As filed with the Securities and Exchange Commission

on December 5, 2023

Registration Number 33_________

UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM S-3

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

GLEN

BURNIE BANCORP

(Exact

Name of Registrant as Specified in Its Charter)

Maryland

(State or Other Jurisdiction of Incorporation or Organization) |

52-1782444

(I.R.S. Employer Identification No.) |

101 Crain Highway, S.E.

Glen Burnie, Maryland 21061

(410) 766-3300

(Address, Including Zip Code, and Telephone

Number, Including Area Code, of

Registrant’s Principal Executive Offices)

Mark C. Hanna

President

101 Crain Highway, S.E.

Glen Burnie, Maryland 21061

(410) 766-3300

(Name, Address,

Including Zip Code, and Telephone Number, Including Area Code, of Agent for Service)

Copy to:

Hillel Tendler, Esquire

Neuberger, Quinn, Gielen, Rubin & Gibber, P.A.

One South Street, 27th Floor

Baltimore, Maryland 21202

(410) 332-8552

Approximate date of commencement of proposed

sale to the public: From time to time after the effective date of this registration statement.

If the only securities being registered on this

form are being offered pursuant to dividend or interest reinvestment plans, please check the following box. þ

If any of the securities being registered on

this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act, other than securities

offered only in connection with dividend or interest reinvestment plans, check the following box. ¨

If this form is filed to register additional

securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities

Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this form is a post-effective amendment filed

pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number

of the earlier effective registration statement for the same offering. ¨

If this Form is a registration statement pursuant

to General Instruction I.D. or a post-effective amendment thereto that shall become effective upon filing with the Commission pursuant

to Rule 462(e) under the Securities Act, check the following box. ¨

If this Form is a post-effective amendment to

a registration statement filed pursuant to General Instruction I.D. filed to register additional securities or additional classes of

securities pursuant to Rule 413(b) under the Securities Act, check the following box. ¨

Indicate by check mark if the registrant is a

large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See

the definition of “large accelerated filer,” “accelerated filer”, “smaller reporting company” and

“emerging growth company” in Rule 12b-2 of the Exchange Act.

| |

Large Accelerated Filer |

¨ |

|

Smaller Reporting Company |

þ |

| |

Accelerated Filer |

¨ |

|

Emerging Growth Company |

¨ |

| |

Non-Accelerated Filer |

þ |

|

|

|

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

PROSPECTUS

Glen

Burnie Bancorp

Dividend Reinvestment and Stock Purchase Plan

150,000 SHARES OF COMMON STOCK

This Prospectus relates

to 150,000 shares of the $1.00 par value common stock (the “Common Stock”) of Glen Burnie Bancorp (the “Company”)

which may be issued to the Company’s shareholders who have elected to reinvest Company dividends under the Company’s Dividend

Reinvestment and Stock Purchase Plan (the “Plan”). The Plan was adopted in 1998.

The Plan provides holders

of the Common Stock with a simple and convenient method of investing cash dividends in additional shares of Common Stock. Shareholders

who elect to enroll in the Plan (“participants”) will, if they so desire, direct any cash dividends paid on their shares

of Common Stock toward automatic investment in additional shares of Common Stock.

The purchase price of shares

purchased from the Company will be the fair market value per share, as defined, at the purchase date less a 5% discount unless the Company’s

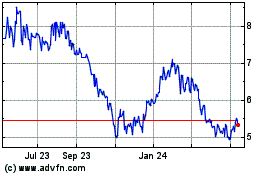

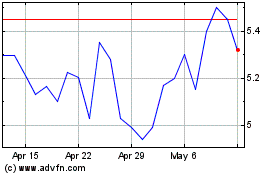

Board of Directors determines otherwise. As of December 1, 2023, the closing price of the Common Stock was $5.54 per share.

Shareholders who do not elect to participate in the Plan will receive dividends, as declared and paid, by check.

The Company is listed on

the NASDAQ Capital Market under the symbol “GLBZ.”

Reference is made to the

“Explanation of our Dividend Reinvestment and Stock Purchase Plan” section, which is considered part of this Prospectus,

for further information on the Plan.

Investing in our Common

Stock involves risk. You should carefully review the risks and uncertainties described under the heading “Risk Factors” on

page 2 of this prospectus before making any decision to invest in our securities.

These securities are not savings accounts,

deposits or other obligations of any bank and are not insured or guaranteed by the Federal Deposit Insurance Corporation or any other

governmental agency.

NEITHER THE SECURITIES AND EXCHANGE COMMISSION

NOR ANY OTHER REGULATORY BODY HAS APPROVED OR DISAPPROVED OF THESE SECURITIES OR PASSED UPON THE ACCURACY OR ADEQUACY OF THIS PROSPECTUS.

ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

The date of this Prospectus is December 5, 2023.

TABLE OF CONTENTS

ABOUT THIS PROSPECTUS

You should read this Prospectus

and the information and documents incorporated by reference carefully. Such documents contain important information you should consider

when making your investment decision. See “Information Incorporated by Reference” on page 12. You should rely only on the

information provided in this Prospectus or documents incorporated by reference in this Prospectus. We have not authorized anyone to provide

you with different information. Shares of our Common Stock are being offered only in jurisdictions in which offers and sales are permitted.

The information contained in this Prospectus is accurate only as of the date of this Prospectus, regardless of the time of delivery of

this Prospectus or of any sale of our Common Stock.

Prospectus

Summary

This summary highlights

selected information from this Prospectus and may not contain all of the information that is important to you. To understand the terms

of the securities we are offering, you should carefully read this document with any attached Prospectus supplement. You should also read

the documents to which we have referred you in “Where You Can Find More Information” on page 12 for additional information

about us and our financial statements.

The Company

Glen Burnie Bancorp

(“we” or the “Company”) is a bank holding company organized in 1990 under the laws of the State of Maryland.

The Company owns all the outstanding shares of capital stock of The Bank of Glen Burnie (the “Bank”), a commercial bank organized

in 1949 under the laws of the State of Maryland, serving northern Anne Arundel County and surrounding areas from its main office branch

in Glen Burnie, Maryland and branch offices in Odenton, Riviera Beach, Crownsville, Severn (two locations), Linthicum and Severna Park,

Maryland. The Bank also maintains a remote Automated Teller Machine (“ATM”) located in Pasadena, Maryland. The Bank maintains

a website at www.thebankofglenburnie.com. It is the oldest independent commercial bank in Anne Arundel County. The Bank is engaged in

the commercial and retail banking business as authorized by the banking statutes of the State of Maryland, including the acceptance of

demand and time deposits, and the origination of loans to individuals, associations, partnerships and corporations.

The Bank’s real estate

financing consists of residential first and second mortgage loans, home equity lines of credit and commercial mortgage loans. Commercial

lending consists of both secured and unsecured loans. The Bank also originates automobile loans through arrangements with local automobile

dealers. The Bank’s deposits are insured up to applicable limits by the Federal Deposit Insurance Corporation (“FDIC”).

We attract deposit customers from the general public and use such funds, together with other borrowed funds, to make loans. Our results

of operations are primarily determined by the difference between interest incomes earned on our interest-earning assets, primarily interest

and fee income on loans and investment securities, and interest paid on our interest-bearing liabilities, including deposits and borrowings.

