UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 OF THE

SECURITIES EXCHANGE ACT OF 1934

For the month of April 2022

Commission File Number 001-40848

GUARDFORCE AI CO., LIMITED

(Translation of registrant’s name into English)

10 Anson Road, #28-01 International Plaza

Singapore 079903

(Address of principal executive offices)

Indicate

by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F: Form 20-F

☒ Form 40-F ☐

Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ☐

Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ☐

Entry into a Material Definitive Agreement.

On April 6, 2022, Guardforce AI Co., Limited (the

“Company”) and certain investors (the “Purchasers”) entered into a securities purchase agreement

(the “Purchase Agreement”), pursuant to which the Company agreed to sell to such investors an aggregate of 8,739,351

ordinary shares, par value $0.003 per share (the “Ordinary Shares”), in a registered direct offering, for total aggregate

gross proceeds of approximately $10.05 million (the “Financing”).

The Company agreed in the Purchase Agreement that

it would not issue any additional Ordinary Shares (or Ordinary Shares equivalents) for 45 calendar days following the closing of the Financing,

subject to certain exceptions. The representations, warranties and covenants contained in the Purchase Agreement were made solely for

the benefit of the parties to the Purchase Agreement and may be subject to limitations agreed upon by the contracting parties. In addition,

such representations, warranties and covenants (i) are intended as a way of allocating the risk between the parties to the Purchase Agreement

and not as statements of fact, and (ii) may apply standards of materiality in a way that is different from what may be viewed as material

by shareholders of, or other investors in, the Company. Accordingly, form of the Purchase Agreement is filed with this report only to

provide investors with information regarding the terms of transaction, and not to provide investors with any other factual information

regarding the Company. Shareholders should not rely on the representations, warranties and covenants or any descriptions thereof as characterizations

of the actual state of facts or condition of the Company. Moreover, information concerning the subject matter of the representations and

warranties may change after the date of the Purchase Agreement, which subsequent information may or may not be fully reflected in public

disclosures.

The Financing raised net cash proceeds of approximately

$9.17 million (after deducting the placement agent fee and expenses of the Financing). The Company intends to use the net cash proceeds

from the Offering for acquisitions and partnerships, investments in technology and expanding corporate infrastructure, expansion of its

sales team and marketing efforts and for general working capital purposes. The Financing is expected to close on or about April 8, 2022,

subject to satisfaction of customary closing conditions.

The Company engaged EF Hutton, division of Benchmark

Investments, LLC (“EF Hutton”) as the Company’s placement agent for the Financing pursuant to a Placement Agency

Agreement (the “Agency Agreement”) dated as of April 6, 2022. Pursuant to the Agency Agreement, the Company agreed

to pay EF Hutton a cash placement fee equal to 7.5% of the gross proceeds of the Financing, an additional cash fee equal to 0.5% of the

gross proceeds raised by the Company in the offering for non-accountable expenses, and also agreed to reimburse EF Hutton up to $70,000

for accountable expenses.

The Placement Agent has required that certain

officers, directors and 6% or more shareholders of the Company enter into lock-up agreements pursuant to which these officers, directors

and shareholders have agreed that, without the prior consent of the Placement Agent, they will not, for a period of forty-five (45) days

following the closing of the Financing, subject to certain exceptions, offer, sell or otherwise dispose of or transfer any securities

of the Company owned by them as of the date of the closing of the Financing or acquired during the lock-up period.

On September 30, 2021, the Company sold 3,614,458

units in connection with a public offering, and 542,168 warrants as the result of the representative’s exercise of the over-allotment

option. Each unit consisted of one ordinary share and a warrant to purchase one ordinary share (the “Public Warrants”).

On January 20, 2022, the Company completed a private placement with several investors, wherein a total of 7,919,997 Ordinary shares of

the Company were issued at a purchase price of $1.30 per share, with each investor also receiving a warrant to purchase up to a number

of Ordinary Shares equal to 150% of the number of Ordinary Shares purchased by such investor in the private placement, at an exercise

price of $1.30 per share (the “Private Warrants”), for a total purchase price of approximately $10.3 million. The Public

Warrants sold as a component of the units and the Private Warrants contain an antidilution provision. As a result of the Financing, the

exercise price of the Company’s Public Warrants and Private Warrants is being adjusted to $1.15 pursuant to the antidilution provisions

of both warrants. The Company has sent the notices to warrant holders regarding the adjustment of exercise price on April 6, 2022.

A copy of form of the Purchase Agreement, the

Agency Agreement, the form of lock-up agreement are attached hereto as Exhibits 10.1, 10.2 and 10.3, respectively, and are incorporated

herein by reference. The foregoing summaries of the terms of the Purchase Agreement, the Agency Agreement and the form of lock-up agreement,

are subject to, and qualified in their entirety by, such documents.

On April 6, 2022, the Company issued a press release announcing the

Financing. A copy of the press release is attached hereto as Exhibit 99.1 and is incorporated herein by reference.

The sale and offering of Ordinary Shares pursuant

to the Purchase Agreement was effected as a takedown off the Company’s shelf registration statement on Form F-3 (File No. 333-261881),

which became effective on January 5, 2022, pursuant to a prospectus supplement filed with the Commission.

| Exhibit Number |

|

Description |

| |

|

|

| 5.1 |

|

Opinion of Conyers Dill & Pearman |

| 10.1 |

|

Form of Securities Purchase Agreement, dated April 6, 2022, between the Company and Purchasers |

| 10.2 |

|

Placement Agency Agreement, dated April 6, 2022, between the Company and EF Hutton, division of Benchmark Investments, LLC |

| 10.3 |

|

Form of Lock-Up Agreement |

| 23.1 |

|

Consent of Conyers Dill & Pearman (included as part of Exhibit 5.1) |

| 99.1 |

|

Press Release, dated April 6, 2022 |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| Date: April 7, 2022 |

Guardforce AI Co., Limited |

| |

|

|

| |

By: |

/s/ Lei Wang |

| |

Lei Wang |

| |

Chief Executive Officer |

4

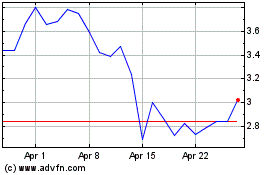

Guardforce AI (NASDAQ:GFAI)

Historical Stock Chart

From Mar 2024 to Apr 2024

Guardforce AI (NASDAQ:GFAI)

Historical Stock Chart

From Apr 2023 to Apr 2024