UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13D/A

Under the Securities Exchange Act of 1934

(Amendment No. 6)*

Melco Resorts

& Entertainment Limited

(Name of Issuer)

Ordinary Shares, par value US$0.01 per share

(Title of Class of Securities)

G5974W103

(CUSIP Number)

Melco Leisure and Entertainment Group Limited

38th Floor, The Centrium

60 Wyndham Street

Central Hong Kong

(852)

3151 3777

(Name, Address and Telephone Number of Person Authorized to Receive Notices and Communications)

August 18, 2022

(Date of

Event which Requires Filing of this Statement)

If the filing person has

previously filed a statement on Schedule 13G to report the acquisition which is the subject of this Schedule 13D, and is filing this schedule because of Sections 240.13d-1(e), 240.13d-1(f) or 240.13d-1(g), check the following box. ☐

NOTE: Schedules filed in paper format shall include a signed original and five copies of the schedule, including all exhibits. See Section 240.13d-7 for other

parties to whom copies are to be sent.

| * |

The remainder of this cover page shall be filled out for a reporting person’s initial filing on this form

with respect to the subject class of securities, and for any subsequent amendment containing information which would alter disclosures provided in a prior cover page. The information required on the remainder of this cover page shall not be deemed

to be “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934 (“Act”) or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however, see

the Notes). |

CUSIP No. G5974W 10 3

|

|

|

|

|

|

|

| 1 |

|

NAMES OF REPORTING PERSONS I.R.S.

IDENTIFICATION NO. OF ABOVE PERSONS (ENTITIES ONLY): Melco

International Development Limited |

| 2 |

|

CHECK THE APPROPRIATE BOX

IF A MEMBER OF A GROUP (SEE INSTRUCTIONS) (a) ☒ (b) ☐

|

| 3 |

|

SEC USE ONLY

|

| 4 |

|

SOURCE OF FUNDS (SEE

INSTRUCTIONS) BK, AF |

| 5 |

|

CHECK IF DISCLOSURE OF

LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) OR 2(e)

☐ |

| 6 |

|

CITIZENSHIP OR PLACE OF

ORGANIZATION Hong

Kong |

|

|

|

|

|

|

|

| NUMBER OF SHARES

BENEFICIALLY OWNED BY

EACH REPORTING PERSON WITH |

|

7 |

|

SOLE VOTING POWER

727,733,982 shares (Melco Leisure and Entertainment Group Limited

and Mr. Ho, Lawrence Yau Lung may also be deemed to have sole voting power with respect to these shares) |

| |

8 |

|

SHARED VOTING POWER

727,733,982 shares |

| |

9 |

|

SOLE DISPOSITIVE POWER

727,733,982 shares (Melco Leisure and Entertainment Group Limited

and Mr. Ho, Lawrence Yau Lung may also be deemed to have sole dispositive power with respect to these shares) |

| |

10 |

|

SHARED DISPOSITIVE POWER

727,733,982 |

|

|

|

|

|

|

|

| 11 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

727,733,982 |

| 12 |

|

CHECK BOX IF THE AGGREGATE

AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (SEE INSTRUCTIONS)

☐ |

| 13 |

|

PERCENT OF CLASS

REPRESENTED BY AMOUNT IN ROW (11) 54.2%(1) |

| 14 |

|

TYPE OF REPORTING PERSON

(SEE INSTRUCTIONS) HC, CO |

| (1) |

The percentage indicated in this Row 13 is calculated based upon the number of Ordinary Shares outstanding as

of March 25, 2022, which reflects the number reported in the Annual Report on Form 20-F filed by the Issuer with the Securities and Exchange Commission on March 31, 2022 (“Form 20-F”), as adjusted to reflect the Issuer’s repurchase of (i) an aggregate of 29,446,827 Ordinary Shares in the form of American Depositary Shares (the “Previously Repurchased Shares”), as

announced by the Issuer in its Form 20-F, Current Report on Form 6-K filed on May 6, 2022 and Current Report on Form 6-K filed on

August 18, 2022, and (ii) 9,995,799 Ordinary Shares and 75,000,000 Ordinary Shares in the form of American Depositary Shares (the “Newly Repurchased Shares”) pursuant to the Share Repurchase Agreement as described in Item 6 hereof

(calculated assuming that the Previously Repurchased Shares and the Newly Repurchased Shares have been cancelled). |

CUSIP No. G5974W 10 3

|

|

|

|

|

|

|

| 1 |

|

NAMES OF REPORTING PERSONS I.R.S.