The Company’s principal

executive office is located at 101 Crain Highway, S.E., Glen Burnie, Maryland 21061. Its telephone number at such office is (410) 766-3300.

The Offering and Plan

The securities offered hereby

are a maximum of 150,000 shares of the Company’s Common Stock (in addition to the 250,000 shares of Common Stock previously registered

for issuance under the Plan, for a total of 400,000 of Common Stock registered for issuance under the Plan). The purpose of the offering

is to provide holders of the Common Stock with a simple and convenient method of investing cash dividends in additional shares of Common

Stock, without incurring brokerage commissions, through the Company’s Dividend Reinvestment and Stock Purchase Plan (the “Plan”).

Detailed information concerning

the Plan is provided under “Explanation of our Dividend Reinvestment and Stock Purchase Plan,” which should be reviewed carefully.

Use of Proceeds

Shares purchased pursuant

to the Plan will be issued by the Company. The proceeds of such sales will be added to the general funds of the Company and will be available

for its general corporate purposes, including working capital requirements and contributions to the Bank to support its operations, growth

and expansion.

Risk

Factors

Purchasers of our Common

Stock should consider carefully, in addition to the other information contained in or incorporated by reference into this Prospectus

or any supplement, the risk factors set forth in this Prospectus and in our reports filed with the Securities and Exchange Commission

(SEC).

Risk

Factors

Before you decide to

invest, you should consider carefully the risks described below. Any or all of those factors, or others not mentioned, could affect our

business or our prospects. The risks and uncertainties we have described in our filings are not the only ones facing our Company. Additional

risks and uncertainties not presently known to us or that we currently deem immaterial may also affect our business operations. If

any of the risks actually occur, our business could be materially adversely affected. In such case, the trading price of our Common Stock

could decline, and you may lose all or part of your investment.

In addition, you should

carefully consider the information incorporated by reference and the information that we file with the SEC from time to time. The information

in this Prospectus is complete and accurate as of the date on the front cover of this Prospectus, but the information may change after

such date.

Risk

Factors Relating to our Business Generally

Changes in interest rates could reduce

our income, cash flows and asset values.

Our income and cash flows

and the value of our assets depend to a great extent on the difference between the interest rates we earn on interest-earning assets,

such as loans and investment securities, and the interest rates we pay on interest-bearing liabilities such as deposits and borrowings.

These rates are highly sensitive to many factors which are beyond our control, including general economic conditions and policies of

various governmental and regulatory agencies and, in particular, the Board of Governors of the Federal Reserve System. Changes in monetary

policy, including changes in interest rates, will influence not only the interest we receive on our loans and investment securities and

the amount of interest we pay on deposits and borrowings but will also affect our ability to originate loans and obtain deposits and

the value of our investment portfolio. If the rate of interest we pay on our deposits and other borrowings increases more than

the rate of interest we earn on our loans and other investments, our net interest income, and therefore our earnings, could be adversely

affected. Our earnings also could be adversely affected if the rates on our loans and other investments fall more quickly than

those on our deposits and other borrowings.

Economic conditions

either nationally or locally in areas in which our operations are concentrated may adversely affect our business.

Deterioration in local,

regional, national, or global economic conditions could cause us to experience a reduction in deposits and new loans, an increase in

the number of borrowers who default on their loans, and a reduction in the value of the collateral securing their loans, all of which

could adversely affect our performance and financial condition. Unlike larger banks that are more geographically diversified, we provide

banking and financial services locally. Therefore, we are particularly vulnerable to adverse local economic conditions.

Many of our loans

are secured, in whole or in part, with real estate collateral which is subject to declines in value.

In addition to considering

the financial strength and cash flow characteristics of a borrower, we often secure our loans with real estate collateral. Real estate

values and the real estate market are generally affected by, among other things, changes in local, regional or national economic conditions,

fluctuations in interest rates and the availability of loans to potential purchasers, changes in tax laws and other governmental statutes,

regulations and policies, and acts of nature. The real estate collateral provides an alternate source of repayment in the event

of default by the borrower. If real estate prices in our markets decline, the value of the real estate collateral securing our

loans could be reduced. If we are required to liquidate real estate collateral securing loans during a period of reduced real estate

values to satisfy the debt, our earnings and capital could be adversely affected.

The Bank is subject to credit risks relating

to its loan portfolio.

The Bank has certain lending

policies and procedures in place that are designed to maximize loan income within an acceptable level of risk. Management reviews and

approves these policies and procedures on a regular basis. A reporting system supplements the review process by providing management

with frequent reports related to loan production, loan quality, concentrations of credit, loan delinquencies, and nonperforming and potential

problem loans. Diversification in the loan portfolio is a means of managing risk associated with fluctuations and economic conditions.

The Bank maintains an independent

loan review department that reviews and validates the credit risk program on a periodic basis. Results of these reviews are presented

to management. The loan review process complements and reinforces the risk identification and assessment decisions made by lenders and

credit personnel, as well as the Bank’s policies and procedures.

In the financial services

industry, there is always a risk that certain borrowers may not repay borrowings. The Bank’s allowance for credit losses may not

be sufficient to cover the loan losses that it may actually incur. If the Bank experiences defaults by borrowers in any of its businesses,

the Bank’s earnings could be negatively affected. Changes in local economic conditions could adversely affect credit quality, particularly

in its local business loan portfolio. Changes in national economic conditions could also adversely affect the quality of its loan portfolio.

Commercial and commercial

real estate loans generally involve higher credit risks than residential real estate and consumer loans. Because payments on loans secured

by commercial real estate or equipment are often dependent upon the successful operation and management of the underlying assets, repayment

of such loans may be influenced to a great extent by conditions in the market or the economy. The Bank seeks to minimize these risks

through its underwriting standards. The Bank obtains financial information and performs credit risk analysis on its customers. Underwriting

standards are designed to promote relationship banking rather than transactional banking. Most commercial and industrial loans are secured

by the assets being financed or other business assets; however, some loans may be made on an unsecured basis. The Bank’s credit

policy sets different maximum exposure limits both by business sector and its current and historical relationship and previous experience

with each customer.

The Bank offers both fixed-rate

and adjustable-rate consumer mortgage loans secured by properties, substantially all of which are located in the Bank’s primary

market area. Adjustable-rate mortgage loans help reduce the Bank’s exposure to changes in interest rates; however, during periods

of rising interest rates, the risk of default on adjustable-rate mortgage loans may increase as a result of repricing and the increased

payments required from the borrower.

Consumer loans are primarily

all other non-real estate loans to individuals in the Bank’s regional market area. Consumer loans can entail risk, particularly

in the case of loans that are unsecured or secured by rapidly depreciating assets. In these cases, any repossessed collateral may not

provide an adequate source of repayment of the outstanding loan balance. The remaining deficiency often does not warrant further substantial

collection efforts against the borrower beyond obtaining a deficiency judgment. In addition, consumer loan collections are dependent

on the borrower’s continuing financial stability, and thus are more likely to be adversely affected by job loss, divorce, illness,

or personal bankruptcy.

Our information systems

may experience an interruption or breach in security.

