UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

Form 20-F/A

Amendment No. 1

(Mark One)

☐ REGISTRATION STATEMENT PURSUANT TO SECTION

12(b) OR 12(g) OF THE SECURITIES EXCHANGE ACT OF 1934

OR

☒ ANNUAL REPORT PURSUANT TO SECTION 13

OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2021

OR

☐ TRANSITION REPORT PURSUANT TO SECTION

13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ___________

to ___________

OR

☐ SHELL COMPANY REPORT PURSUANT TO SECTION

13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Date of event requiring this shell company report

_________________________

Commission file number: 001-40848

GUARDFORCE AI CO., LIMITED

(Exact Name of Registrant as Specified in Its Charter)

Not Applicable

(Translation of Registrant’s Name Into English)

Cayman Islands

(Jurisdiction of Incorporation or Organization)

10 Anson Road, #28-01 International Plaza, Singapore

079903

Tel: +65 6702 1179

(Address of Principal Executive Offices)

Lei Wang, CEO

+65 6702 1179

olivia.wang@guardforceai.com

10 Anson Road, #28-01 International Plaza, Singapore

079903

(Name, Telephone, E-mail and/or Facsimile number

and Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b)

of the Act:

| Title of Each Class |

|

Trading Symbol(s) |

|

Name of Each Exchange On

Which Registered |

|

Ordinary Shares,

par value $0.003 per share |

|

GFAI |

|

The Nasdaq Stock Market LLC |

|

Warrants,

No par value |

|

GFAIW |

|

The Nasdaq Stock Market LLC |

Securities registered or to be registered pursuant to Section 12(g)

of the Act.

None

(Title of Class)

Securities for which there is a reporting obligation pursuant to Section

15(d) of the Act.

None

(Title of Class)

Indicate the number of outstanding shares of each

of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report (December 31, 2021):

There were 21,201,842 shares of the registrant’s ordinary shares outstanding, par value $0.003 per share.

Indicate by check mark if the registrant is a

well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes ☐ No ☒

If this report is an annual or transition report,

indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act

of 1934.

Yes ☐ No ☒

Indicate by check mark whether the registrant

(1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months

(or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements

for the past 90 days.

Yes ☒ No ☐

Indicate by check mark whether the registrant

has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T during the preceding

12 months (or for such shorter period that the registrant was required to submit such files).

Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated

filer, an accelerated filer, or a non-accelerated filer.

| Large Accelerated Filer ☐ |

Accelerated Filer ☐ |

Non-Accelerated Filer ☒ |

Emerging growth company ☒ |

If an emerging growth company that prepares its

financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition

period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant

has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial

reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or

issued its audit report. ☐

Indicate by check mark which basis of accounting

the registrant has used to prepare the financial statements included in this filing:

| U.S. GAAP ☐ |

|

International Financial Reporting ☒ |

|

Other ☐ |

| |

|

Standards as issued by the International |

|

|

| |

|

Accounting Standards Board |

|

|

If “Other” has been checked in response

to the previous question, indicate by check mark which financial statement item the registrant has elected to follow.

☐ Item 17 ☐ Item 18

If this is an annual report, indicate by check

mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes ☐ No ☒

TABLE OF CONTENTS

EXPLANATORY NOTE

This Amendment No. 1 on Form 20-F/A (this “Amendment”)

amends the Annual Report on Form 20-F of Guardforce AI Co., Limited (the “Company”) for the year ended December 31, 2021,

which was filed with the Securities and Exchange Commission on March 31, 2022 (the “Original Filing”).

The Company is filing this Amendment solely for

the purpose of updating the disclosure in Item 16G of Part II of the Original Filing. In accordance with Rule 12b-15 promulgated under

the Securities Exchange Act of 1934, as amended (the “Exchange Act”), Item 16G of Part II of the Original Filing is hereby

amended and restated in its entirety. In addition, pursuant to Rule 12b-15 under the Exchange Act, the Company is including new certifications

by the Company’s principal executive officer and principal financial officer as exhibits to this Amendment pursuant to Rule 13a-14(a)

of the Exchange Act and Section 1350 of Chapter 63 of Title 18 of the United States Code (18 U.S.C. 1350).

Except as described above or as otherwise expressly

provided by the terms of this Amendment, no other changes have been made to the Original Filing. Except as otherwise indicated herein,

this Amendment continues to speak as of the date of the Original Filing, and the Company has not updated the disclosures contained therein

to reflect any events that occurred subsequent to the date of the Original Filing.

