Current Report Filing (8-k)

April 14 2020 - 8:59AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of Report: April 13, 2020

(Date of earliest event reported)

ImmuCell Corporation

(Exact name of registrant as specified in its charter)

|

DE

|

|

001-12934

|

|

01-0382980

|

|

(State or other jurisdiction

|

|

(Commission File Number)

|

|

(IRS Employer

|

|

of incorporation)

|

|

|

|

Identification Number)

|

|

56 Evergreen Drive

|

|

|

|

Portland, Maine

|

|

04103

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

207-878-2770

(Registrant’s telephone number, including

area code)

Not Applicable

(Former Name or Former Address, if changed

since last report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligations of the registrant under any of the following provisions:

|

|

☐

|

Written communications pursuant to Rule 425 under the Securities

Act (17 CFR 230.425)

|

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange

Act (17 CFR 240.14a-12)

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b)

under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c)

under the Exchange Act (17 CFR 240.13e-4(c))

|

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2

of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by

check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial

accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Securities registered pursuant to Section

12(b) of the Act:

|

Title of each class

|

|

Trading Symbol(s)

|

|

Name of each exchange on which registered

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Item 1.01 - Entry into a Material Definitive Agreement

Item 2.03 - Creation of a Direct Financial Obligation or

an Obligation under an Off-Balance Sheet Arrangement of a Registrant

On April 13, 2020, the Company received $937,700 in funding

from the Paycheck Protection Program under the Keeping American Workers Paid and Employed Act that was approved by Congress on

March 25, 2020.

This funding accrues interest at a rate of 1% per annum, and

the Company’s obligation to repay the principal amount of the funding will be forgiven provided that the Company uses the

funding proceeds only for eligible payroll costs, eligible utility expenses, eligible rent payments and interest on mortgage debt

borrowed prior to February 15, 2020, in each case incurred and paid during the eight-week period from April 13, 2020 through June

8, 2020 (which period may be extended at some future date). At least 75% of such forgiven amounts must be used for eligible payroll

costs. If any portion of this funding were not to be applied to eligible expenses during the applicable eight-week period, the

Company expects to repay such excess amount without any prepayment penalty by approximately October 13, 2020. By current estimated

calculations, this repayment obligation may be approximately $150,000, due to projected payroll costs during the applicable eight-week

period potentially being less than the 2019 levels used to determine the amount of available funding and the possible exclusion

of interest expense on the Company’s mortgage debt because it was refinanced after February 15, 2020. The forgiveness also

may be reduced proportionately to the extent that the Company were to reduce payroll during the applicable eight-week period below

allowable limits or below full-time equivalent employment levels as compared to prior historical levels. The Company has no

intent to make any such reductions and therefore does not expect to repay principal for this reason. Such forgiveness of indebtedness,

in accordance with the CARES Act, does not give rise to taxable income to recipients like the Company.

The Promissory Note executed in connection with this credit

facility is attached as Exhibit 99.2 to this Current Report on Form 8-K.

The information shall not be deemed “filed” for

purposes of Section 18 of the Securities Exchange Act of 1934 (the “Exchange Act”) or otherwise subject to liabilities

of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933 or the Exchange

Act, except as expressly set forth by specific reference in such filing.

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

IMMUCELL CORPORATION

|

|

|

|

|

Date: April 14, 2020

|

By:

|

/s/ Michael F. Brigham

|

|

|

|

Michael F. Brigham

|

|

|

|

President, Chief Executive Officer

and Principal Financial Officer

|

Exhibit Index

3

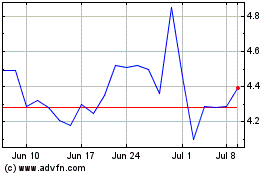

ImmuCell (NASDAQ:ICCC)

Historical Stock Chart

From Mar 2024 to Apr 2024

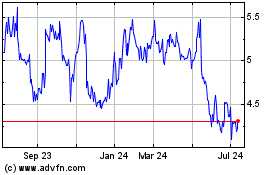

ImmuCell (NASDAQ:ICCC)

Historical Stock Chart

From Apr 2023 to Apr 2024