We rely heavily on communications

and information systems to conduct our business. Any failure, interruption or breach in security of these systems could result

in failures or disruptions in our customer-relationship management, general ledger, deposit, loan and other systems. While we have policies

and procedures designed to prevent or limit the effect of the failure, interruption or security breach of our information systems, there

can be no assurance that any such failures, interruptions or security breaches will not occur; or, if they do occur, that they will be

adequately addressed. The occurrence of any failures, interruptions or security breaches of our information systems could damage our

reputation, result in a loss of customer business, subject us to additional regulatory scrutiny or expose us to civil litigation and

possible financial liability; any of which could have a material adverse effect on our financial condition and results of operations.

We face the risk

of cyber-attack to our computer systems.

Our computer systems, software

and networks have been and will continue to be vulnerable to unauthorized access, loss or destruction of data (including confidential

client information), account takeovers, unavailability of service, computer viruses or other malicious code, cyber-attacks and other

events. These threats may derive from human error, fraud or malice on the part of employees or third parties, or may result from accidental

technological failure. If one or more of these events occurs, it could result in the disclosure of confidential client information, damage

to our reputation with our clients and the market, additional costs to us (such as repairing systems or adding new personnel or protection

technologies), regulatory penalties and financial losses, to both us and our clients and customers. Such events could also cause interruptions

or malfunctions in our operations (such as the lack of availability of our online banking system), as well as the operations of our clients,

customers or other third parties. Although we maintain safeguards to protect against these risks, there can be no assurance that we will

not suffer losses in the future that may be material in amount.

Competition may decrease

our growth or profits.

We face substantial competition

in all phases of our operations from a variety of different competitors, including commercial banks, savings and loan associations, mutual

savings banks, credit unions, consumer finance companies, factoring companies, leasing companies, insurance companies, and money market

mutual funds. There is very strong competition among financial services providers in our principal service area. Our competitors

may have greater resources, higher lending limits, or larger branch systems than we do. Accordingly, they may be able to offer

a broader range of products and services as well as better pricing for those products and services than we can.

In addition, some of the

financial services organizations with which we compete are not subject to the same degree of regulation as is imposed on federally insured

financial institutions. As a result, those non-bank competitors may be able to access funding and provide various services more

easily or at less cost than we can, adversely affecting our ability to compete effectively.

The value of certain

investment securities is volatile and future declines or other-than-temporary impairments could materially adversely affect our future

earnings and regulatory capital.

Continued volatility in

the market value for certain of our investment securities, whether caused by changes in market perceptions of credit risk, as reflected

in the expected market yield of the security, or actual defaults in the portfolio could result in significant fluctuations in the value

of the securities. This could have a material adverse impact on our accumulated other comprehensive income/loss and shareholders’

equity depending on the direction of the fluctuations. Furthermore, future downgrades or defaults in these securities could result in

future classifications of investment securities as other than temporarily impaired. This could have a material impact on our future earnings.

We may be adversely affected by government

regulation.

The banking industry is

heavily regulated. Banking regulations are primarily intended to protect the federal deposit insurance funds and depositors, not shareholders.

Changes in the laws, regulations, and regulatory practices affecting the banking industry may increase our costs of doing business or

otherwise adversely affect us and create competitive advantages for others. Regulations affecting banks and financial services companies

undergo continuous change, and we cannot predict the ultimate effect of these changes, which could have a material adverse effect on

our profitability or financial condition.

The potential exists for

additional federal or state laws and regulations, or changes in policy, affecting many aspects of our operations, including capital levels,

lending and funding practices, and liquidity standards. New laws and regulations may increase our costs of regulatory compliance

and of doing business and otherwise affect our operations, and may significantly affect the markets in which we do business, the markets

for and value of our loans and investments, the fees we can charge and our ongoing operations, costs and profitability.

We rely on our management

and other key personnel, and the loss of any of them may adversely affect our operations.

We are and will continue

to be dependent upon the services of our executive management team. In addition, we will continue to depend on our ability to retain

and recruit key commercial loan officers. The unexpected loss of services of any key management personnel or commercial loan officers

could have an adverse effect on our business and financial condition because of their skills, knowledge of our market, years of industry

experience, and the difficulty of promptly finding qualified replacement personnel.

Environmental liability

associated with lending activities could result in losses.

In the course of our business,

we may foreclose on and take title to properties securing our loans. If hazardous substances were discovered on any of these properties,

we could be liable to governmental entities or third parties for the costs of remediation of the hazard, as well as for personal injury

and property damage. Many environmental laws can impose liability regardless of whether we knew of, or were responsible for, the

contamination. In addition, if we arrange for the disposal of hazardous or toxic substances at another site, we may be liable for

the costs of cleaning up and removing those substances from the site even if we neither own nor operate the disposal site. Environmental

laws may require us to incur substantial expenses and may materially limit use of properties we acquire through foreclosure, reduce their

value or limit our ability to sell them in the event of a default on the loans they secure. In addition, future laws or more stringent

interpretations or enforcement policies with respect to existing laws may increase our exposure to environmental liability.

Failure to implement

new technologies in our operations may adversely affect our growth or profits.

The market for financial

services, including banking services and consumer finance services, is increasingly affected by advances in technology, including developments

in telecommunications, data processing, computers, automation, Internet-based banking, and telebanking. Our ability to compete successfully

in our markets may depend on the extent to which we are able to exploit such technological changes. However, we can provide no assurance

that we will be able to properly or timely anticipate or implement such technologies or properly train our staff to use such technologies.

Any failure to adapt to new technologies could adversely affect our business, financial condition, or operating results.

External events,

including natural disasters, national or global health emergencies, and events of armed conflict in other countries, and terrorist threats

could impact our ability to do business or otherwise adversely affect our business, operations or financial condition.

Financial institutions,

like other businesses, are susceptible to the effects of external events that can compromise operating and communications systems and

otherwise have adverse effects. Such events, should they occur, can cause significant damage, impact the stability of our operations

or facilities, result in additional expense, or impair the ability of our borrowers to repay their loans. Although we have established

and regularly test disaster recovery procedures, the occurrence of any such event could have a material adverse effect on our business,

operations, and financial condition. In addition, other external events, including natural disasters, health emergencies and epidemics

or pandemics, such as the COVID-19 pandemic, and events of armed conflict in other parts of the world, such as the present armed conflict

involving Ukraine and Russia, could adversely affect the global or regional economies resulting in unfavorable economic conditions in

the United States. Any such development could have an adverse effect on our business, operations or financial condition.

An investment in

our Common Stock is not an insured deposit.

Our Common Stock is not

a bank deposit and, therefore, is not insured against loss by the FDIC, any other deposit insurance fund, or by any other public or private

entity. Investment in our Common Stock is subject to the same market

The Company may not be able to pay dividends.

The Company intends to pay

dividends of 30% to 40% of its profits for each quarter. The Company's ability to pay dividends to stockholders depends on its ability

to receive dividends from the Bank. Payment of dividends by the Bank to the Company and by the Company to its stockholders, however,

is subject to their respective financial conditions and to regulation. Federal and state banking regulations prohibit dividend payments

unless the Company and the Bank have sufficient net retained earnings and capital as determined by the regulators. The Company does not

believe that these restrictions will materially limit its ability to pay dividends. There is no assurance that either the Bank or the

Company will be legally or financially able to pay any specified amount of dividends in the future.

