Initial Statement of Beneficial Ownership (3)

October 25 2019 - 5:44PM

Edgar (US Regulatory)

FORM 3

|

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

INITIAL STATEMENT OF BENEFICIAL OWNERSHIP OF SECURITIES

|

OMB APPROVAL

OMB Number:

3235-0104

Estimated average burden

hours per response...

0.5

|

|

Filed pursuant to Section 16(a) of the Securities Exchange Act of 1934 or Section 30(h) of the Investment Company Act of 1940

|

|

|

1. Name and Address of Reporting Person

*

Madsen Michael R |

2. Date of Event Requiring Statement (MM/DD/YYYY)

10/15/2019

|

3. Issuer Name and Ticker or Trading Symbol

HONEYWELL INTERNATIONAL INC [HON]

|

|

(Last)

(First)

(Middle)

300 SOUTH TRYON STREET |

4. Relationship of Reporting Person(s) to Issuer (Check all applicable)

_____ Director _____ 10% Owner

___X___ Officer (give title below) _____ Other (specify below)

President & CEO, Aerospace / |

|

(Street)

CHARLOTTE, NC 28202

(City)

(State)

(Zip)

| 5. If Amendment, Date Original Filed(MM/DD/YYYY)

| 6. Individual or Joint/Group Filing(Check Applicable Line)

_X_ Form filed by One Reporting Person

___ Form filed by More than One Reporting Person

|

Table I - Non-Derivative Securities Beneficially Owned

|

1.Title of Security

(Instr. 4) | 2. Amount of Securities Beneficially Owned

(Instr. 4) | 3. Ownership Form: Direct (D) or Indirect (I)

(Instr. 5) | 4. Nature of Indirect Beneficial Ownership

(Instr. 5) |

| Common Stock | 28281 (1) | D | |

| Common Stock | 227.396 | I | Held in 401(k) plan |

Table II - Derivative Securities Beneficially Owned (e.g., puts, calls, warrants, options, convertible securities)

|

1. Title of Derivate Security

(Instr. 4) | 2. Date Exercisable and Expiration Date

(MM/DD/YYYY) | 3. Title and Amount of Securities Underlying Derivative Security

(Instr. 4) | 4. Conversion or Exercise Price of Derivative Security | 5. Ownership Form of Derivative Security: Direct (D) or Indirect (I)

(Instr. 5) | 6. Nature of Indirect Beneficial Ownership

(Instr. 5) |

| Date Exercisable | Expiration Date | Title | Amount or Number of Shares |

| Employee Stock Options (right to buy) | (15) | 2/26/2024 | Common Stock | 16007 | $89.48 | D | |

| Employee Stock Options (right to buy) | (15) | 2/25/2025 | Common Stock | 13696 | $98.93 | D | |

| Employee Stock Options (right to buy) | (2) | 2/24/2026 | Common Stock | 23107 | $98.70 | D | |

| Employee Stock Options (right to buy) | (3) | 2/27/2027 | Common Stock | 24021 | $119.69 | D | |

| Employee Stock Options (right to buy) | (4) | 2/26/2028 | Common Stock | 24021 | $148.79 | D | |

| Employee Stock Options (right to buy) | (5) | 2/25/2029 | Common Stock | 23735 | $154.22 | D | |

| Restricted Stock Units | (6) | (6) | Common Stock | 2146 | (7) | D | |

| Restricted Stock Units | (8) | (8) | Common Stock | 3521 | (7) | D | |

| Restricted Stock Units | (9) | (9) | Common Stock | 3437 | (7) | D | |

| Restricted Stock Units | (10) | (10) | Common Stock | 3502 | (7) | D | |

| Restricted Stock Units | (11) | (11) | Common Stock | 3437 | (7) | D | |

| Restricted Stock Units | (12) | (12) | Common Stock | 3314 | (7) | D | |

| Restricted Stock Units | (13) | (13) | Common Stock | 8629 | (7) | D | |

| Supplemental Savings Plan Interests | (14) | (14) | Common Stock | 340.482 | (14) | D | |

| Explanation of Responses: |

| (1) | Includes shares held in a separate dividend reinvestment plan account of a family member over which the reporting person has power of attorney. |

| (2) | The Employee Stock Options were granted under the 2011 Stock Incentive Plan with 17,330 options fully vested and 5,777 options vesting on February 25, 2020. |

| (3) | The Employee Stock Options were granted under the 2016 Stock Incentive Plan with 12,010 options fully vested and 6,005 options vesting on February 28, 2020 and 6,006 on February 28, 2021. |

| (4) | The Employee Stock Options were granted under the 2016 Stock Incentive Plan with 6,004 options full vested and 6,006 options vesting on February 27, 2020; 6,005 options vesting on February 27, 2021 and 6,006 options vesting on February 27, 2022. |

| (5) | Employee Stock Options were granted under the 2016 Stock Incentive Plan with 5,933 options vesting on February 26, 2020; 5,933 options vesting on February 26, 2021; 5,933 options vesting on February 26, 2022 and 5,936 options vesting on February 26, 2023. |

| (6) | The Restricted Stock Units were granted under the 2011 Stock Incentive Plan with all units vesting on July 26, 2020. |

| (7) | Instrument converts to common stock on a one-for-one basis. |

| (8) | The Restricted Stock Units were granted under the 2016 Stock Incentive Plan with 1,733 units vesting on July 29, 2021 and 1,788 units vesting on July 29, 2023. |

| (9) | The Restricted Stock Units were granted under the 2016 Stock Incentive Plan with all units vesting on February 28, 2020. |

| (10) | The Restricted Stock Units were granted under the 2016 Stock Incentive Plan with 1,724 units vesting on July 27, 2021 and 1,778 units vesting on July 27, 2023. |

| (11) | The Restricted Stock Units were granted under the 2016 Stock Incentive Plan with all units vesting on February 27, 2021. |

| (12) | The Restricted Stock Units were granted under the 2016 Stock Incentive Plan with all units vesting on February 26, 2022. |

| (13) | The Restricted Stock Units were granted under the 2016 Stock Incentive Plan with 2,847 units vesting on July 25, 2021, 2,848 units vesting on July 25, 2023 and 2,934 units vesting on July 25, 2025. |

| (14) | Instrument converts to common stock on a one-for-one basis and reflects phantom shares of common stock represented by Company contributions to my account under the Executive Supplemental Savings Plan under rule 16b-3 on October 15, 2019. |

| (15) | The Employee Stock Options were granted under the 2011 Stock Incentive Plan and are fully vested. |

Reporting Owners

|

| Reporting Owner Name / Address | Relationships |

| Director | 10% Owner | Officer | Other |

Madsen Michael R

300 SOUTH TRYON STREET

CHARLOTTE, NC 28202 |

|

| President & CEO, Aerospace |

|

Signatures

|

| Su Ping Lu for Michael R. Madsen | | 10/25/2019 |

| **Signature of Reporting Person | Date |

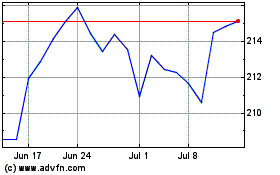

Honeywell (NASDAQ:HON)

Historical Stock Chart

From Mar 2024 to Apr 2024

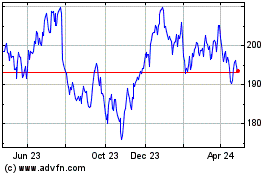

Honeywell (NASDAQ:HON)

Historical Stock Chart

From Apr 2023 to Apr 2024