0001412665false00014126652024-02-022024-02-02

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

Current Report

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported) February 2, 2024

MidWestOne Financial Group, Inc.

(Exact name of registrant as specified in its charter)

Commission file number 001-35968

| | | | | | | | |

| Iowa | | 42-1206172 |

(State or other jurisdiction of incorporation) | | (I.R.S. Employer Identification Number) |

102 South Clinton Street

Iowa City, Iowa 52240

(Address of principal executive offices, including zip code)

(319) 356-5800

(Registrant’s telephone number, including area code)

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2 below):

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| | | | | | | | | | | | | | |

| Securities registered pursuant to Section 12(b) of the Act: |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common stock, $1.00 par value | | MOFG | | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 7.01. Regulation FD Disclosure.

On February 2, 2024, MidWestOne Financial Group, Inc. issued a press release announcing the completion of its acquisition of Denver Bankshares, Inc., parent company of the Bank of Denver, a copy of which is attached hereto as Exhibit 99.1 and incorporated herein by reference.

The information in this Item 7.01 and the attached press release shall not be deemed "filed" for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, (the "Exchange Act") or otherwise subject to the liabilities under that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

| | | | | | | | | | | |

| | Press Release, dated February 2, 2024 |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | | | | | | | | | | |

| | MIDWESTONE FINANCIAL GROUP, INC. | | |

| | | | | | |

| Dated: | February 2, 2024 | By: | | /s/ BARRY S. RAY | | |

| | | | Barry S. Ray | | |

| | | | Chief Financial Officer | |

| | | | | | |

MidWestOne Financial Group, Inc. Completes

Acquisition of Denver Bankshares, Inc.

IOWA CITY, IOWA – FEBRUARY 2, 2024 – MidWestOne Financial Group, Inc. (Nasdaq: MOFG) (“MidWestOne” or the “Company”), parent company of MidWestOne Bank (the “Bank”), today announced the completion of its acquisition of Denver Bankshares, Inc. (“DNVB”), parent company of the Bank of Denver, effective January 31, 2024. Immediately following completion of the acquisition, the Bank of Denver was merged with and into the Bank.

Under the terms of the merger agreement, DNVB shareholders received $462.42 in cash in exchange for each share of DNVB stock. The value of the total deal consideration was $32.6 million.

With the addition of DNVB, on a pro forma basis, MidWestOne would have total assets of approximately $6.7 billion, total loans held for investment of $4.3 billion, and total deposits of $5.6 billion as of December 31, 2023 (unaudited and excluding acquisition accounting adjustments).

MidWestOne received financial advisory services from Piper Sandler & Co., and Barack Ferrazzano Kirschbaum & Nagelberg LLP served as legal counsel. DNVB received financial advisory services from Olsen Palmer LLC, and Spierer, Woodward, Corbalis & Goldberg served as legal counsel.

About MidWestOne Financial Group, Inc.

MidWestOne Financial Group, Inc. is a financial holding company headquartered in Iowa City, Iowa. MidWestOne is the parent company of MidWestOne Bank, which operates banking offices in Iowa, Minnesota, Wisconsin, Florida, and Colorado. MidWestOne provides electronic delivery of financial services through its website, MidWestOne.bank. MidWestOne Financial Group, Inc. trades on the Nasdaq Global Select Market under the symbol “MOFG”.