The price per share at the time a dividend

is declared may be higher than the price per share when the shares are actually issued.

The Company cannot assure

investors that the market price of the Common Stock will stay at the level at which it is trading at the time the dividend reinvestment

price is calculated pursuant to the Plan. Under the Plan, the value of the shares to be issued in lieu of cash dividends is determined

based on the higher of (a) 95% of the market price at the time a dividend is declared or (b) the stock’s par value ($1.00 per share).

By the time the dividend is actually paid, the market price at which the Company’s stock is selling may have declined from the

dividend reinvestment price. Thus, the number of shares issued to a shareholder may be less than the number of shares that would have

been issued had such number been based on the sales price of the shares at the time the dividend is paid, and the market value of the

shares actually issued may be less than the amount of cash that would have been received had the dividend been paid in cash.

Risk Factors Relating to

the Company’s Articles of Incorporation and the Common Stock

The liability of our directors is limited.

Our Articles of Incorporation

limit the liability of directors to the maximum extent permitted by Maryland law.

The trading volume in the Common Stock is

less than that of other larger services companies.

Although the Common Stock

is listed for trading on the Nasdaq Capital Market, the trading volume in the Common Stock is less than that of other larger financial

services companies. A public trading market having the desired characteristics of depth, liquidity and orderliness depends on the presence

in the marketplace of willing buyers and sellers of the Common Stock at any given time. This presence depends on the individual decisions

of investors and general economic and market conditions over which the Company has no control. Given the lower trading volume of the

Common Stock, significant sales of the Common Stock, or the expectation of these sales, could negatively impact the Company’s stock

price.

It may be difficult for a third party to acquire the Company, which

could affect the price of the Common Stock.

Our charter and Bylaws contain

certain anti-takeover provisions pursuant to the Maryland General Corporation Law. As a result, we may be a less attractive target to

a potential acquirer who otherwise may be willing to pay a premium for our Common Stock above its market price. These provisions effectively

inhibit a non-negotiated merger or other business combination, even if doing so would be perceived to be beneficial to the Company’s

stockholders and could adversely affect the market price of the Common Stock.

Cautionary

Statement Regarding Forward-Looking Statements

We have made forward-looking

statements (as such term is defined in the Private Securities Litigation Reform Act of 1995) in this document and in documents that are

incorporated by reference in this document that are subject to risks and uncertainties. We caution you to be aware of the speculative

nature of forward-looking statements. Forward-looking statements include the information concerning possible or assumed future results

of our operations. Also, statements including words such as “believes,” “expects,” “anticipates,”

“intends,” “plans,” “estimates,” or similar expressions are forward-looking statements. These statements

reflect our good faith belief based on current expectations, estimates, and projections about (among other things) the industry and the

markets in which we operate, but they are not guarantees of future performance. Purchasers of shares offered hereby should note that

many factors, some of which are discussed elsewhere in this document and in the documents incorporated by reference in this document,

could affect our future financial results and could cause actual results to differ materially from those expressed in forward-looking

statements contained or incorporated by reference in this document. Important factors that could cause actual results to differ materially

from the expectations reflected in the forward-looking statements in this Prospectus include, among others, the factors set forth under

the caption “Risk Factors,” general economic, business and market conditions, changes in laws, and increased competitive

pressure. We can give no assurances that the actual results we anticipate will be realized or, even if substantially realized, that they

will have the expected consequences to, or effects on, us or our business or operations. Except as required by applicable laws, we do

not intend to publish updates or revisions of any forward-looking statements we make to reflect new information, future events or otherwise.

EXPLANATION OF OUR DIVIDEND

REINVESTMENT

AND STOCK PURCHASE PLAN

The following questions and

answers explain the Plan. The Plan is contained in a written Plan instrument, a copy of which is maintained at the offices of the Company.

In the event of any inconsistency between that Plan instrument and this explanation, the Plan instrument will control. The Plan does

not represent a change in our dividend policy, which will continue to depend upon earnings, financial and regulatory requirements and

other factors, and which will be determined by our Board of Directors from time to time. Shareholders who do not wish to participate

in the Plan will continue to receive cash dividends when and as declared. We cannot provide any assurance whether, or at what rate, we

will continue to pay dividends.

Purpose

| 1. | What is the purpose of the

Plan? |

The purpose of the Plan is

to provide the Company’s shareholders with a convenient and economical method of investing cash dividends payable on their shares

of Common Stock in additional shares of Common Stock. The amount of the cash dividends which will be retained by the Company in exchange

for the issuance of the additional shares will be used by the Company for its general corporate purposes.

Advantages

| 2. | What are the advantages of

the Plan? |

Participation in the Plan offers a number of

advantages:

| · | The

Plan enables the shareholders to acquire additional shares of Common Stock at a discount

of 5% off the last sale price on the day prior to the dividend declaration date. |

| · | The

Plan enables the shareholders to acquire additional shares of Common Stock without the payment

of brokerage commissions. |

| · | The

Plan provides shareholders of the Company with the opportunity to reinvest their dividends

automatically in additional shares of Common Stock. |

| · | Participants’

funds will be fully utilized through the crediting of fractional shares of stock to their

accounts under the Plan. |

| · | Participants

will receive periodic statements of the transactions for their accounts under the Plan. |

Administration

| 3. | Who administers the Plan for

participants? |

The Company administers

the Plan as agent for the participants (the “Plan Administrator”). In such capacity, the Plan Administrator will send periodic

statements of account to participants and perform other administrative duties relating to the Plan. Any notices, questions or other communications

relating to the Plan should include the participant’s account number and should be addressed as follows: President, Glen Burnie

Bancorp, 101 Crain Highway, S.E., Glen Burnie, Maryland 21061.

Participation

| 4. | Who is eligible to participate

in the Plan? |

All holders of Common Stock

of the Company will be eligible to participate in the Plan. However, shareholders who reside in jurisdictions in which it is unlawful

for the Company to permit their participation are not eligible to participate in the Plan. Furthermore, the Company may refuse to offer

the Plan to various shareholders of the Company for any reason, including for the reason that the state in which the shareholder resides

may require registration, qualification or exemption of the Common Stock to be issued under the Plan, or registration or qualification

of the Company or any of its officers or employees as a broker, dealer, salesman or agent.

Holders of shares of Common

Stock in “street name” through a broker are not eligible to participate in the Plan with respect to those shares. Any such

holder who desires to participate in the Plan should contact his or her broker and arrange to have such shares registered in the shareholder’s

name as record holder.

| 5. | How does an eligible shareholder

become a participant in the Plan? |

Any eligible shareholder

may join the Plan at any time by completing and signing an authorization form and returning it to the Plan Administrator. Authorization

forms may be obtained at any time from the Plan Administrator. A properly completed authorization form must be received before the date

a dividend is declared by the Company’s Board of Directors in order for that dividend to be reinvested in shares of Common Stock

under the Plan.

| 6. | Must a shareholder authorize

dividend reinvestment on a minimum number of shares? |

No. There is no minimum

number of shares required for participation in the Plan. However, a shareholder may participate in the Plan only with respect to all

of his or her shares of the Company’s Common Stock; that is, a shareholder may not participate in the Plan with respect to fewer

than all of his or her shares of Common Stock.

