false

0001735948

A6

0001735948

2024-03-04

2024-03-04

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

March 4, 2024

GREENBROOK TMS INC.

(Exact name of registrant as specified in its

charter)

| Ontario |

|

001-40199 |

|

98-1512724 |

|

(State or Other Jurisdiction

of Incorporation) |

|

(Commission

File No.) |

|

(IRS Employee

Identification No.) |

890 Yonge Street, 7th Floor

Toronto, Ontario Canada

M4W 3P4

(Address of Principal Executive Offices)

(866) 928-6076

(Registrant’s telephone number, including

area code)

(Former name or former address, if changed since

last report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of Each Class |

|

Trading

Symbol(s) |

|

Name of Each Exchange

on Which Registered |

| Common Shares, without par value |

|

GBNH |

|

The

Nasdaq Stock Market LLC(1) |

(1) On February 22, 2024, Greenbrook TMS Inc. (the “Company”

or “Greenbrook”) was notified by the staff of the Nasdaq Stock Market LLC (“Nasdaq”) that it plans

to file a Form 25 with the Securities and Exchange Commission (the “SEC”) to delist the Company’s common

shares (the “Common Shares”) from Nasdaq upon the completion of all applicable procedures. After the Form 25 is

filed by Nasdaq, the delisting will become effective 10 days later. The deregistration of the Common Shares under Section 12(b) of

the Securities Exchange Act of 1934, as amended (the “Exchange Act”), will be effective 90 days after filing of the

Form 25, or such shorter period as the SEC may determine.

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities

Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company x

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act.

Item 5.02 Departure of Directors or Certain

Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

(c) Appointment of Chief Operating Officer

On March 4, 2024, the

Company announced that Mr. Andrew Crish, age 47, was appointed as the Company’s full-time Chief Operating Officer, effective

immediately.

Mr. Crish has a diverse

work experience spanning over two decades. Prior to joining Greenbrook, Andrew served as the Vice President of Operations at M2 Orthopedics

since December 2021. Prior to this, he worked as the Vice President of Operations at National Veterinary Associates from November 2018

to November 2021. Before joining National Veterinary Associates, Andrew held various roles at DaVita Kidney Care, including Division

Vice President; Division Vice President of Hospital Service; Group Director of Hospital Services; and Regional Operations Director. Andrew's

tenure at DaVita Kidney Care lasted from September 2013 to November 2018. Andrew's earlier experience includes working at GE

Healthcare as a Business Operations Manager, Director of Service, and Quality Assurance Leader from April 2007 to December 2012.

Andrew also worked as a Consultant at BearingPoint, Inc from October 2006 to October 2007. Before transitioning into the

corporate sector, Andrew served in the US Navy from May 2000 to October 2006 as a Surface Warfare Officer, Facilities Manager,

and Instructor. Andrew completed his Bachelor of Science degree in Economics at the United States Naval Academy from 1996 to 2000. Andrew

then pursued further education and obtained his MBA from Northwestern University - Kellogg School of Management, specializing in Marketing,

Finance, Management & Strategy, from 2008 to 2011.

In connection with his appointment

as full-time Chief Operating Officer, Mr. Crish signed an employment agreement, dated March 4, 2024 (the “Employment

Agreement”) that includes an annual base salary of US$300,000 with a target annual performance bonus of up to 40% of his base

salary. As part of the Employment Agreement, a stock option plan award in the grant amount of 250,000 Common Shares to Mr. Crish

pursuant to the Company’s Equity Incentive Plan, which is described in Item 6 of the Company’s Annual Report on Form 20-F

for the year ended December 31, 2022, will be presented to the board of directors for approval. Under the Employment Agreement, Mr. Crish

will also be subject to a 12-month non-compete in the event of the termination of Mr. Crish’s employment for any reason. A

copy of the Employment Agreement will be filed as an exhibit to the Company’s Annual Report on Form 10-K for the year ended

December 31, 2023.

In connection with Mr. Crish’s

appointment, he has also entered into the Company’s standard form of indemnity agreement, dated March 4, 2024 (the “Indemnity

Agreement”). The Indemnity Agreement requires the Company to indemnify Mr. Crish to the fullest extent permitted under

applicable law and to advance expenses incurred as a result of any proceeding against him as to which he could be indemnified. The Indemnity

Agreement is substantially similar to the indemnity agreements signed by other officers of the Company. A copy of the Indemnity Agreement

will be filed as an exhibit to the Company’s Annual Report on Form 10-K for the year ended December 31, 2023.