IDENTIFICATION NO. OF ABOVE PERSONS (ENTITIES ONLY): Melco Leisure and

Entertainment Group Limited |

| 2 |

|

CHECK THE APPROPRIATE BOX

IF A MEMBER OF A GROUP (SEE INSTRUCTIONS) (a) ☒ (b) ☐

|

| 3 |

|

SEC USE ONLY

|

| 4 |

|

SOURCE OF FUNDS (SEE

INSTRUCTIONS) BK, AF |

| 5 |

|

CHECK IF DISCLOSURE OF

LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) OR 2(e)

☐ |

| 6 |

|

CITIZENSHIP OR PLACE OF

ORGANIZATION British Virgin

Islands |

|

|

|

|

|

|

|

| NUMBER OF SHARES

BENEFICIALLY OWNED BY

EACH REPORTING PERSON WITH |

|

7 |

|

SOLE VOTING POWER

727,733,982 shares (Melco International Development Limited and Mr.

Ho, Lawrence Yau Lung may also be deemed to have sole voting power with respect to these shares) |

| |

8 |

|

SHARED VOTING POWER

727,733,982 shares |

| |

9 |

|

SOLE DISPOSITIVE POWER

727,733,982 shares (Melco International Development Limited and Mr.

Ho, Lawrence Yau Lung may also be deemed to have sole dispositive power with respect to these shares) |

| |

10 |

|

SHARED DISPOSITIVE POWER

727,733,982 |

|

|

|

|

|

|

|

| 11 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

727,733,982 |

| 12 |

|

CHECK BOX IF THE AGGREGATE

AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (SEE INSTRUCTIONS)

☐ |

| 13 |

|

PERCENT OF CLASS

REPRESENTED BY AMOUNT IN ROW (11) 54.2%(1) |

| 14 |

|

TYPE OF REPORTING PERSON

(SEE INSTRUCTIONS) CO |

| (1) |

The percentage indicated in this Row 13 is calculated based upon the number of Ordinary Shares outstanding as

of March 25, 2022, which reflects the number reported in the Annual Report on Form 20-F, as adjusted to reflect the Issuer’s repurchase of (i) the Previously Repurchased Shares, as announced by the Issuer in its Form 20-F, Current Report on Form 6-K filed on May 6, 2022 and Current Report on Form 6-K filed on August 18, 2022, and (ii) the

Newly Repurchased Shares pursuant to the Share Repurchase Agreement as described in Item 6 hereof (calculated assuming that the Previously Repurchased Shares and the Newly Repurchased Shares have been cancelled). |

CUSIP No. G5974W 10 3

|

|

|

|

|

|

|

| 1 |

|

NAMES OF REPORTING PERSONS I.R.S.

IDENTIFICATION NO. OF ABOVE PERSONS (ENTITIES ONLY): Ho, Lawrence Yau

Lung |

| 2 |

|

CHECK THE APPROPRIATE BOX

IF A MEMBER OF A GROUP (SEE INSTRUCTIONS) (a) ☒ (b) ☐

|

| 3 |

|

SEC USE ONLY

|

| 4 |

|

SOURCE OF FUNDS (SEE

INSTRUCTIONS) BK, AF |

| 5 |

|

CHECK IF DISCLOSURE OF

LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) OR 2(e)

☐ |

| 6 |

|

CITIZENSHIP OR PLACE OF

ORGANIZATION

Canada |

|

|

|

|

|

|

|

| NUMBER OF SHARES

BENEFICIALLY OWNED BY

EACH REPORTING PERSON WITH |

|

7 |

|

SOLE VOTING POWER

735,408,066 shares (Out of these shares, Melco International

Development Limited and Melco Leisure and Entertainment Group Limited may also be deemed to have sole voting power with respect to 727,733,982 shares) |

| |

8 |

|

SHARED VOTING POWER

727,733,982 shares (including shares disclaimed; see Item 5

below) |

| |

9 |

|

SOLE DISPOSITIVE POWER

735,408,066 shares (Out of these shares, Melco International

Development Limited and Melco Leisure and Entertainment Group Limited may also be deemed to have sole dispositive power with respect to 727,733,982 shares) |

| |

10 |

|

SHARED DISPOSITIVE POWER

727,733,982 shares (including shares disclaimed; see Item 5

below) |

|

|

|

|

|

|

|

| 11 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

735,408,066 shares (Out of these shares, Melco International Development Limited and Melco Leisure and Entertainment Group Limited may also

be deemed to beneficially own 727,733,982 shares) |

| 12 |

|

CHECK BOX IF THE AGGREGATE

AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (SEE INSTRUCTIONS)

