Current Report Filing (8-k)

December 19 2019 - 4:31PM

Edgar (US Regulatory)

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT PURSUANT

TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported):

November 26, 2019

Predictive Oncology Inc.

(Exact name of registrant as specified in

charter)

|

Delaware

|

|

001-36790

|

|

83-4360734

|

|

(State or other jurisdiction

|

|

(Commission

|

|

(IRS Employer

|

|

of incorporation)

|

|

File Number)

|

|

Identification No.)

|

2915 Commers Drive, Suite 900

Eagan, Minnesota 55121

(Address of principal executive offices)

(651) 389-4800

(Registrant’s telephone number, including

area code)

Not Applicable

(Former name or former address, if changed

from last report)

Check the appropriate box below if the Form 8-K filing

is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see

General Instruction A.2. below):

☐ Written communications pursuant to

Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to

Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant

to Rule 14-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant

to Rule 13e-4(c) under the Exchange Act (17 CFR 240. 13e-4(c))

Indicate by check mark whether the registrant is an emerging

growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities

Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the

registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards

provided pursuant to Section 13(a) of the Exchange Act. ☐

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Common stock, $0.01 par value

|

POAI

|

Nasdaq Capital Market

|

|

|

Item 1.01

|

Entry into a Material Definitive Agreement

|

On November 26, 2019, Oasis Capital, LLC (“Oasis Capital”)

advanced $125,000 to the Company and received a promissory note in the principal amount of $136,579 including original discount

and expenses. The maturity date of the note is six months after the date of issuance. Interest at a rate of 8% is payable at maturity.

Repayment of such note is subject to a premium, such that the payment shall be 105% of the payment amount during the 30 calendar

day period after the issuance date of the note; 110% during the 31st through 60th calendar day period after the issuance date;

and 125% following the 60th calendar day period after the date of issuance, including payment on and after the maturity date. If

the Company completes any sale of securities after the issuance of the note, including but not limited to “putting”

shares of common stock to any investor in any “equity line” transactions, the proceeds of each such sale shall first

and solely be applied to the repayment of the note. On December 10, 2019, Oasis Capital advanced an additional $135,000 to the

Company and received an additional promissory note in the principal amount of $147,106 , including original discount and expenses.

The terms and conditions of this promissory note are the same as for the November 26, 2019 note. The Company also expects to receive

an additional advance of $180,000 from Oasis Capital on or about the date hereof and to issue another promissory note to Oasis

Capital in the amount of $194,475.

The parties expect that these loans from Oasis Capital serve as

advances for amounts to be paid by Oasis Capital for the purchases of Company common stock under the Company’s equity line

arrangement with Oasis Capital. This arrangement pursuant to the Equity Purchase Agreement dated October 24, 2019 is described

in the Form 8-K report filed by the Company on October 25, 2019. As Oasis Capital purchases shares under the equity line on an

ongoing basis, the proceeds of the purchases are applied to the repayment of these promissory notes. As of December 18, 2019, such

repayments have reduced the balance payable of the November 26, 2019 promissory note to $26,866.

The foregoing description of the promissory

notes issued to Oasis is qualified in its entirety by reference to the form of promissory note, which is filed as Exhibit 10.1

to this Current Report and is incorporated herein by reference.

|

|

Item 9.01

|

Financial Statements and Exhibits.

|

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned

hereunto duly authorized.

Date: December 19, 2019

|

|

PREDICTIVE ONCOLOGY INC.

|

|

|

|

|

|

|

|

By:

|

/s/ Bob Myers

|

|

|

|

|

Bob Myers

|

|

|

|

|

Chief Financial Officer

|

Exhibit

Index

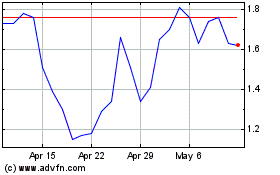

Predictive Oncology (NASDAQ:POAI)

Historical Stock Chart

From Mar 2024 to Apr 2024

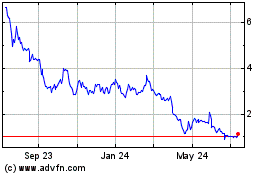

Predictive Oncology (NASDAQ:POAI)

Historical Stock Chart

From Apr 2023 to Apr 2024