Mr. Crish has no

family relationship with any of the executive officers or directors of the Company. There is no arrangement or understanding between Mr. Crish

and any other persons pursuant to which he was selected to serve as an officer of the Company. There are no related party transactions

between the Company and Mr. Crish that would require disclosure under Item 404(a) of Regulation S-K.

Certain information in this

Current Report on Form 8-K may constitute forward-looking information within the meaning of applicable securities laws in Canada

and the United States, including the United States Private Securities Litigation Reform Act of 1995. In some cases, but not necessarily

in all cases, forward-looking information can be identified by the use of forward-looking terminology such as “plans”, “targets”,

“expects” or “does not expect”, “is expected”, “an opportunity exists”, “is positioned”,

“estimates”, “intends”, “assumes”, “anticipates” or “does not anticipate”

or “believes”, or variations of such words and phrases or state that certain actions, events or results “may”,

“could”, “would”, “might”, “will” or “will be taken”, “occur”

or “be achieved”. In addition, any statements that refer to expectations, projections or other characterizations of future

events or circumstances contain forward-looking information. Statements containing forward-looking information are not historical facts

but instead represent management’s expectations, estimates and projections regarding future events.

Forward-looking information

is necessarily based on a number of opinions, assumptions and estimates that, while considered reasonable by the Company as of the date

of this Current Report on Form 8-K, are subject to known and unknown risks, uncertainties, assumptions and other factors that may

cause the actual results, level of activity, performance or achievements or future events or developments to differ materially from those

expressed or implied by the forward-looking statements, including, without limitation: macroeconomic factors such as inflation and recessionary

conditions, substantial doubt regarding the Company’s ability to continue as a going concern due to recurring losses from operations;

inability to increase cash flow and/or raise sufficient capital to support the Company’s operating activities and fund its cash

obligations, repay indebtedness and satisfy the Company’s working capital needs and debt obligations; prolonged decline in the price

of the Common Shares reducing the Company’s ability to raise capital; inability to satisfy debt covenants under the Company’s

credit facility and the potential acceleration of indebtedness; including as a result of an unfavorable decision in respect of the litigation

with Benjamin Klein; risks related to the ability to continue to negotiate amendments to the Company’s credit facility to prevent

a default; risks relating to the Company’s ability to deliver and execute on the previously-announced restructuring plan (the “Restructuring

Plan”) and the possible failure to complete the Restructuring Plan on terms acceptable to the Company or its suppliers (including

Neuronetics, Inc.), or at all; risks relating to maintaining an active, liquid and orderly trading market for the Common Shares as

a result of the Company’s suspension of trading on Nasdaq; risks relating to the Company’s ability to realize expected cost-savings

and other anticipated benefits from the Restructuring Plan; risks related to the Company’s negative cash flows, liquidity and its

ability to secure additional financing; increases in indebtedness levels causing a reduction in financial flexibility; inability to achieve

or sustain profitability in the future; inability to secure additional financing to fund losses from operations and satisfy the Company’s

debt obligations; risks relating to strategic alternatives, including restructuring or refinancing of the Company’s debt, seeking

additional debt or equity capital, reducing or delaying the Company’s business activities and strategic initiatives, or selling

assets, other strategic transactions and/or other measures, including obtaining bankruptcy protection, and the terms, value and timing

of any transaction resulting from that process; claims made by or against the Company, which may be resolved unfavorably to us; risks

relating to the Company’s dependence on Neuronetics, Inc. as its exclusive supplier of TMS devices. Additional risks and uncertainties

are discussed in the Company’s materials filed with the Canadian securities regulatory authorities and the SEC from time to time,

available at www.sedarplus.ca and www.sec.gov, respectively. These factors are not intended to represent a complete list of the factors

that could affect the Company; however, these factors should be considered carefully. There can be no assurance that such estimates and

assumptions will prove to be correct. The forward-looking statements contained in this Current Report on Form 8-K are made as of

the date of this Current Report on Form 8-K, and the Company expressly disclaims any obligation to update or alter statements containing

any forward-looking information, or the factors or assumptions underlying them, whether as a result of new information, future events

or otherwise, except as required by law.

| Item 7.01 | Regulation FD Disclosure. |

On

March 4, 2024, the Company issued a press release announcing the appointment of Mr. Andrew Crish as full-time Chief Operating

Officer. The press release is filed as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein by reference.