ITEM 16G. CORPORATE GOVERNANCE

We are incorporated in the Cayman Islands and

our corporate governance practices are governed by applicable laws of the Cayman Islands and our memorandum and articles of association.

In addition, because our ordinary shares and warrants are listed on the Nasdaq Stock Market, or Nasdaq, we are subject to Nasdaq’s

corporate governance requirements.

For the fiscal year ended December 31, 2021, we

were a “controlled company” within the meaning of the Nasdaq Listing Rules, where more than 50% of the voting power of our

securities for the election of directors was held by an individual, group or another company and, as a result, qualified for and relied

on exemptions from certain Nasdaq corporate governance requirements, including, without limitation (i) the requirement that to hold an

annual meeting of shareholders no later than one year after the end of its fiscal year; (ii) the requirement that the compensation of

our officers be determined or recommended to our board of directors by a compensation committee that is comprised solely of independent

directors, and (iii) the requirement that director nominees be selected or recommended to the board of directors by a majority of independent

directors or a nominating and corporate governance committee comprised solely of independent directors. Since we relied on the “controlled

company” exemption, we were not required to have either a compensation committee or a nominating and corporate governance committee

composed solely of independent directors.

On January 20, 2022, we ceased to be a “controlled

company” under the rules of Nasdaq. However, as a foreign private issuer, Nasdaq Listing Rule 5615(a)(3) permits us to follow home

country practices in lieu of certain requirements of Listing Rule 5600, provided that we disclose in our annual report filed with the

SEC each requirement of Rule 5600 that we do not follow and describe the home country practice followed in lieu of such requirement.

We are currently following some Cayman Islands

corporate governance practices in lieu of Nasdaq corporate governance listing standards as follows:

| ● | We

are currently following Cayman Islands corporate governance practice in lieu of Nasdaq

Rule 5605(d)(2), which requires a compensation committee to compose entirely of independent

directors. Mr. Terence Wing Khai Yap, our Chairman and Ms. Lei Wang, our Executive Director,

serve as non-independent directors in the compensation committee. |

| ● | We

are currently following Cayman Islands corporate governance practice in lieu of Nasdaq

Rule 5605(e)(1)(B), which requires a nominating and corporate governance committee to compose

entirely of independent directors. Mr. Terence Wing Khai Yap, our Chairman and Ms. Lei Wang,

our Executive Director, serve as non-independent directors in our nominating and corporate

governance committee. |

| ● | We

are currently following Cayman Islands corporate governance practice in lieu of Nasdaq

Rule 5635(a), which requires shareholder approval prior to the issuance of securities in

connection with the acquisition of the stock or assets of another company in certain circumstances. |

| ● | We

are currently following Cayman Islands corporate governance practice in lieu of Nasdaq

Rule 5635(c), which requires shareholder approval for the establishment of or any material

amendments to equity compensation or purchase plans or other equity compensation arrangements. |

| ● | We

are currently following Cayman Islands corporate governance practice in lieu of Nasdaq

Rule 5635(d), which requires shareholder approval in order to enter into any transaction,

other than a public offering, involving the sale, issuance or potential issuance by the Company

of ordinary shares (or securities convertible into or exercisable for ordinary shares) equal

to 20% or more of the outstanding share capital of the Company or 20% or more of the voting

power outstanding before the issuance for less than the greater of book or market value of

the ordinary shares. |

Our Cayman Islands counsel has provided

relevant letters to Nasdaq certifying that under Cayman Islands law, we are not required to seek shareholders’ approval in the above

circumstances.

ITEM 19. EXHIBITS

| |

* |

Filed herewith. |

| |

** |

Furnished herewith. |

SIGNATURES

The registrant hereby certifies that it meets

all of the requirements for filing on Form 20-F and that it has duly caused and authorized the undersigned to sign this Amendment No.

1 to the annual report on its behalf.

| |

GUARDFORCE AI CO., LIMITED |

| |

|

| |

By: |

/s/ Lei Wang |

| |

Name: |

Lei Wang |

| |

Title: |

Chief Executive Officer |

Date: April 14, 2022

3

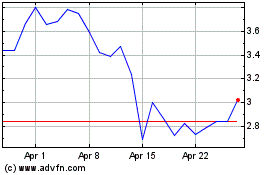

Guardforce AI (NASDAQ:GFAI)

Historical Stock Chart

From Mar 2024 to Apr 2024

Guardforce AI (NASDAQ:GFAI)

Historical Stock Chart

From Apr 2023 to Apr 2024