

Change in fair value of convertible loan |

|

|

504,976 |

|

|

|

— |

|

|

|

— |

|

|

Changes in fair value of derivative liabilities |

|

|

277,600 |

|

|

|

— |

|

|

|

— |

|

|

Issuance expenses attributable to derivative warrant

liabilities |

|

|

247,129 |

|

|

|

— |

|

|

|

— |

|

|

Inventory write-down |

|

|

33,360 |

|

|

|

12,387 |

|

|

|

— |

|

|

Foreign currency exchange differences with respect to amount due to

a Former Parent Company |

|

|

— |

|

|

|

(243,948 |

) |

|

|

(402,365 |

) |

|

Finance expenses |

|

|

583 |

|

|

|

4,021 |

|

|

|

342 |

|

| Changes in operating assets

and liabilities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Trade receivables, net |

|

|

161,689 |

|

|

|

(176,863 |

) |

|

|

28,595 |

|

|

Other current assets |

|

|

(472,020 |

) |

|

|

(96,782 |

) |

|

|

21,667 |

|

|

Deferred prospective initial public offering cost |

|

|

— |

|

|

|

(252,041 |

) |

|

|

— |

|

|

Inventories |

|

|

6,995 |

|

|

|

34,205 |

|

|

|

6,738 |

|

|

Operating lease right-of-use asset |

|

|

48,766 |

|

|

|

(48,633 |

) |

|

|

49,020 |

|

|

Trade payables |

|

|

9,422 |

|

|

|

10,145 |

|

|

|

(35,764 |

) |

|

Operating lease liabilities |

|

|

(45,911 |

) |

|

|

(48,975 |

) |

|

|

50,836 |

|

|

Other accounts payable |

|

|

(83,785 |

) |

|

|

404,597 |

|

|

|

(107,213 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Net cash used in operating activities |

|

|

(2,938,300 |

) |

|

|

(1,971,635 |

) |

|

|

(985,898 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| CASH FLOWS FROM

INVESTING ACTIVITIES: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Purchase of property and equipment |

|

|

(25,757 |

) |

|

|

(9,725 |

) |

|

|

(5,572 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Net cash used in investing activities |

|

|

(25,757 |

) |

|

|

(9,725 |

) |

|

|

(5,572 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| CASH FLOWS FROM

FINANCING ACTIVITIES: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Cost associated with the conversion of the Former Parent Company’s

debt |

|

|

— |

|

|

|

(84,780 |

) |

|

|

— |

|

|

Proceeds from issuance of convertible notes |

|

|

— |

|

|

|

1,514,928 |

|

|

|

— |

|

|

Issuance of ordinary shares in initial public offering, net of

issuance costs |

|

|

6,695,957 |

|

|

|

— |

|

|

|

— |

|

|

Issuance of ordinary shares, pre-funded warrants and warrants in

private placement, net of issuance costs |

|

|

4,106,699 |

|

|

|

— |

|

|

|

— |

|

|

Receipt of loan from related party |

|

|

245,000 |

|

|

|

500,000 |

|

|

|

— |

|

|

Repayment of loan from related party |

|

|

(745,000 |

) |

|

|

— |

|

|

|

— |

|

|

Receipt of loans from the Former Parent Company |

|

|

— |

|

|

|

107,994 |

|

|

|

940,624 |

|

|

Repayment of bank loan |

|

|

— |

|

|

|

— |

|

|

|

(30,068 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Net cash provided by financing activities |

|

|

10,302,656 |

|

|

|

2,038,142 |

|

|

|

910,556 |

|

ParaZero Technologies (NASDAQ:PRZO)

Historical Stock Chart

From Mar 2024 to Apr 2024

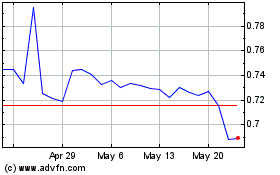

ParaZero Technologies (NASDAQ:PRZO)

Historical Stock Chart

From Apr 2023 to Apr 2024