Cautionary Note Regarding Forward Looking Statements

Certain statements contained in this presentation that are not statements of historical fact constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 that are subject to risks and uncertainties and are made pursuant to the safe harbor provisions of Section 27A of the Securities Act and Section 21E of the Exchange Act. These forward-looking statements may include information about MidWestOne’s possible or assumed future economic performance or future results of operations, including MidWestOne’s future revenues, income, expenses, provision for loan losses, provision for taxes, effective tax rate, earnings per share and cash flows, and MidWestOne’s future capital expenditures and dividends, future financial condition and changes therein, including changes in MidWestOne’s loan portfolio and allowance for loan losses, future capital structure or changes therein, as well as the plans and objectives of management for MidWestOne’s future operations, future or proposed acquisitions, the future or expected effect of acquisitions on MidWestOne’s operations, results of operations, financial condition, and future economic performance, statements about the benefits of the merger, and the statements of the assumptions underlying any such statement. Such statements are typically, but not exclusively, identified by the use in the statements of words or phrases such as “aim”, “anticipate”, “estimate”, “expect”, “goal”, “guidance”, “intend”, “is anticipated”, “is expected”, “is intended”, “objective”, “plan”, “projected”, “projection”, “will affect”, “will be”, “will continue”, “will decrease”, “will grow”, “will impact”, “will increase”, “will incur”, “will reduce”, “will remain”, “will result”, “would be”, variations of such words or phrases (including where the word “could”, “may”, or “would” is used rather than the word “will” in a phrase) and similar words and phrases indicating that the statement addresses some future result, occurrence, plan or objective. The forward-looking statements that MidWestOne makes are based on our current expectations and assumptions regarding MidWestOne’s business, the economy, and other future conditions. Because forward-looking statements relate to future results and occurrences, they are subject to inherent uncertainties, risks, and changes in circumstances that

are difficult to predict. Many possible events or factors could affect MidWestOne’s future financial results and performance and could cause those results or performance to differ materially from those expressed in the forward-looking statements. Such risks and uncertainties include, among others: the outcome of any legal proceedings that may be instituted against MidWestOne, the possibility that the anticipated benefits of the merger are not realized when expected or at all, including as a result of the impact of, or problems arising from, the integration of the two companies or as a result of the strength of the economy and competitive factors in the areas where MidWestOne does business, the possibility that the merger may be more expensive to complete than anticipated, including as a result of unexpected factors or events, diversion of management’s attention from ongoing business operations and opportunities, potential adverse reactions or changes to business or employee relationships, including those resulting from the completion of the merger and MidWestOne’s ability to complete the integration of DNVB successfully. MidWestOne disclaims any obligation to update such factors or to publicly announce the results of any revisions to any of the forward-looking statements included herein to reflect future events or developments. Further information on MidWestOne, and factors which could affect the forward-looking statements contained herein can be found in MidWestOne’s Annual Report on Form 10-K for the fiscal year ended December 31, 2022, its Quarterly Report on Form 10-Q for the three-month and nine-month period ended September 30, 2023 and its other filings with the SEC.

| | | | | | | | | | | | | | |

| Contact: | | | | |

| Charles N. Reeves | | Barry S. Ray | | |

| Chief Executive Officer | | Chief Financial Officer | | |

| 319.356.5800 | | 319.356.5800 | | |

v3.24.0.1

Cover Page

|

Feb. 02, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Feb. 02, 2024

|

| Entity Registrant Name |

MidWestOne Financial Group, Inc.

|

| Entity File Number |

001-35968

|

| Entity Incorporation, State or Country Code |

IA

|

| Entity Tax Identification Number |

42-1206172

|

| Entity Address, Address Line One |

102 South Clinton Street

|

| Entity Address, City or Town |

Iowa City

|

| Entity Address, State or Province |

IA

|

| Entity Address, Postal Zip Code |

52240

|

| City Area Code |

319

|

| Local Phone Number |

356-5800

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common stock, $1.00 par value

|

| Trading Symbol |

MOFG

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity Central Index Key |

0001412665

|

| Document Information [Line Items] |

|

| Document Period End Date |

Feb. 02, 2024

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

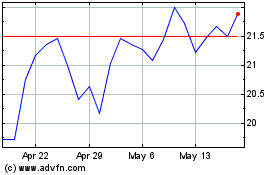

MidWestOne Financial (NASDAQ:MOFG)

Historical Stock Chart

From Apr 2024 to May 2024

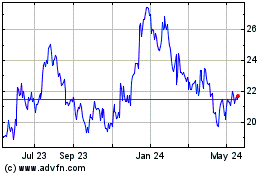

MidWestOne Financial (NASDAQ:MOFG)

Historical Stock Chart

From May 2023 to May 2024