The

information contained in this Current Report on Form 8-K under Item 7.01, including the attached Exhibit 99.1, is being furnished

pursuant to Item 7.01 of Form 8-K and shall not be deemed to be “filed” for purposes of Section 18 of the Exchange

Act, or otherwise subject to the liabilities of that section. The information contained in this Current Report on Form 8-K under

Item 7.01 shall not be incorporated by reference into any filing under the Securities Act of 1933, as amended, or any filing under the

Exchange Act, whether made before or after the date hereof, except as shall be expressly set forth by specific reference in such a filing.

| Item 9.01 | Financial Statements and Exhibits. |

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Date: March 8, 2024

| |

Greenbrook TMS Inc. |

| |

|

|

| |

By: |

/s/ Bill Leonard |

| |

Name: |

Bill Leonard |

| |

Title: |

President & Chief Executive Officer |

Exhibit 99.1

GREENBROOK APPOINTS CHIEF OPERATING OFFICER

March 4,

2024 – Toronto, ON – Greenbrook TMS Inc. (OTC Pink: GBNHF) (“Greenbrook” or the “Company”)

announced today the appointment of Andrew Crish as Chief Operating Officer, effective immediately. In his role as Chief Operating Officer,

Andrew will have responsibility for Company operations and leading the execution of the Company’s strategic growth plan alongside

the Company’s executive leadership team.

Andrew has a diverse work experience spanning

over two decades. Prior to joining Greenbrook, Andrew served as the Vice President of Operations at M2 Orthopedics since December 2021.

Prior to this, he worked as the Vice President of Operations at National Veterinary Associates from November 2018 to November 2021.

Before joining National Veterinary Associates, Andrew held various roles at DaVita Kidney Care, including Division Vice President; Division

Vice President of Hospital Service; Group Director of Hospital Services; and Regional Operations Director. Andrew’s tenure at DaVita

Kidney Care lasted from September 2013 to November 2018. Andrew’s earlier experience includes working at GE Healthcare

as a Business Operations Manager, Director of Service, and Quality Assurance Leader from April 2007 to December 2012. Andrew

also worked as a Consultant at BearingPoint, Inc from October 2006 to October 2007. Before transitioning into the corporate

sector, Andrew served in the US Navy from May 2000 to October 2006 as a Surface Warfare Officer, Facilities Manager, and Instructor.

Andrew completed his Bachelor of Science degree in Economics at the United States Naval Academy from 1996 to 2000. Andrew then pursued

further education and obtained his MBA from Northwestern University - Kellogg School of Management, specializing in Marketing, Finance,

Management & Strategy, from 2008 to 2011.

“Andrew is a seasoned executive with over

20 years of diverse operational experience. His passion for driving operational efficiencies and building high-performing teams aligns

perfectly with our vision for Greenbrook”, commented Bill Leonard, President and Chief Executive Officer. “We are thrilled

to welcome such a dynamic and skilled executive to our team.”

About Greenbrook TMS Inc.

Operating through 130 Company-operated treatment

centers, Greenbrook is a leading provider of Transcranial Magnetic Stimulation (“TMS”) therapy and Spravato® (esketamine

nasal spray), FDA-cleared, non-invasive therapies for the treatment of Major Depressive Disorder (“MDD”) and other

mental health disorders, in the United States. TMS therapy provides local electromagnetic stimulation to specific brain regions known

to be directly associated with mood regulation. Spravato® is offered to treat adults with treatment-resistant depression and depressive

symptoms in adults with MDD with suicidal thoughts or actions. Greenbrook has provided more than 1.3 million treatments to over 40,000

patients struggling with depression.

For further information please contact:

Glen Akselrod

Investor Relations

Greenbrook TMS Inc.