Purchases

| 7. | How are shares of Common Stock

acquired under the Plan? |

Cash dividends payable on

shares of Common Stock held by persons participating in the Plan will be retained by the Company, and the Company will issue shares of

Common Stock for such cash dividends.

| 8. | What will be the price of shares

purchased under the Plan? |

Shares of Common Stock will

be purchased directly from the Company at a purchase price per share equal to 95% of last sale price per share prior to the dividend

declaration date.

| 9. | How many shares will be purchased

for participants? |

The number of shares that

will be purchased for each participant will depend upon the amount of cash dividends to be reinvested for the participant. Each participant’s

account will be credited with the whole and fractional shares equal to the pro rata amount invested for the respective participant, divided

by the purchase price per share.

| 10. | Will dividends on shares in

participants’ accounts be used to purchase shares? |

Yes. Dividends subsequently

paid on shares that have been purchased under the Plan will also be used to purchase shares of Common Stock, thereby compounding each

participant’s investment. Fractional shares held under the Plan for a participant’s account will receive dividends in the

same way as a whole share, but in proportion to the size of the fractional share.

| 11. | Are there any expenses to

participants in connection with purchases under the Plan? |

The Company will pay all

costs of administration of the Plan. No brokerage fees will be incurred pursuant to purchases of share of Common Stock made under the

Plan.

Reports to Participants

| 12. | What reports will participants

in the Plan receive? |

Each participant will receive

periodic statements of account showing the following: the amount of dividends invested for the participant; the number of shares of stock

purchased; the price per share; and the total number of shares accumulated for the participant under the Plan. These statements will

serve as a record of the transactions for the participant under the Plan and should be retained for income tax purposes. Each participant

will also receive the same communications sent to all other persons holding shares of Common Stock, as well as Internal Revenue Service

information for reporting dividend income received.

| 13. | How will a participant’s

shares be voted at meetings of shareholders? |

All shares issued to a participant

under the Plan will be registered in the name of the participant and can be voted directly or by proxy in the same manner as the participant

votes all other shares registered in his or her name.

Federal Income Tax Information

| 14. | What are the federal income

tax consequences of participating in the Plan? |

We believe that the following

is an accurate summary of the material federal income tax consequences as of the date of this Prospectus:

| · | Cash

dividends reinvested under the Plan will be taxable as having been received by participants,

even though participants have not actually received them in cash. |

| · | Each

participant will receive an annual statement from the Plan Administrator indicating the amount

reported to the Internal Revenue Service of reinvested dividends to be treated as dividend

income. The tax basis per share will be the price at which the shares are credited to a participant’s

account. |

| · | In

general, if a participant fails to furnish valid taxpayer identification number to the Plan

Administrator, the participant’s dividend distributions will be subject to U.S. backup

withholding. The dividends, less the amount of federal income tax required to be withheld,

will then be reinvested. |

| · | These

rules may not be applicable to certain participants in the Plan, such as tax-exempt entities

(e.g., pension funds) and foreign shareholders. These particular participants should consult

their own tax advisors concerning the tax consequences applicable to their situations. |

| · | In

the case of those foreign shareholders whose dividends are subject to U.S. federal income

tax withholding, the amount of tax to be withheld will be deducted from the amount of the

dividend and only the remaining amount of the dividend will be reinvested. |

The foregoing is only an outline

of our understanding of some of the applicable federal income tax provisions. The outline is general in nature and does not purport to

cover every situation. Moreover, it does not include a discussion of state and local income tax consequences of participation in the

Plan. For specific information on the tax consequences of your participation in the Plan, including any future changes in applicable

law or interpretation thereof, you should consult your own tax advisor.

Withdrawal of Shares from Plan Accounts

| 15. | How may a participant withdraw

shares purchased under the Plan? |

A participant may withdraw

all or a portion of the whole shares of Common Stock credited to his or her account by notifying the Plan Administrator in writing to

that effect and by specifying in the notice the number of shares to be withdrawn. Certificates for whole shares of Common Stock so withdrawn

from the Plan will be mailed to the participant’s address of record. No certificates for fractional shares will be issued under

any circumstance. Any notice of withdrawal received from a participant after a dividend record date will not be effective until the participant’s

dividends paid on that date have been reinvested and the shares credited to the participant’s account.

Dividends on shares withdrawn

from a participant’s account will continue to be reinvested unless the participant otherwise notifies the Plan Administrator in

writing. A participant who withdraws all of the whole and fractional shares from his or her account will be treated as having terminated

participation in the Plan.

Termination of Participation

| 16. | How does a participant terminate

participation in the Plan? |

Participation in the Plan

is entirely voluntary, and a participant may request to withdraw from the Plan at any time by notifying the Plan Administrator in writing.

Upon termination of Plan participation, the participant will receive certificates for full shares of Common Stock then held in his account.

Any fractional shares in the participant’s account shall be redeemed by the Company for cash in an amount equal to the fraction

of a whole share times the price per share of Common Stock determined under the provisions of the Plan at the last dividend declaration

date prior to the date of withdrawal.

If the request to withdraw

is received on or after the dividend declaration date for a dividend payment, any dividend paid on the corresponding dividend payment

date will be credited to the withdrawing participant’s account as stock in accordance with the provisions of the Plan. The request

to withdraw will then be processed promptly following such dividend payment date. Thereafter, all dividends will be paid in cash (or

in stock dividends if so declared by the Board of Directors on all Common Stock) to the shareholder who withdraws from the Plan. A shareholder

may elect again to become a participant at any time subsequent to withdrawal from the Plan.

If a participant disposes

of any or all of his shares of Common Stock registered in his name other than shares credited to the participant’s account under

the Plan, the shares of Common Stock credited under the Plan will continue to be administered under the provisions of the Plan until

the participant withdraws from the Plan.

Certificates for Shares

| 17. | Will certificates be issued

for shares purchased under the Plan? |

Generally not. Certificates

for shares purchased for a participant’s account under the Plan will not be issued unless:

| · | the

participant requests in writing that the Plan Administrator issue a certificate; |

| · | the

participant withdraws shares from his or her Plan account; |

| · | the

participant terminates his or her participation in the Plan; or |

| · | the

Company terminates the Plan. |

Requests for certificates

will be handled by the Plan Administrator without charge. Any remaining whole or fractional shares will continue to be held in the participant’s

account. No certificate for a fractional share will be issued; under the Plan, dividends on a fractional share will be credited to a

participant’s account. Withdrawal of shares in the form of a certificate does not affect dividend reinvestment.

| 18. | In whose name will shares

be registered when certificates are issued to participants? |

Certificates will be issued

in the name or names that appear on the participant’s account under the Plan. If a participant requests a certificate to be registered

in a name other than that shown on the account, the request must be signed by all persons in whose names the account appears, with signatures

Medallion guaranteed and accompanied by such other documentation as the Plan Administrator may require.