☐ |

| 13 |

|

PERCENT OF CLASS

REPRESENTED BY AMOUNT IN ROW (11) 54.8%(1) |

| 14 |

|

TYPE OF REPORTING PERSON

(SEE INSTRUCTIONS) IN |

| (1) |

The percentage indicated in this Row 13 is calculated based upon the number of Ordinary Shares outstanding as

of March 25, 2022, which reflects the number reported in the Annual Report on Form 20-F, as adjusted to reflect the Issuer’s repurchase of (i) the Previously Repurchased Shares, as announced by the Issuer in its Form 20-F, Current Report on Form 6-K filed on May 6, 2022 and Current Report on Form 6-K filed on August 18, 2022, and (ii) the

Newly Repurchased Shares pursuant to the Share Repurchase Agreement as described in Item 6 hereof (calculated assuming that the Previously Repurchased Shares and the Newly Repurchased Shares have been cancelled). |

This Amendment No. 6 (this “Amendment”) amends and supplements the Schedule 13D filed on

February 6, 2017, as amended by Amendment No. 1 filed on May 17, 2017, Amendment No. 2 filed on November 19, 2018, Amendment No. 3 filed on February 19, 2019, Amendment No. 4 filed on July 15, 2019 and Amendment No 5.

filed on May 13, 2022, with respect to the Issuer by the Reporting Persons (the “Original Filing”). Information reported in the Original Filing remains in effect except to the extent that it is amended, restated or superseded by

information contained in this Amendment. Capitalized terms used but not defined in this Amendment have the respective meanings set forth in the Original Filing.

Percentages of the Ordinary Shares outstanding reported in this Amendment are calculated based upon the number of Ordinary Shares outstanding as of March 25,

2022, which reflects the number reported in the Annual Report on Form 20-F filed by the Issuer with the Securities and Exchange Commission on March 31, 2022 (“Form

20-F”), as adjusted to reflect the Issuer’s repurchase of (i) 29,446,827 Ordinary Shares in the form of American Depositary Shares (the “Previously Repurchased Shares”), as announced by the

Issuer in its Form 20-F, Current Report on Form 6-K filed on May 6, 2022 and Current Report on Form 6-K filed on August 18,

2022 and (ii) 9,995,799 Ordinary Shares and 75,000,000 Ordinary Shares in the form of American Depositary Shares pursuant to the Share Repurchase Agreement as described in Item 6 hereof (the “Newly Repurchased Shares”) (calculated assuming

that the Previously Repurchased Shares and the Newly Repurchased Shares were cancelled).

| Item 1. |

Security and Issuer |

Item 1 is hereby amended by replacing it in its entirety with the following:

This Schedule 13D relates to the ordinary shares (the “Ordinary Shares”) of Melco Resorts & Entertainment Limited, a Cayman Islands exempted

company (the “Issuer”). The address of the Issuer’s principal executive offices is 38th Floor, The Centrium, 60 Wyndham Street, Central, Hong Kong.

| Item 2. |

Identity and Background |

Items 2(a) and 2(c) are hereby amended by replacing them in their entirety with the following:

| (a) |

This Schedule 13D is being filed on behalf of each of the following persons (collectively, the “Reporting

Persons”): Melco International Development Limited, a Hong Kong-listed company (“Melco International”), its wholly-owned subsidiary Melco Leisure and Entertainment Group Limited, a company incorporated under the laws of the British

Virgin Islands (“Melco Leisure”), and Mr. Ho, Lawrence Yau Lung, a citizen of Canada (“Mr. Ho”). |

As of the date of this Amendment, 122,243,024 ordinary shares of Melco International are held by Lasting Legend Ltd., 301,368,606 ordinary

shares of Melco International are held by Better Joy Overseas Ltd., 53,491,345 ordinary shares of Melco International are held by Mighty Dragon Developments Limited, 91,445,132 ordinary shares of Melco International are held by Black Spade Capital

Limited, and 1,566,000 ordinary shares of Melco International are held by Maple Peak Investments Inc., representing approximately 8.1%, 19.9%, 3.5%, 6.0% and 0.1%, respectively, of Melco International’s shares. All of such companies are

controlled corporations of Mr. Ho and are owned by persons and/or trusts associated with Mr. Ho. In addition, 4,212,102 ordinary shares of Melco International are held by Mr. Ho’s spouse, representing approximately 0.3% of Melco

International’s shares.

Mr. Ho also has an interest in L3G Holdings Inc., a company controlled by a discretionary family trust,

the beneficiaries of which include Mr. Ho and his immediate family members, that holds 312,666,187 ordinary shares of Melco International, representing approximately 20.6% of Melco International’s shares.