Contact Information:

investorrelations@greenbrooktms.com

1-855-797-4867

Cautionary Note Regarding Forward-Looking Information

Certain information in this press release may

constitute forward-looking information within the meaning of applicable securities laws in Canada and the United States, including the

United States Private Securities Litigation Reform Act of 1995. In some cases, but not necessarily in all cases, forward-looking information

can be identified by the use of forward-looking terminology such as “plans”, “targets”, “expects”

or “does not expect”, “is expected”, “an opportunity exists”, “is positioned”, “estimates”,

“intends”, “assumes”, “anticipates” or “does not anticipate” or “believes”,

or variations of such words and phrases or state that certain actions, events or results “may”, “could”, “would”,

“might”, “will” or “will be taken”, “occur” or “be achieved”. In addition,

any statements that refer to expectations, projections or other characterizations of future events or circumstances contain forward-looking

information. Statements containing forward-looking information are not historical facts but instead represent management’s expectations,

estimates and projections regarding future events.

Forward-looking

information is necessarily based on a number of opinions, assumptions and estimates that, while considered reasonable by the Company

as of the date of this press release, are subject to known and unknown risks, uncertainties, assumptions and other factors that may cause

the actual results, level of activity, performance or achievements or future events or developments to differ materially from those expressed

or implied by the forward-looking statements, including, without limitation: macroeconomic factors such as inflation and recessionary

conditions, substantial doubt regarding the Company’s ability to continue as a going concern due to recurring losses from operations;

inability to increase cash flow and/or raise sufficient capital to support the Company’s operating activities and fund its cash

obligations, repay indebtedness and satisfy the Company’s working capital needs and debt obligations; prolonged decline in the

price of the Company’s common shares (the “Common Shares”) reducing the Company’s ability to raise capital;

inability to satisfy debt covenants under the Company’s credit facility and the potential acceleration of indebtedness; including

as a result of an unfavorable decision in respect of the litigation with Benjamin Klein; risks related to the ability to continue to

negotiate amendments to the Company’s credit facility to prevent a default; risks relating to the Company’s ability to deliver

and execute on the previously-announced restructuring plan (the “Restructuring Plan”) and the possible failure to

complete the Restructuring Plan on terms acceptable to the Company or its suppliers (including Neuronetics, Inc.), or at all; risks

relating to maintaining an active, liquid and orderly trading market for the Common Shares as a result of the Company’s suspension

of trading on the Nasdaq Capital Market; risks relating to the Company’s ability to realize expected cost-savings and other anticipated

benefits from the Restructuring Plan; risks related to the Company’s negative cash flows, liquidity and its ability to secure additional

financing; increases in indebtedness levels causing a reduction in financial flexibility; inability to achieve or sustain profitability

in the future; inability to secure additional financing to fund losses from operations and satisfy the Company’s debt obligations;

risks relating to strategic alternatives, including restructuring or refinancing of the Company’s debt, seeking additional debt

or equity capital, reducing or delaying the Company’s business activities and strategic initiatives, or selling assets, other strategic

transactions and/or other measures, including obtaining bankruptcy protection, and the terms, value and timing of any transaction resulting

from that process; claims made by or against the Company, which may be resolved unfavorably to us; risks relating to the Company’s

dependence on Neuronetics, Inc. as its exclusive supplier of TMS devices. Additional risks and uncertainties are discussed in the

Company’s materials filed with the Canadian securities regulatory authorities and the United States Securities and Exchange Commission

from time to time, available at www.sedarplus.ca and www.sec.gov,

respectively. These factors are not intended to represent a complete list of the factors that could affect the Company; however, these

factors should be considered carefully. There can be no assurance that such estimates and assumptions will prove to be correct. The forward-looking

statements contained in this press release are made as of the date of this press release, and the Company expressly disclaims any obligation

to update or alter statements containing any forward-looking information, or the factors or assumptions underlying them, whether as a

result of new information, future events or otherwise, except as required by law.

v3.24.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionISO 3166-1 alpha-2 country code.

| Name: |

dei_EntityAddressCountry |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:countryCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

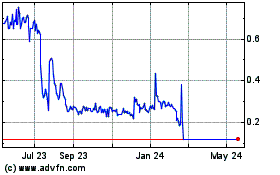

Greenbrook TMS (NASDAQ:GBNH)

Historical Stock Chart

From Mar 2024 to Apr 2024

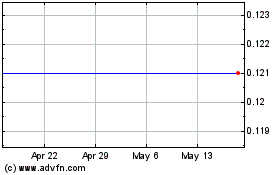

Greenbrook TMS (NASDAQ:GBNH)

Historical Stock Chart

From Apr 2023 to Apr 2024