Other Information

| 19. | What are the responsibilities

of the Plan Administrator under the Plan? |

Except as set forth in the

Plan, the Plan Administrator has no duties, responsibilities or liabilities with respect to the Plan. The Plan Administrator does not

have any responsibility beyond the exercise of ordinary care for any reasonable and prudent actions taken or omitted pursuant to the

Plan including, without limitation, any claim for liability arising out of failure to terminate a participant’s account upon such

participant’s death or adjudicated incompetency prior to receipt of notice in writing of such death or adjudicated incompetency.

| 20. | Who bears the risk of market

price fluctuations in the Common Stock? |

You do. Your investment

in shares of Common Stock under the Plan will be no different from an investment in directly-held shares of the Company’s Common

Stock. You will bear the risk of loss and may realize the benefits of gain from market price changes with respect to all shares

held by you in the Plan or otherwise. The shares are not deposits and are not insured by the FDIC or any other government

agency.

| 21. | May the Plan be modified or

terminated? |

Yes. Although the Company

intends to continue the Plan in the future, the Board of Directors reserves the right to amend, suspend or modify the Plan at any time.

However, the Plan cannot be permanently terminated unless the shareholders at a regular or special meeting vote to terminate the Plan.

Written notice of any amendment, suspension, modification or termination will be sent to the participants within 30 days following any

such action. The Company also may adopt reasonable procedures for administration of the Plan.

| 22. | Who do I contact if I have

questions about the Plan? |

The Plan Administrator will

answer any questions you have about buying or selling our Common Stock through the Plan or about any other Plan services. You may contact

the Plan Administrator in writing at the address specified above in Question 3.

PLAN

OF DISTRIBUTION

The

shares of Common Stock acquired under the Plan will be sold directly by us through the Plan. As stated elsewhere in this Prospectus,

you will not pay any brokerage fees or commissions for shares securities purchased under the Plan.

Persons

who acquire shares of our common stock through the Plan and resell them shortly after acquiring them, including coverage of short positions,

under certain circumstances may be participating in a distribution of securities that would require compliance with Regulation M under

the Securities Exchange Act of 1934 (“Exchange Act”), and may be considered to be underwriters within the meaning of the

Securities Act of 1933 (“Securities Act”). We will not extend to any such person any rights or privileges other than those

to which they would be entitled as a participant, nor will we enter into any agreement with any such person regarding the resale or distribution

by any such person of the shares of our Common Stock so purchased.

Shares

of Common Stock may not be available under the Plan in all states or jurisdictions. This prospectus does not constitute an offer to sell,

or a solicitation of an offer to buy, any of our Common Stock in any jurisdiction to any person to whom it is unlawful to make such offer

in such jurisdiction.

Use

of Proceeds

We do not know the number of shares of Common

Stock that will be purchased under the Plan or the prices at which such shares will be purchased. We intend to add proceeds we receive

from the sales to our general funds to be used for general corporate purposes, including, without limitation, investments in and advances

to the Bank. The amounts and timing of the application of proceeds will depend upon our and the Bank’s funding requirements and

the availability of other funds.

Commission

Position on Limitation of Liability

Our directors and officers are entitled to indemnification

as expressly permitted by the provisions of the Maryland General Corporation Law, as amended, and our articles of incorporation and bylaws.

We also have directors’ and officers’ liability insurance, which provides, in general, insurance for our directors and officers

against any loss by reason of any of their wrongful acts, subject to the terms and conditions of the policy. Insofar as indemnification

for liabilities arising under the Securities Act may be permitted to directors, officers or persons controlling the Company as described

above, the Company has been informed that in the opinion of the Securities and Exchange Commission such indemnification is against public

policy as expressed in the Securities Act and is therefore unenforceable.

Legal

Matters

The validity of the shares

of Common Stock being offered for sale hereby has been passed on for us by Neuberger, Quinn, Gielen, Rubin & Gibber, P.A., Baltimore,

Maryland.

Experts

UHY LLP, independent registered

public accounting firm, has audited our consolidated financial statements and schedules as of December 31, 2021 and 2022 and for each

of the two years in the period ended December 31, 2022, as set forth in their reports. We have incorporated our financial statements

and schedules by reference into this registration statement in reliance on UHY LLP’s reports, given on their authority as experts

in accounting and auditing.

Information

Incorporated by Reference

The SEC allows us to provide

information about our business and other important information to you by “incorporating by reference” the information we

file with the SEC, which means that we can disclose the information to you by referring in this Prospectus to the documents we file with

the SEC. Under the SEC’s regulations, any statement contained in a document incorporated by reference in this Prospectus is automatically

updated and superseded by any information contained in this Prospectus, or in any subsequently filed document of the types described

below.

We incorporate into this

Prospectus by reference the following documents filed by us with the SEC, each of which should be considered an important part of this

Prospectus:

We also incorporate by reference

any filings we make with the SEC under Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act (other than any information in such filings

which, as permitted by SEC rules and regulations, is not deemed “filed”) after the initial filing of the registration statement

of which this Prospectus forms a part and before the expiration or withdrawal of the registration statement of which this Prospectus

forms a part.

You may request a copy of

each of our filings at no cost, by writing or telephoning us at the following address or telephone number: Glen Burnie Bancorp, 101 Crain

Highway, S.E., Glen Burnie, Maryland 21061, Attn: Shareholder Relations, (410) 766-3300.

Exhibits to a document will

not be provided unless they are specifically incorporated by reference in that document.

You should rely only on

the information contained in this Prospectus or any supplement. We have not authorized any other person to provide you with different

information. If anyone provides you with different or inconsistent information, you should not rely on it. We are not making an offer

to sell these securities in any jurisdiction where the offer or sale is not permitted. You should not assume that the information in

this Prospectus or any supplement is accurate as of any date other than the date on the front of those documents. Our business, financial

condition, results of operations and prospects may have changed since that date.

The information in this

Prospectus or any supplement may not contain all of the information that may be important to you. You should read the entire Prospectus

or any supplement, as well as the documents incorporated by reference in the Prospectus or any supplement, before making an investment

decision.

Where

You Can Find More Information

We file annual, quarterly,

and current reports, proxy statements and other information with the SEC. You can inspect, read and copy these reports, proxy statements

and other information at the public reference facilities that the SEC maintains at 100 F Street N.E., Room 1580, Washington, D.C. 20549.

You can also obtain copies

of these materials from the public reference facilities of the SEC at prescribed rates. You can obtain information on the operation of

the public reference facilities by calling the SEC at 1-800-SEC-0330. Our SEC filings are also available to you free of charge at the

SEC’s web site at http://www.sec.gov. Information about us may be obtained from our website

www.thebankofglenburnie.com. Copies of our Annual Report on Form 10-K, quarterly reports on Form

10-Q, current reports on Form 8-K, are available free of charge on the website as soon as they are filed with the SEC through a link

to the SEC’s EDGAR reporting system. Simply select the “Investor Relations” menu item, then click on the “All

SEC Filings” link.

We have filed with the SEC

a registration statement on Form S-3 under the Securities Act, as amended, to register with the SEC the securities described herein.

This Prospectus, which is a part of the registration statement, does not contain all of the information set forth in the registration

statement. For further information about us and our securities, you should refer to the registration statement.