Consequently, Mr. Ho may be deemed to beneficially own an aggregate of 886,992,396 ordinary shares of Melco International, representing

approximately 58.5% of Melco International’s ordinary shares outstanding.

| (c) |

The principal business of Melco International and Melco Leisure, through their subsidiaries, is engaging in

leisure, gaming and entertainment, and other investments. |

| Item 4. |

Purpose of the Transaction |

Item 4 of the Original Filing is hereby amended and supplemented by adding the following information:

Item 6 summarizes certain provisions of the Share Repurchase Agreement and is incorporated herein by reference. A copy of the Share Repurchase Agreement is

attached as an exhibit to this Schedule 13D, and incorporated herein by reference.

| Item 5. |

Interest in Securities of the Issuer |

Item 5 is hereby amended by replacing it in its entirety with the following:

| (a) |

As of the date of this Amendment, the Reporting Persons may be deemed to each beneficially own an aggregate of

727,733,982 Ordinary Shares, which are held by Melco Leisure (the “Shares”). The Shares represent approximately 54.2% of the Issuer’s outstanding Ordinary Shares. In addition, Mr. Ho personally holds 312,012 Ordinary Shares and

holds 7,362,072 Ordinary Shares through the companies controlled by him, representing a further approximately 0.02% and 0.6% of the Issuer’s Ordinary Shares outstanding. All of such companies are controlled corporations of Mr. Ho and are owned

by a trust associated with Mr. Ho. |

| (b) |

The Reporting Persons have shared voting and dispositive power over 727,733,982 of the Shares, and Mr. Ho

has sole voting and dispositive power over 7,674,084 of the Shares. |

| (c) |

Except for the repurchase of 9,995,799 Ordinary Shares and 75,000,000 Ordinary Shares in the form of American

Depositary Shares pursuant to the Share Repurchase Agreement as described in Item 6 hereof, the Reporting Persons have not effected any transaction in the Ordinary Shares during the past 60 days. |

| Item 6. |

Contracts, Arrangements, Understandings or Relationships with Respect to Securities of the Issuer

|

On August 18, 2022, Melco International, Melco Leisure and the Issuer entered into a share repurchase agreement (“Share

Repurchase Agreement”) pursuant to which Melco Leisure agreed to sell and the Issuer agreed to repurchase 9,995,799 Ordinary Shares and 75,000,000 Ordinary Shares in the form of American Depositary Shares in the Issuer for an aggregate

repurchase price of US$152,709,118.87 (“Repurchase Transaction”). The Share Repurchase Agreement contains a number of customary closing conditions, and the Repurchase Transaction is expected to close on August 25, 2022.

The description of the Share Repurchase Agreement in this Item 6 is qualified in its entirety by reference to the complete text of the Share Repurchase

Agreement, which has been filed as Exhibit 99.9 and which is incorporated herein by reference in its entirety.

| Item 7. |

Material to be Filed as Exhibits |

|

|

|

| Exhibit

Number |

|

Description of Exhibit |

|

|

| 99.1 |

|

Share Repurchase Agreement dated as of August 18, 2022 between Melco Resorts & Entertainment Limited, Melco Leisure and Entertainment Group Limited and Melco International Development Limited |

SIGNATURE

After reasonable inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true, complete and correct.

Date: August 18, 2022

|

|

|

| For and on Behalf of

MELCO INTERNATIONAL DEVELOPMENT LIMITED |

| By: |

|

/s/ Ho, Lawrence Yau Lung |

| Name: |

|

Ho, Lawrence Yau Lung |

| Title: |

|

Director |

|

| For and on Behalf of

MELCO LEISURE AND ENTERTAINMENT GROUP LIMITED |

| By: |

|

/s/ Ho, Lawrence Yau Lung |

|

|

Ho, Lawrence Yau Lung |

| Title: |

|

Director |

|

| HO, LAWRENCE YAU LUNG |

| By: |

|

/s/ Ho, Lawrence Yau Lung |

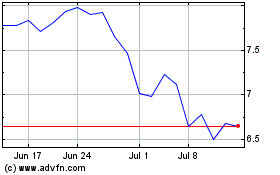

Melco Resorts and Entert... (NASDAQ:MLCO)

Historical Stock Chart

From Mar 2024 to Apr 2024

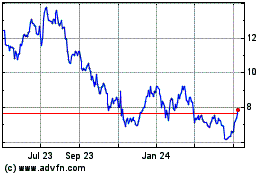

Melco Resorts and Entert... (NASDAQ:MLCO)

Historical Stock Chart

From Apr 2023 to Apr 2024