Part II

Information Not

Required in Prospectus

Item

14. Other Expenses of Issuance and Distribution

The following table sets

forth the fees and expenses in connection with the issuance and distribution of the securities being registered hereunder. All such fees

and expenses shall be borne by us.

| SEC Registration Fee | |

$ | 115.57 | |

| Legal Fees and Expenses | |

| 7,000.00 | |

| Accounting Fees and Expenses | |

| 5,000.00 | |

| Miscellaneous | |

| 300.00 | |

| Total | |

$ | 12,415.57 | |

All of the above expenses, except the SEC registration fee, are estimates.

Item

15. Indemnification of Directors and Officers

Maryland law requires us

(unless our charter provides otherwise, which our charter does not) to indemnify a director or officer who has been successful, on the

merits or otherwise, in the defense of any proceeding to which he is made a party by reason of his service in that capacity. Maryland

law permits us to, and our bylaws require us to, indemnify our present and former directors and officers against judgments, penalties,

fines, settlements, and reasonable expenses actually incurred by them in connection with any proceeding to which they may be made a party

by reason of their service in those or other capacities unless it is established that:

| · | the

act or omission of the director or officer was material to the matter giving rise to the

proceeding and (i) was committed in bad faith or (ii) was the result of active

and deliberate dishonesty, |

| · | the

director or officer actually received an improper personal benefit in money, property or

services, or |

| · | in

the case of any criminal proceeding, the director or officer had reasonable cause to believe

that the act or omission was unlawful. |

A court may order indemnification

if it determines that the director or officer is fairly and reasonably entitled to indemnification, even though the director or officer

did not meet the prescribed standard of conduct or was adjudged liable on the basis that personal benefit was improperly received. However,

indemnification for an adverse judgment in a suit by us or in our right, or for a judgment of liability on the basis that personal benefit

was improperly received, is limited to expenses.

In addition, Maryland law

permits us to, and our bylaws require us to, advance reasonable expenses to a director or officer upon receipt of (a) a written

affirmation by the director or officer of his good faith belief that he has met the standard of conduct necessary for indemnification

and (b) a written undertaking by him or on his behalf to repay the amount paid or reimbursed if it is ultimately determined that

the standard of conduct was not met.

Our bylaws also authorize

our board of directors, to the maximum extent permitted by Maryland law, to indemnify any employee or agent other than a director or

officer against any claim or liability arising from that status and to pay or reimburse their reasonable expenses in advance of final

disposition of a proceeding.

The Company also maintains

director and officer insurance coverage.

Item

16. Exhibits

Item 17.

Undertakings

The registrant hereby undertakes:

1. To file, during any

period in which offers or sales are being made, a post-effective amendment to this registration statement:

| (i) | To include any prospectus required by

section 10(a)(3) of the Securities Act of 1933; |

| (ii) | To reflect in the prospectus any facts

or events arising after the effective date of the registration statement (or the most recent

post-effective amendment thereof) which, individually or in the aggregate, represent a fundamental

change in the information set forth in the registration statement. Notwithstanding the foregoing,

any increase or decrease in the volume of securities offered (if the total dollar value of

the securities offered would not exceed that which was registered) and any deviation from

the low or high end of the estimated maximum offering range may be reflected in the form

of prospectus filed with the Commission pursuant to Rule 424(b) if, in the aggregate, the

changes in volume and price represent no more than a 20% change in the maximum aggregate

offering price set forth in the “Calculation of Registration Fee” table in the

effective registration statement; |

| (iii) | To include any material information

with respect to any plan of distribution not previously disclosed in the registration statement

or any material change to such information in the registration statement; |

provided, however,

that paragraphs (i), (ii) and (iii) do not apply if the information required to be included in a post-effective amendment

by those paragraphs is contained in reports filed with or furnished to the Commission by the registrant pursuant to section 13 or

section 15(d) of the Securities Exchange Act of 1934 that are incorporated by reference in the registration statement, or is contained

in a form of prospectus filed pursuant to Rule 424(b) that is part of the registration statement.

2. That, for the purpose

of determining any liability under the Securities Act of 1933, each such post-effective amendment shall be deemed to be a new registration

statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial

bona fide offering thereof.

3. To remove from registration

by means of a post-effective amendment any of the securities being registered which remain unsold at the termination of the offering.

4. That, for the purpose

of determining liability under the Securities Act of 1933 to any purchaser, each prospectus filed pursuant to Rule 424(b) as part of

a registration statement relating to an offering, other than registration statements relying on Rule 430B or other than prospectuses

filed in reliance on Rule 430A, shall be deemed to be part of and included in the registration statement as of the date it is first used

after effectiveness. Provided, however, that no statement made in a registration statement or prospectus that is part of the registration

statement or made in a document incorporated or deemed incorporated by reference into the registration statement or prospectus that is

part of the registration statement will, as to a purchaser with a time of contract of sale prior to such first use, supersede or modify

any statement that was made in the registration statement or prospectus that was part of the registration statement or made in any such

document immediately prior to such date of first use.

5. That, for the purpose

of determining liability of the registrant under the Securities Act of 1933 to any purchaser in the initial distribution of the securities,

the undersigned registrant undertakes that in a primary offering of securities of the undersigned registrant pursuant to this registration

statement, regardless of the underwriting method used to sell the securities to the purchaser, if the securities are offered or sold

to such purchaser by means of any of the following communications, the undersigned registrant will be a seller to the purchaser and will

be considered to offer or sell such securities to such purchaser:

| (i) | Any preliminary prospectus or prospectus

of the undersigned registrant relating to the offering required to be filed pursuant to Rule

424; |

| (ii) | Any free writing prospectus relating

to the offering prepared by or on behalf of the undersigned registrant or used or referred

to by the undersigned registrant; |

| (iii) | The portion of any other free writing

prospectus relating to the offering containing material information about the undersigned

registrant or its securities provided by or on behalf of the undersigned registrant; and |

| (iv) | Any other communication that is an offer

in the offering made by the undersigned registrant to the purchaser. |

6. That, for the purpose

of determining any liability under the Securities Act of 1933, each filing of the registrant’s annual report pursuant to Section 13(a)

or Section 15(d) of the Securities Exchange Act of 1934 (and, where applicable, each filing of an employee benefit plan’s

annual report pursuant to Section 15(d) of the Securities Exchange Act of 1934) that is incorporated by reference in the registration

statement shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities

at that time shall be deemed to be the initial bona fide offering thereof.

7. Insofar as indemnification

for liabilities arising under the Securities Act of 1933 may be permitted to directors, officers and controlling persons of the

registrant pursuant to the foregoing provisions, or otherwise, the registrant has been advised that in the opinion of the Securities

and Exchange Commission such indemnification is against public policy as expressed in the Act, and is, therefore, unenforceable. In the

event that a claim for indemnification against such liabilities (other than the payment by the registrant of expenses incurred or paid

by a director, officer or controlling person of the registrant in the successful defense of any action, suit or proceeding) is asserted

by such director, officer or controlling person in connection with the securities being registered, the registrant will, unless in the

opinion of its counsel the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction the question

whether such indemnification by it is against public policy as expressed in the Act and will be governed by the final adjudication of

such issue.

Signatures

Pursuant to the requirements

of the Securities Act of 1933, the Registrant certifies that it has reasonable grounds to believe that it meets all of the requirements

for filing on Form S-3 and has duly caused this Registration Statement to be signed on its behalf by the undersigned, thereunto duly

authorized, in the City of Glen Burnie, State of Maryland on December 5, 2023.

| |

GLEN BURNIE BANCORP |

| |

|

|

| |

By: |

/s/ Mark C.

Hanna |

| |

|

Mark C. Hanna |

| |

|

President and Chief Executive Officer |

KNOW ALL MEN BY THESE PRESENTS,

that each person whose signature appears below constitutes and appoints each of Mark C. Hanna and Jeffrey D. Harris, as their true and

lawful attorney-in-fact and agent, each with full power of substitution and resubstitution, for him or her and in his or her name, place

and stead, in any and all capacities to sign the Form S-3 Registration Statement and any and all amendments thereto, and to file the

same, with all exhibits thereto, and other documents in connection therewith, with the U.S. Securities and Exchange Commission, granting

unto each said attorney-in-fact and agent full power and authority to do and perform each and every act and thing requisite and necessary

to be done as fully to all intents and purposes as he or she might or could do in person, hereby ratifying and confirming all that said

attorney-in-fact and agent, or either one of his or their substitute or substitutes, may lawfully do or cause to be done by virtue hereof.

Pursuant

to the requirements of the Securities Act of 1933, as amended, this Registration Statement has been signed by the following persons in

the capacities and on the dates indicated:

| Signature |

|

Title |

|

Date |

| |

|

|

|

|

| /s/ Mark C.

Hanna |

|

President, Chief Executive Officer |

|

December 5, 2023 |

| Mark C. Hanna |

|

and Director |

|

|

| |

|

|

|

|

| /s/ Jeffrey

D. Harris |

|

Senior Vice President and Chief |

|

December 5, 2023 |

| Jeffrey D. Harris |

|

Financial Officer |

|

|

| |

|

|

|

|

| /s/ John E.

Demyan |

|

Chairman of the Board and Director |

|

December 5, 2023 |

| John E. Demyan |

|

|

|

|

| |

|

|

|

|

| /s/ Thomas Clocker |

|

Director |

|

December 5, 2023 |

| Thomas Clocker |

|

|

|

|

| |

|

|

|

|

| /s/ Julie M.

Mussog |

|

Director |

|

December 5, 2023 |

| Julie M. Mussog |

|

|

|

|

| |

|

|

|

|

| /s/ F. W. Kuethe,

III |

|

Director |

|

December 5, 2023 |

| F. W. Kuethe, III |

|

|

|

|

| |

|

|

|

|

| |

|

Director |

|

__________, 2023 |

| Charles Lynch |

|

|

|

|

| |

|

|

|

|

| /s/ Andrew Cooch |

|

Director |

|

December 5, 2023 |

| Andrew Cooch |

|

|

|

|

| |

|

|

|

|

| |

|

Director |

|

__________, 2023 |

| Joan M. Rumenap |

|

|

|

|

| |

|

|

|

|

| |

|

Director |

|

__________, 2023 |

| Stanford D. Hess |

|

|

|

|

| |

|

|

|

|

| /s/ Mary Louise

Wilcox |

|

Director |

|

December 5, 2023 |

| Mary Louise Wilcox |

|

|

|

|

EXHIBIT INDEX

Exhibit 5.1

LAW OFFICES

Neuberger,

Quinn, Gielen, Rubin & Gibber, P.A.

27th FLOOR

ONE SOUTH STREET

BALTIMORE, MARYLAND 21202-3282

www.nqgrg.com

(410) 332-8550

| Hillel Tendler |

|

Fax No. |

| (410) 332-8552 |

|

(410) 332-8553 |

| |

|

E-MAIL ADDRESS: |

| |

|

HT@NQGRG.COM |

December

5, 2023

Glen Burnie Bancorp

101 Crain Highway, S.E.

Glen Burnie, Maryland 21061

| Re: | Registration Statement on Form S-3 |

Ladies and Gentlemen:

We have acted as counsel to Glen Burnie Bancorp,

a Maryland corporation (the “Company”) in connection with the preparation and filing with the Securities and Exchange Commission

(the “Commission”) on or about the date hereof, of a registration statement on Form S-3 (as amended or supplemented, the “Registration

Statement”) under the Securities Act of 1933 (the “Act”), relating to the registration of 150,000 shares of the Company’s

Common Stock, $1.00 par value per share (the “Shares”), to be offered and sold from time to time by the Company pursuant to

the Company’s Dividend Reinvestment and Stock Purchase Plan (the “Plan”) as described in the Registration

Statement. This opinion is being provided at your request for filing as an exhibit to the Registration Statement.

In connection with this opinion, we have examined

originals, or copies certified or otherwise identified to our satisfaction, of such instruments, certificates, records and documents,

and have reviewed such questions of law, as we have deemed necessary or appropriate for purposes of this opinion. In such examination,

we have assumed the genuineness of all signatures, the authenticity of all documents submitted to us as originals, the conformity to the

original documents of all documents submitted as copies and the authenticity of the originals of such latter documents, and that all individuals

executing such documents had the requisite legal authority and capacity to do so. As to any facts material to our opinion, we have relied

upon the aforesaid instruments, certificates, records and documents and inquiries of your representatives.

The opinion expressed below is subject to, and

qualified and limited by the effects of (i) bankruptcy, fraudulent conveyance or fraudulent transfer, insolvency, reorganization, moratorium,

liquidation, conservatorship and similar laws, and limitations imposed under judicial decisions related to or affecting creditors’

rights and remedies generally, (ii) general equitable principles, regardless of whether the issue of enforceability is considered in a

proceeding in equity or at law (regardless of whether arising prior to, or after, the date hereof), and principles limiting the availability

of the remedy of specific performance or injunctive relief, and (iii) concepts of good faith, fair dealing and reasonableness.

Based upon the foregoing examination, we are of

the opinion that the Shares are duly authorized, and, when issued against payment as provided for pursuant to the terms of the Plan, will

be validly issued, fully paid and nonassessable.

We are, in this opinion, opining only on the Maryland

General Corporation Law (including the relevant statutory provisions and the reported judicial decisions interpreting these laws) and

the federal law of the United States. We are not opining on “blue sky” or other state securities laws.

We hereby consent to the filing of this opinion

as an exhibit to the Registration Statement and to the statements with respect to our name wherever it appears in the Registration Statement

and in any amendment or supplement thereto. In giving the foregoing consent, we do not hereby admit that we come within the category of

persons whose consent is required under Section 7 of the Act, or the rules and regulations of the Commission thereunder. This opinion

has been prepared for use in connection with the Registration Statement and may not be relied upon for any other purpose without our prior

written consent.

| |

Very truly yours, |

| |

|

| |

/s/ NEUBERGER, QUINN, GIELEN, RUBIN & GIBBER, P.A. |

Exhibit 23.1

CONSENT OF INDEPENDENT

ACCOUNTANTS

We hereby consent to the incorporation by reference